Angola's insurance market (2015-2019)

Angola's insurance market features

- Regulatory authority: Angolan Insurance Regulatory and Supervisory Agency (ARSEG)

- Life and non-life premiums: 374.123 million USD

- Insurance density (2019): 11.7 USD

- Penetration rate (2019): 0.4%

Structure of the Kenyan insurance market in 2020

| Market stakeholders | Total |

|---|---|

Insurance companies | 28 |

Insurance agents | 22 |

Insurance and reinsurance brokers | 64 |

Profile

- Area (1): 1 281 432 Km2

- Population (1) (2019) :31 825 299 inhabitants

- GDP (1) (2019) : 89.417 billion USD

- GDP per capita (2019) : 2 809 USD

- GDP growth rate (2019) (1):-0.6%

- Inflation rate (2019) :17%

- Main economic sectors : Petroleum and gas industry and services (banking, communications, tourism)

Major cities (2)

(per number of inhabitants in 2017)

- Luanda (capital): 9 165 776

- Lobito - Benguela: 1 172 741

- Huambo: 1 105 819

(1) Source : population.data

(2)Source Banque Mondiale

Angola's insurance market: premiums per life and non-life class of business (2015-2019)

Figures in thousands USD

| Class of business | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

Non life | 815 757 | 602 505 | 731 538 | 439 873 | 364 885 |

life | 15 266 | 12 135 | 11 387 | 10 047 | 9 238 |

| Total | 831 023 | 614 640 | 742 926 | 449 920 | 374 123 |

Exchange rate as at 31/12/2019 : 1 AOA = 0.00205 USD ; at 31/12/2018 : 1 AOA = 0.00322 USD ; at 31/12/2017 : 1 AOA = 0.0060 USD ; at 31/12/2016 : 1 AOA = 0.0060 USD ; at 31/12/2015 : 1 AOA = 0.00735 USD

Angola's insurance market: turnover per class of business (2018-2019)

Figures in thousands| 2019 turnover | 2018 turnover | 2018-2019 (1) evolution | 2019 shares | |||

|---|---|---|---|---|---|---|

| In AOA | In USD | In AOA | In USD | |||

ENSA Seguros de Angola | 63 796 284 | 130 782 | 47 696 763 | 153 584 | 33.75% | 34.96% |

Saham Angola Seguros | 24 893 074 | 51 031 | 21 588 088 | 69 514 | 15.31% | 13.64% |

Fidelidade Seguros Angola | 22 338 090 | 45 793 | 14 308 322 | 46 073 | 56.12% | 12.24% |

Nossa Seguros | 19 107 861 | 39 171 | 11 863 103 | 38 199 | 61.07% | 10.47% |

Global Seguros | 9 216 423 | 18 894 | 9 389 939 | 30 236 | -1.85% | 5.05% |

BIC Seguros | 7 336 685 | 15 040 | 5 743 070 | 18 493 | 27.75% | 4.02% |

Tranquilidade - Corporação Angolana de Seguros | 6 040 943 | 12 384 | 4 778 955 | 15 388 | 26.41% | 3.31% |

Prudencial Seguros | 5 566 446 | 11 411 | 5 184 162 | 16 693 | 7.37% | 3.05% |

Fortaleza Segura | 4 599 202 | 9 428 | 3 535 386 | 11 384 | 30.09% | 2.52% |

Mundial Seguros | 3 668 458 | 7 520 | 2 669 080 | 8 594 | 37.44% | 2.01% |

BONWS Seguros | 3 212 211 | 6 585 | 4 764 982 | 15 343 | -32.59% | 1.76% |

STAS Seguros | 2 883 713 | 5 912 | 1 257 839 | 4 050 | 129.26% | 1.58% |

Protteja Seguros | 2 390 966 | 4 901 | 2 096 200 | 6 750 | 14.06% | 1.31% |

Aliança Seguros | 1 989 469 | 4 078 | 531 260 | 1 711 | 274.48% | 1.09% |

Liberty & Trevo (Angola) | 1 752 220 | 3 592 | 894 550 | 2 880 | 95.88% | 0.96% |

Sol Seguros | 1 551 471 | 3 181 | 195 916 | 631 | 691.91% | 0.85% |

Providência Royal Seguros | 693 727 | 1 422 | 1 677 020 | 5 400 | -58.63% | 0.38% |

