Special feature on reinsurance: Middle East and Africa markets

The second part will be dedicated, among other things, to the rating of reinsurers, the loss experience of natural catastrophe risks and to aviation reinsurance. The issue summary will be completed with an overview of the world's main reinsurance markets. In addition, and as of early November, we will be publishing on the website of Atlas Magazine a directory of leading reinsurers operating in Africa, the Middle East and the world.

The status of reinsurance in the Middle East and Africa

It is at the end of the ongoing year that much of the business from Africa and MENA will expire. On the eve of renewals, we draw up below an overview of the forces involved.

The Middle East

Demand for reinsurance

Dubai Marina © Francisco Anzola, CC BY 2.0 Dubai Marina © Francisco Anzola, CC BY 2.0 |

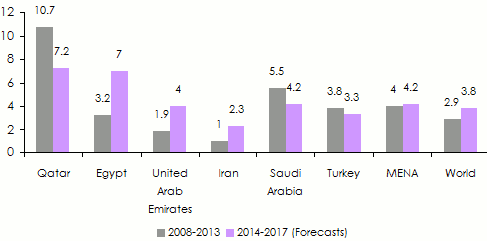

After 2008, economic activity has faded in the MENA region and especially in the Gulf countries, the hardest hit by the global financial crisis. Since 2010, an upturn emerges. Regional GDP growth has become again significantly higher than the global average, set at 5% in the most important insurance markets: Morocco, Algeria, Tunisia, Egypt, Turkey, Lebanon, Jordan, Saudi Arabia, Kuwait, Bahrain, Qatar, UAE, Oman and Iran. The MENA zone countries generate a GDP of nearly 3 500 billion USD 1. 1 MENA Reinsurance Barometer 2014

GDP’s growth rates

Source: MENA Reinsurance Barometer 2014

Source: MENA Reinsurance Barometer 2014

Growth estimates of the region remain optimistic in the short and medium term for oil exporters in particular. The recovery of global demand should lead to an acceleration of the consumption of energy products. The oil and gas revenues are likely to strengthen public investments leading to a diversification of the economies concerned (early June 2014, infrastructure investments reached 405 billion USD in the Gulf). Despite the political and social tension, the International Monetary Fund is forecasting an average growth of over 4% for the Gulf in the medium term.

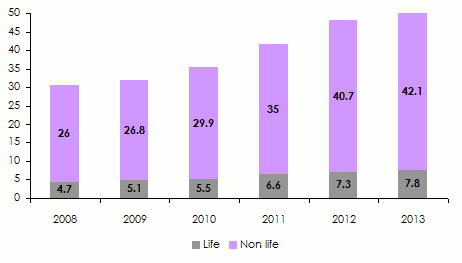

Thanks to this vigorous activity, to the progress margin of historically low insurance penetration rates (1.4% in 2013) and to the establishment of a greater number of mandatory covers in most countries, the insurance market is poised grow strongly. Meanwhile, population growth and the improvement of living conditions of the middle classes would pave the way for the emergence of new products. MENA region has achieved an insurance premium volume of 49.9 billion USD in 2013 compared to 30.7 billion USD in 2008. Turkey, Iran, the United Arab Emirates and Saudi Arabia account for 75% of these amounts.

Life and non life premiums’ volume in the MENA zone

In billions USD  Source: MENA Reinsurance Barometer 2014

Source: MENA Reinsurance Barometer 2014

The set of factors mentioned above are attractive elements for reinsurers including major players facing stagnation or slow growth in their traditional markets. Moreover, with the exception of Turkey, Algeria, Iran and to a lesser extent Saudi Arabia, these countries have low exposure to natural events. The overall MENA countries offer diversification to portfolios of global or Bermudian reinsurers.

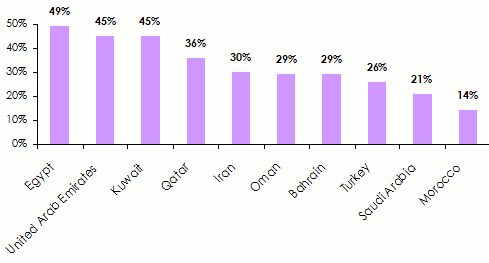

In the MENA region, 30% of non life premiums are ceded to reinsurance. Globally, the average non life cession rate is set at 8.4% only. In 2013, these cessions amounted to approximately 12.6 billion USD. It is in Egypt, the United Arab Emirates and Kuwait that the support of reinsurers is proportionally the most important. Retention of local insurers is less important. Conversely however, it is in Morocco and Saudi Arabia that the percentage of reinsurance ceded premiums is the lowest.

