Agricultural insurance: products and schemes

|

According to FAO, in order to meet the globe's food needs by 2050, agricultural production must be 70% higher than the one we are witnessing nowadays. In developing countries, the primary sector is of a very particular importance as it stands for the basis of economic growth.

In Africa, agriculture accounts for 30% to 40% of GDP and nearly 60% of the value of exported products. These values are well below for developed countries.

In this context, agricultural insurance, which has a long history, shall become essential. According to reinsurer Swiss Re, its turnover is likely to triple by 2025.

Dans ce contexte, l’assurance agricole, qui a une longue histoire, devient primordiale. Selon le réassureur Swiss Re, son chiffre d’affaires pourrait tripler d’ici à 2025.

Agricultural insurance worldwide

Agricultural insurance in figures

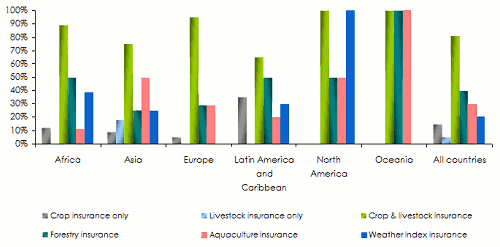

Agricultural insurance is not just confined to the coverage of crops and livestock. It also applies to aquaculture, forestry, animals of high market value (high pedigree animals) greenhouse crops, etc.

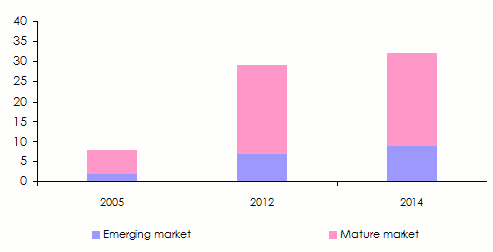

Agricultural insurance is also designed to cover companies as well as individuals dealing with agricultural production. In less than a decade (2005 to 2014), agricultural insurance premiums have grown almost fourfold.

Evolution of agricultural insurance premiums: 2005-2014

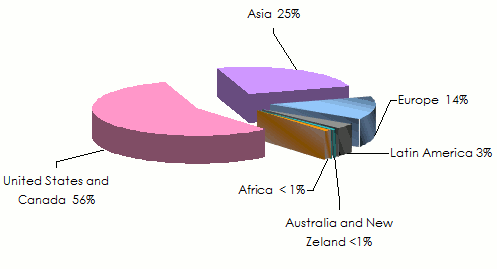

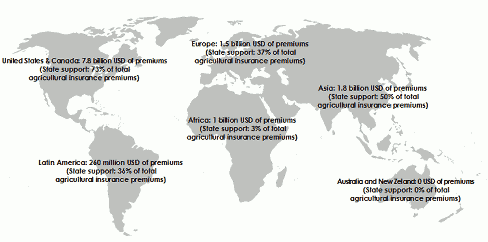

Breakdown of premiums per region in 2014

Three main factors account for the increase of insurance demand :

- The rising value of agricultural production in various areas of business: cereals, aquaculture, etc.

- The increase in the value of the insured assets.

- The development of new markets.

Moreover, the support of the public sector can only consolidate demand.

In terms of premium volume, North America stands as the world’s number one market in agricultural risks, accounting for 60% of global premiums, followed by Asia (25%) and Europe (14%).

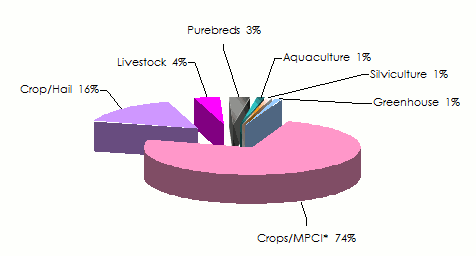

In terms of types of products, it is crop insurance that gets the overwhelming majority of premiums. Crop insurance may be underwritten as a multiple peril policy, as is the case in both the United States and Canada. This kind of coverage accounts for 74% of the premiums of this class of business at the global level. The insurance of named perils more specifically present in Europe, accounts for nearly 16% of agricultural insurance premiums throughout the world. The other kinds of insurance plans represent only 10% of the overall premiums.

Breakdown of premiums per type of product

Source: Swiss Re *multi-peril crop insurance

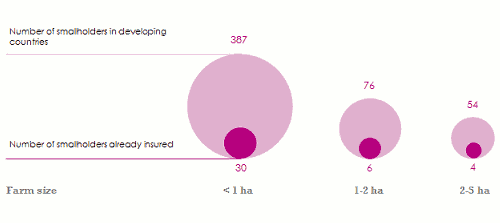

Source: Swiss Re *multi-peril crop insuranceIn developing countries, 357 million smallholder farmers, possessing less than one hectare, remain uninsured. The major challenge faced by agricultural insurance in the future is associated with the capacity to extend insurance coverage to these small farmers. Nearly 80% of the food consumed in low-income countries is produced by smallholder farmers. Any hazard that is likely to disrupt the latter’s production would trigger a food disaster.

