Al Ain Ahlia

On the local market, Al Ain Ahlia is renowned for its technical expertise in the engineering and energy classes of business in which it became one of the biggest specialists. A number of infrastructure and skyscrapers projects along with industrial risks are insured at the company.

On the local market, Al Ain Ahlia is renowned for its technical expertise in the engineering and energy classes of business in which it became one of the biggest specialists. A number of infrastructure and skyscrapers projects along with industrial risks are insured at the company.

|

| Mr Mohamed Mazhar Hamadeh |

| General manager |

Such level of specialization could not have been achieved without the establishment of top-level technical team. In fact, the development of the company rests on a sound financial foundation. Throughout the years, Al Ain Ahlia has managed to set up its war chest. Its shareholders' equity represents the double of its yearly turnover. This wealth enables it to easily face the international financial crisis whose repercussions on the region have been severely felt.

Al Ain Ahlia in 2008

Turnover | 696 463 879 AED (189 709 796 USD) |

Paid up capital | 150 000 000 AED (40 858 500 USD) |

Underwriting result | 54 654 000 AED (14 887 203 USD) |

Net result | 143 866 868 AED (39 187 896 USD) |

Shareholder's equity | 1 154 471 000 AED (314 466 356 USD) |

Total assets | 2 171 110 000 AED (591 388 653 USD) |

Loss ratio | 94.6% |

Number of branches | 3 |

Number of motor insurance offices | 7 |

Number of employees | 170 |

Management

| General manager | Mohamed Mazhar Hamadeh |

| Deputy general manager | Ron Bakica |

| Chairman of the board of directors | Mohamed Bin Juan Al Badi |

| Deputy chairman | Khalid Mohammed Bin Juan Al Badi |

| Board member | Ahmed G. Al Hamily |

| Board member | Mohamed F. Al Mazroui |

| Board member | Gaith H. Al Qubaisi |

| Board member | Mohamed S. Al Ahbabi |

| Board member | Saeed A. S. Al Kuwaiti |

Main shareholders

| Abu Dhabi Investment Authority | 19.70% |

| Mohamed J. Al Badi | 10.28% |

| Khaled M. J. Al Dhahiri | 5.45% |

Main technical highlights 2004-2008

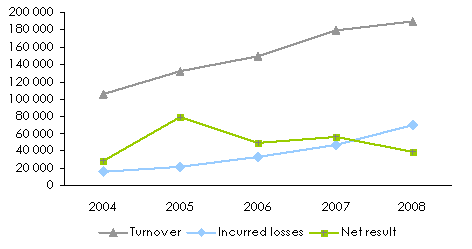

in USD| 2004 | 2005 | 2006 | 2007 | 2008 | |

|---|---|---|---|---|---|

Gross written premiums | 105 281 109 | 132 103 479 | 149 348 750 | 172 952 229 | 189 709 796 |

Ceded reinsurance premiums | 79 065 120 | 93 164 093 | 96 862 078 | 105 364 965 | 111 771 968 |

Premiums net of reinsurance | 26 215 989 | 38 939 386 | 52 486 672 | 67 587 264 | 77 937 828 |

Net earned premiums | 23 306 118 | 34 063 036 | 46 848 744 | 61 424 499 | 74 245 070 |

Net incurred losses | 16 316 706 | 22 299 470 | 32 909 838 | 47 095 838 | 70 228 679 |

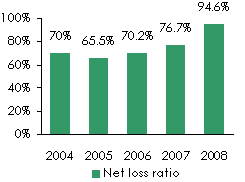

Net loss ratio | 70.0% | 65.5% | 70.2% | 76.7% | 94.6% |

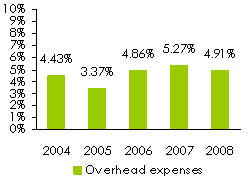

Administrative expenses | 4 674 130 | 4 461 855 | 7 254 865 | 9 109 104 | 9 321 186 |

Underwriting result | 13 715 520 | 19 798 391 | 20 359 321 | 21 570 740 | 14 887 203 |

Net result | 28 626 118 | 78 746 984 | 49 871 940 | 56 718 265 | 39 187 896 |

Net investment & other income | 20 851 151 | 64 475 489 | 38 250 698 | 44 759 332 | 29 226 357 |

Premiums, losses and results' evolution

in thousands USD

Turnover's evolution per class of business: 2004-2008

in thousands USD| Marine | Fire and accident | Total | |

|---|---|---|---|

| 2004 | |||

Turnover | 7 537 309 | 97 743 800 | 105 281 109 |

Share | 7.2% | 92.8% | 100% |

| 2005 | |||

Turnover | 7 500 071 | 124 603 408 | 132 103 479 |

Share | 5.7% | 94.3% | 100% |

| 2006 | |||

Turnover | 11 360 919 | 137 987 831 | 149 348 750 |

Share | 7.6% | 92.4% | 100% |

| 2007 | |||

Turnover | 12 009 132 | 160 943 097 | 172 952 229 |

Share | 6.9% | 93.1% | 100% |

| 2008 | |||

Turnover | 9 110 671 | 180 599 125 | 189 709 796 |

Share | 4.8% | 95.2% | 100% |

2007/2008 growth | -24.1% | 12.2% | 9.7% |

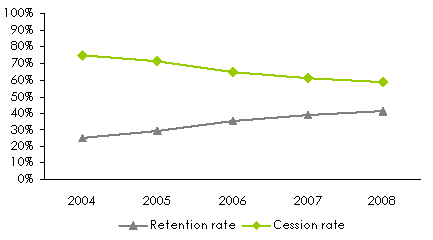

Cession and retention rates: 2004-2008

in % of written premiums

Loss ratio 's evolution: 2004-2008 | Overhead expenses: 2004-2008 | |

|  |

Exchange rate AED/USD as at 31/12 | 2004 | 2005 | 2006 | 2007 | 2008 |

0.27229 | 0.27233 | 0.27234 | 0.27232 | 0.27239 |

Contact

Head office | Airport Road, P.O. Box 3077 Abu Dhabi, United Arab Emirates |

Phone | (+971) 2 4459900 |

Fax | (+971) 2 4456685 |

Webite | |

Email | alainins [at] emirates [dot] net [dot] ae |

0

Your rating: None

Mon, 20/05/2013 - 15:12

The online magazine

Live coverage

16:28

16:04

11:51

04/24

04/24

Latest news