Risk appetite in the insurance industry

|

Sustainability and profitability are dependent on the insurer’s capacity to mutualize and manage risks, a task that requires a flawless in-house organization. The insurer is also required to take into account restrictions and obligations set out by the legal framework. He is subject to multiple regulatory constraints, especially when it comes to the prudential rules imposed by supervisory authorities.

The development of tools and models for the support of the industry constitutes the bedrock of the overall strategy of the insurance company.

Within the company, it is up to the general management and to the board of directors to devise mechanisms and operating principles that make it possible to fulfill the objectives set out by shareholders.

Risk appetite: definition

Insurance and reinsurance companies do not all share the same vision of risk, with guidelines varying considerably from one company to another. Some insurers would underwrite risks that others would not. This appetite or attraction for risk depends on a multitude of factors, in particular:

- shareholders’ requirements in terms of profitability,

- the level of expertise attained,

- experience acquired in the area considered,

- competition,

- reinsurance or retrocession coverage.

Appetite for risk depends on the profitability pursued by shareholders. Based on the objectives set out by the latter, the board of directors proceeds to the design of a policy for risk acceptance in keeping with the amounts of shareholder’s equity available. The strategy devised and initiated by the boarding team must be carried out within a framework guaranteeing corporate sustainability and compliance with the commitments made toward the insured and service beneficiaries.

Disproportionate profitability objectives may result in excessive risk taking by insurance companies, one of the causes, among others, behind the 2008 financial crisis. That is how the subprime affair was brought about, jeopardizing the entire economic system. For the record, risky loans had been transferred into apparently low risk products. Consequently, numerous insurers fell prey to those products, with part of their funds melting away.

This painful episode is living proof that a clear vision of appetite or of risk aversion is paramount, which means that the insurer’s task consists in seeking to strike a balance between:

- the pursued profitability,

- capital level,

- solvency,

- turnover objectives,

- protection of the capital raised by shareholders,

- covers and products offered.

Combination of all of these factors combined must be done in strict compliance with the legislative framework and conformity rules.

The levels of risk appetite

Insurers and reinsurers’ approach to risk may be broken down into three different steps:

Risk appetite, that is in other terms, the definition of the risk or risks that the insurers are willing to underwrite according to their skills, the level of diversification sought, the frequency and severity of the potential events they assume they have to face.

|

Risk profile focuses on the insurers’ orientation. Risk selection is conducted in view of their confrontation to one another: are insurers guided toward financial or non-financial risks, non-life insurance, health insurance, life insurance? etc.

Risk tolerance determines the framework which best adjusts risk profile to the afore-mentioned appetite and preference. This framework is characterized by four types of shortcomings:

- risk factor-based limits according to the frequency and to the severity of potential claims,

- limits according to the projections of disaster scenarios,

- limits as regards the underwriting of risks thanks to the elaboration of underwriting guides,

- a target solvency ratio determined by prudential rules. For instance: Solvency II in Europe which comprises an in-house model and a standard formula.

Risk appetite and the ERM approach

|

For fifteen years now, the Enterprise Risk Management (ERM) notion has been imposed on financial companies. It has been designed to improve risk management within banks and insurance companies. ERM, which differs from risk appetite, sets up devices or rules that ensure adequacy between risk appetite and the commercial strategy devised by the company.

ERM takes into account all the risks that are imposed on the company along with their incidence. The various risks are, therefore, not dealt with in distinct ways. On the contrary, this approach comes within a global and integrated risk method called holistic approach.

The establishment of this approach is carried out in several steps or cycles namely:

- Determination of the approach according to the environment

- Determination of risks

- Assessment of risks

- Risk neutralization strategy

- Ongoing monitoring

Determination of the approach according to the environment

As far as management bodies, in particular, board of directors are concerned, the task consists in devising a global risk strategy through the definition of objectives that are compatible to risk appetite. The market situation along with corporate characteristics do impact the orientations expressed.

Determination of risks

Following the above-mentioned first step, the company leaders are required to seek and analyze all elements that are likely to impact the progress of the strategy and the fulfillment of objectives.

Assessment of risks

In the third stage, insurers weigh up the chances of occurrence of contrary events and their impact on the development plan.

Risk neutralization strategy

Devising a strategy that makes it possible to avoid risks. Elaboration of risk elimination plans along with plans for risk coverage or positioning designed to take advantage of particular circumstances.

Ongoing monitoring

At a final stage, insurers are required to set up a monitoring system for the processes and for the strategy devised. This stage integrates the dissemination of information at all corporate levels.