Number in millions smallholders Source: FAO 2014

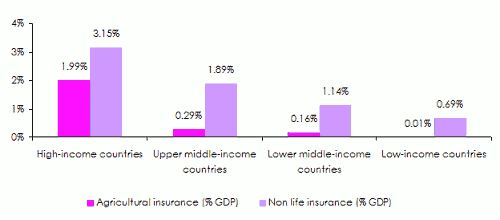

Source: FAO 2014 Agricultural and non life insurance shares in the GDP

Source : Mahul and Stutley

Source : Mahul and StutleyThe specific features of agricultural insurance

Agricultural insurance is a class of business of its own whose specific features are as follows:

- The localization of crops stands as an impediment to risk spreading. The accumulation of the same crops in close geographical areas would expose risks to the same hazards.

- The information available is dissymmetric and favorable to anti-selection. The policyholders most exposed to the hazards are those who are most tempted to underwrite an insurance policy. Meanwhile, having an insurance policy may incite farmers to make riskier choices: plantations at less favorable dates, use of less effective fertilizers, etc.

- The dispersion of insurable zones throughout the world increases operational and administrative costs. Furthermore, the specificity of some products compels farmers to be particularly innovative both in terms of the design of covers and in their distribution (microinsurance, via mobile phones, etc.).

- The underwriting of agricultural risks requires great expertise. In addition to the staff members at their disposal, insurers often collaborate with specialized agencies such as agricultural engineers, veterinaries, chemical product experts, etc.

Agricultural insurance: the various insurance products available

Are insurable the installations, agricultural products, production factors and consumable supplies such as:

- livestock feed,

- fertilizers and pesticides,

- products harvested on the farm such as milk, eggs, the various products reaped from the land (cereals, vegetables, fruits, flowers, etc.), pedigree livestock and animals,

- forests,

- machines and equipment owned or rented by the farmer: engines, machines, tools and equipment that are used in the agricultural operations carried out on the farm,

- agricultural installations and premises.

The various covers of agricultural insurance

In order to insure their properties, farmers are provided with a variety of schemes that may be broken down into three major groups. Each group differs from the others in the way compensations are calculated (a, b, c):

| Kinds of agricultural insurance products | Reimbursements | Availability |

|---|---|---|

| a) Compensation-based agricultural insurance (Insurance payments based on the actual loss sustained by the insured) | ||

| 1. Named perils | Percentage of the damage | widespread |

| 2. Multiple perils | Yield loss | widespread |

| b) Index-based agricultural insurance | ||

| 3. Yield/area index | Yield/area loss | United States, India, Brazil |

| 4. Climate/crop index insurance | Climate index payment scale | India, Mexico, Malawi, Canada, United States |

| 5. Standard Vegetation Index (SVI) | SVI index payment scale | Mexico, Spain, Canada |

| 6. Livestock mortality index insurance | Livestock mortality index payment scale | Mongolia |

| 7. Forest fire index insurance | Ignition concentration/ burnt area payment scale | Canada, United States |

| c) Crop Revenue Coverage | ||

| Crop Revenue Coverage (CRC) | Yield and price losses | Limited to United States |

Insurance covers based on the compensation paid to the insured

|

Policyholders are compensated on the basis of the actual loss sustained. Following the occurrence of an insured event, an insurance expertise (appraisal) is undertaken in order to determine the causes behind the loss and to assess the amount of compensation to be disbursed. This kind of compensation is common for named perils and multiple perils plans.

1- Named peril plans

Predefined type of insurance products makes it possible to indemnify farmers only when one of the plans selected in the policy is identified as the factor responsible for the claim. The characteristics of these guarantees are as follows:

- the insured amount is known upon contract signing. It is based on the production cost or on the anticipated value of the crop,

- the amount of the claim depends on the percentage of the damage sustained by the policyholder,

- a deductible shall be applied to the amount of the compensation owed to the policyholder.

This kind of insurance is particularly adapted to the hail risk, insurance of fruit and vegetables, flowers, warm greenhouses, livestock and aquaculture.

2- Multiple peril plans

Multiple peril insurance covers policyholders against all risks pertaining to production loss, with the exception of the risks that are especially mentioned in the policy. With this kind of insurance contract:

- the insured amount is defined in terms of the yield expected by the farmer. This yield may depend on the estimated or actual production or the latter’s experience, or on the average of the geographical area in question.

- the coverage offered is generally comprised within a bracket of 50% to 70% of the estimated yield.

- the insured amount may also be based on the market price of the guaranteed minimum yield. If the farmer has contracted a loan to finance the crop, the insured sums may depend on the amount of money borrowed.

