What is an insurance assistance?

Assistance insurance: Background

© Brian Robert Marshall, CC BY-SA 2.0 © Brian Robert Marshall, CC BY-SA 2.0 |

Assistance insurance started out in Sweden as a service provided to holiday makers. The Swedes, in search of sunnier weather, have started to travel outside their country as of 1950.

With communication systems, back then, being less developed than today’s, holiday makers experiencing some difficulties were left on their own, as tourists could get very little help from local authorities. That is when a Swedish company took the initiative to provide assistance to its fellow-citizens in trouble abroad in return for a prior payment of a contribution.

As tourism grew rapidly in Nordic countries, assistance insurance became very successful in Sweden then in the rest of Europe. In France in 1963, Pierre Desnos persuaded Renault and Club Méditerranée to embark with him on this venture. It is thanks to their help and that of Generali that Pierre Desnos launched Europ Assistance in 1963, a company insuring tourists during their trip. In light of this success, many other assistance companies saw the light of day.

Definition of assistance

Assistance is an activity through which a company mandated by an insurance company provides relief for an insured who has sustained damage. The coverage becomes effective after the guarantee offered by the insurer has been affected. Damages may be provided by means of material or financial assistance.

This plan remains optional depending upon personal choice. The individual who chooses to contract this plan pays a premium in order to guard against any random event. The beneficiary may be the policy underwriter or a third party.

Basic principles of assistance insurance

Assistance insurance has always focused on travelers’ service, which means providing relief to holidaymakers abroad who are unable to resolve an emergency situation straining them seriously. The terms for the insurer’s intervention are defined by the contract signed between the underwriter and the insurance company. The policyholder, having paid his premium, may claim entitlement for assistance whenever he deems that, the situation in which he is requires implementation of the underwritten guarantee.

In the absence of agencies located in the countries where policyholders get into trouble, the insurer receives claim reports most of the time via telephone. Seldom do the insured resort to an agency to report a prejudice. Assistance companies and the antenna of specialized insurers are the first to have established call centers which operate around the clock seven days a week in order to respond to all emergencies.

Because of the international character of some interventions, these insurers’ staff members are required to have excellent command over foreign languages to be able to communicate with assistance companies that may be located anywhere around the world.

Whenever the insurer deems over the phone that the situation indeed requires his intervention, he contacts an assistance company which intervenes directly by providing relief to his customer. A written report confirming the claim made by phone is later drafted by the insured.

Assistance has witnessed an astonishing evolution, getting widely diversified since its inception.

Is assistance an insurance?

For a long time, assistance has not been recognized as insurance but rather as a service or a benefit devoid of any accurately-defined legal status.

For a long time, assistance has not been recognized as insurance but rather as a service or a benefit devoid of any accurately-defined legal status.

At its beginning in France in 1963, the activity performed by Europ Assistance was a service. Moreover, this company did not have the status of an insurance company because the assistance provided to customers had to be carried out by a mechanic in the event of breakdown of a car for instance, a plumber in the event of leak or a locksmith in case keys were lost. Assistance companies were, therefore, service providers having no link with insurance.

With the advent of policies designed to ensure convergence of European legislations and the development of assistance, community-based authorities have focused on the link between assistance and insurance to finally come to the conclusion that assistance is similar to insurance activity. This acknowledgement has been considered in view of the concept of premium and risk.

Indeed, in order to benefit from possible compensation or services (material or financial assistance), the customer is required to pay a premium at the beginning of the period. Premium payment upon signing the policy is the prime feature of insurance. Moreover, the randomness characterizing claim occurrence has further enhanced similarity with insurance.

Last but not least, assistance contract comprises terms and guarantees which define the insurer’s framework for action. The insured is entitled to the benefit as provided when the occurrence of the guaranteed event is consistent with the terms as defined in the contract during the risk underwriting.

These similarities between insurance and assistance have induced the European Union to bring both activities closer in legal terms as of 1979. Consequently, the regulations governing assistance companies are the ones drawn up from the insurance code.

Assistance insurance: a highly diversified field

Assistance has witnessed an astonishing evolution, getting widely diversified since its inception, with insurers including numerous related guarantees in their basic policies.

These facultative guarantee extensions have allowed to increase insurance companies’ turnover while providing policyholders with complex covers. Top-of-the-line insurance policies include a wide range of assistance services.

Assistance and householder’s comprehensive insurance

The integration of assistance guarantees is thoroughly mentioned in householder’s comprehensive insurance. This product may include assistance following loss of house keys, property protection, basic fees (clothing, dresser set) and even hotel accommodation fees when the house is no longer usable.

As far as water damage guarantee is concerned, plumbing assistance is optionally proposed. Health benefits may also be provided in the contract of householder’s comprehensive insurance: baby-sitting in the event of abrupt hospitalization of parents, search for physician in case of accident or sudden illness.

Assistance and motor insurance

© Rasback (image modifiée), CC BY-SA 3.0 © Rasback (image modifiée), CC BY-SA 3.0 |

Motor insurance fits well with the concept of assistance. Insurers are fiercely battling out over the services provided to customers

While motor insurance is compulsory, assistance covers remain optional, oftentimes enabling insurers to mitigate the losses reported by this class of business.

Assistance cover becomes effective most of the time during tie-up of the vehicle of the insured, which renders the latter eligible for coverage as follows: transport fees of the mechanic, towing or accommodation fees of guarantee beneficiaries, provision of travel documents to ensure the return of beneficiaries home or in order to pursue their journey, provision of rental vehicle in replacement of tie-up cars, ...

Assistance and consumer goods

Assistance guarantees are also designed to help customers: purchase a car, a TV set, computer hardware, etc. This commercial approach often stands as an argument which incites consumers to invest more.

Insurers, on the other hand, have to broker deals with specialists and even industrialists with whom maintenance and after-sales services are contracted.

Assistance and health insurance

Some niches such as medical assistance (home care and assistance) or human services are recent. Ageing population has triggered new needs for the retired. This assistance has been extended to individuals who sustained an illness or an accident which resulted in their status of medical provisional or definitive dependence.

Some niches such as medical assistance (home care and assistance) or human services are recent. Ageing population has triggered new needs for the retired. This assistance has been extended to individuals who sustained an illness or an accident which resulted in their status of medical provisional or definitive dependence.

This kind of assistance comes as a supplement to health care repayments by social security. It mainly focuses on the material assistance provided to the patient at home: dispatching medicines or medical assistance, providing an ambulance or a taxi to see a doctor or to go to hospital, providing housekeeper service, garden maintenance, TV rental in case of hospitalization...

In case of death of beneficiary, some provisions cater for some kind of assistance pertaining to funeral services.

Home health care insurance provides protection for all individuals living under the same roof. It is underwritten as an extension to a supplementary health insurance.

Assistance and travel insurance

Travel insurance, among the flagship products, has, since its inception, remained a successful cover. It is underwritten by tourists as well as by business men who no longer travel around without underwriting such a cover.

Travel insurance may include a wide range of services: travel cancellation, repatriation assistance, medical expenses, theft, loss, luggage destruction or delay, flight delay, third party liability, personal accident, legal assistance, etc. These services are available upon purchase of a plane ticket at a travel agency or an airliner.

Assistance insurance: The new trends

New assistance schemes have emerged recently. They are equally designed for individuals as well as corporate: assistance to the disabled, to job seekers, to corporates for machine repair work, etc. These different offers require from insurers to have thorough knowledge about risks in order to be able to duly accommodate their pricing accordingly.

Assistance to corporate business may include the following: plumbing and dewatering coverage, faulty cables, electrical failure, problem affecting heaters, gas, locks, glass windows or keys, service for the handling of pests, regular surveillance, legal counseling, ...

Growth of assistance insurance

With the growth of tourism, insurance assistance has developed considerably. Moreover, the technical results of travel assistance remain excellent.

With the growth of tourism, insurance assistance has developed considerably. Moreover, the technical results of travel assistance remain excellent.

This type of cover has greatly diversified and is developing regularly. Nowadays, the new development niches pertain to motor, housing, personal service, assistance to SME. The extension of assistance to these niches has generated numerous jobs in a wide range of sectors.

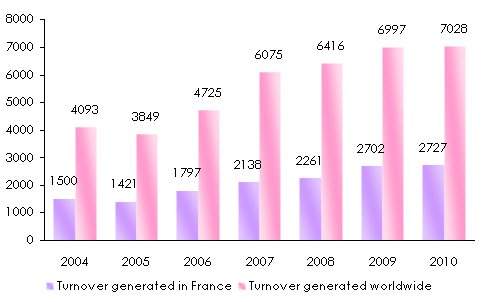

In France, for instance, the turnover of assistance companies has almost doubled between 2004 and 2010, attaining 7 billion USD, with growth rate reaching nearly 9% between 2009 and 2010. The main activity of assistance providers is henceforth focused on motor insurance with nearly 70% of the turnover. The core business, made up of tourism, has declined because of better information and planning of travelers thanks to the internet, especially. Moreover, the quality of infrastructure available abroad makes travel insurance underwriting less necessary. With 15% of annual growth, personal services are reporting a double digit increase.

New assistance schemes have emerged recently. They are equally designed for individuals as well as corporate.

The French assistance insurers’ activity: turnover generated in France and abroad

in million USD

Finaccord, a British study firm, has recently conducted a survey on assistance and travel insurance in many countries including Australia, Brazil, Canada, China, India, Japan, Russia, South Africa, South Korea and United States.

According to this survey, United States are the world’s number one in travel insurance followed by Canada. Profit growth for these markets remains nonetheless poor whereas that of emerging countries like India and Brazil amounts to respectively 12.1% and 10.6% per year. By way of example, Japan’s profit growth amounts to 3%.

In China, the market of travel assistance has gone three fold between 2003 and 2010. The driving factors that induce travelers to underwrite this type of cover are numerous: epidemiological crises, recurrent natural catastrophes...