Risk appetite and the Solvency II approach

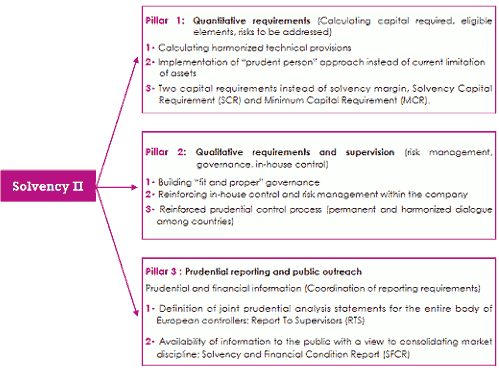

Solvency II has extended internal analysis to the entire process of risk management by insurers. The focus is no longer limited to the minimum capital required and to solvency. While such criteria remain essential as regards the relationship governing the funds required to underwrite risks and the commitments taken by insurers toward customers, we, henceforth, refers to quantitative and qualitative analyses as well as about reporting.

Such approaches are essential to the determination of risk tolerance and to the approval of the operating models by the supervisory authorities.

With Solvency II, insurance companies are required to:

- be endowed with a system of in-house risk management and solvency measurement. This system will depend on the profile of the risk adopted and on the limits of risk tolerance previously indicated.

- have their in-house model validated by the authorities, or otherwise adopt the so-called standard formula. Either of the solutions selected will make it possible to :

- quantify risks,

- determine risk appetite,

- define risk limits,

- devise a risk strategy.

- communicate to the public analyses as well as the risk tolerance measurements and monitoring.

The three pillars of Solvency II :

Risk appetite versus diversity of stakeholders

The diversity of interests plays out within insurance companies, with each stakeholder pursuing its own interests: shareholders, rating agencies, analysts, regulators, executive divisions, insured, debt holders… The company is, therefore, required to set priorities according to the pressure exerted by each of the parties involved. Such priorities will weigh down corporate risk appetite.

- Shareholders

Shareholders’ profile varies and their profitability objectives are not the same as they differ according to their investment orientations, long-term for some, short-term for others. The decisions they take require maximum transparency: level of capital, commercial and financial strategy, risk profile, risk tolerance, potential gains/losses, etc.

- The company’s executive divisions

Executive divisions, board of directors and management are tasked to meet shareholders’ expectations. They have, nevertheless, obligation to take into account regulatory constraints and honor their responsibilities toward the insured. The operating and supervision processes are established in keeping with parameters that are binding to the company while executive divisions always act to serve shareholders’ best interests.

- Regulatory authorities

Supervisory and regulatory authorities endeavor for the best interest of policyholders, ensuring compliance with the legislation by insurers and reinsurers. They also supervise the level of capital, solvency margin according to risk profiles and also in keeping with the marketing strategy and with risk tolerance limits.

- Rating agencies

Rating agencies analyze the relevance and efficiency of the risk management policy pursued by insurance companies. They calculate insurers and reinsurers’ capacity to face their commitments on the long-term basis. Portfolio exposure, results volatility and capital levels are also scrutinized. Since the start of the 2000s, they have also ensured ERM quality. Shareholders, debt holders (bonds), investors and other policyholders rely on their findings to appraise the companies processed.

- The insured

- Their aims are well too known, seeking guarantees as to the compliance of insurer’s commitments. In non life insurance, the insured focus their attention on financial soundness and the insurer’s level of capital. In life insurance, they have introduced an additional requirement, that is, financial results.

- Bond and debt holders

Their interests are close to those of the insured, with insurer’s financial soundness being the only guarantee for the reimbursement of the debt they detain. The appraisal of bond value in case of rating improvement for the company may also impact their judgment.

The role of management boards within the insurance company

Decisions pertaining to risk appetite are shared out within insurance companies, with each management board playing a specific role.

The board of directors

It is the board of directors which is tasked to start talks on the principles of risk appetite. The board is required to improve and review its risk appraisal policy in a regular fashion. It shall proceed to the vote and validation of the policy chosen then to the information of the company’s different levels.

The management

|

The management is tasked with the analysis and discussion of ERM implementation, a duty performed in conformity with the guidelines set out by the board of directors as regards appetite for risk. The management shall be able to influence or guide the decisions of the board of directors, trickling down to the other levels of the organizational chart the decisions made as regards strategy and appetite for risk. It shall also inform the board of directors about the progress achieved by all of the teams.