Africa Re: the group activities

Africa Re: Regional offices

| Country | Address | Date of creation |

|---|---|---|

| Morocco | Casablanca regional office 33 Boulevard Moulay Youssef . B.P. 7556 Casablanca. Morocco Phone: (212) 22 43 77 00 - 5 Fax: (212) 22 43 77 29 -30 E-mail:casablanca [at] africa-re [dot] com | 1980 |

| Nigeria | Lagos regional office Plot 1679. KarimuKotun Street Victoria Island. P.M.B. 12765 Lagos - Nigeria Phone: (234 -1) 461 6820. 28 000 78 Fax: (234 -1) 28 000 74 E-mail:lagos [at] africa-re [dot] com | 1981 |

| Kenya | Nairobi regional office Africa Re Centre. Hospital Road. Upper Hill. Nairobi - Kenya P.O. Box 62328 - 00200. Nairobi Phone: ( 254-20) 297 -0000 Fax: (254-20) 297 -0666. 297 -0777 E-mail:nairobi [at] africa-re [dot] com | 1982 |

| Côte d'Ivoire | Abidjan regional office Rue. Viviane A24 - Cocody. 20 B.P. 1623 Abidjan 20. Côte d'Ivoire Phone : (225 ) 22404480 / 75 Fax: (225) 22404482 E-mail:abidjan [at] africa-re [dot] com | 1987 |

| Mauritius | Ebene regional offices 11th Floor. One Cybercity. Ebene Port Louis. Mauritius Phone: (230) 454-7074 Fax: (230) 454-7067 E-mail: p [dot] louis [at] africa-re [dot] com | 2003 |

| Egypt | Cairo regional office 7. Elkhalily Str. Plot No. 1149 Masaken Sheraton. Heliopolis Postal Code: 11361 Cairo. Egypt Phone: (202) 2268566 8 Fax: (202) 22685667 E-mail:cairo @africa-re.com | 2004 |

Africa Re: Subsidiaries

| Country | Address | Date of creation |

|---|---|---|

| South Africa | Johannesburg subsidiary. South Africa 2nd Floor (West Wing) Oakhurst Building 11-13 St. Andrews Rd. Parktown P.O. Box 3013. Houghton 2041 Johannesburg South Africa | 2004 |

| Egypt | Africa Retakaful 7. Elkhalily Str. Plot No. 1149 Masaken Sheraton. Heliopolis Postal Code: 11361 Cairo. Egypt Phone: (202) 2268566 8 Fax: (202) 22685667 E-mail:cairo [at] africa-re [dot] com | 2010 |

Africa Re: Contact office

| Country | Address | Creation date |

|---|---|---|

Ethiopia | Addis Ababa contact office Debrezeit Road. Beklobet Kirkos Sub City. Kebele 05 Garad Mall 6th floor. Ho. No. 432-6/7 P.O.Box 1055 Addis Ababa | 2011 |

Africa Re' shareholders

Africa Re: The Member States

| Country | Accession date | % |

|---|---|---|

| Algeria | 1976 | 1.33% |

| Angola | 1989 | 0.59% |

| Benin | 1976 | 0.42% |

| Burkina Faso | 1976 | 0.40% |

| Burundi | 1976 | 0.23% |

| Cameroon | 1976 | 1.10% |

| Central African Republic | 1976 | 0.24% |

| Chad | 1976 | 0.40% |

| Congo | 1976 | 0.30% |

| Democratic Republic of Congo | 1976 | 0.63% |

| Côte d’Ivoire | 1977 | 0.56% |

| Egypt | 1976 | 4.04% |

| Eritrea | 1993 | 0.23% |

| Ethiopia | 1976 | 0.94% |

| Gabon | 1976 | 0.44% |

| Gambia | 1976 | 0.63% |

| Ghana | 1976 | 1.04% |

| Guinea | 1976 | 0.37% |

| Guinea Bissau | 1976 | 0.18% |

| Kenya | 1977 | 0.23% |

| Liberia | 1982 | 0.24% |

| Libya | 1976 | 1.33% |

| Madagascar | 1976 | 0.61% |

| Mali | 1976 | 0.32% |

| Mauritania | 1976 | 0.44% |

| Mauritius | 1976 | 0.31% |

| Morocco | 1977 | 3.12% |

| Niger | 1976 | 0.23% |

| Nigeria | 1976 | 6.33% |

| Rwanda | 1989 | 0.23% |

| Senegal | 1977 | 0.55% |

| Seychelles | 1989 | 0.23% |

| Sierra Leone | 1976 | 0.30% |

| Somalia | 1976 | 0.27% |

| Sudan | 1977 | 0.88% |

| Swaziland | 1976 | 0.25% |

| Tanzania | 1976 | 0.54% |

| Togo | 1976 | 0.25% |

| Tunisia | 1976 | 0.56% |

| Uganda | 1977 | 0.60% |

| Zambia | 1977 | 0.76% |

Total | 33.59% | |

Africa Re: Non African shareholders

| Country | Shareholder | Accession date | % |

|---|---|---|---|

| France | Axa Africa Holding | February. 2015 | 7.15% |

| Canada | Fairfax Financial Holding | March. 2015 | 7.15% |

| France | Proparco Groupe Agence Française de Développement | October. 2005 | 2.92% |

| Brazil | IRB-Brasil Resseguros | October. 2012 | 8.17% |

Total | 25.39% | ||

Africa Re: African shareholders

| Shareholder | Accession date | % |

|---|---|---|

| African Development Bank (ADB) | 1976 | 8 .17% |

| Country | Shareholder | Accession date | % | |

|---|---|---|---|---|

| 1 | Algeria | Compagnie Algérienne d’Assurances et de Réassurance (CAAR) | 1990 | 1.26% |

