Al-Rajhi Takaful

| Date of creation: 1 January 2008, Riyad, Saudi Arabia |  |

| Classes of business: Takaful life and non-life | |

| Rating: Moody's / A3 / Stable | |

| Staff members: 974 employees |

Al Rajhi Takaful in 2020

|  |

| Abdallah Sulaiman Al Rajhi Chairman of the Board of Directors |

Management

| Abdallah Sulaiman Al Rajhi | Chairman of the Board of Directors |

| Saud Abdullah Al Rajhi | Vice-Chairman of the Board |

| Mahmoud Salim Dahduli | Acting Group CEO |

| Robert Pereira | Chief Financial Officer, CFO |

Contact

| Head office | 3485 Thomamah road, Al Rabie Dist., P.O. Box 67791, Riyad 11517, Saudi Arabia |

| Phone | +966 11 440 9666-1117 |

| Fax | +966 11 4755017 |

| malhodaithy [at] alrajhitakaful [dot] com |

Shareholding

Shareholders | Shares |

Al Rajhi Insurance Co Ltd | 26.50% |

Al Rajhi Bank | 22.50% |

Ahmed Sulaiman Abdulaziz Al Rajhi | 1.50% |

Saud Abdullah Suleiman Al Rajhi | 1.50% |

Saleh Mansour Al Garbooa | 1.50% |

Sultan Abdullah Al Rajhi | 1.50% |

Others | 45% |

Al Rajhi Takaful : main technical highlights

Figures in thousands USDIndicators | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|

Gross written premiums | 519 120 | 850 997 | 791 601 | 684 364 | 727 764 |

Gross non-life written premiums | 511 675 | 836 658 | 771 116 | 656 703 | 685 732 |

Gross life written premiums | 7 445 | 14 339 | 20 485 | 27 661 | 42 032 |

Net written premiums | 494 532 | 818 898 | 762 160 | 648 767 | 616 791 |

Net non-life written premiums | 488 755 | 807 027 | 744 738 | 625 657 | 586 613 |

Net earned premiums | 409 239 | 742 770 | 761 688 | 702 795 | 621 267 |

Net non-life earned premiums | 403 294 | 731 012 | 744 844 | 679 559 | 590 861 |

Net incurred losses | 342 293 | 625 572 | 617 877 | 588 113 | 427 269 |

Net non-life incurred losses | 342 098 | 624 645 | 615 570 | 583 730 | 417 461 |

Management expenses | 48 067 | 71 432 | 91 173 | 93 620 | 119 178 |

Non-life management expenses | 47 130 | 69 952 | 89 722 | 90 823 | 115 154 |

Net non-life loss ratio 1 | 84.83% | 85.45% | 82.64% | 85.90% | 70.65% |

Net non-life management expenses ratio 2 | 9.64% | 8.67% | 12.05% | 14.52% | 19.63% |

Net non-life combined ratio 3 | 94.47% | 94.12% | 94.69% | 100.42% | 90.28% |

Net result | 23 218 | 53 768 | 44 065 | 22 952 | 60 462 |

(1) Net non-life loss ratio = Non-life incurred losses / Net non-life earned premiums

(2) Net non-life management expenses ratio = Non-life management expenses / Net non-life reinsurance written premiums

(3) Net non-life combined ratio = Net non-life loss ratio + Net non-life management expenses ratio

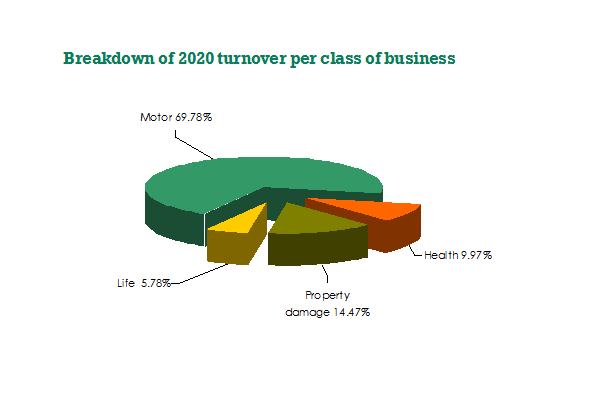

Al Rajhi Takaful : turnover breakdown per class of business

Figures in thousands USDClass of business | 2016 | 2017 | 2018 | 2019 | 2020 | 2020 shares |

|---|---|---|---|---|---|---|

Motor | 421 878 | 682 935 | 559 334 | 484 966 | 507 838 | 69.78% |

Property damage and accident | 32 005 | 33 924 | 26 961 | 38 775 | 105 292 | 14.47% |