In 2002, nearly 60% of direct life and non life premiums written in the MENA region were ceded to reinsurance. This amount was of 30% on average in 2013. While insurers retain most of the risks mainly in fire, it is especially the change in portfolio structure of ceding companies that accounts for this shift. Insurers now hold a more substantial health and life portfolio where retentions are higher.

Apart from low retentions, (an index of low interest for risks), reinsurers operating in these markets are troubled by other concerns. Excess of capacity leads to fierce competition between reinsurers and thus contribute to the establishment of a soft market. The deterioration of the base line due to the struggle between local actors defending their market shares, legislative frameworks with very few incentives and political instability are compromising reinsurance results pulling them down. Lack of expertise among local insurers also hinders market development. Only large global reinsurers have the resources allowing them to analyze the sharpest risks.

Shares of reinsurance ceded premiums in 2013

Source: MENA Reinsurance Barometer 2014

Source: MENA Reinsurance Barometer 2014

Reinsurance offer

With the emergence of financial centers in Dubai, Qatar, Abu Dhabi, many reinsurers now have a direct presence in the most active local markets. With proximity helping the facultative underwriting at least initially, it becomes the priority of these regional hubs. This approach helps to build closer ties with ceding companies. The flow of capacity to these financial markets is increasing although some reinsurers have expressed their desire to leave the area.

New local reinsurers have emerged: Al Fajer Retakaful (renamed Emirates Retakaful), Asia Capital Retakaful, Gulf Reinsurance, Qatar Re, Oman Reinsurance, Takaful Re and Saudi Reinsurance Cooperative. All of these reinsurers are competing over small-scale markets.

Despite all the uncertainties, rating agencies expect order to be maintained among reinsurers even if the existence of an excess capacity in the MENA region should allow local insurers to benefit from the more favorable terms and conditions in 2015. Such a scenario is likely to deteriorate reinsurers’ performance.

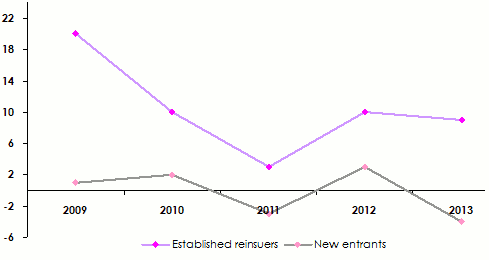

According to a study of A.M. Best, the ROE over the 2009-2013 period for reinsurers traditionally present in the MENA region is higher than that of new entrants. The low profitability of the latter is accounted for by:

- The search of market shares that requires them to be less selective, underwriting thus less profitable business,

- Their size does not allow them to achieve economies of scale.

While pricing conditions are particularly relaxed in recent years, reinsurers have managed however to impose some of their demands. At next renewal, they will try to limit their exposure. The most important actions may include:

- Reduction of coinsurance or facultative acceptances in proportional programs,

- The introduction of limits per event in proportional treaties,

- A redefinition and coverage limitation of risks of political and social nature.

ROE’s evolution of established and new entrants reinsurers: 2009-2013

Source: AM Best Report

Source: AM Best Report

In this study, are considered long-established reinsurers in the region: Arab Re, SCR (Morocco), ARIG, CCR (Algeria), Hannover ReTakaful, Kuwait Re, Milli Re, Trust International and Tunis Re. The so-called recent companies are named: ACR ReTakaful, Emirates Retakaful, Gulf Re, Qatar Re, Saudi Re.

Retakaful actors have multiplied in recent years in the markets of the Middle East and Asia. Being among new entrants, they have trouble to introduce their brands. For the moment, none of them has really succeeded to assert itself among regional references. Their strategy based on direct competition with traditional reinsurers has not paid off. Pressure from their shareholders to increase premiums volumes often leads them to under-price risks. Moreover, their lack of capacity to underwrite large business and their poor ratings is detrimental to them.

