NSIA group, a 100% African success story

Today, the group detains 25 subsidiaries, two of which are banks operating in twelve Western and Central African countries.

The NSIA group’s genesis

Set up in January 1995 in Côte d’Ivoire by Jean Kacou Diaguo, the Nouvelle Société Interafricaine d’Assurance (NSIA) started operating in July of the same year.

In 1996, it has acquired the life and non life subsidiaries of Assurances Générales de France (AGF) which decided to withdraw from the Ivorian market.

The group NSIA-AGCI, in its new configuration, will stand as a basis for the future building that will soon harbor the new developers. A remarkable expansion comprising in-house and external growth ensues.

The NSIA group first acquisitions: 1998-2007

View of the towers of Plateau’s Est Center © Skiper, CC BY-SA 3.0 View of the towers of Plateau’s Est Center © Skiper, CC BY-SA 3.0 |

From its Ivorian base, the newly-established NSIA group sets out for the conquest of Africa. It was in Benin, in 1998 that the first operation across the border was conducted.

In 2000, the Anciennes Mutuelles du Gabon (AMG) joined the group, a takeover that gave birth to NSIA Assurances Gabon.

In 2002, NSIA-AGCI entity changed its corporate name to become NSIA group. New establishments in Senegal (2002), Congo (2004) and Togo (2005) followed.

The group then extends its operations to include the life class of business by setting up no less than four subsidiaries in 2005: Congo, Gabon, Senegal, and Benin. The subsidiary NSIA Vie Togo saw the light of day in 2006.

During 2006, all companies came together within a holding named NSIA Participations SA Holding which now steers the group’s operations from Côte d’Ivoire.

Loyal to its expansion strategy, the group continues weaving its web allying with private nationals with a view to extending its field of action.

Consequently, two new non life subsidiaries were set up in 2007 in Guinea Bissau and in Cameroon.

NSIA group sets foot in bancassurance

The year 2006 is a turning point for NSIA which decided to diversify its activities by embarking on bancassurance.

Thanks to its pioneering and ambitious spirit, the group decided not to settle with a simple agreement with a financial institution, by acquiring the Banque Internationale de l’Afrique de l’Ouest (BIAO), the Ivorian subsidiary of the Belgian-Dutch group Fortis.

This move enabled NSIA not only to have its own banking network but also to multiply its territorial presence via BIAO’s agencies.

At the end of this first period of a little more than ten years, NSIA group has become present in eight Western and Central African countries. Its network comprises 13 insurance companies in addition to a bank, the BIAO.

2008, a new start, new horizons

The group’s performance did not go unnoticed. Emerging Capital Partners (ECP), an investment fund manager, dedicated to Africa, based in Tunis, entered in 2008 NSIA’s shareholding, with a 20% stake in the capital of the Ivorian group for a contribution worth 22.95 billion FCFA (49.34 million USD).

At the end of 2008, the group reported 63 billion FCFA (135.4 million USD) in turnover. Its average annual growth is of 20% during the last five years. This performance was achieved in spite of the political and military crisis that strained Côte d’Ivoire from 2002 until 2007.

Extension of the banking activity

Five years after the acquisition of BIAO Côte d’Ivoire, NSIA group extended its banking operations to include Guinea. In 2011, it set BIAO Guinea which became, one year later, NSIA Banque Guinée.

Activities excluding insurance and banking operations

In order to support its insurance and banking operations, NSIA has invested in new technologies, a value-adding sector. Based in Côte d’Ivoire, NSIA Technologies started its operations in 2012.

In order to support its insurance and banking operations, NSIA has invested in new technologies, a value-adding sector. Based in Côte d’Ivoire, NSIA Technologies started its operations in 2012.

The company specialized in information and communication technologies, security consultancy for information systems and project management.

A giant Canadian in NSIA group capital

In March 2015, the national bank of Canada (BNC) and French investment fund dedicated to Africa, “Amethis Finance”, acquired the shares detained by Emerging Capital Partners (ECP) for the amount of 91.53 million USD. BNC, one of the most important Canadian financial groups worth nearly 165.7 billion USD in the stock market and Amethis acquired respectively 20.9% and 5.4% of NSIA’s capital. The financial resources reaped from this transaction were to speed up NSIA’s development, boosting it to the rank of the leading African specialists in bancassurance.

