Maritime gigantism, a risky turning point for insurers

Maritime gigantism: container ships, a high risk

The largest container ship CSCL Globe © Keith Skipper , CC BY-SA 2.0 The largest container ship CSCL Globe © Keith Skipper , CC BY-SA 2.0 |

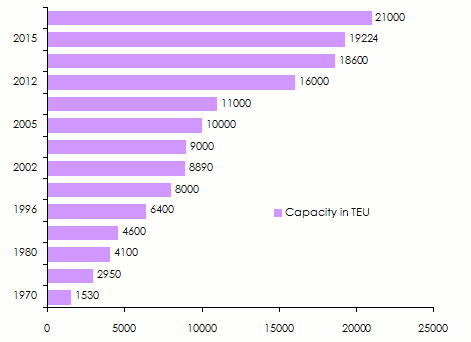

The biggest container ships could today ship more than 19 000 TEU (1) , whereas in the beginning of the 1970s, when modern containership emerged, the capacity of such ships was limited to just 1 500 TEU.

The record of the world’s biggest commercial ship was beaten twice in 2015. The first time in January when the ship “MSC OSCAR”, with a capacity exceeding 19 000 TEU was delivered to Swiss ship owner “Mediterranean Shipping Company”. The second time was in July when “MSC ZOE” tied up at the dock of Anvers port with a cargo capacity of 19 224 TEU. It is the world’s biggest container ship with a length equal to four soccer pitches.

Despite the problems it raised, this maritime gigantism is nowhere near stopping and the race for size does not seem to end in the foreseeable future. The first 21 000 TEU units were delivered in 2017. It is the case of the OOCL Hong Kong or the OOCL Germany.

According to a report jointly published by the Organization for Economic Cooperation and Development (OECD), and International Transport Forum (ITF) (2) , 24 000 TEU containerships are expected to be put in service as of 2020. The same source is also expecting that in 2019, 135 containerships with a capacity exceeding 18 000 TEU will be seaworthy.

Ship size went threefold in twenty years and the trend is poised to continue

(1) TEU: Twenty-foot Equivalent Unit (1 foot = 30.48 cm).

(2) Source: internationaltransportforum.org/pub/pdf/15CSPA_Mega-Ships.pdf

Maritime gigantism: Evolution of container ships capacity from 1970 to 2017

Source: Allianz Global Corporate&Speciality

Source: Allianz Global Corporate&Speciality Unprecedented value concentration

|

This mad race for size has triggered value concentrations of unprecedented scale. According to the report by the International Union of Marine Insurance (IUMI) (1) , published in mid-September 2015, the hull value of a giant container ship with a capacity of 19 000 TEU has been estimated at 200 million USD whereas its maximum cargo is estimated at 800 million USD. For insurers, this commercial vessel accounts for one billion USD in hull and cargo capital, excluding liability-triggering loss. Needless to picture the amount of damages triggered by a collision of two giant container ships!

(1)iumi2015.de/wp-content/uploads/2015/09/14+09_1155_seltmann.compressed.pdfPorts adapting to maritime gigantism

Major ports have been, on their part, compelled to cope with the growing trend of containerization and the consolidation of maritime traffic flows. Port basic structures have been enlarged to facilitate cargo loading and unloading, container transfer as well as to improve warehousing capacity.

The rapid growth of warehouse goods has prompted the extended stays at quay, thus, increasing the already high risks, aggravated by the increasing value of hulls. The mega loss that occurred in August 2015 in Tianjin harbor (China) is very close to the scenario whereby hull and cargo losses have been combined in a modern port.

The Tianjin catastrophe, the event that unveils the other facet of maritime gigantism

|

The year 2015 was the scene of an unprecedented marine disaster. The hyper concentration of risks in the Tianjin Harbor, the world’s fourth biggest port(1) , has resulted in monumental human and financial losses. The official toll established by the Chinese authorities reported 173 people killed and 700 injured. With regard to material damage the report states that 17 000 dwellings have been damaged, 1 700 businesses badly affected and 10 000 new cars completely destroyed.

According to Guy Carpenter(2) , this catastrophe has generated a record number of compensation claims from insurers. The American broker has estimated the cost of human and material damages related to the disaster at more than 3.3 billion USD, a huge portion of which has been accounted for by marine insurance (marine cargo insurance). It is in countries known for their high marine traffic, mature or emerging countries with high growth rates that these losses are most dreaded.

Cruise boat gigantism, another burden for insurers

«Harmony of the Seas» en construction © Ludovic Péron , CC BY-SA 4.0 «Harmony of the Seas» en construction © Ludovic Péron , CC BY-SA 4.0 |

The situation for passengers' marine transport is not reassuring, either. Just like container ships, cruise boats have been under the spell of gigantism.

More than a century ago, the British boat Titanic had the capacity to carry 3300 passengers, 944 of whom were crew members.

Today, “the Allure of the Seas”, owned by the Finnish ship company Royal Caribbean Cruise Line, put in service in 2010, is regarded as the biggest passenger ship in the world, with a capacity of up to 7784 persons, 2384 of whom are crew members.

The cruise boat “Harmony of the Seas”, delivered in May 2016 to the same Finnish ship owner. With 362 meters in length and 66 meters in width, it was the world’s biggest boat in 2016. However, the “Symphony of the seas” snatches its title in 2018.

Cruise boats today are real floating small towns, with the possibility of harboring shops, swimming pools, theaters, green areas and even surf practices and gulf fields. The size of those giants of the seas and the amounts of compensation in the event of a claim are raising many questions and worrying insurers.

