Reinsurance: new risks, new challenges

The Icelandic volcano Eyjafjallajökull eruption © Boaworm, CC BY 3.0 The Icelandic volcano Eyjafjallajökull eruption © Boaworm, CC BY 3.0 |

Several factors, individually isolated or combined, have triggered the emergence of new risks.

The resulting claims are troubling insurers who are struggling to come up with the appropriate responses in terms of guarantees and capacity.

The new order that ensued has introduced globalization with the consequences of free capital flow, the dismantlement of customs barriers and the new distribution of labor. Countries of Central Europe, Africa and Asia have become subcontractors for the major global industrial groups. Hence, the relocation of labor, growing competition and supremacy of two currencies: the dollar and the euro.

On the social level, the recent decades have witnessed the emergence, especially in Asia, of a middle class of hundreds of millions eager for consumption. This phenomenon has been boosted by the advent of new technologies that interconnected individuals and societies. Social transformations have become irreversible: waves of people have left rural villages to settle around cities in a trend of accelerated urbanization.

In countries with mature economies, recent years have been characterized by the appearance of structural unemployment, which, combined with ageing population, has strained public finances.

In some regions, such upheavals, occurring in a relatively short period of time, have only worsened the political problems left unsolved for a long time. The consequences were soon noticed with the increase of political unrest, the appearance of civil wars and worldwide terrorism.

The topic dealing with the context surrounding the development of new risks cannot be closed without referring to climate risks whose upsurge has worried both insurers and public authorities.

Out of the 21 emerging risks listed in the insurance and reinsurance sector, six are characterized as major risks. Those risks with high claim potential may be classified into two categories: cyber risks and the other new risks of either technological or political nature or any other.

IT-related new risks or cyber-risks

Thenew risks related to information technology or cyber-risk may be defined as the failure or any attack targeting the computer system of a company or individual, which is likely to trigger financial losses, disruption of service or damage to reputation. Cases of cybercrime (see Atlas Magazine, N°121, May 2015) are all the more numerous as the economic challenge is of major importance.

Cost of cyber attacks

A cyber attack may generate considerable losses for the targeted company. Economic damage caused by such an event depend, among others, on the size of the company, the duration for the recovery of the affected systems and on the nature of the hacked data. Future loss of earnings sustained due to interruption of activities of the targeted company is to be added to the list of damages.

The challenge of cybercrime is high because it involves theft of compromising data for third parties, including personal information (names, addresses, telephone numbers) or professional data such as bank account and credit card numbers, etc.

The costs of the attacks generally include fees for the recovery of the software system, damage caused to third parties, recourse to justice by the company customers and business interruption.

The Target affair

In December 2013, Target, the third largest American retailer was the victim of a nasty attack by a group of hackers. Seventy million customers had their personal information hacked, especially their banking data. Consequently, Target’s reputation was seriously affected.This cyber attack cost the retailer approximately 1 billion USD (compensations to customers, especially for the re-issuance of credit cards). This act slashed the group’s profits for the fourth quarter of 2013 by 440 million USD.

The CEO had to step down several months later. In March 2015, a judge in Minnesota ordered Target to pay up to 10 million USD to each customer having sustained damage in this affair.

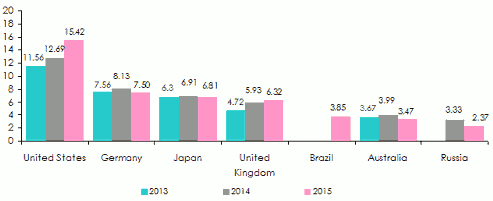

Economic cost of cyber attacks per country: 2013-2015

With 15.42 billion USD in economic damage, the United States tops the list of the countries that were hardest hit by cybercriminality in 2015. This amount is on a 21.5% rise in comparison with 2014.

In billions USD Source: 2015 Cost of of Cyber Crime Study: Global, October 2015

Source: 2015 Cost of of Cyber Crime Study: Global, October 2015 Technological advances and the new risk arising from them

The ever-increasing technological breakthroughs are impacting all economic sectors. Despite its upsides, technological progress comes at a price. The generalized recourse to digitalization, the internet and other related devices has given rise to new emerging risks that the experts and the scientific circle are unable to contain effectively.

Two risks are particularly worrisome: Nanotechnologies and driverless cars.

Nanotechnologies

Nanotechnology is a new technique that consists in dismantling and reconstructing nature at the atomic and molecular level at a nanometer scale, that is, at a length equal to one billionth of a meter.

Initially associated with major breakthroughs in medicine, this subject has now extended to various scientific and technological areas. The development of nanotechnologies in the areas of health, energy, environment and data processing requires huge financial resources. The risks incurred are commensurate with the investment. Experts estimate that about 20% of all products manufactured worldwide will be relying on nanotechnologies by 2020. The damage caused by misuse of those techniques is likely to be monumental.

