Special Reinsurance, concentration in the reinsurance business: a strategic or defensive solution?

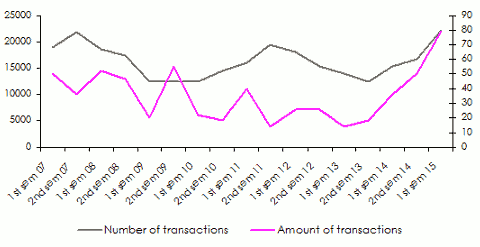

In the first half of the current year, the amount of the transactions realized in non life insurance and reinsurance went up by 290% in comparison with the same period of 2014. The number of transactions rose by 73% from 44 transactions during the first half of 2014 to 76 in the same period of 2015.

In the first half of the current year, the amount of the transactions realized in non life insurance and reinsurance went up by 290% in comparison with the same period of 2014. The number of transactions rose by 73% from 44 transactions during the first half of 2014 to 76 in the same period of 2015.

According to A.M. Best, the average volume of the transactions brokered in the non life and reinsurance classes of business also improved by 260% in the course of the period mentioned, going up from 279 million USD to 725 million USD per transaction.

In the current year of 2015, the market as a whole has been undergoing consolidation. Insurers are the first ones that initiated this merger cycle. The big moves started out in the United States with so many consolidations in health insurance.

The health insurer, Anthem, has disbursed 54.2 billion USD for the takeover of its competitor Cigna. Aetna, on its part, has laid hand on Humana for 37 billion USD while UnitedHealth acquired Catamaran for the sums of 13 billion USD. The contagion soon spread to reach Great Britain with the takeover of Friends Life by Aviva for 8.7 billion USD. Major international brokerage and consultancy firms have not been immune to the trend with the merger between Willis and Tower Watson for the sums of 18 billion USD.

The consolidation wave has then reached reinsurance where, after numerous experiments, the moves have resulted in an important reconfiguration of the industry. In the end, the market ended up with a reduced number of players endowed with sounder financial platform, oftentimes, candidates for a position among the top ten most important global reinsurers.

Reinsurance, a market in full consolidation

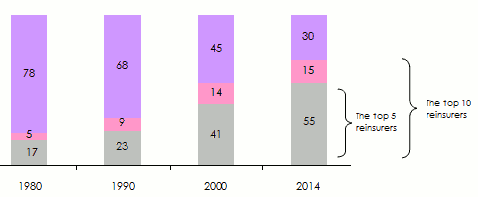

Reinsurance remains dominated by the first five global groups that are: Munich Re, Swiss Re, Hannover Re, Berkshire Hathaway and SCOR. In terms of premium volume, the supremacy of these five companies has sharply gained momentum over competition. Their market shares went from 47% in 2013 up to 55% in 2014. The same trend has been noticed for the first ten reinsurers whose contribution rose from 62% to 70% for the considered period.

Going back in time to a more remote period, we notice that within thirty years, the market structure has undergone an overhaul. From a rate of 22% in global premiums underwritten by the first ten world reinsurers in 1980, 70% of the very same premiums were in the hands of the ten players by the end of 2014.

(1)Thomson Reuters studyEvolution of the reinsurance market consolidation: 1980-2014

Source: SCOR

Source: SCORIn reinsurance, this wave of mergers-acquisitions started out with relatively small operations. Most of the transactions involved medium-size players seeking to improve their position by means of external growth, and by the same token, diversify their activities. The acquisition of Platinum by Renaissance Re in November 2014 is an example of this wave. Ever since that date, announcements have come from all directions and the move has picked up in number as well as in volume of operations.

This merger-acquisition wind is not exclusively limited to the players belonging to the reinsurance world. It has also attracted operators strangers to the profession such as investment funds or hedge funds. Exor, the Italian holding of the Agnelli family, has finally won the battle against Axis Capital, taking over Partner Re for the sums of 6.9 billion USD. China Minsheng Investment has also made its entry in the reinsurance business by acquiring Sirius International Insurance Group, subsidiary of the Bermudan White Mountains.

New York New York |

According to Standard & Poor’s, from 24 November 2014 to 3 August 2015, that is, in less than a year, nine major transactions were achieved in reinsurance for the amount of nearly 57 billion USD.

The most onerous operation, which was concluded between Ace and Chubb, amounted to 28.3 billion USD. The Swiss group laid hand in early July 2015 on its American competitor, an acquisition that enables Ace to build an insurance and reinsurance group whose stock-market value is estimated at 46 billion USD.

While the overall merger and acquisition operations for the first half of 2015 amounted to 21 billion USD, this figure jumped to 56.9 billion USD by the end of August 2015.

Amount and number of merger-acquisition transactions in non life insurance and in reinsurance

Sources: A.M. Best, Bloomberg, other companies

Sources: A.M. Best, Bloomberg, other companies

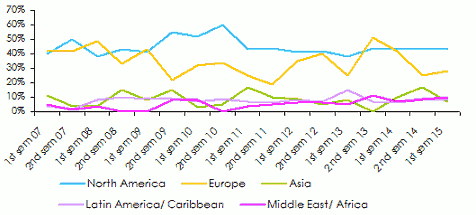

The geographic distribution of merger-acquisition transactions

Even though most transactions involve various regional investors, we have noticed the arrival of Asian players, namely Japanese and Chinese. The latter do not hesitate anymore to get out of Asia to operate in Europe and in the United States.

