Political risks insurance

This term generally encompasses a series of events including terrorism, sabotage, strikes, riots, civil commotion, war risks and the like.

The coverage of these political risks has drastically changed since the 9/11 attacks. At a time when instability grows, the threats are more present, as evidentiated by the recent events of the Arab Spring, the disappearance of flight MH 17 downed over the Ukraine, political unrest in Africa and the Middle East.

The coverage of these political risks has drastically changed since the 9/11 attacks. At a time when instability grows, the threats are more present, as evidentiated by the recent events of the Arab Spring, the disappearance of flight MH 17 downed over the Ukraine, political unrest in Africa and the Middle East.

The upsurge of events revives the debate over the insurability of these risks. States’ influence to determine liability remains of paramount importance.

Because political risks are poorly defined and poorly understood, they have for a long time been a central issue for insurers who are struggling to analyze their actual exposure to these events.

Political risks: Definition

Political risks are risks that affect all players in public and private life. Investors are particularly vulnerable because the existence of such risks strains the economic activity.

The occurrence of an event related to one of these risks can be prompted by a political decision, a societal upheaval, a security movement. It is likely to give rise to a wide variety of actions, expropriation by local authorities, nationalization without compensation or with minor indemnification, strike, riot, civil disorder, rebellion, insurrection, revolution, coup, terrorism, sabotage, malicious acts, civil war, etc.

Of all the risks listed above, terrorism is now one of the most significant risks to the world of insurance even though the awareness of the terrorist threat remains relatively new among the professionals in this business.

For insurers, terrorism can be defined as an act, with the use or threat of use of violence or force, committed by a person or group of persons acting for or on behalf of an organization or a government, for political, religious, ideological, ethnic or similar reasons, including for the purpose of influencing any government and/or scare the population or part of the population.

As for terrorism, there are also numerous definitions of risk of war (declared or not), civil war, revolution, insurrection and rebellion. Broker AON annually publishes a map of political risks, displaying through a colour scheme, the States and the types of risks to which they are exposed.

Political risks: A very subtle line between insured and uninsured events

The AZF factory in ruins, Toulouse © Anton Merlina Bonnafous, CC BY-SA 3.0 The AZF factory in ruins, Toulouse © Anton Merlina Bonnafous, CC BY-SA 3.0 |

In the area of political risk, the boundary between events covered by insurance policies and reinsurance treaties and those not covered is sometimes very thin.

It is necessary to clearly define the risk and establish, for instance, the difference between events devoid of political claim (covered by insurance) and a riot or civil commotion of political nature (excluded from ordinary insurance contracts).

This is the case between an accidental explosion (covered by insurance) and an act of sabotage or terrorism (excluded from standard insurance contracts). The explosion of the AZF factory in Toulouse (France) or the disappearance of flight MH 370 in the southern Indian Ocean are relevant examples.

The classification of an event can be simplified when public or political authorities grant clear characterization for the event in question: riots, demonstrations, civil war, etc.

The subjective nature of this topic may trigger controversial debate between the parties involved after the occurrence of an event causing losses. It is therefore essential to clearly define the coverage using terms that leave no margin for misinterpretation.

Evolution of political risks in insurance

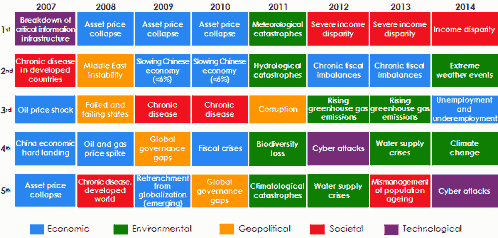

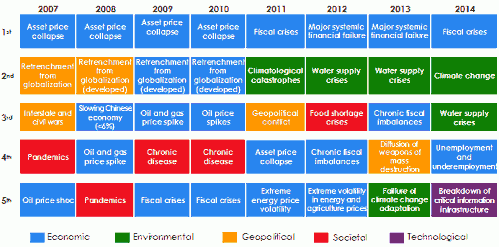

he annual World Economic Forum studies have highlighted the evolution of risk perception by companies, showing that political risks are, until 2011, the most dreaded by companies in terms of likelihood of occurrence. They remain equally feared in terms of impact even if they are less present today in the minds of corporate business.

Evolution in the perception of occurrence likelihood and in the impact of the five most significant risks from the standpoint of corporate business

Top 5 global risks in terms of likelihood

Top 5 global risks in terms of impact

The scope and terms of political risk coverage vary from one region to another. Insurance obligations induced by some State laws may also come into play.

After 2001, the fear of an upsurge in terrorist threats led to an evolution among insurers and reinsurers. Terrorism, when it has not been totally excluded from standard insurance policies and reinsurance treaties, has often been limited to a percentage of the insured sums.

The same pattern has also been replicated to the riots and civil commotion. Ever since, limits per event and per year of insurance have been systematically imposed by proportional treaties. For non-proportional reinsurance treaties, the risk is confined to a limited number of reinstatements of covers.

Finally, terrorism and war risks are increasingly transferred to specialized insurers or reinsurers as this is the case for aviation risks split between standard and war risks.

In terms of reinsurance, a major transfer of capacity to the facultative market has been noted. According to Guy Carpenter, more than 2.5 billion USD in capacity for terrorism and sabotage risks were made available on the facultative reinsurance market in 2013.