| 2 | Compagnie Algérienne des Assurances (CAAT) | 1990 | 1.26% | |

| 3 | Société Nationale d’Assurance (SAA) | 1990 | 1.26% | |

| 4 | Compagnie Centrale de Réassurance (CCR) | 1990 | 3.05% | |

| 5 | Angola | ENSA Seguros d’Angola (ENSA) | 1990 | 1.02% |

| 6 | Benin | Nouvelle Société Interafricaine d’Assurance (NSIA) | 1990 | 0.08% |

| 7 | Nouvelle Société Interafricaine d’Assurance Vie (NSIA VIE) | 2011 | 0.16% | |

| 8 | Africaine des Assurances | ND | 0.07% | |

| 9 | Burkina Faso | Union des Assurances du Burkina IARDT (UAB) | 1990 | 0.10% |

| 10 | Société Nationale d’Assurance et de Réassurance (SONAR) | 1990 | 0.13% | |

| 11 | Allianz Burkina | 1992 | 0.10% | |

| 12 | Générale Des Assurances (GAB) | 1992 | 0.04% | |

| 13 | Burundi | Société Générale d’Assurance et de Réassurance (SOGEAR) | 1990 | 0.02% |

| 14 | Burundi Insurance Corporation (BICOR) | 1990 | 0.05% | |

| 15 | Société d’Assurances du Burundi (SOCABU) | 1990 | 0.24% | |

| 16 | Cameroon | Société Africaine d’Assurances et de Réassurance (SAAR) | 1990 | 0.08% |

| 17 | SAHAM Assurances | 1990 | 0.05% | |

| 18 | ACTIVA Assurances | 1990 | 0.23% | |

| 19 | ACTIVA VIE Assurances | 2012 | 0.05% | |

| 20 | CHANAS Assurances | 1990 | 0.75% | |

| 21 | AXA Cameroun | 2013 | 0.03% | |

| 22 | Chad | STAR Nationale | 1990 | 0.06% |

| 23 | Congo | Assurances Générales du Congo (AGC) | NA | 0.14% |

| 24 | Nouvelle Société Interafricaine d’Assurance Congo (NSIA CONGO) | 2013 | 0.03% | |

| 25 | Nouvelle Société Interafricaine d’Assurance Vie Congo (NSIA VIE CONGO) | 2013 | 0.01% | |

| 26 | DR of Congo | Société Nationale d’Assurance (SONAS) | 1990 | 0.05% |

| 27 | Côte d’Ivoire | Mutuelle d’Assurance des Taxis Compteurs d’Abidjan (MATCA) | 1990 | 0.10% |

| 28 | Société Mutuelle d’Assurance Vie (SOMAVIE) | N.D | 0.10% | |

| 29 | Société Ivoirienne d’Assurance Mutuelle (SIDAM) | 1990 | 0.10% | |

| 30 | Société Atlantique Assurance Vie (STAMVIE) | 1990 | 0.10% | |

| 31 | Nouvelle Société Interafricaine d’Assurance, Côte d’Ivoire (NSIA CI) | 1990 | 0.24% | |

| 32 | Nouvelle Société Interafricaine d’Assurance Vie (NSIA VIE) | 1990 | 0.25% | |

| 33 | Sunu Assurances IARD Côte d'Ivoire | 1990 | 0.08% | |

| 34 | Garantie Cautionnement des Transports de Côte d’Ivoire (GMTCI) | 1990 | 0.01% | |

| 35 | Amsa Assurances | 1990 | 0.03% | |

| 36 | Allianz Côte d’Ivoire | 1990 | 0.07% | |

| 37 | Axa Côte d’Ivoire | 2013 | 0.03% | |

| 38 | Egypt | Misr Insurance Company | 1990 | 2.38% |

| 39 | Misr Life Insurance Company | 2010 | 1.78% | |

| 40 | Mohandes Insurance Company | 1990 | 0.20% | |

| 41 | Eritrea | National Insurance Corporation of Eritrea (NICE) | 1990 | 0.39% |

| 42 | Ethiopia | Ethiopian Insurance Corporation (EIC) | 1990 | 0.80% |

| 43 | Gabon | Omnium Gabonais d’Assurances et de Réassurances (OGAR/OGARVIE) | 1990 | 0.14% |

| 44 | Nouvelles Société Interafricaine d’Assurances du Gabon (NSIA GABON) | 1990 | 0.04% | |

| 45 | Axa Gabon | 2013 | 0.03% | |

| 46 | Ghana | State Insurance Corporation of Ghana | 1990 | 0.20% |

| 47 | Ghana Reinsurance Corporation | 1990 | 0.20% | |

| 48 | Enterprise Insurance Company (GH) LTD | 1990 | 0.01% | |

| 49 | Ghana Union Assurance Company LTD | 1990 | 0.04% | |

| 50 | Guinea | Union Guinéenne d’Assurances et de Réassurances (UGAR) | 1990 | 0.12% |

| 51 | Kenya | Jubilee Insurance Company of Kenya LTD | 1990 | 0.02% |

| 52 | Blue Shield Insurance Company LTD | 1990 | 0.03% | |

| 53 | Pioneer Holdings (AFRICA) LIMITED | 1990 | 0.05% | |

| 54 | Apollo Investments Company Limited | 1990 | 0.05% | |

| 55 | United Insurance Company LTD | 1990 | 0.07% | |

| 56 | Kenya Reinsurance Corporation | 1990 | 0.22% | |

| 57 | First Reinsurance Brokers Limited | 2011 | 0.02% | |

| 58 | Libya | Libya Insurance Company (LIC) | 1990 | 3.79% |

| 59 | Madagascar | Compagnie Malgache d’Assurances et de Réassurances (NY HAVANA) | 1990 | 0.32% |

| 60 | Assurances Reassurances Omnibranches (ARO) | 1990 | 0.52% | |

| 61 | Mali | Compagnie d’Assurances Lafia | NA | 0.08% |

| 62 | Compagnie d’Assurance et de Réassurance (SABU-NYUMAN) | NA | 0.01% | |

| 63 | Mauritania | Nationale d’Assurance et de Réassurance (NASR) | 1990 | 0.15% |

| 64 | Mauritius | Rainbow Insurance Company LTD | NA | 0.01% |

| 65 | Anglo – Mauritius Assurance Society LTD | 1990 | 0.02% | |

| 66 | British American Insurance (Mauritius) LTD | 1990 | 0.02% | |

| 67 | Indian Ocean General Assurance LTD (IOGA) | 1990 | 0.02% | |

| 68 | Island Life Assurance Company LTD | 1990 | 0.02% | |

| 69 | Mauritian Eagle Insurance CO. LTD | 1990 | 0.03% | |

| 70 | State Insurance Corporation (SICOM) | 1990 | 0.02% | |

| 71 | Sun Insurance Company LTD | 1990 | 0.02% | |

| 72 | Swan Insurance Company LTD | 1990 | 0.02% | |

| 73 | Mauritius Union Assurance Company LTD | 1990 | 0.10% | |

| 74 | Sugar Insurance Fund Board | 1990 | 0.06% | |

| 75 | Morocco | Compagnie d’Assurances et de Réassurances ATLANTA | 1990 | 0.14% |

| 76 | SAHAM Assurance | 1990 | 0.16% | |

| 77 | Zurich Assurances Maroc | 1990 | 0.06% | |

| 78 | Compagnie d’Assurance Sanad | 1990 | 0.14% | |

| 79 | Axa Assurance Maroc | 1990 | 0.16% | |

| 80 | RMA Watanya | 1990 | 0.91% | |

| 81 | Société Centrale de Réassurance (SCR) | 1990 | 2.57% | |

| 82 | Mutuelle Agricole Marocaine d’Assurances (MAMDA) | NA | 0.44% | |

| 83 | Wafa Assurance | 1990 | 0.18% | |

| 84 | Niger | Société Nationale d’Assurance et de Réassurance (SNAR-LEYMA) | 1990 | 0.04% |

| 85 | Compagnie d’Assurances et de Réassurances du Niger (CAREN) | 1990 | 0.03% | |

| 86 | Nigeria | Royal Exchange Assurance (NIG) PLC | 1990 | 0.06% |

| 87 | Continental Reinsurance PLC | 1990 | 0.02% | |

| 88 | Leadway Assurance CO. LTD | 1990 | 0.47% | |

| 89 | Guinea Insurance Company LTD | 1990 | 0.02% | |

| 90 | Intercontinental West African Provencial Insurance Company LTD | 1990 | 0.02% | |

| 91 | United Nigeria Insurance CO. PLC (UNIC) | 1990 | 0.04% | |

| 92 | AIICO Insurance PLC | 1990 | 0.17% | |

| 93 | Nigerian Reinsurance Corporation | 1990 | 0.26% | |

| 94 | Nicon Insurance Corporation | 1990 | 0.44% | |

| 95 | Niger Insurance PLC | NA | 0.09% | |

| 96 | Custodian and Allied Insurance | 2013 | 0.09% | |

| 97 | Rwanda | Société Nouvelle d’Assurance du Rwanda (SONARWA) | 1990 | 0.18% |

| 98 | Senegal | La Prévoyance Assurances | 1990 | 0.07% |

| 99 | Allianz Sénégal | 1990 | 0.19% | |

| 100 | Société Sénégalaise de Réassurance (SEN RE) | 1990 | 0.12% | |

| 101 | Axa Sénégal | 2013 | 0.03% | |

| 102 | Sierra Leone | National Insurance Corporation of Sierra Leone (NIC (S/L) | 1990 | 0.03% |

| 103 | Sudan | Middle East Insurance Company | 2012 | 0.02% |

| 104 | Tanzania | National Insurance Corp. of Tanzania (NIC) | 1990 | 0.36% |

| 105 | Tanzania National Reinsurance Corporation (TAN RE) | 2011 | 0.27% | |

| 106 | Togo | Groupement Togolais d'Assurances/Compagnie / Africaine d’Assurances IARD (GTA/C2A IARD) | 1990 | 0.07% |

| 107 | Groupement Togolais d'Assurances/Compagnie / Africaine d’Assurances Vie (GTA/C2A VIE) | 1990 | 0.07% | |

