Alliance Insurance Company

With Oman Insurance, Al Ain Al Ahlia and ADNIC, Alliance is part of the very first insurance companies established in the United Arab Emirates.

Detained in a majority stake by local entrepreneurs, the company has been listed on the Dubai stock market since 2005. By December 31, 2016, Alliance Insurance capital amounted to 27 million USD for an overall shareholder’s equity of 125 million USD and assets of 363 million USD.

The 2016 turnover amounted to 82 million USD, that is a 1.5% decrease in comparison with 2015. The company’s operations have been sustained by the non life class of business which accounted in 2016 for 63.1% of the overall premiums. The remainder of the underwritings pertains to life insurance.

Unlike so many other Emirati companies, Alliance Insurance is solely focused on the local market where it holds eight subsidiaries scattered around the country’s main economic and commercial zones. With a turnover undergoing a slight rise during the past five years and net results of approximately 15% of the written premiums during the same period, Alliance is a profitable company in a market renowned for being quite competitive. The evolution of the combined ratio, main technical indicator which reached the peak of 62.2% in 2016, confirms the good governance of the company.

|  |

| Ahmed Bin Saeed Al Maktoum | Aiman Saba Azara |

| Chairman of the board of directors | General manager |

Alliance Insurance in 2016

| Paid up capital | 27 232 000 USD |

| Turnover | 82 157 000 USD |

| Total assets | 363 323 000 USD |

| Shareholder’s equity | 125 062 190 USD |

| Net result | 12 282 000 USD |

| Non life net loss ratio | 53.5% |

| Non life expenses ratio | 8.6% |

| Non life combined ratio | 62.1% |

| Number of branches in the United Arab Emirates | 8 |

Main shareholders

| Juma Saif Rashid Bin Bakhit | 29.5% |

| Ahmed Bin Saeed Al Maktoum | 25% |

| Gulf insurance company | 20% |

| Other shareholders | 25.5% |

Board of directors and management

| Chairman of the board of directors | Ahmed Bin Saeed Al Maktoum |

| Vice–chairman | Saeed Mohammed Al Kamda |

| General manager | Aiman Saba Azara |

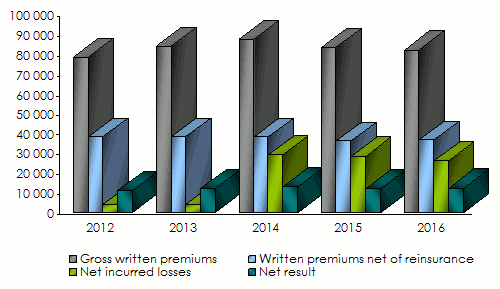

Alliance Insurance : main technical highlights (2012-2016)

in USD

| 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|

Gross written premiums | 78 336 770 | 83 761 206 | 87 336 764 | 83 396 911 | 82 156 826 |

Non life gross written premiums | 39 413 299 | 54 385 849 | 58 314 974 | 53 576 494 | 51 818 943 |

Life gross written premiums | 38 923 471 | 29 375 357 | 29 021 790 | 29 820 417 | 30 337 883 |

Written premiums net of reinsurance | 38 034 409 | 38 077 971 | 38 183 163 | 36 263 938 | 36 856 087 |

Earned premiums net of reinsurance | - | 37 981 586 | 38 051 456 | 36 720 043 | 35 400 253 |

Non life earned premiums net of reinsurance | 5 068 790 | 9 470 123 | 10 002 372 | 8 552 868 | 6 426 673 |

Net incurred losses | 4 034 372 | 3 997 906 | 29 049 183 | 28 388 463 | 25 970 091 |

Non life net incurred losses | 2 114 793 | 4 433 866 | 4 424 112 | 4 301 695 | 3 441 273 |

Management expenses | 6 647 680 | 10 806 287 | 12 954 777 | 9 200 451 | 15 348 445 |

Non life management expenses | 3 403 254 | 4 588 677 | 4 596 984 | 4 327 793 | 4 460 871 |

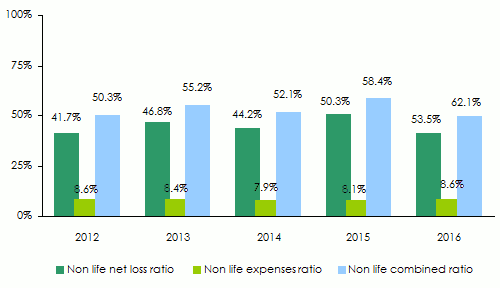

Non life net loss ratio | 41.7% | 46.8% | 44.2% | 50.3% | 53.5% |

Non life expenses ratio(1) | 8.6% | 8.4% | 7.9% | 8.1% | 8.6% |

Non life combined ratio | 50.3% | 55.2% | 52.1% | 58.4% | 62.1% |

Net result | 11 070 692 | 12 052 088 | 13 107 225 | 11 984 009 | 12 282 684 |

Alliance Insurance : evolution of premiums, losses and results (2012-2016)

In thousands USD

Alliance Insurance : evolution of non life ratios (2012-2016)

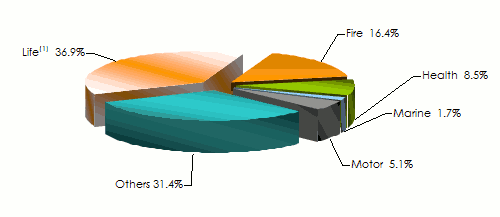

Alliance Insurance : turnover breakdown per class of business (2015-2016)

in USD

| 2015 | 2016 | 2016 shares | |

|---|---|---|---|

Fire | 14 053 608 | 13 488 860 | 16.4% |

Health | 6 759 962 | 6 994 389 | 8.5% |

Marine | 1 621 754 | 1 377 792 | 1.7% |

Motor | 4 161 399 | 4 178 569 | 5.1% |

Others | 26 979 771 | 25 779 333 | 31.4% |

Total non life | 53 576 494 | 51 818 943 | 63.1% |

Individual life policies | 28 944 110 | 29 577 125 | 36% |

Group life insurance | 876 307 | 760 758 | 0.9% |

Total life | 29 820 417 | 30 337 883 | 36.9% |

Grand total | 83 396 911 | 82 156 826 | 100% |

Alliance Insurance : turnover breakdown per class of business in 2016

Source: The different balance sheets of «Alliance Insurance»

Exchange rate AED/USD as at 31/12 | 2012 | 2013 | 2014 | 2015 | 2016 |

0.272260 | 0.27230 | 0.272310 | 0.272340 | 0.27232 |

Alliance Insurance

| Head office | St. Alliance Insurance PSC P O Box 5501, Dubai, United Arab Emirates |

| Phone | +971 4 605 1111 |

| Fax | +971 4 605 1112 |

| Website |