Africa, still an attractive reinsurance market

|

But that is not the only reason. Indeed, falling raw material rates, slowing attractiveness of China and of its investments on the continent, generalized depreciation of currencies have also chipped in. These elements disrupt insurance and reinsurance sectors, which slows down market organization and merger-acquisition operations. The perspectives of African reinsurers have eventually turned bleak.

This difficult environment has not nevertheless decreased the insurers attractiveness to business. The market is still welcoming new companies, mainly located in regional hubs recently established such as Casablanca, Abidjan, Nairobi and Mauritius.

In fact, despite the current pitfall, the African market remains quite a promising one. The factors accounting for its development may be summed up as follows:

- a poor insurance penetration rate,

- legislative frameworks evolving towards international standards,

- moderate exposure to natural events,

- a relatively low loss experience,

- a young population,

- an emerging middle class,

- substantial needs in basic infrastructure and industries.

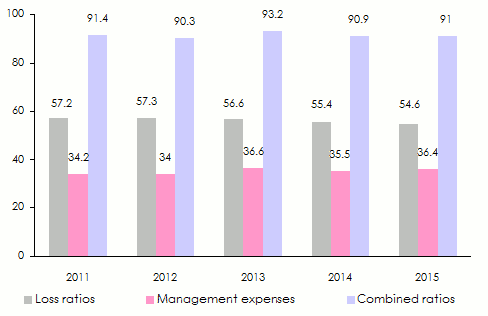

The results of reinsurers operating in Africa remain good. Average combined ratios set around 90% have been steady for several years. While remaining positive, these results vary considerably according to the regions and to the companies.

Technical performance of non life Sub-Saharan African reinsurers

in % Source: Best’s Special Report, AM Best

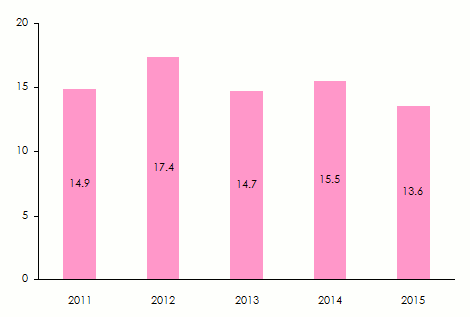

Source: Best’s Special Report, AM Best For all areas, return on investment for the reinsurers whose activities are mainly focused on Africa remains better than that of their counterparts operating in other areas of the world. These results remain, however, poor in volume.

Today, numerous African governments are advocating market protection. Compulsory cessions for the benefit of local reinsurers tend to be disseminated. Consequently, new local capacities have emerged, which prompted unbridled competition. In 2016, nearly 45 reinsurers domiciled in Africa have been reported.

Return on investment equity of the Sub-saharan African reinsurers rated by AM Best

in % Source: Best’s Special Report, AM Best

Source: Best’s Special Report, AM Best Related article