| 108 | Tunisia | Groupement des Assurances de Tunisie (GAT) | NA | 0.26% |

| 109 | Société Tunisienne de Réassurance (TUNIS RE) | NA | 1.02% | |

| 110 | Uganda | Lion Assurance Company LIMITED | 1990 | 0.04% |

| 111 | National Insurance Corporation of Uganda (NIC) | 1990 | 0.14% | |

Total | 32.85% | |||

Africa Re: Shareholding per country

State % | Companies % | Total countries % | |

|---|---|---|---|

| Algeria | 1.33% | 6.84% | 8.17% |

| Angola | 0.59% | 1.02% | 1.61% |

| Benin | 0.42% | 0.30% | 0.73% |

| Burkina Faso | 0.40% | 0.37% | 0.78% |

| Burundi | 0.23% | 0.31% | 0.54% |

| Cameroon | 1.10% | 1.21% | 2.31% |

| Central African Republic | 0.24% | NA | 0.24% |

| Chad | 0.40% | 0.06% | 0.46% |

| Congo | 0.30% | 0.18% | 0.48% |

| DR of Congo | 0.63% | 0.05% | 0.68% |

| Côte d’Ivoire | 0.56% | 1.10% | 1.66% |

| Egypt | 4.04% | 4.36% | 8.41% |

| Eritrea | 0.23% | 0.39% | 0.62% |

| Ethiopia | 0.94% | 0.80% | 1.74% |

| Gabon | 0.44% | 0.20% | 0.64% |

| Gambia | 0.63% | NA | 0.63% |

| Ghana | 1.04% | 0.46% | 1.50% |

| Guinea | 0.55% | 0.12% | 0.67% |

| Guinea Bissau | 0.23% | NA | 0.23% |

| Kenya | 0.88% | 0.46% | 1.33% |

| Libya | 0.24% | NA | 0.24% |

| Liberia | 1.33% | 3.79% | 5.12% |

| Madagascar | 0.61% | 0.84% | 1.45% |

| Mali | 0.32% | 0.09% | 0.41% |

| Mauritania | 0.44% | 0.15% | 0.59% |

| Mauritius | 0.31% | 0.35% | 0.66% |

| Morocco | 3.12% | 4.78% | 7.89% |

| Niger | 0.23% | 0.07% | 0.30% |

| Nigeria | 6.33% | 1.68% | 8.01% |

| Rwanda | 0.23% | 0.18% | 0.42% |

| Senegal | 0.55% | 0.42% | 0.97% |

| Seychelles | 0.23% | NA | 0.23% |

| Sierra Leone | 0.30% | 0.03% | 0.33% |

| Somalia | 0.27% | NA | 0.27% |

| Sudan | 0.88% | 0.02% | 0.90% |

| Swaziland | 0.25% | NA | 0.25% |

| Tanzania | 0.54% | 0.63% | 1.18% |

| Togo | 0.25% | 0.14% | 0.38% |

| Tunisia | 0.56% | 1.28% | 1.84% |

| Uganda | 0.60% | 0.18% | 0.78% |

| Zambia | 0.76% | NA | 0.76% |

| Total | 33.59% | 32.85% | 66.44% |

Africa Re: Gross written premiums per region (2000-2014)

International business | North East Africa | Indian Ocean Islands | French speaking West and Central Africa | Austral Africa | Maghreb | East Africa | English speaking West Africa | Total | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Premiums | % | Premiums | % | Premiums | % | Premiums | % | Premiums | % | Premiums | % | Premiums | % | Premiums | % | ||

| 2000 | 3.12 | 4% | NA | NA | NA | NA | 9.36 | 12% | 10.92 | 14% | 23.4 | 30% | 21.06 | 27% | 10.14 | 13% | 78 |

| 2001 | 4.25 | 5% | 5.95 | 7% | 5.95 | 7% | 10.2 | 12% | 11.9 | 14% | 17.85 | 21% | 16.15 | 19% | 12.75 | 15% | 85 |

| 2002 | 6.35 | 5% | 8.89 | 7% | 7.62 | 6% | 13.97 | 11% | 29.21 | 23% | 24.13 | 19% | 20.32 | 16% | 16.51 | 13% | 127 |

| 2003 | 9.9 | 5% | 9.9 | 5% | 13.86 | 7% | 19.8 | 10% | 61.38 | 31% | 35.64 | 18% | 25.74 | 13% | 21.78 | 11% | 198 |

| 2004 | 11.12 | 4% | 11.12 | 4% | 13.9 | 5% | 22.24 | 8% | 136.22 | 49% | 36.14 | 13% | 25.02 | 9% | 22.24 | 8% | 278 |

| 2005 | 12.8 | 5% | 10.24 | 4% | 12.8 | 5% | 20.48 | 8% | 125.44 | 49% | 25.6 | 10% | 25.6 | 10% | 23.04 | 9% | 256 |

| 2006 | 17.58 | 6% | 11.72 | 4% | 11.72 | 4% | 23.44 | 8% | 117.2 | 40% | 35.16 | 12% | 38.09 | 13% | 38.09 | 13% | 293 |

| 2007 | 22.2 | 6% | 14.8 | 4% | 7.4 | 2% | 25.9 | 7% | 162.8 | 44% | 44.4 | 12% | 44.4 | 12% | 48.1 | 13% | 370 |

| 2008 | 52.13 | 13% | 32.08 | 8% | 8.02 | 2% | 28.07 | 7% | 128.32 | 32% | 48.12 | 12% | 52.13 | 13% | 52.13 | 13% | 401 |

| 2009 | 53.6 | 10% | 37.52 | 7% | 10.72 | 2% | 32.16 | 6% | 209.04 | 39% | 53.6 | 10% | 64.32 | 12% | 75.04 | 14% | 536 |

| 2010 | 56.52 | 9% | 43.96 | 7% | 12.56 | 2% | 31.4 | 5% | 263.76 | 42% | 56.52 | 9% | 75.36 | 12% | 87.92 | 14% | 628 |

| 2011 | 44.17 | 7% | 56.79 | 9% | 12.62 | 2% | 44.17 | 7% | 233.47 | 37% | 50.48 | 8% | 94.65 | 15% | 94.65 | 15% | 631 |