According to a report by the French sea institute IFM(1), the value of large boats (carrying between 5000 and 8000 passengers on board) may amount to 1.2 billion USD, in addition to Protection and Indemnity Clubs (P&I Clubs). In total, the amount of a major claim in terms of a classical insurance policy may, according to the experts, attain 4 billion USD.

Despite the improvements made at the level of marine transport safety, the insurance market remains confronted to new challenges(2). The evacuation of passengers, whose number ranges between 6 000 and 8 000 from cruise boats, poses numerous security issues in the event of damage in the open sea.

(1) Source: ifm.free.fr/htmlpages/pdf/2009/rapport-gigantisme.pdf

(2) Atlas Magazine «Safety and maritime transport»

The sinking of the Titanic

The RMS Titanic is a British transatlantic boat belonging to the company “White Star Line”. It is renowned to be the largest and most luxurious boat ever built at the time of its launch. On its first voyage from Southampton (United Kingdom) to New York, it hit an iceberg and sank three hours later, in the night of April 14t h to 15 th , 1912. The sinking claimed the lives of 1513 people out of the 2200 passengers on board. This tragedy has been a source of inspiration for numerous films and novels, the most famous of which was James Cameron’s movie, “Titanic”.The race for gigantism of cruise boats and container ships has aggravated risks for insurers. Their commitments are heavier and heavier due to the value of ships and their cargo as well as to the operating costs of repair, rescue, wreckage recovery, in addition to risks emanating from pollution and compensation of passengers and third parties.

Read also | Top 10 of the largest cruise boats

Maritime gigantism and cyber-risks

The evolution of ships in terms of size and value goes hand in hand with the progress of technologies on board. Today, the development of electronic navigation has triggered growing concern for marine insurers. A cyber attack targeting the electronic navigation system is likely to result in the total loss of a ship and possibly affect several navigation structures of other transport units belonging to the same ship owner.

Other scenarios presented by the last report of Allianz “Safety and Shipping Review 2015”(1), showcase the possibilities for cyber criminals to target an important harbor, close terminals or compromise confidential data. Such attacks are likely to trigger significant operating losses, without forgetting risks pertaining to third party liability and damage to reputation.

(1) Source: agcs.allianz.com/assets/PDFs/Reports/Shipping-Review-2015.pdf

Major marine catastrophes: (2002-2015 period)

| Date | Event |

|---|---|

30-09-2015 | American cargo ship SS El Faro, en route between Jacksonville (Florida) and the Island of Porto Rico (the Great Antilles), sank off the coasts of the Bahamas. The loss, which was caused by hurricane Joaquim, claimed the lives of 33 crew members. |

01-06-2015 | A cruise boat, carrying 458 people on board, ran aground Yantsé River (China). 445 people went missing. |

16-04-2014 | South Korean ferry-boat Sewol sank en route between Incheon and the island of Jeju. The event claimed the lives of more than 300 people out of the 476 passengers. |

17-06-2013 | Japanese container ship MOL Comfort, carrying 4 382 containers, sank in the Indian Ocean as a result of a hull crack. The 26 crew members had evacuated the ship before it ran aground. |

29-10-2012 | The replica of the three mastered HMS Bounty sank off the coasts of North Carolina (USA) during the passage of hurricane Sandy. The incident claimed the life of one person while another went missing. |

02-02-2012 | Papuan New Guinean (Pacific Island) ferry-boat, MV Rabaul Queen, sank on its voyage between the cities of Kimbe and Lae. 104 passengers went missing. |

13-01-2012 | Cruise boat Costa Concordia ran around near the island of Giglio in Italy, claiming the lives of 32 people while 2 went missing. |

16-12-2011 | Cargo ship TK Bremen sank in Erdeven in Morbihan (France) as storm Joachim swept the area. |

05-10-2011 | Container ship MV Rena grounded on a reef in New Zealand. It broke into two parts between January 1 and 13, 2012. |

17-12-2009 | Cargo ship MV Danny F II sank off the coasts of Lebanon en route from Montevideo (Uruguay) to Tartous (Syria). 9 people lost their lives, as a consequence. |

05-08-2009 | Sinking of the Tongan ferry-boat MV Princess Ashika on its voyage from the capital city Tonga to Ha’apai (Oceania islands), claiming the lives of 74 people. |

23-05-2009 | Commando, a ferry-boat owned by the company Ilagan Shipping Lines, sank killing 12 people. The boat connected Batangas to Puerto Galera, Philippines. |

11-09-2008 | Irish brick-goélette Asgard II sank off the coasts of Belle-Ile-en-Mer (France) as a result of a water leakage. |

21-06-2008 | Ferry-boat Princess Of The Stars, owned by the company Sulpicio Lunes, sank claiming the lives of 828 people. The ship ran aground because of tidal waves triggered by typhoon Fengshen in the Philippines. |

06-04-2007 | Cruise boat Sea Diamond sank near the coasts of Santorin Island in the Cyclades (Greece). |

02-02-2006 | Ferry-boat Al-Salam Boccaccio sank in the Red Sea, claiming the lives of 1000 people. |

13-11-2002 | Oil tanker Prestige sank in Spain off the coasts of Cape Finisterre. |

26-09-2002 | Senegalese ferry-boat Le Joola sank off the coasts of Gambia, claiming officially the lives of 1 863 people, and unofficially more than 2000 victims. The ferry’s legal capacity is set at 550 passengers. |

Read also:

The Joola catastrophe

Joola, the car-ferry connecting the Senegalese capital Dakar with the region of Casamance sank on October 26, 2002 off the coast of Gambia. The disaster claimed the lives of 1863 passengers whereas the boat was designed to carry only 550 passengers. The loss of Joola stands among the deadliest marine catastrophes in modern history, ahead of the Titanic (1513).See also: