Africa Re, a success story

Throughout the years, the company has succeeded in getting established as a pan African giant, a consecration that has altered the landscape of the insurance and reinsurance business on a continental scale.

|

Today, forty years on, Africa Re stands among the world’s leading reinsurer. It underwrites 689 million USD of premiums in more than 60 countries and is endowed with several subsidiaries and regional offices.

Africa Re has been granted an A- rating by the two greatest rating agencies in the world, Standard & Poor’s and A.M. Best, a success nobody saw coming.

Difficult birth of Africa Re

Headquarters of Africa Re in Lagos Headquarters of Africa Re in Lagos |

The need to outfit the African market with a continental reinsurance company had been felt since the beginning of the 1970s. Unfortunately, the circumstances back then were not favorable for such a venture.

The difficulty of such an enterprise was compounded by the striking lack of human and material resources, let alone political, economic, cultural and language disparities that seemed insurmountable. Back then, the reinsurance business was attributed to the only conventional companies of the economically mature countries.

Such obstacles were not big enough to discourage the initiators of the project. On February 24, 1976, Africa Re saw the light of day in Yaoundé, Cameroon, endowed with an authorized capital of 15 million USD(1).

The African Development Bank(AfDB)(2), along with 36 member States of the Organization of African Unity (OAU) were its first shareholders(3).

The company’s objectives are clear. It is tasked with the duty of mobilizing financial resources, increasing the market’s reinsurance capacity, cutting down to the lowest possible level currency outflows outside the continent, and supporting African economic development.Tumultuous youth

In the early 1980-1990s socio-economic issues lingered on, with political instability affecting a large part of Africa.

This context did strain companies' activity threatening some of extinction. The structural and monetary adjustment plans imposed by the International Monetary Fund (IMF) made the situation worse increasing the vulnerability of the insurance and reinsurance industry and turning Africa Re’s future perspectives into uncertainty.

In an effort to address this critical situation, the board of directors decided in 1990 to raise capital to 30 million USD and to put on sale its shares for African and foreign companies.

In 1992, other African States, convinced by the company’s potential, joined Africa Re, raising the number of State shareholders from 36 to 41(4).

Africa Re adulthood

View of Johannesburg View of Johannesburg |

The end of apartheid(5) in South Africa constituted a turning point in the evolution of Africa Re. In 1995, a contact office was set up in Johannesburg to be turned in 2004 into a subsidiary.

The company is now not only present in the four corners of the continent, but it has particularly access to the most important African insurance market. Today, South Africa, alone, accounts for nearly one third of the company s’ premiums.

In 1997, Africa Re proceeded to the second capital increase, raising the latter from 30 to 50 million USD. The financial resources generated by this move facilitated the company’s expansion. Indeed, in the course of the same year, a contact office was set up in Mauritius which was turned in 2003 into a regional one.

In 2000, the company built its own headquarters “Africa Re House” in the commercial neighbourhood Victoria Island in Lagos. Other premises were later built, namely in Abidjan in 2001, Nairobi in 2003 and in Casablanca in 2005. The acquisition of these new head offices is living proof of the firm resolve to achieve the company’s growth and go continental in the process.

In 2001, a third capital increase was carried out, raising the capital from 50 to 100 million USD while the company’s growth was continuing. Still in 2001, a contact office was set up in Cairo (Egypt) which became in 2004 a regional office. This new structure completed the territorial coverage of North Eastern Africa.

Around 2004 and 2005, four financial institutions(6) entered the capital up to 20%.

Several years later, in 2007, the board of directors took the decision to proceed to a fourth increase in capital which was raised to 500 million USD. This move granted the African reinsurer with a new dimension, being henceforth endowed with the capacity required to underwrite more business and consolidate its presence in different markets on the continent.

In 2010, Africa Re proceeds to the inauguration of a subsidiary company in Cairo dedicated to Islamic reinsurance. Named Africa Retakaful, the company has been operational mainly in the MENA zone (7).

In 2011, a local office was set up in Ethiopia, further consolidating the company’s foothold in Eastern Africa and optimizing business opportunities in this strategic region of the world.

Africa Re, Capital increase chronology

| Figure in USD | Date | |

|---|---|---|

| Initial authorized capital | 15 millions | 1976 |

| 1st capital increase | From 15 to 30 millions | 1990 |

| 2ndcapital increase | From 30 to 50 millions | 1997 |

| 3rd capital increase | From 50 to 100 millions | 2001 |

| 4thcapital increase | From 100 to 500 millions | 2007 |

| Current capital | 500 millions | 2014 |

Africa Re maturity

Africa Re obtained in 2012 the status of operator in Brazil © Klaus with K, CC BY-SA 3.0 Africa Re obtained in 2012 the status of operator in Brazil © Klaus with K, CC BY-SA 3.0 |

After several years of concerted effort to expand, Africa Re has not only managed to shoulder reinsurers that are traditionally present on the continent, but it also succeeded in attracting within its organization foreign companies.

Indeed, in 2012, IRB-Brasil Re, the number one Brazilian reinsurer, entered the company’s capital, an alliance that enabled Africa Re o obtain the status of operator in Brazil, extend its operations in Latin America, and to benefit, among others, of the technical expertise of its South American counterpart.

In February 2015, Axa, the world’s insurance leader became Africa Re’s shareholder with a 7.15% stake. In March of the same year, the Canadian group Fairfax Financial Holdings also acquired a 7.15% participation for the amount of 61 million USD.

These shareholders have bought out the shares detained by Development Financing Institutions (SFI, DEG and FMO) which quit the shareholding in accordance with their investment strategy.

The African reinsurer is now endowed with substantial support and financial capacity to match its ambitions which consist in consolidating its position as Africa’s number one reinsurer.

In this regard, Africa Re is due to open in July 2016 a new local office in Sudan.

Africa Re under the scrutiny of rating agencies

Upon setting foot on the South African market, by far the continent’s most developed one, Africa Re took steps to undergo in 1995 the local rating of Fitch IBCA which granted it an A.

In 1998, Standard & Poor’s (S&P) granted Africa Re a “BBB” rating, a score that came one year after the second capital increase and which boosted the company on the international arena.

Ever since, Africa Re has been in the select circle of leading reinsurers, gradually increasing its shareholder’s equity in an effort to meet the requirements of an international market that has fallen prey to the dictates of rating agencies.

In 2002, one year after the company’s third capital increase, A.M. Best granted the South African reinsurer an A- rating with stable outlook.

In 2004, Africa Re was standing among the first 150 world reinsurers. One year later, Standard & Poor’s raised the company’s rating from “BBB” to “BBB+” with stable outlook.

In 2009, the same rating agency increased Africa Re’s credit and financial soundness rating from “BBB+” to A- (excellent) with stable outlook.

Africa Re’s strategy continued to bear its fruit, with S&P ranking the company in 2013 among the 40 greatest reinsurance companies worldwide and number one reinsurer in Africa and the Middle East by the same token.

And so did A.M. Best, the American rating agency in 2014, in a renewed tribute to the reinsurer’s financial soundness, by raising its outlook from stable to positive while maintaining the financial soundness at A- (excellent).

Unanimous tribute came from rating agencies which commended the strong capitalization of the company, its excellent competitive position over the continent, its geographically diversified portfolio, the improvement of its risk management and its cautious underwriting and investment policy.

Those accomplishments are all the more memorable that they happened in an African contest characterized by political and economic turmoil, an environment that has in fine strained Africa Re.

Evolution of Africa Re’s ratings

| Date | A.M. Best | Standard & Poor’s |

|---|---|---|

| 1998 | - | BBB |

| 2002 | A- with stable outlook | BBB |

| 2005 | A- with stable outlook | BBB+ |

| 2009 | A- with stable outlook | A- with stable outlook |

| 2014 | A- positive outlook | A- with stable outlook |

| 2015 | A- positive outlook | A- with stable outlook |

- 1976On February 24, 1976 the African reinsurance company was created in Yaounde (Cameroon) with a subscribed capital worth 10 million USD

- 1977Start of Africa Re’s activities in Accra (Ghana) Transfer of operations to Lagos (Nigeria)

- 1978Underwriting of the first pieces of business from its Bookshop House headquarters in Lagos

- 1980Creation of Casablanca regional office (Morocco)

- 1982Creation of Nairobi regional office (Kenya)

- 1987Creation of Abidjan regional office (Côte d’Ivoire)

- 19901st capital increase to 30 million USD

- 1995Creation of a contact office in Johannesburg (South Africa) which turned into a regional office in 2004First local rating: «A» granted by Fitch IBCA, South Africa

- 19972nd capital increase (from 30 to 50 million USD) Creation of a contact office in Port Louis (Mauritius). The latter turned, in 2003, into a regional office based in Ebene

- 1998Standard & Poor’s granted «BBB» rating to Africa Re

- 2000Inauguration of the new headquarters of Africa Re in Lagos(Nigeria)

- 20013rd capital increase (from 50 to 100 million USD)Creation of a contact office in Cairo (Egypt) which became a regional office in 2004

- 2002A.M. Best granted «A-» rating with stable outlook to Africa Re

- 2005Standard & Poor’s upgraded Africa Re rating from «BBB» to «BBB+»

- 20074th capital increase (from 100 to 500 million USD)

- 2009Standard & Poor’s upgraded Africa Re rating from «BBB» to «BBB+»

- 2010Creation of the subsidiary Africa Retakaful (Egypt)

- 2011Creation of a contact office in Addis-Ababa (Ethiopia)

- 2012Entry of IRB-Brasil Re in the capital of Africa Re

- 2013S&P classified Africa Re among the top 40 global reinsurance groups

- 2014A.M. Best upgraded Africa Re rating outlook from stable to positive

- 2015Entry of AXA and Fairfax in the capital of Africa Re

Africa Re, legal cessions

The agreement pertaining to the establishment of Africa Re stipulates that all insurers of member States should be required to cede 5% of their reinsurance treaties to the Pan African company.

This move has enabled Africa Re, recently established, to get better positioned in a market dominated back then by the big international groups such as Scor, Munich Re, Swiss Re, Hannover Re…

Thanks to the proximity policy conducted by very active regional offices, Africa Re has managed, gradually, to get accepted as a commercial reinsurer that quotes and leads treaties as well as facultative risks.

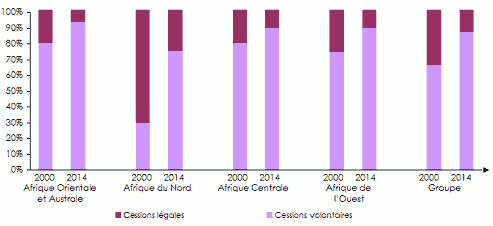

Today, forty years on; legal cessions account for just a relatively low percentage of the company’s global turnover. From nearly 100% of the turnover in 1978, these legal cessions went down to 9% at the end of 2014.

These proportions vary from region to region over the continent.

Legal cessions/ Voluntary cessions: 2000-2014 comparison

Source: Africa Re

Source: Africa Re

Eastern and Southern African zones are the ones assigning most of the non-mandatory cessions. In 2014, legal cessions accounted for just 5% of the overall business underwritten in this region.

On the contrary, it is North Africa’s portfolio that accounts for the highest percentage of legal cessions, 25% in 2014, a rate that dwindled down considerably since 2000 when it was set at 70%.

Africa Re shareholding

Initially composed exclusively of African States associated with AfDB, the current shareholding of Africa Re is quite diversified.

It includes African States, African insurance and reinsurance companies, international financial institutions and foreign insurers and reinsurers.

Africa Re, shareholding as at 31-12-2015

| Shareholding as at 31-12-2015(8) | |

|---|---|

| 41 Member States of the African Union | 33.59% |

| 111 African insurance and reinsurance companies | 32.85% |

| African Development Bank (AfDB) | 8.17% |

| Non African shareholders(IRB-Brasil Re) | 8.17% |

| AXA Africa Holding | 7.15% |

| Fairfax Financial Holding | 7.15% |

| PROPARCO | 2.92% |

Source: Africa Re (1) Authorized capital 15 million USD, subscribed capital 10 million USD, paid-up capital 4.6 million USD.

(2)The AfDB is the initiator of the Africa Re project as from 1971.

(3) Algeria, Benin, Burkina, Burundi, Cameroon, Central Africa, Chad, Congo, Democratic Republic of Congo, Côte d’Ivoire, Egypt, Ethiopia, Gabon, Gambia, Ghana, Guinea, Guinea Bissau, Kenya, Libya, Madagascar, Mali, Mauritania, Mauritius, Morocco, Niger, Nigeria, Senegal, Sierra Leone, Somalia, Sudan, Swaziland, Tanzania, Togo, Tunisia, Uganda, Zambia. (4)See details in Appendix II

(5)Apartheid, a word of African origin, meaning “separation”. Apartheid is said to be a “separate development” policy affecting the masses based on racial or ethnic criteria. This policy was introduced in South Africa by the national party as of 1948 and was abolished on June 30, 1991. (6)In 2004, the international finance corporation , SFI (8%). In 2005, the German investment and development corporation, DEG (8%), the Dutch business bank, FMO (1%) and PROPARCO, a subsidiary of the French development agency, AFD (3%).

(7)MENEA: acronym for «Middle East and North Africa» (8)See details in Appendix II