| 2012 | 38.88 | 6% | 64.8 | 10% | 12.96 | 2% | 38.88 | 6% | 213.84 | 33% | 58.32 | 9% | 116.64 | 18% | 103.68 | 16% | 648 |

| 2013 | 20.1 | 3% | 67 | 10% | 13.4 | 2% | 60.3 | 9% | 194.3 | 29% | 60.3 | 9% | 140.7 | 21% | 113.9 | 17% | 670 |

| 2014 | 21.54 | 3% | 78.98 | 11% | 14.36 | 2% | 64.62 | 9% | 208.22 | 29% | 64.62 | 9% | 157.96 | 22% | 107.7 | 15% | 718 |

| Total(1) | 374.26 | 6.33% | 453.75 | 7.67% | 157.89 | 2.67% | 444.99 | 7.52% | 2106.02 | 35.59% | 634.28 | 10.72% | 918.14 | 15.52% | 827.67 | 13.98% | 5917 |

Africa Re: Gross written premiums per class of business (2000-2014)

Fire & Accident | Oil & Energy | Marine & Aviation | Life | Total | |||||

|---|---|---|---|---|---|---|---|---|---|

WP | % | WP | % | WP | % | WP | % | ||

| 2000 | 60.52 | 77.59% | ND | ND | 13.87 | 17.78% | 3.61 | 4.63% | 78 |

| 2001 | 64.10 | 75.41% | ND | ND | 17.18 | 20.21% | 3.72 | 4.38% | 85 |

| 2002 | 88.56 | 69.73% | 16.7 | 13.15% | 15.14 | 11.92% | 6.60 | 5.2% | 127 |

| 2003 | 140.14 | 70.78% | 22.8 | 11.51% | 25.40 | 12.83% | 9.66 | 4.88% | 198 |

| 2004 | 223.96 | 80.56% | 15.9 | 5.71% | 28.11 | 10.11% | 10.06 | 3.62% | 278 |

| 2005 | 190.11 | 74.26% | 31.2 | 12.2% | 26.24 | 10.25% | 8.42 | 3.29% | 256 |

| 2006 | 216.76 | 73.98% | 32.5 | 11.1% | 33.14 | 11.31% | 10.58 | 3.61% | 293 |

| 2007 | 287.71 | 77.76% | 35.0 | 9.46% | 37.56 | 10.15% | 9.73 | 2.63% | 370 |

| 2008 | 289.20 | 72.12% | 37.9 | 9.44% | 61.91 | 15.44% | 12.03 | 3% | 401 |

| 2009 | 401.46 | 74.90% | 48.8 | 9.1% | 67.00 | 12.50% | 18.76 | 3.5% | 536 |

| 2010 | 484.75 | 77.19% | 58.4 | 9.3% | 64.18 | 10.22% | 20.66 | 3.29% | 628 |

| 2011 | 458.36 | 72.64% | 84.6 | 13.41% | 62.41 | 9.89% | 25.62 | 4.06% | 631 |

| 2012 | 472.59 | 72.93% | 78.0 | 12.03% | 67.20 | 10.37% | 30.26 | 4.67% | 648 |

| 2013 | 464.11 | 69.27% | 113.8 | 16.99% | 56.88 | 8.49% | 35.18 | 5.25% | 670 |

| 2014 | 508.42 | 70.81% | 113.5 | 15.81% | 56.72 | 7.90% | 39.35 | 5.48% | 718 |

| Total(1) | 4350.74 | 73.6% | 689.1 | 11.6% | 632.93 | 10.7% | 244.25 | 4.1% | 5917 |

(1) As from 2007, this class of business has been split into two categories: fire -engineering and accident-motor

(2) Total of collected premiums from 2000 to 2014 Source: Atlas Magazine - Africa Re

Africa Re: Loss ratios per region (2000-2014)

2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

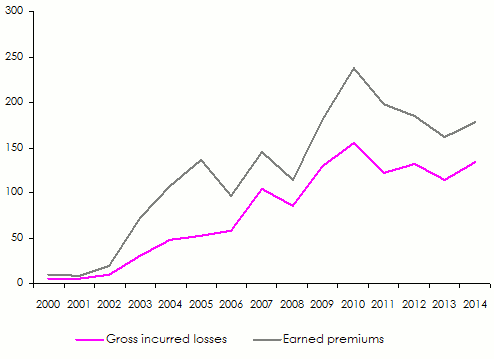

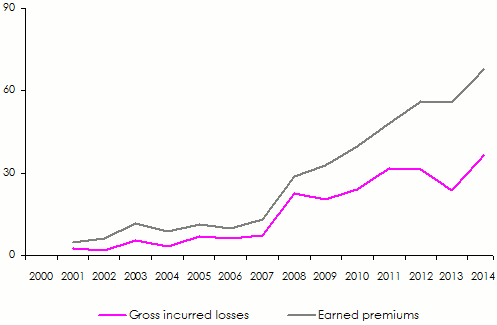

| Austral Africa | Gross earned premiums | 9.38 | 9.24 | 20.24 | 72.23 | 107.31 | 136.71 | 96.8 | 145.2 | 114.56 | 181.74 | 236.88 | 197.58 | 184.8 | 161.24 | 178.06 |

| Gross incurred losses | 5.62 | 5.26 | 10.05 | 30.28 | 48.63 | 52.73 | 58.58 | 104.11 | 85.19 | 129.20 | 154.78 | 122.14 | 132.34 | 114.24 | 133.94 | |

| Loss ratios | 59.94% | 56.91% | 49.64% | 41.92% | 45.32% | 38.57% | 60.52% | 71.7% | 74.36% | 71.09% | 65.34% | 61.82% | 71.61% | 70.85% | 75.22% | |