Being an emerging technology, the risks associated with the manufacture and use of nanomaterial are hardly known. Scientists have too little background to be able to assess the impact of the different applications on health and environment. A large-scale use of those techniques in the industrial sector is likely to expose thousands or even millions of workers to risks still unknown so far.

The potential side effects of miniaturization of cell phones components, computers, TV sets and other household appliances on human beings have been for many years a source of concern for pension bodies and for various associations in charge of health protection. For instance, the debate that has lasted for years over the harmful effects of mobile phones on human brain may be revived some other day under some different heading and at a larger scale.

Scientists dread in particular the hazards of nanoparticles, especially those containing asbestos or toxic substances.

The French agency of health safety and environmental and labor protection has listed more than 246 products manufactured for common use such as tooth brushes, stuffed toys, sunscreen, clothes that contain nanoparticles.

Handling nanoparticles, deemed to be very reactive, represents potential for toxicity during the manufacture and processing of food products. These microscopic entities may penetrate the cells of the human body, threatening health. For instance, nanoparticles of titanium oxide found in sunscreens may penetrate through the skin, causing new kinds of skin diseases in the long run.

Driverless cars

Generated by artificial intelligence, a driverless car is a car that can run automatically without a driver. It is outfitted with softwares that include data on road status and that decide the next actions to undertake by leading the vehicle’s controls on the road.

Google driverless car © Michael Shick, CC BY-SA 4.0 Google driverless car © Michael Shick, CC BY-SA 4.0 |

In 2035, partially or wholly autonomous vehicles would account for approximately 30% of global car production. Currently at the experimental stage, driverless cars are expected to reduce by 80% the number of road crashes which are oftentimes accounted for by human error. Other no less considerable advantages consist in diminishing road traffic and significantly reducing air pollution.

However, the number of blessings of driverless cars cannot conceal some shortcomings. Indeed, some aspects are surrounded by a degree of uncertainty. These vehicles have to face the following challenges:

- The legal liability associated with their use. Who is held responsible in the event of an accident? The manufacturer, the software provider, the car dealer, the user, etc.

- The threat of car hacking; this risk may threaten the life of passengers or motorists on the road.

- Keeping control over the vehicle in case of an emergency. Passengers do not have access to the code of driverless cars. They, therefore, can neither control them nor act during an improper decision that may pose a threat to their life.

- At the level of traffic wardens' orders that they cannot obey.

- At the level of employment in the automobile sector. The dissemination of these cars is likely to trigger a serious employment crisis in the sectors specialized in the manufacture of cars and in transportation.

New risks related to the supply chain

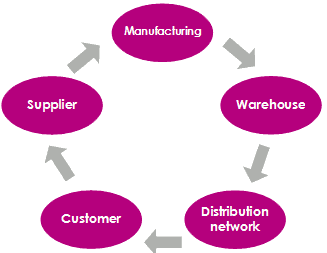

A supply chain is a complex process that involves several stakeholders. Any disruption will prompt a chain reaction which, combined with the effect of globalization, would strain a number of players located in all continents of the globe. The gigantic nature of companies is a risk-exacerbating factor.

A supply chain includes three functions: the supply of products to manufacturers, the manufacturing process, and the distribution of finished products to consumers by means of a distribution chain.

The companies that take part in the different stages of this process are related to one another by a supply chain. The risks related to the disruption of this supply chain are witnessing an extremely fast growth. The domino effect is dreaded by the entire corporate world.

Disruption of the supply chain

This interruption may generally be accounted for by in-house factors (mismanagement, strikes, sabotage, etc.) or by external factors (stock market fluctuations, natural catastrophes, political turmoil, etc.).

Here are some of the most striking examples of supply chain disruptions that have taken place during the recent ten years. These events shall give an overview of the excessive damage caused by such a risk:

2010: On April 14, dust clouds released from the explosion of the Icelandic volcano Eyjafjallajökull had seriously disrupted air traffic in a large area of western Europe for six days. Many countries closed their space to traffic, with 100 000 flights cancelled, that is, approximately 70% of European air traffic for the first two days. As a consequence, and confronted with a paralysis of aircraft traffic, the authorities decided to keep 10 million passengers stranded. The resulting losses set by airliners would be comprised between 1.5 and 2.5 billion EUR (2 and 3.4 billion USD).

2011: On March 11, an earthquake followed by a tsunami shook Japan causing huge damage and triggering the closure of car manufacturing factories in the United States and Europe due to disruption of spare parts supply.

2015: On August 12, an explosion in a chemical warehouse in the port of Tianjin (China) caused not only material and human losses but it also disrupted the bulk of supply chain in various areas around the world.

Tianjin explosion Tianjin explosion |

Huge operating losses have compounded the toll of the damage caused directly to corporate property: suspension of transit of some products, production stoppage and disruption of trade on a global scale.

