Emergence and evolution of Takaful insurance

|

Currently operational in more than 75 countries, Takaful insurance saw the light of day in the 1970s in the wake of the development of the Islamic financial system.

At its beginning, the pattern remained confined to Muslim countries, its original sphere. It first got established in the Middle East (Saudi Arabia, United Arab Emirates) and Southeast Asia (Malaysia, Brunei, and Indonesia). Starting from 2006, Takaful insurance has been gathering momentum, spreading to other areas in Africa and even in Europe where a big community of Muslim people has settled down.

Takaful insurance : Number of operators in 2014

| Region | Number of operators |

|---|---|

The Gulf Cooperation Council (GCC) | 72 |

Iran | 19 |

East Asia and Pacific | 40 |

Africa | 41 |

South Asia | 21 |

Near East | 8 |

Others | 4 |

According to an estimate carried out by Deloitte firm in 2012, the global takaful insurance market is likely to attain 20 billion USD in 2017, forecasts that were already largely exceeded as of 2014. By the end of 2015, the 2016 report on Islamic Financial Services Industry Stability evaluated the market at 23.2 billion USD.

For the same year, premium growth is set at 5% compared to 4.2% of the global conventional insurance market.

Over a ten-year period, that is, between 2006 and 2015, takaful insurance progression was of 355%.

Takaful insurance : market growth 2006-2015

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|---|---|---|---|---|

Takaful premiums | 5.1 | 7.2 | 10.2 | 12 | 14.2 | 16 | 19 | 19.5 | 22.1 | >23.2 |

Global insurance premiums | 3 674 | 4 127 | 4 220 | 4 109 | 4 335 | 4 566 | 4 599 | 4 641 | 4 755 | 4 554 |

Share of takaful insurance | 0.13% | 0.17% | 0.24% | 0.29% | 0.32% | 0.35% | 0.41% | 0.42% | 0.46% | 0.51% |

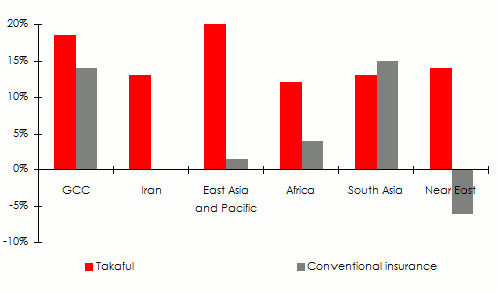

Growth in % of takaful and conventional insurance per region between 2014 and 2015

Takaful insurance : breakdown of 2015 premiums per region

In billion USD| Region | 2015 premiums | Market shares |

|---|---|---|

Asia | 5.2 | 22.4% |

Gulf Cooperation Council (GCC) | 10.4 | 44.8% |

MENA outside CCG | 7.1 | 30.6% |

Sub-Saharan Africa | 0.5 | 2.2% |

Total | 23.2 | 100% |

With 44.8% in market shares, the countries of the Gulf Cooperation Council (GCC) are in the pole positions of takaful insurance. The overall turnover amassed for the six GCC countries is set at 10.4 billion USD in 2015. The countries of the MENA zone, excluding GCC States, which account for 30.6% of the premium collection, come second, followed by Asia with 22.4%. In Sub-Saharan Africa where takaful insurance is at its beginning, the overall premiums amount to 0.5 billion USD, that is 2.2% of the total market.

According to the Islamic Financial Services Board (IFSB), three countries namely Saudi Arabia (37%), Iran (34%) and Malaysia (14%) dominate the market reporting 85% in premiums.

Takaful insurance in the Gulf and Asian countries

Takaful insurance has witnessed a remarkable boom in the Gulf States as well as in Southeast Asia. It remains underexploited in some areas of Africa and Europe.

Takaful insurance in Southeast Asia

Even though approximately 60% of the population is Muslim, Malaysia remains a pioneer market of takaful insurance. It was in 1984 that a specific institutional framework was designed and that the first specialized operator, known as Syarikat Takaful Malaysia, was born. The development prospects of this market are promising, mainly in the family takaful class of business which equates traditional life insurance.

This segment is poised to account for 25% of the insurance market share in Malaysia by 2020, compared to 14% by the end of 2014. For the same period, the number of customers is likely to reach 8.4 million people compared to 4 million for the time being. The market has aroused envy among several foreign operators in the likes of American MetLife, South African Sanlam and the Swiss group Zurich Insurance which have proceeded to some acquisitions in recent years.

Indonesia, Pakistan, Brunei, Thailand and the Philippines stand among Southeast Asian countries where takaful insurance is witnessing substantial growth. The establishment by some insurers of takaful windows, providing at the same time conventional products that are consistent with Sharia, has boosted this activity.