Confiança Seguros | 365 229 | 749 | 1 327 703 | 4 275 | -72.49% | 0.20% |

Giant Magic Seguros | 328 729 | 674 | 14 271 | 46 | 2203.49% | 0.18% |

Triunfal Seguros | 273 979 | 562 | - | - | - | 0.15% |

Master Seguros | 255 729 | 524 | - | - | - | 0.14% |

Super Seguros | 109 730 | 225 | 140 025 | 451 | -21.64% | 0.06% |

Garantia Seguros | 73 231 | 150 | 70 162 | 226 | 4.37% | 0.04% |

Internacional Seguros | 54 981 | 113 | - | - | - | 0.03% |

AAA Seguros (2) | - | - | - | - | - | 0.00% |

Mandume Seguros (2) | - | - | - | - | - | 0.00% |

Glinn Seguros (2) | - | - | - | - | - | 0.00% |

Meu Seguros (2) | - | - | - | - | - | 0.00% |

| Total | 182 498 850 | 374 123 | 139 726 796 | 449 920 | 30.61% | 100% |

(1) Growth rate in local currency

(2) Licenses revoked by the ARSEG

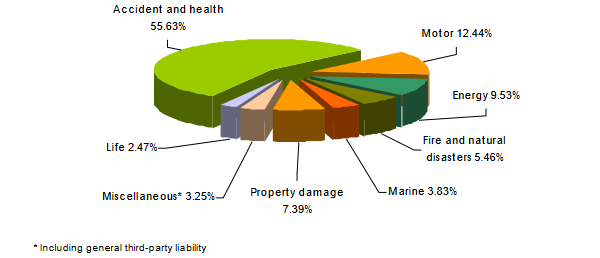

Angola's insurance market: turnover per class of business (2015-2019)

Figures in thousands USD| Class of business | 2015 | 2016 | 2017 | 2018 | 2019 | 2018-2019 (1) evolution | 2019 shares |

|---|---|---|---|---|---|---|---|

Accident, health and travel insurance | 377 474 | 370 116 | 389 097 | 242 344 | 208 132 | 34.90% | 55.63% |

Motor | 197 149 | 123 633 | 132 350 | 74 565 | 46 552 | -1.94% | 12.44% |

Energy | 67 716 | 6 997 | 86 587 | 45 393 | 35 638 | 23.32% | 9.53% |

Fire and natural disasters | 23 047 | 19 679 | 33 082 | 25 875 | 20 419 | 23.95% | 5.46% |

Marine | 28 755 | 18 760 | 12 699 | 13 503 | 14 342 | 66.83% | 3.83% |

General third-party liability | 63 861 | 9 754 | 10 156 | 8 813 | 6 463 | 15.19% | 1.73% |

Other property damage | 29 621 | 33 711 | 48 682 | 22 124 | 27 631 | 96.18% | 7.39% |

Miscellaneous | 28 133 | 19 855 | 18 885 | 7 257 | 5 708 | 23.54% | 1.52% |

Total non-life | 815 757 | 602 505 | 731 538 | 439 873 | 364 885 | 30.30% | 97.53% |

Life | 15 266 | 12 135 | 11 387 | 10 047 | 9 238 | 44.41% | 2.47% |

| Grand total | 831 023 | 614 640 | 742 926 | 449 920 | 374 123 | 30.61% | 100% |

(1) Growth rate in local currency

Turnover 2019 per class of business

Angola's insurance market: incurred losses per non-life class of business (2015-2019)

Figures in thousands USD| Class of business | 2015 | 2016 | 2017 | 2018 | 2019 | 2018-2019 (1) evolution |

|---|---|---|---|---|---|---|

Accident, health and travel insurance | 200 327 | 225 456 | 226 392 | 149 516 | 126 550 | 32.95% |

Motor | 63 510 | 58 567 | 58 852 | 24 045 | 18 555 | 21.21% |

Energy | 74 | 3 | 351 | -580 | 10 482 | 2939.04% |

Fire and natural disasters | -2 730 | 2 921 | 71 507 | 14 136 | 2 037 | -77.37% |

Marine | 728 | 349 | 17 738 | 7 682 | -4 894 | -200.07% |

General third-party liability | 1 791 | 673 | -99 | 284 | 534 | 195.51% |

Other property damage | 13 103 | -4 352 | 32 199 | 8 405 | 1 438 | -73.12% |

Miscellaneous | 1 776 | 963 | 919 | 320 | 808 | 297.05% |

| Total non-life | 278 578 | 284 580 | 407 859 | 203 808 | 155 511 | 19.85% |

(1) Growth rate in local currency

Angola's insurance market: loss ratio per non-life class of business (2015-2019)

| Class of business | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

Accident, health and travel insurance | 53.07% | 60.91% | 58.18% | 61.70% | 60.80% |

Motor | 32.21% | 47.37% | 44.47% | 32.25% | 39.86% |

Energy | 0.11% | 0.05% | 0.41% | -1.28% | 29.41% |

Fire and natural disasters | -11.85% | 14.85% | 216.15% | 54.63% | 9.98% |

Marine | 2.53% | 1.86% | 139.67% | 56.89% | -34.12% |

General third-party liability | 2.80% | 6.90% | -0.97% | 3.22% | 8.27% |

Other property damage | 44.24% | -12.91% | 66.14% | 37.99% | 5.21% |

Miscellaneous | 6.31% | 4.85% | 4.87% | 4.41% | 14.16% |

| Total non-life | 34.15% | 47.23% | 55.75% | 46.33% | 42.62% |

0

Your rating: None

Tue, 26/10/2021 - 10:58

The online magazine

Live coverage

16:28

16:04

11:51

04/24

04/24

Latest news