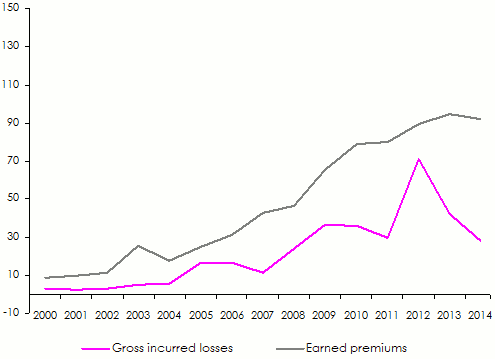

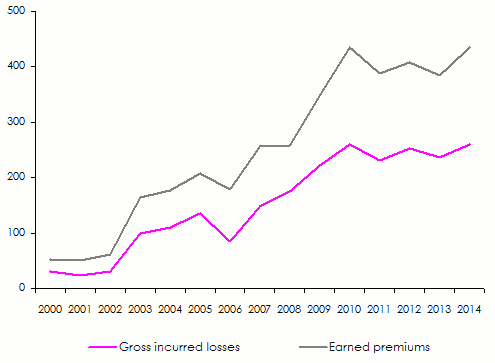

| English speaking West Africa | Gross earned premiums | 8.71 | 9.9 | 11.44 | 25.63 | 17.52 | 25.11 | 31.46 | 42.9 | 46.54 | 65.24 | 78.96 | 80.1 | 89.6 | 94.52 | 92.1 |

| Gross incurred losses | 3.31 | 2.80 | 3.14 | 5.22 | 5.79 | 16.56 | 16.89 | 11.50 | 23.76 | 36.61 | 36.14 | 29.82 | 70.94 | 42.19 | 28.14 | |

| Loss ratios | 37.95% | 28.25% | 27.41% | 20.38% | 33.02% | 65.95% | 53.68% | 26.81% | 51.06% | 56.12% | 45.77% | 37.23% | 79.17% | 44.64% | 30.55% | |

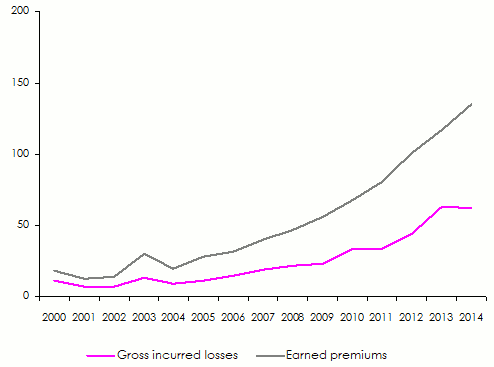

| East Africa | Gross earned premiums | 18.09 | 12.54 | 14.08 | 30.29 | 19.71 | 27.9 | 31.46 | 39.6 | 46.54 | 55.92 | 67.68 | 80.1 | 100.8 | 116.76 | 135.08 |

| Gross incurred losses | 10.84 | 7.14 | 6.65 | 13.17 | 9.23 | 11.14 | 14.44 | 18.60 | 21.70 | 22.94 | 33.39 | 33.88 | 43.74 | 62.63 | 62.19 | |

| Loss ratios | 59.94% | 56.91% | 47.24% | 43.49% | 46.81% | 39.92% | 45.9% | 46.98% | 46.62% | 41.03% | 49.34% | 42.3% | 43.39% | 53.64% | 46.04% | |

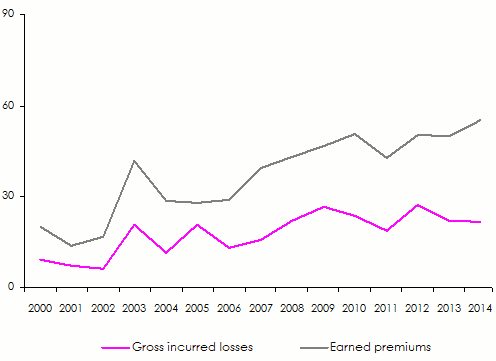

| Maghreb | Gross earned premiums | 20.1 | 13.86 | 16.72 | 41.94 | 28.47 | 27.9 | 29.04 | 39.6 | 42.96 | 46.6 | 50.76 | 42.72 | 50.4 | 50.04 | 55.26 |

| Gross incurred losses | 9.32 | 7.31 | 6.09 | 20.65 | 11.60 | 20.70 | 13.28 | 15.77 | 21.89 | 26.80 | 23.72 | 18.63 | 27.40 | 22.00 | 21.81 | |

| Loss ratios | 46.37% | 52.76% | 36.43% | 49.24% | 40.74% | 74.21% | 45.74% | 39.82% | 50.96% | 57.51% | 46.73% | 43.62% | 54.37% | 43.97% | 39.46% | |

| Nort East Africa | Gross earned premiums | NA | 4.62 | 6.16 | 11.65 | 8.76 | 11.16 | 9.68 | 13.2 | 28.64 | 32.62 | 39.48 | 48.06 | 56 | 55.6 | 67.54 |

| Gross incurred losses | NA | 2.44 | 1.69 | 5.63 | 3.24 | 7.01 | 6.10 | 7.43 | 22.47 | 20.51 | 24.06 | 31.72 | 31.43 | 23.62 | 36.49 | |