Takaful in the Gulf countries

In the Gulf countries, the 18.5% progression of takaful insurance in 2014 turned out to be faster than that of conventional insurance which is set at 14%. This market, which, alone, accounts for 72 takaful insurers out of the 205 operating worldwide, exhibited an average penetration rate(1) of 8% in 2014.

Disparities have, nonetheless, been spotted at the level of regional countries. Saudi Arabia, alone, accounts for 80% of the takaful premiums of the Gulf Cooperation Council region whereas Bahrain, Kuwait, Qatar, Oman and United Arab Emirates share the remainder of the market. The highest penetration rates have been reported in Bahrain (22%) and in Qatar (13%). In Oman, where takaful is witnessing sustained growth, this rate is set at 9%. In 2015, Omani takaful operators reported a 64% increase in premiums at 39 million OMR (102 million USD).

(1) Share of takaful insurance in the overall insurance premiums

Takaful insurance in Egypt

The Egyptian takaful insurance market remains tight. Its contribution to the global turnover accounts for just 8% of the total premiums. According to Moody’s, Egypt is endowed with huge growth potential, thanks to its population of 92 million people, mainly Muslim.

The recent evolution at the level of takaful regulations has prompted new entrants such as Misr Emirates Insurance Company (Metlico) which started operations in 2015. A new player is equally poised to see the light of day before the end of 2017.

Takaful insurance in the Maghreb countries

In the Maghreb countries, the takaful market is also promising. Several obstacles are, nonetheless, hindering its development. The weakness of the local financial market, the absence of any risk culture, and most importantly, the absence of a regulatory framework constitute impediments for the growth of the activity.

Takaful insurance in Algeria

Algeria provides Islamic insurance products through the company Salama Assurance whereas the country is not yet endowed with a regulatory framework that is dedicated to takaful activity.

Established in 2000, the first Algerian takaful insurer reported a turnover of 44 million USD in 2015 . Its market share also progressed going from 3% in 2008 up to 4% in 2015.

Takaful insurance in Tunisia

In Tunisia, three takaful companies have recently seen the light of day. They are Zitouna Takaful (2013), Amana Takaful (2014) and At-Takafulia (2014).

In 2015, the combined turnover of those three companies was set at 24.4 million USD, which accounts for a market share of 3%. Takaful insurance, only starting in Tunisia, benefited in 2014 from a specific regulatory framework.

Takaful insurance in Morocco

Morocco, where no takaful insurance product is currently being distributed, modified its insurance code in 2016, introducing a new regulatory framework governing takaful activity. The law stipulates that companies keen on exercising takaful activity are required to set up separate legal entities from traditional insurance companies.

Wafa Assurance has announced the imminent establishment of a takaful entity.

Takaful insurance in Sub-Saharan Africa

Kenya , where Muslims account for approximately 15% of a population estimated at 40 million people, has embarked on takaful business. In this country, Islamic finance accounts for 2% of the banking sector. Kenya introduced a new regulation in May 2015, enabling conventional players to make their entry to this niche.

The law, however, requires that companies set up separate takaful units whose operational management shall be tasked to a committee that is approved by the council of religious studies.

Takaful Insurance Company of Africa (TIA) is the first operator to be established in the country in 2011. In the course of the last five years, TIA has witnessed rapid growth. Indeed, the premiums which amounted to 7.6 million USD in 2015 are poised to attain 12 million USD in 2016.

Nigeria With a poor insurance penetration rate and rapid growth of the middle class, the Nigerian insurance market remains promising. The national insurance commission (NAICOM) published a directive in 2013 governing takaful activity.

Composite insurers have embarked on this niche, providing life and non life products along with saving and investment schemes compliant with Sharia. They are African Alliance Insurance, Niger Insurance and Cornerstone Insurance.

Takaful insurance in Europe

Western countries have also exhibited their interest in takaful market This is the case of Great Britain, the most advanced European country on this course. London has already proclaimed itself as the center for Islamic finance. In April 2015, the first association of Islamic insurance (Islamic Insurance Association London), saw the light of day. Great Britain is also the first country outside the realm of the Islamic world to have issued in 2014 Sukuk (Islamic bonds). In April 2015, XL group, in association with Cobalt Underwriting, a specialist in Islamic insurance, launched, through Lloyd’s, a product that is consistent with the Sharia principles.

In France, over a basis of 2% of market share, the takaful activity potential is estimated at 3 billion USD.

Spain set up in 2015 a CoopHalal cooperative, the first operational instrument of Islamic finance, which distributes takaful insurance products in the country. In search for a new growth vector, global reinsurance leaders have also adopted this concept. This is the case of Hannover Re which created, in Bahrain and Malaysia, subsidiaries devoted to Islamic reinsurance.

Since respectively 2006 and 2007, Swiss Re and Munich Re have also been practicing reinsurance activities of Islamic nature. Finally, several reinsurance companies named retakaful have seen the light of day in the last decade.