- the received compensation is equivalent to the difference between the obtained yield and the yield guaranteed at the pre-defined rate at the beginning of the contract.

This kind of insurance cover provides better protection to policyholders for a rate that is substantially higher than the multi peril plan. It is not convenient to smallholder farms.

3- Revenue-based insurance schemes

Revenue or income-based insurance provides policyholders with protection against price or yield decreases. These plans may also be a combination of both price decrease and poor yields at the same time.

This kind of insurance plan may be regarded as a multi-peril scheme based on yield with an additional “price” parameter.

This approach is relatively recent. Traditional plans have been based on the harvested quantity whereas the new form of guarantee is focused on the income generated. The latter is adapted to the needs of the farmers who are now endowed with short-term funding. Both the farmer and the fund lender benefit from a good estimate of expected revenues.

This kind of insurance plan is quite widespread in the countries where financial services are sophisticated such as the United States or Canada.

Agricultural insurance plans with index-based claims

Index-based agricultural schemes make it possible to compensate policyholders according to an index value. This index fluctuates and its random variation determines the losses incurred by policyholders. Index variations are not related to the behavior of policyholders. It may be the case of a climate index, an index based on the level of water course, on the yield of wheat crops at the regional level, etc. it is the index variation during the insurance period that shall determine the notion of a claim. It is, therefore, essential that both insurers and insured set this index and mode of calculation in no uncertain terms.

Index defining may, nonetheless, turn out to be both complex and onerous. For instance, satellite images or data, accurate hydrometric records, etc.

Index-based insurance is endowed with several assets:

- there is no claim evaluation on the insured parcel of land, which rules out any disputes. The index is indisputable (level of precipitation, temperature, level of a river, etc)

- due to the nature of the index, insurers have easier access to reinsurance coverage plans

- anti-selection effects are lessened when the index is based on yield at the level of a region, for instance

- claims may be expeditiously settled

- for insurers, there is more room for innovation by subjecting compensations to new methods such as the quality of fruit or vegetable crops, etc.

Agricultural insurance and State intervention

Fish farming Fish farming |

While agricultural insurance may be totally under the control of private players, it is, nonetheless, not uncommon to notice the intervention of public authorities.

With the primary sector, having a huge economic and social impact in numerous countries, it has become inevitable to support this activity in order to maintain agricultural productivity, thus sustaining the standard of living for rural populations.

The administration of agricultural insurance at a global level may culminate in:

- des marchés d’assurance entièrement contrôlés par les Etats

- des marchés d’assurance fondés sur des partenariats privé/public

- des marchés entièrement dominés par le secteur privé ou « marchés purs »

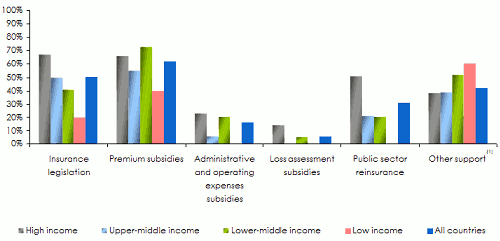

Government support to agricultural insurance

Source : Mahul and Stutley

Source : Mahul and StutleyBy and large, penetration rate for agricultural insurance is strongly dependent on the support of public authorities. This means that the more support provided by public authorities to farmers, the more involved the latter get by underwriting insurance policies. This is particularly the case of North America, the leader of agricultural insurance. Contrarily, it is in Africa that public authorities are least forthcoming in supporting agricultural insurance, hence the poorest turnovers reported for this class of business.

According to a survey carried out by the World Bank in 65 countries, State support for agricultural insurance may come in different ways:

- the drafting of an insurance code that is specific to agricultural risks

- granting subsidies for the underwriting of insurance premiums to low-income farmers. This practice is often used to support insurance schemes designed for livestock mortality and crops

- subsidizing administrative costs, a less common practice but still used in one country out of ten

- funding of campaigns designed to promote insurance plans against livestock mortality and crops: management of costs pertaining to research and development, data collection, staff members’ training, …

- the establishment of a State-run reinsurance system, a model used in one country out of three with regard to insurance covers against livestock mortality and crops

Forms of government support to agricultural insurance per income

(1) including research & development and training Source: Mahul and Stutley

(1) including research & development and training Source: Mahul and Stutley The challenges of agricultural insurance

|

The system that has been set up to support the agricultural sector through the insurance industry is facing numerous challenges which may otherwise stand as growth opportunities. The obstacles to overcome pertain to:

- climate change which has direct impact on production and on increased exposure to systemic hazards

- growing global population and changing consumer habits, especially with regard to the rise in consumption of meat which requires recourse to additional lands for the provision of livestock feed

- reduction of arable lands due to urbanization, increase of areas used for animal feed

- the development of renewable energies using one part of arable lands,

- price volatility for grown products and for livestock