| Loss ratios | 46.37% | 52.76% | 27.44% | 48.34% | 36.94% | 62.83% | 63.02% | 56.28% | 78.46% | 62.89% | 60.93% | 66% | 56.12% | 42.48% | 54.03% | |

| French speaking West and Central Africa | Gross earned premiums | 8.04 | 7.92 | 9.68 | 23.3 | 17.52 | 22.32 | 19.36 | 23.1 | 25.06 | 27.96 | 28.2 | 37.38 | 33.6 | 50.04 | 55.26 |

| Gross incurred losses | 3.03 | 3.30 | 2.39 | 7.53 | 4.47 | 12.13 | 12.22 | 9.20 | 11.52 | 16.42 | 14.60 | 10.97 | 6.76 | 9.97 | 10.86 | |

| Loss ratios | 37.71% | 41.69% | 24.64% | 32.32% | 25.51% | 54.33% | 63.1% | 39.82% | 45.97% | 58.71% | 51.76% | 29.36% | 20.11% | 19.92% | 19.65% | |

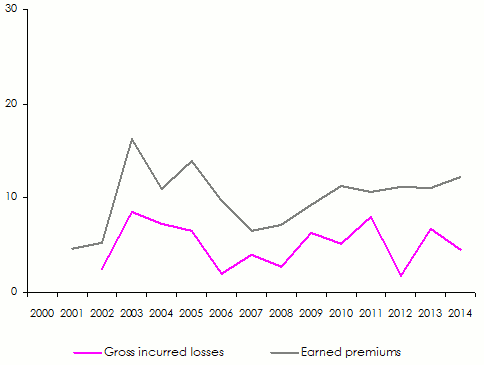

| African islands of the Indian Ocean | Gross earned premiums | NA | 4.62 | 5.28 | 16.31 | 10.95 | 13.95 | 9.68 | 6.6 | 7.16 | 9.32 | 11.28 | 10.68 | 11.2 | 11.12 | 12.28 |

| Gross incurred losses | NA | NA | 2.53 | 8.52 | 7.30 | 6.58 | 2.06 | 4.03 | 2.80 | 6.30 | 5.17 | 7.98 | 1.82 | 6.77 | 4.55 | |

| Loss ratios | NA | NA | 47.88% | 52.26% | 66.71% | 47.2% | 21.26% | 61.08% | 39.08% | 67.63% | 45.82% | 74.73% | 16.28% | 60.89% | 37.04% | |

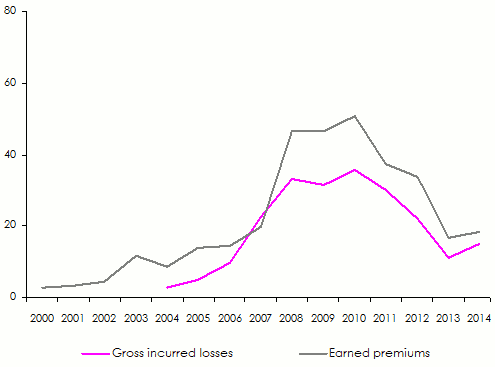

| International business | Gross earned premiums | 2.68 | 3.3 | 4.4 | 11.65 | 8.76 | 13.95 | 14.52 | 19.8 | 46.54 | 46.6 | 50.76 | 37.38 | 33.6 | 16.68 | 18.42 |

| Gross incurred losses | NA | NA | NA | NA | 2.90 | 4.95 | 9.87 | 22.67 | 33.25 | 31.60 | 35.72 | 30.20 | 22.02 | 11.16 | 15.18 | |

| Loss ratios | NA | NA | NA | NA | 33.13% | 35.45% | 67.98% | 114.49% | 71.45% | 67.81% | 70.38% | 80.78% | 65.55% | 66.9% | 82.4% |

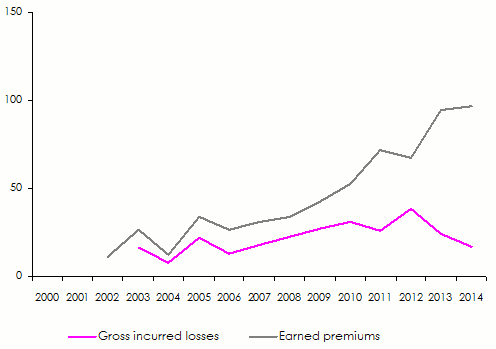

Gross earned premiums and gross incurred losses per region (2000-2014) Austral Africa In millions USD

English speaking West Africa in millions USD

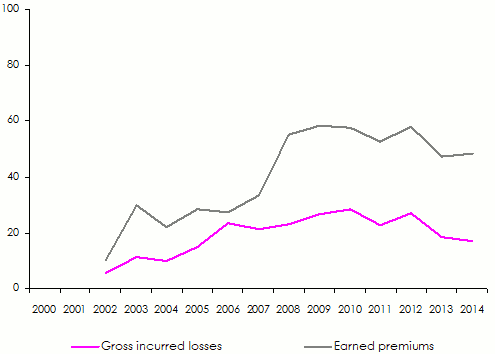

East Africa In millions USD

East Africa In millions USD  Maghreb In millions USD

Maghreb In millions USD  North East Africa In millions USD

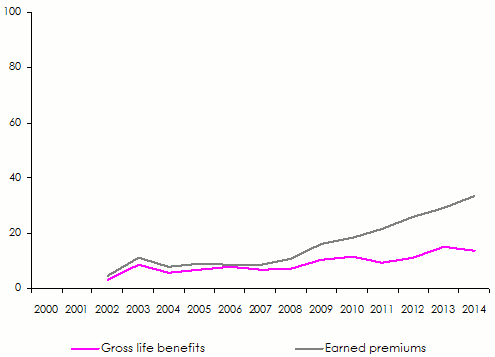

North East Africa In millions USD  African islands of the Indian Ocean In millions USD