The arrival of new partners will materialize with successive capital increases, the first of which amounting to 15 billion FCFA (25 million USD)(1) and will be concluded during the first quarter of 2016.

(1) www.jeuneafrique.com/mag/287915/economie/jean-kacou-diagou-nsia-saisirons-toutes-opportunites-domaine-bancaire

New partner, new resources, new horizons

At the end of 2014, NSIA group was well-established in West and Central Africa. The group reported a turnover of 195.7 billion FCFA (362.6 million USD), 149.2 billion FCFA (276.5 million USD) of which for its insurance activity. The group has a network of 25 subsidiaries and 1700 staff members.

This flattering provisional assessment has not restrained NSIA’s ambitions whose activities were no longer confined to the sub-region of West Africa.

The group was then endowed with the expertise and the human resources that enabled it to widen its ambitions and conquer other African regions.

The democratic Republic of Congo, which had just authorized the establishment of foreign companies on its territory , Angola, Tanzania, Uganda, Rwanda, Ethiopia and Kenya stood as mid-term achievable objectives.

Once these objectives have been achieved, the group will have to just target Africa from both ends, that is, North Africa and the southern cone of the continent, which required, once more, new resources and new partners.

Overall turnover of NSIA group at 31.12.2014

In USD

| Activity | Turnover | % |

|---|---|---|

| Insurance | 276 513 925 | 76,26% |

| Banking | 78 504 198 | 21,65% |

| Other activities | 7562 093 | 2,09% |

| Total | 362 580 216 | 100% |

Exchange rate as at 31/12/2014: 1 FCFA =0.001853 USD Source: NSIA

- 1995

- January: Establishment of Nouvelle société interafricaine d’Assurances NSIA

- July: Start of NSIA’s activities

- 1996Acquisition of «Assurances Générales de Côte d’Ivoire» (AGCI and AGCI Vie)

- 1998Nouvelle Société d’Assurance du Bénin(NSIA Benin)

- 2000Acquisition of Anciennes Mutuelles du Gabon (NSIA Assurances Gabon)

- 2002NSIA Assurances SénégalThe NSIA-AGCI group renamed Groupe NSIA

- 2004

- 2005

- 2006NSIA Participations SA Holding NSIA Vie Assurances Togo Acquisition of BIAO Côte d’Ivoire (NSIA Banque CI)

- 2007

- 2008Entry of ECP in the capital of NSIA Participations SA

- 2009

- 2010Acquisition of (CDH) which becomes NSIA Assurances Ghana

- 2011Acquisition of ADIC Insurance (NSIA Nigeria)BIAO Guinée (NSIA Banque Guinée)

- 2012NSIA Technologies

- 2013

- 2014NSIA Fondation

- 2015The national bank of Canada (BNC) and «Amethis» aquire the stakes held by Emerging Capital Partners ECP in NSIA

The NSIA group set up a charity in 2014. Baptized NSIA Fondation, this institution was designed to support the group’s social actions undertaken in the country where it is established.

Its mission focused on supporting children at school by building schools in underprivileged areas.

The Foundation also provides scholarships to graduate students keen on pursuing studies in Europe.

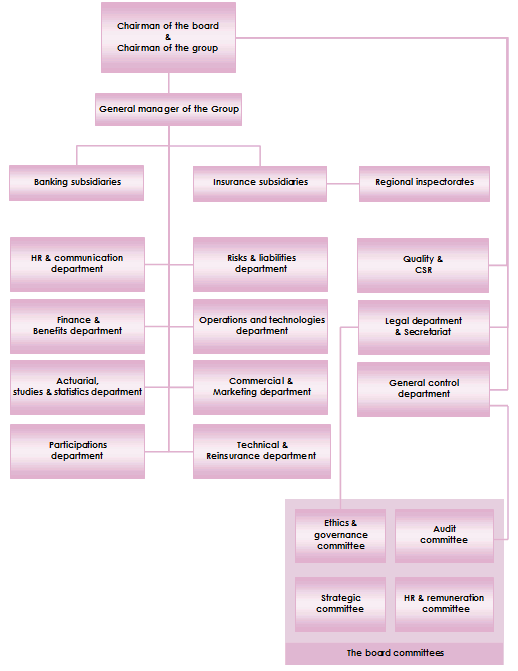

Organisation chart of the Holding