During the first three quarters of 2015, 38% of major operations have been realized at the cross-border level. Asia, Latin America, the Middle East and Africa account for 28% of the operations made worldwide whereas North America and Europe are respectively involved in 43% and 23% of the transactions.

Europe, M&A operations declining

The old continent has witnessed major merger operations such as the takeover of Catlin by XL, for the amount of 4.1 billion USD, a transaction that gave birth to the world’s eighth reinsurer.

However, a decrease in these transactions has been noticed in the region. This trend is partly accounted for by the uncertainty surrounding the new Solvency II regulation and the difficult economic situation triggered by the Euro crisis.

Asia, in search for other sources of income

Asians are now part of the most dynamic operators. Endowed with substantial financial resources, they are facing saturated domestic markets, yielding very few growth opportunities. These operators, especially those of Japan and China, have advocated the diversification of their portfolio abroad, in Europe and North America, in particular.

Despite the linguistic and cultural barriers, Asian purchasers, especially the Japanese, have adapted well to the companies acquired. The latter have maintained their identity while continuing to manage their business. The customers may, therefore, benefit from better financial security while preserving the same relational continuity.

Bermuda, still a very active market

Bermuda has been particularly involved in mergers-acquisitions (M&A) transactions. Starting from the second half of 2014 until now, eight major transactions have been achieved by Bermudan players, the most remarkable of which has been the one regarding the merger between XL and Catlin for 4.1 billion USD.

The Middle East, a market under construction

Dubai view Dubai view |

The reinsurance market in the Middle East has reported a few transactions during the last 18 months. Major transactions involved medium-sized local reinsurers.

By the end of July 2015, Arab Reinsurance Group (ARIG) announced its intention to target the Emirati Islamic reinsurance company Takaful Re. In October 2015, Al Ahlia Insurance finalized its entry in Kuwait Re’s capital.

Apart from these purely local transactions, the Middle East has been the target of foreign investors. Indeed, the Bermudan reinsurer Arch has taken control of 50% of Gulf Re’s capital.

This trend is not at all poised to slow down. Analysts are forecasting, for the next two years, a wave of mergers and acquisitions that would involve numerous players. Faced with competition from London, continental and Bermudan reinsurers, local players will be struggling harder and harder to survive; mergers seem to be a matter of survival.

Africa, hardly any mergers

The African reinsurance market remains a quite nuanced market where new establishments and shareholdings go together. New companies endowed with relatively small capital continue to be set up, interacting with older players that are targeted by foreign investors. In Africa, the transactions involve the acquisition of stakes in existing companies rather than genuine merger-acquisition operations.

The most important transaction pertains to the takeover in September 2015, by Saham Finances, of 53.6% of Continental Re’s capital.

For its part, Africa Re, which obtained the status of “occasional reinsurer” in Brazil, opened its capital for several foreign shareholders, including IRB-Brasil Re (8% in October 2013), French insurer AXA (7.15% in February 2015) and Canadian Fairfax (7.15% in March 2015).

Finally in May 2015, International Finance Corporation (IFC), subsidiary of the World Bank, announced its intention to take control of 11% of Kenya Re’s capital.

The mergers and acquisitions in non life insurance and reinsurance per targeted region in % of all transactions

Source: A.M. Best, Bloomberg

Source: A.M. Best, Bloomberg

How this wave of M&A came about

According to analysts, the proliferation of M&A in the reinsurance industry is accounted for by cyclic as well as structural factors:

Abundance of liquidity and mild loss experience

Tokyo Tokyo |

The abundance of accumulated liquidity in recent years stands among the main reasons why such transactions have been prompted. According to S&P, following the 2008 crisis, companies have consolidated their balance sheets, recovering substantial liquidity. They now detain a lot of cash, thus, having the capacity to undertake ambitious operations.

In addition to the market conditions favorable to M&A, very few large losses likely to use up reinsurers’ reserves have been reported. The capacities of major reinsurers have, therefore, remained positive thanks to a relatively mild year 2014 in terms of natural catastrophes.

Rough environment and tariff decrease

During the recent two years, the reinsurance sector found itself up against an unprecedented situation of tariff decrease. The next renewal will have also a downward trend event if rate erosion has slowed down a bit. The abundance of supply and the inflow of alternative capacities has greatly bothered reinsurers who find it increasingly harder to develop their turnover.

The race for size for a better global ranking

Faced with difficult market conditions and in view of the ever-rising operating costs, small and medium-sized reinsurers are struggling. They sense the need to expand in size, diversify their portfolio geographically and achieve scale economies.

Reinsurers required to follow in the footsteps of insurers

The consolidation of primary market is also a threat for reinsurers. The reinforcement of insurers’ shareholders’ equity has prompted the latter to retain more premiums, hence, the decrease in coverage demand. In order to face this situation and remain profitable, reinsurers are required to offer new products to ceding companies and ensure better service quality.