African islands of the Indian Ocean In millions USD  International business In millions USD

International business In millions USD

Africa Re: Loss ratios per non life insurance: 2000-2014)

Fire & Accident | Oil & Energy | Marine & Aviation | |||||||

|---|---|---|---|---|---|---|---|---|---|

Gross earned premiums | Loss incurred losses | Loss ratios | Gross earned premiums | Loss incurred losses | Loss ratios | Gross earned premiums | Loss incurred losses | Loss ratios | |

| 2000 | 51.99 | 29.97 | 57.65% | NA | NA | NA | NA | NA | NA |

| 2001 | 49.77 | 23.13 | 46.48% | NA | NA | NA | 14.27 | 8.97 | 62.86% |

| 2002 | 61.36 | 31.39 | 51.15% | NA | NA | NA | 10.49 | 5.79 | 55.2% |

| 2003 | 164.92 | 99.66 | 60.43% | 26.82 | 16.21 | 60.43% | 29.89 | 11.39 | 38.09% |

| 2004 | 176.43 | 109.84 | 62.26% | 12.50 | 7.79 | 62.26% | 22.14 | 9.92 | 44.8% |

| 2005 | 207.19 | 135.31 | 65.31% | 34.04 | 22.23 | 65.31% | 28.60 | 15.12 | 52.88% |

| 2006 | 179.03 | 85.60 | 47.81% | 26.86 | 12.84 | 47.81% | 27.37 | 23.46 | 85.73% |

| 2007 | 256.61 | 148.35 | 57.81% | 31.22 | 18.04 | 57.775% | 33.50 | 21.39 | 63.865% |

| 2008 | 258.19 | 174.90 | 67.74% | 33.80 | 22.89 | 67.74% | 55.28 | 23.22 | 42% |

| 2009 | 349.03 | 222.16 | 63.65% | 42.41 | 26.99 | 63.65% | 58.25 | 26.68 | 45.8% |

| 2010 | 435.35 | 259.30 | 59.56% | 52.45 | 31.24 | 59.56% | 57.64 | 28.59 | 49.6% |

| 2011 | 387.90 | 230.95 | 59.54% | 71.61 | 25.79 | 36.01% | 52.81 | 22.61 | 42.81% |

| 2012 | 408.41 | 253.50 | 62.07% | 67.37 | 38.21 | 56.72% | 58.07 | 26.98 | 46.46% |

| 2013 | 385.14 | 235.59 | 61.17% | 94.46 | 24.09 | 25.5% | 47.20 | 18.61 | 39.42% |

| 2014 | 434.77 | 259.21 | 59.62% | 97.07 | 16.90 | 17.41% | 48.51 | 17.09 | 35.24% |

| Total | 3806.08 | 2298.85 | 60.40% | 590.61 | 263.21 | 44.57% | 544.02 | 259.82 | 47.76% |

Oil & energy In millions USD

Marine & aviation In millions USD

Life In millions USD

Africa Re: Evolution of management expenses, loss ratio and combined ratios: 2000-2014

| Year | Management expenses | Overhead expenses/Gross written premiums in % | Acquisition costs | Acquisition costs/Gross written premiums in % | Management expenses ratios(1) | Gross loss ratios(2) | Combined ratios(3) |

| 2000 | 4 520 366 | 5.80 | 24 800 000 | 31.79 | 37.59 | 46.82 | 84.41 |

| 2001 | 4 945 005 | 5.82 | 22 844 104 | 26.88 | 32.69 | 50.74 | 83.43 |

| 2002 | 5 411 478 | 4.26 | 29 192 144 | 22.99 | 27.25 | 52.91 | 80.16 |

| 2003 | 6 008 584 | 3.03 | 48 715 748 | 24.60 | 27.64 | 56.62 | 84.26 |

| 2004 | 7 532 773 | 2.71 | 67 633 968 | 24.33 | 27.04 | 60.33 | 87.37 |

| 2005 | 11 149 000 | 4.36 | 74 934 000 | 29.27 | 33.63 | 63.93 | 97.56 |

| 2006 | 12 840 000 | 4.38 | 75 604 000 | 25.80 | 30.19 | 55.90 | 86.09 |

| 2007 | 16 445 000 | 4.44 | 93 424 000 | 25.25 | 29.69 | 60.48 | 90.17 |

| 2008 | 17 392 000 | 4.34 | 103 841 000 | 25.90 | 30.23 | 62.25 | 92.48 |

| 2009 | 22 842 000 | 4.26 | 126 233 000 | 23.55 | 27.81 | 62.65 | 90.46 |

| 2010 | 27 094 000 | 4.31 | 161 682 000 | 25.75 | 30.06 | 58.12 | 88.18 |

| 2011 | 31 282 000 | 4.96 | 151 994 000 | 24.09 | 29.05 | 54.06 | 83.11 |

| 2012 | 30 910 000 | 4.77 | 157 069 000 | 24.24 | 29.01 | 59.10 | 88.11 |

| 2013 | 34 157 000 | 5.10 | 164 477 000 | 24.55 | 29.65 | 52.74 | 82.39 |

| 2014 | 37 780 000 | 5.26 | 180 910 000 | 25.20 | 30.46 | 49.46 | 79.92 |

(3) Calculated as follows: Incurred losses (paid losses+outstanding losses)/Earned premiums of the year

(4) Calculated as follows: (1)+(2)