As a whole, the technical catastrophe may amount to 6 billion USD, 1.5 billion USD of which is accounted for by the marine cargo business.

Political new risks

Deglobalization and terrorism appear as two major risks that are likely to disrupt the fragile global balance established in the early 2000s.

Deglobalization

The 2008 financial crisis seems to be the first evidence showing that the new economic order established after the fall of the Berlin wall is running out of steam. Launched in the United States, the crisis had almost brought the international financial system down to its knees.

In order to protect themselves, some States have reintroduced more stringent regulations restricting free flow of capital while others swiftly chose to re-establish control over some sectors of the economy. Such measures are inconsistent with the new global order for which they pose a threat.

Deglobalization entails:

- The restriction of free trade,

- The relocation of production within national boundaries,

- The establishment of more targeted customs duties,

- The end of social dumping along with the repatriation of manpower,

- The control over the flow of foreign capital,

- The regulation of global finance.

Deglobalization will, in the long run, strain global balance, triggering a new economic order with the likelihood of exasperating nationalistic sentiments. Migration issues are also likely to exacerbate political conflicts.

Terrorism

9/11 attacks © Robert J. Fisch, CC BY-SA 2.0 9/11 attacks © Robert J. Fisch, CC BY-SA 2.0 |

Terrorist risk seems to be the archetype of extreme risk. It depends on factors that render it ambiguous and in most cases unpredictable. In the course of recent decades, terrorism went global; with attacks previously concentrated in some areas extending to affect other areas like Europe, United States, Asia and Africa.

The emergence of new local political conflicts is increasing the risk. Human and financial losses caused by these events are detrimental to the countries affected which often lose some percentage of their GDP.

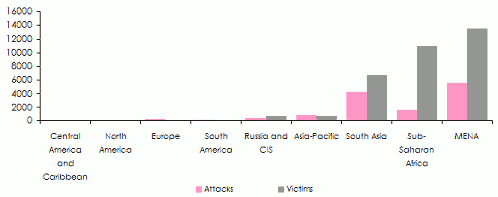

Number of attacks and victims by region in 2014  Source: Global terrorism index 2015

Source: Global terrorism index 2015

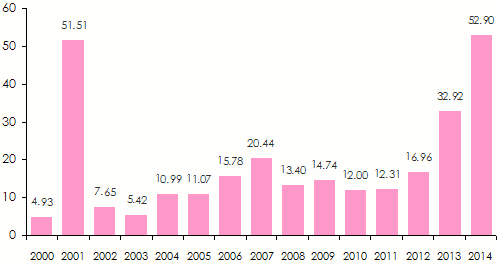

Financial damage related to acts of terrorism and the like: 2000-2014

In 2014, financial losses related to acts of terrorism and the like amounted to 52.9 billion USD at the global level. This significant figure pertains to direct and indirect damage often caused in conflict areas such as the Middle East, Nigeria, Libya, etc.

In terms of financial losses, the year 2014 has surpassed 2001 even though the latter was marked by the nine eleven attacks in the United States. The Institute for Economics and Peace listed approximately 140 000 acts of terrorism in 2014 for a total amount of 52.9 billion USD in damage.

In billions USD  Source: Global terrorism index 2015 Economic damage per event in 2014 in millions USD

Source: Global terrorism index 2015 Economic damage per event in 2014 in millions USD

| Event | Cost of damage |

|---|---|

Death | 51 275 |

injuries | 918 |

Bombing | 410 |

Infrastructure attack | 104 |

Armed assault | 99 |

Hijacking | 67 |

Hostage | 20 |

Unarmed assault | 3 |

Assassination | 2 |

Total | 52 898 |

Source: Global terrorism index 2015

Climate change: a new risk par excellence

Recent decades have witnessed upsurge of large-scale natural catastrophes that are straining global economy and the populations living in affected areas.

The frequency, intensity and duration of extreme phenomena (heat waves, floods, droughts, hurricanes, etc.) are increasing from year to year due to the effect of climate change triggering:

- rising temperatures,

- the multiplication of hurricanes,

- heavy rain,

- ice melting,

- rising sea levels,

- the overflowing of river beds.

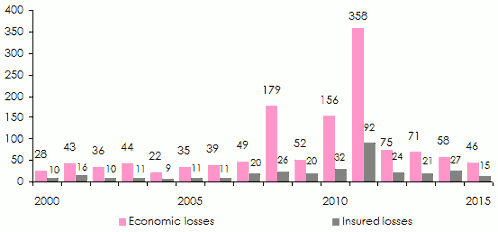

In 2014, natural catastrophes caused financial losses of about 58 billion USD, with only 31.7% of the reported events being insured. For the first nine months of the year 2015, the toll of the damage caused by this kind of event amounted to 46 billion USD, with only one third of the damage being borne by insurers.

Economic and insured losses: 2000-2015

In billions USD  Source: Aon Benfield

Source: Aon Benfield

Read more:

- The longevity risk