Other factors may also intervene when seeking external growth by means of merger-absorption:

- the fierce competition between market players,

- the search for technical expertise,

- the search for other sources of revenues and profits,

- the increase of capital efficacy,

- the consolidation of distribution channels,

- a reduced exposure to market cycles,

- the improvement of solvency margin,

- the obtaining of better financing on the markets (interest rate, stock price, etc.),

- the reinforcement of added value and corporate image.

Reinsurance leaders facing this wave of concentration

Global reinsurance leaders such as Munich Re, Swiss Re, Scor or Hannover Re are hardly interested in the current merger-acquisition operations. These companies have already acquired a quite advantageous position, thus favoring organic growth.

They are rather focusing on the improvement of customer relationship and innovation: new covers for cyber risks, driverless cars, new third party liability and technological risks, etc.

Impediments to merger-acquisition operations

According to the agency Fitch Ratings, companies involved in merger-acquisition transactions usually face integration issues. Obstacles are generally due to:

- cultural disparity,

- structural challenges,

- uncertainty surrounding new regulations such as Solvency II,

- geographic remoteness separating the entities gathered under the same group,

- deficiency at the level of expertise. Such failure is likely to cause mistakes with serious consequences.

Position of rating agencies

This restored infatuation for external growth by reinsurers has not gone unnoticed by rating agencies. The latter unanimously foresee the progress of this consolidation move until the end of the current downward cycle affecting reinsurance and whose recovery is not expected before 2017.

A.M. Best is likely to revise reinsurance outlook upwards from negative to stable if the M&A trend is to continue. The agency has forecast that 2016 will witness an intensification of consolidation movements, especially among second and third rank reinsurers.

As for Moody’s, M&A transactions are beneficial to reinsurance as long as they contribute to the adjustment of global equities available. The agency, however, does not appreciate the entry of foreign players in the reinsurance market. “The operations conducted by investment holdings are not supposed to reduce the amount of equities available; hence, they will not be favorable to the business as a whole. In 2014, four M&A have involved players strange to the industry.

In its survey entitled “Reinsurance Shark Tank – Only The Strong Will Survive”, Standard & Poor’s is predicting a difficult year for the market. Consequently, for the next 12 to 24 months, it is very unlikely that reinsurers exhibit the same level of profitability as achieved in the last five years. “Rating is not poised to increase adequately enough. Reinsurers will, therefore, have to adopt the Charles Darwin’s methodology: adapt, evolve and survive”, the report states.

Perspectives

M&A operations are set to continue on this path, especially after the renewed interest exhibited by the investors in the reinsurance industry. The latter, henceforth, favor the diversification of their strategies for investment, following in the footsteps of the conglomerate Berkshire Hathaway.

Despite their upsurge, mergers-acquisitions are not going to necessarily impact the structure of the market. Such operations oftentimes involve second-rank players but not “price-makers.“

On the short-term basis, traditional leaders will continue to keep their iron fist on the market. Positive changes will be felt only at the level of medium-sized reinsurers whereas for small players, the future is expected to be ever harder than the past.

The main merger-acquisition transactions concluded or announced during the last half of 2014 and 2015 (non life insurance and reinsurance)

- JuneBermuda-United States: Validus Holdings acquired the total of Western World Insurance (690 million USD)

- AugustBermuda-Hong Kong: Allied World took over the activities of RSA (215 million USD)

- November

- JanvierIreland-Bermuda: Merger between XL Group and Catlin Group (4.1 billion USD)Germany-Chile: Talanx AG acquired Aseguradora Magallanes (208 million USD)

- FebruaryFrance-Nigeria: AXA announced the acquisition of 7.15% of Africa Re’s capital Canada-United Kingdom: Fairfax finalised the acquisition of Brit (1.9 billion USD)

- MarchBermuda- Bermuda: Endurance purchased Montpelier Re (1.83 billion USD)Canada-Nigeria: Fairfax acquired 7.15% of Africa Re‘s capital

- MayBermuda-United Arab Emirates: Arch acquired 50% of Gulf Re’s capitalChina-Bermuda: Fosun fully took control of Ironshore (2.304 billion USD)

- JuneJapon-United States: Tokio Marine took control of HCC Insurance Holdings (7.5 billion USD)

- JulySwitzerland - United States: ACE acquired Chubb (28.3 billion USD)China-Bermuda: China Minsheng Investment purchased Sirius International Insurance Group (2.235 billion USD)

- AugustItaly - Bermuda: Exor purchased Partner Re (6.9 billion USD)

- SeptemberBahrain-United Arab Emirates: ARIG planned to acquire the entire Takaful ReJapan-United Kingdom: Mitsui Sumitomo Insurance in negociations for the purchase of Amlin (5.3 billion USD)

The business and finance district, LondonMorocco-Nigeria: Saham Finances acquired 53.6% of Continental Re’s capital (Nigeria)

The business and finance district, LondonMorocco-Nigeria: Saham Finances acquired 53.6% of Continental Re’s capital (Nigeria) - OctoberKuwait-Kuwait: Al Ahlia Insurance increased its participation in Kuwait Re‘s capital from 30% to 92%