Premiums and results of the main reinsurers based in the MENA zone

in millions USD

Company | Country | Gross written premiums | Net written premiums | Technical result |

|---|---|---|---|---|

Milli Re | Turkey | 432.7 | 373.7 | -20.8 |

Trust Re | Bahrain | 398 | 259.4 | 18.2 |

Qatar Re | Qatar | 336.7 | 131.1 | -19.1 |

Société Centrale de Réassurance | Morocco | 266.3 | 185.4 | 55.1 |

Arab Ins Group | Bahrain | 262.0 | 246.3 | 4.4 |

Compagnie Centrale de Réassurance | Algeria | 261.2 | 164.7 | 32.2 |

Kuwait Re | Kuwait | 143.2 | 129.5 | 1.1 |

Hannover Re Takaful | Bahrain | 135.9 | 127.4 | -19.5 |

Saudi Re | Saudi Arabia | 112.0 | 102.9 | -34.6 |

Arab Re | Lebanon | 86.0 | 66.8 | -2.6 |

Emirates Retakaful | United Arab Emirates | 67.1 | 63.1 | 1.1 |

Tunis Re | Tunisia | 52.4 | 26.2 | 0.1 |

Gulf Re | United Arab Emirates | 51.2 | 46.0 | -10.3 |

ACR ReTakaful | Bahrain | 21.5 | 5.1 | 6.5 |

Total | 2 626.2 | 1 927.6 | 11.8 |

Sources: AM Best Report, companies’ reports

Africa

Demand for reinsurance

Accra, Ghana © Rjruiziii, CC BY-SA 3.0 Accra, Ghana © Rjruiziii, CC BY-SA 3.0 |

Direct insurance reported strong growth in 2013 in life business (+13%) 1 and more moderate growth in the non life (+2.1%)1 due to the economic downturn in South Africa. This country, alone, generates 90% of the premiums reported on the continent.

The performance of direct market varies from one country to another. Premiums growth is higher in sub-Saharan Africa (excluding South Africa), supported by dynamic economies, a young population with increasing wages and a low penetration rate. The combination of these factors are positive elements for reinsurers.

Local markets remain highly dependent on reinsurers, especially international ones. Cedants’ underwriting capacities and expertise are limited. Nearly 90% of business is placed in proportional reinsurance. Non-proportional business remained far behind although some upward trend is noted, especially in States holding energy resources.

Some countries such as Algeria, Nigeria and Gabon have amended their legislation to limit premiums cession outside the territory. In other States such as Ghana and Uganda, authorities make it harder for foreign players to access the reinsurance market by introducing binding amendments to the insurance code.

1 Swiss Re figures

Gross and net premiums of the main African reinsurers*

in thousands USD

| Country | Gross premiums | Evolution | Net premiums | Evolution | |||

|---|---|---|---|---|---|---|---|

| 2013 | 2012 | 2013 | 2012 | ||||

Africa Re | Nigeria | 670 458 | 647 980 | 3.47% | 569 100 | 586 400 | -2.95% |

Munich Re of Africa | South Africa | 448 833 | 561 765 | -20.10% | 234 800 | 315 900 | -25.67% |

General Reinsurance Africa | South Africa | 193 141 | 218 455 | -11.59% | 186 500 | 211 300 | -11.74% |

Hannover Life Reassurance Africa | South Africa | - | - | - | 159 600 | 177 300 | -9.98% |

Swiss Re Life & Health Africa | South Africa | - | - | - | 132 300 | 159 300 | -16.95% |

Hannover Reinsurance Africa | South Africa | - | - | - | 124 400 | 117 400 | 5.96% |