Health | 57 792 | 119 799 | 184 821 | 132 962 | 72 602 | 9.97% |

Total non-life | 511 675 | 836 658 | 771 116 | 656 703 | 685 732 | 94.22% |

Total life | 7 445 | 14 339 | 20 485 | 27 661 | 42 032 | 5.78% |

Grand total | 519 120 | 850 997 | 791 601 | 684 364 | 727 764 | 100% |

Al Rajhi Takaful : net written premiums per class of business

Figures in thousands USDClasses of business | 2016 | 2017 | 2018 | 2019 | 2020 | 2019-2020 evolution 1 |

|---|---|---|---|---|---|---|

Motor | 417 556 | 678 828 | 553 779 | 482 642 | 505 567 | 4.75% |

Property damage and accident | 13 904 | 8 467 | 6 419 | 10 009 | 8 444 | -15.63% |

Health | 57 295 | 119 732 | 184 540 | 133 006 | 72 602 | -45.41% |

Total non-life | 488 755 | 807 027 | 744 738 | 625 657 | 586 613 | -6.24% |

Total life | 5 777 | 11 871 | 17 422 | 23 110 | 30 178 | 30.59% |

Grand total | 494 532 | 818 898 | 762 160 | 648 767 | 616 791 | -4.93% |

Al Rajhi Takaful : net earned premiums per class of business

Figures in thousands USDClasses of business | 2016 | 2017 | 2018 | 2019 | 2020 | 2019-2020 evolution (1) |

|---|---|---|---|---|---|---|

Motor | 343 895 | 638 727 | 595 577 | 493 581 | 488 927 | -0.94% |

Property damage and accident | 4 400 | 4 206 | 6 517 | 8 210 | 8 846 | 7.74% |

Health | 54 999 | 88 079 | 142 750 | 177 768 | 93 088 | -47.63% |

Total non-life | 403 294 | 731 012 | 744 844 | 679 559 | 590 861 | -13.05% |

Total life | 5 945 | 11 758 | 16 844 | 23 236 | 30 406 | 30.86% |

Grand total | 409 239 | 742 770 | 761 688 | 702 795 | 621 267 | -11.60% |

(1) Evolution in local currency

Exchange rate as at 31/12/2020 : 1 SAR = 0.2663 USD ; 31/12/2019 : 1 SAR = 0.26631 USD; at 31/12/2018: 1 SAR = 0.26621 USD; at 31/12/2017 : 1 SAR = 0.26648 USD ; at 31/12/2016 : 1 SAR = 0.2664 USD

Al Rajhi Takaful : Incurred losses per non-life class of business

Figures in thousands USDClasses of business | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|

Motor | 300 179 | 554 024 | 481 271 | 359 852 | 335 090 |

Property damage and accident | 400 | 1 517 | 223 | 667 | 1 542 |

Health | 41 519 | 69 104 | 134 076 | 223 211 | 80 829 |

Total non-life | 342 098 | 624 645 | 615 570 | 583 730 | 417 461 |

Al Rajhi Takaful : net loss ratio per non-life class of business

Figures in thousands USDClasses of business | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

Motor | 87.29% | 86.74% | 80.81% | 72.91% |

Property damage and accident | 9.10% | 36.07% | 3.43% | 8.12% |

Health | 75.49% | 78.46% | 93.92% | 125.56% |

Total non-life | 84.83% | 85.45% | 82.64% | 85.90% |

Source: Al-Rajhi Company for Cooperative

0

Your rating: None

Wed, 30/03/2022 - 17:03

The online magazine

Live coverage

17:36

15:34

11:25

10:00

04/17

Latest news