For less "extreme" political risks, the Arab Spring, has introduced a distinction between movements with or without political claims. The former have been excluded from traditional insurance policies while the latter have remained under insurance coverage.

Political risks insurance: The specificity of the marine class of business

Until 1967, war risks had been considered ordinary risks and were gradually excluded from traditional insurance policies to be subjected to specific coverage. Today, the basic policies do not provide coverage for political risk. This risk separation is accounted for by the exceptional nature of this type of event. The occurrence of a claim of political nature is likely to trigger huge losses to both transported goods whose value continues to rise and to the ship hull.

Container ship © New Zealand Defence Force, CC BY 2.0 Container ship © New Zealand Defence Force, CC BY 2.0 |

The current basic marine policies are usually consistent with the terms of the London market. The marine contracts include the conditions known as Joint Excess Loss Committee.

However, it is common that special agreements and additional clauses take into consideration the facts related to certain political risks. The most used terms include the following:

- Special agreements to cargo and/or hull insurance against the majority of political risks with extended guarantees. Extended guarantee clauses provide additional policies to special agreements for the coverage of cargo and/or hull insurance.

- Guarantees known as Waterborne Agreement: these special agreements for cargo and/or hull insurance by sea.

Read also | Safety and maritime transport

Insurance and modeling of political risks

Modeling political risk involves two distinct phases:

- identification of threats to insured property,

- the development of an insurance policy that exactly matches the risks incurred.

This second phase can be difficult given the complexity of the definition and the varied interpretations of political risks. In addition, reinsurers have a point of view that goes beyond the limits of a single country.

They can impose a protection based on a divergent and therefore more restricted perimeter than that envisaged by the local insurer. In this case, the latter has to protect itself against the gap between the policies it sells and the coverage it gets from its reinsurers. This situation is common when underwriting comprehensive risks which require analysis of the exclusions as per the terms provided by the insurer and those imposed by the reinsurers.

The Umbrella Revolution, Hong Kong © Doctor Ho, CC BY-SA 2.0 The Umbrella Revolution, Hong Kong © Doctor Ho, CC BY-SA 2.0 |

The emergence of the Arab Spring has significantly altered insurers’ practices regarding the marketing of political risks. Strikes, riots and civil commotion were oftentimes attached, with no surcharge, to the basic fire covers.

Following the outbreak of turmoil in Arab societies, reinsurers have consistently demanded an additional premium to cover the political risks in non life insurance policies without real modeling as the lack of data on this subject does not allow accurate pricing.

After the 9/11 attacks, experts started to question the insurability of terrorism risks whose nature is difficult to determine. The occurrence of such an event evolves according to geopolitical friction.

Furthermore, as tension has been running high, experts fear that terrorist groups may be endeavoring to obtain nuclear, biological, and chemical weapons, which is likely to render risk modeling even more complex. For each previously identified potential target, the models make it possible:

- to consider blast damage, the distribution of toxic elements from possible attack by non-conventional weapon, and the dispersion of gas according to the evolution of meteorology,

- to calculate insured losses by insurance policy and by scenario.

Insurance pools and state coverage of political risks

To help insurers and reinsurers improve their management of political risks, particularly the risk of terrorism, some States have set up specialized insurance pools.

These pools, thus, allow the insured to benefit from a minimum cover in particular with regard to major industrial and commercial risks.

List of countries having established compulsory or facultative terrorism pools

| Country | Compulsory pool Yes/No | Terrorism pools or reinsurance mechanisms |

|---|---|---|

South Africa | No | South African Special Risks Insurance Association (SASRIA) |

Germany | No | Extremus Versicherungs-AG |

Australia | No | Australian Reinsurance Pool Corporation (ARPC) |

Austria | No | Oesterreichischer Versicherungspool zur Deckung von Terrorisiken (The Austrian Terrorpool) |

Bahrain | No | The Arab War Risk Insurance Syndicate (AWRIS) |

Belgium | No | Terrorisme Reinsurance & Insurance Pool (TRIP) |

Denmark | No | Danish Terrorism Insurance Scheme |

Spain | Yes | Consorcio de compensacion de Seguros (CCS) |

United States | No | Terrorism Risk Insurance Reauthorization Act of 2007 (TRIPRA) |

Finland | No | Finnish Terrorism Pool |

France | Yes | Gestion de l’Assurance et de la Réassurance des risques d’Attentats et Terrorisme (GAREAT) |

Hong Kong - China | No | The Motor Insurance Bureau (MIB) |

India | No | The General Insurance Corporation of India |

Indonesia | No | Indonesian Terrorism Insurance Pool |

Northern Ireland | No | Criminal Damage Compensation Scheme Northern Ireland |

Namibia | No | Namibia Special Risks Insurance Association (NASRIA) |

Netherlands | No | Nederlandse Herverzekeringsmaatschappij voor Terrorismeschaden |

United Kingdom | No | Pool Reinsurance Company Limited (Pool Re) |

Russia | No | Russian Anti-terrorism Insurance Pool |

Switzerland | No | Terrorism Reinsurance Facility |

Sri Lanka | No | SRCC/Terrorism Fund-Government |

Taiwan | No | Taiwan Terrorism Insurance Pool |

Source: Guy Carpenter