Kenya Re | Kenya | 113 500 | 93 400 | 21.52% | 108 200 | 88 300 | 22.54% |

ZEP-RE | Kenya | 100 100 | 81 715 | 22.50% | 84 000 | 66 308 | 26.68% |

Continental Re | Nigeria | 86 800 | 76 527 | 13.42% | 83 683 | 66 571 | 25.7% |

CICA Re | Togo | 54 415 | 43 546 | 24.95% | 46 011 | 37 292 | 23.38% |

Tan Re | Tanzania | 40 274 | 43 968 | -8.40% | - | 38 455 | - |

Sen Re | Senegal | 34 507 | 30 630 | 12.66% | - | - | - |

East Africa Re | Kenya | 33 099 | 28 744 | 15.15% | 31 878 | 27 168 | 17.33% |

Ghana Re | Ghana | 29 038 | 33 215 | -12.58% | 28 100 | 32 800 | -14.33% |

Aveni Re | Côte d’Ivoire | 21 638 | 20 823 | 3.91% | - | - | - |

SCG Ré | Gabon | 18 143 | 12 106 | 49.86% | 15 724 | 11 979 | 31.26% |

Globus Re | Burkina Faso | 17 263 | 11 360 | 52% | - | - | - |

Waica Re | Sierra Leone | 15 922 | 7 169 | 122.09% | 15 319 | 6 533 | 134.48% |

FBC Re | Zimbabwe | 15 228 | 13 709 | 11.08% | 11 592 | 11 840 | -2.10% |

NamibRe | Namibia | 14 117 | 15 539 | -9.15% | 10 900 | 12 670 | -13.97% |

NCA Re | Côte d’Ivoire | 13 200 | - | - | - | - | - |

Prima Re | Zambia | 4 918 | 4 190 | 17.36% | 3 194 | 3 009 | 6.13% |

Total | - | 1 458 498 | 1 371 716 | 6.7% | 1 845 301 | 1 970 525 | -6.35% |

* North African countries are listed in the MENA zone Sources: Standard & Poor’s, compagnies’ reports

Reinsurance offer

Kampala, Uganda © Andrew Regan, CC BY-SA 3.0 Kampala, Uganda © Andrew Regan, CC BY-SA 3.0 |

Reinsurers are increasingly interested in Africa where reinsurance capacities flock. New local reinsurers are emerging such as namely Uganda National Reinsurance, NCA Re (Côte d’Ivoire) and SCG Ré (Gabon).

The disappearance of legal cession in some countries favors the development of these new players. Regional reinsurers are opening representation offices to better serve their customers on the whole continent: SCR and Tunis Re are established in Abidjan. Continental Re provides reinsurance services from Tunis, Nairobi, Abidjan, Gaborone and Douala. CICA-Re has two regional offices: the Douala office which covers Central Africa while that of Abidjan handles business in West Africa.

For most of these players, it is important to reach critical mass and to obtain a solid rating from rating agencies. But the extreme fragmentation of markets with limited resources (excluding South Africa) makes the task difficult. It is for this reason that some reinsurers extend their underwriting to Asia and the MENA region with varying success. For the reinsurers who benefit from the legal cession, the latter is, often, their most important source of turnover.

Traditional reinsurance companies operate from South Africa or Europe. Four of the top five global reinsurers (Munich Re, Swiss Re, Hannover Re and Scor) are present, in different forms, in South Africa. Only Africa Re which has monopoly over reinsurance in Africa is endowed with a real network on the continent. The company which is headquartered in Lagos has several offices and sometimes branches in different countries (Nigeria, Morocco, Côte d’Ivoire, Egypt, Ethiopia, South Africa, Kenya and Mauritius).

Traditional reinsurance companies operate from South Africa or Europe. Four of the top five global reinsurers (Munich Re, Swiss Re, Hannover Re and Scor) are present, in different forms, in South Africa. Only Africa Re which has monopoly over reinsurance in Africa is endowed with a real network on the continent. The company which is headquartered in Lagos has several offices and sometimes branches in different countries (Nigeria, Morocco, Côte d’Ivoire, Egypt, Ethiopia, South Africa, Kenya and Mauritius).

Competition among reinsurers, rough around the continent in all classes of business, is not likely to calm down in the short term, especially since most markets yield profits for reinsurers. The results in South Africa, where underpricing is important are, however, more mixed. The frequency of large losses is measured over the entire continent, but exposure to natural catastrophes is important especially in South Africa, Algeria and Egypt.

Demand for the coverage of acts of terrorism and attacks has increased following the events that have recently affected Kenya, Nigeria, Egypt and Sudan. This demand that is likely to increase in the future because of the confusion that characterizes the political situation in much of the continent. Formerly, the specialty of the London market and of a few specialized pools, the cover of political risks is increasingly underwritten by global and regional reinsurers that perceive their coverage as a new niche of development.