Bahrain National Holding Company

The group’s activities are structured around Bahrain Insurance Company, a non-life insurance company and Bahrain National Life Assurance, a single local life insurer.

The group’s activities are structured around Bahrain Insurance Company, a non-life insurance company and Bahrain National Life Assurance, a single local life insurer.

First company in terms of shareholder’s equity in 2011, BNH acquired financial strength which allows it not only to secure its partners and customers, but also to diversify its investments.

Despite the crisis experienced by the countries of the region in recent years, BNH has continued to generate substantial profits in 2009, 2010 and 2011.

Thanks to its local performance, the group began its regional expansion. BNH has targeted markets in the MENA region and in particular Qatar and the United Arab Emirates.

|  |

| Farouk Yousif Almoayyed | Mahmood Al Soufi |

| Chairman | CEO |

Bahrain National Holding Company in 2011

| Share capital | 30 009 800 USD |

| Turnover | 57 954 494 USD |

| Total assets | 189 366 000 USD |

| Shareholder's equity | 111 634 000 USD |

| Technical result | 5 901 475 USD |

| Net profit | 8 738 519 USD |

| Net loss ratio | 52.86% |

| Expenses ratio | 29.52% |

| Net combined ratio | 82.38% |

| Number of branches & subsidiaries | 2 subsidiaries (Bahrain National Insurance & Bahrain National Life) and 10 branches |

| Rating | BBB+ (good) by Standard & Poor’s |

Management

| Chairman | Farouk Yousif Almoayyed |

| CEO | Mahmood Al Soufi |

| General manager of Bahrain National Life | Robert Grey |

| Financial manager | David Matthews |

| Non life insurance manager | Joseph Rizzo |

| Motor manager | Abdoullah Al Suwaidi |

| IT manager | Adrian Reid |

Main shareholders

| Yousif A. Amin | 10.80% |

| National Insurance Co. | 6.55% |

| Abdulhammeed A. Mohammed | 5.77% |

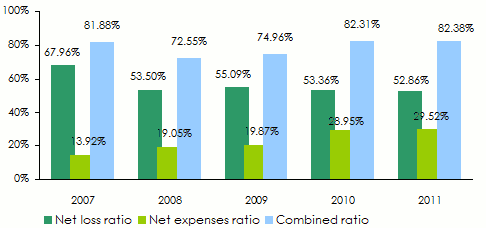

Main technical highlights: 2007-2011

in USD| 2007 | 2008 | 2009 | 2010 | 2011 | |

|---|---|---|---|---|---|

Gross written premiums | 71 913 203 | 73 726 856 | 65 399 170 | 60 979 924 | 57 954 494 |

Written premiums net of reinsurance | 32 941 156 | 34 676 425 | 35 957 116 | 35 050 184 | 35 250 208 |

Net earned premiums | 31 793 536 | 33 929 451 | 35 417 720 | 35 887 479 | 35 316 309 |

Net incurred losses | 21 070 210 | 18 458 673 | 20 721 812 | 20 673 533 | 20 274 422 |

Net management expenses | 5 008 750 | 7 067 321 | 7329445 | 10 279 979 | 9 917 757 |

Net loss ratio* | 67.96% | 53.50% | 55.09% | 53.36% | 52.86% |

Net expenses ratio* | 13.92% | 19.05% | 19.87% | 28.95% | 29.52% |

Net combined ratio* | 81.88% | 72.55% | 74.96% | 82.31% | 82.38% |

Net technical result | 5 244 025 | 8 024 710 | 7 860 909 | 5 303 750 | 5 901 475 |

Financial income | 8 111 770 | 1 139 872 | 6 779 472 | 6 946 645 | 4 566 240 |

Net result | 18 800 203 | 5 315 614 | 10 758 843 | 10 073 956 | 8 738 519 |

Technical ratios: 2007-2011*

* Non life insurance only

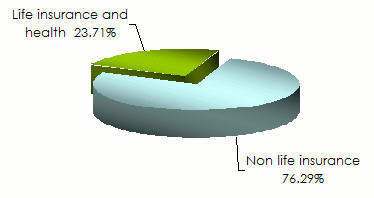

* Non life insurance onlyGross written premiums per class of business: 2007-2011

in USD| 2007 | 2008 | 2009 | 2010 | 2011 | Shares 2011 | 2010/11 evolution | |

|---|---|---|---|---|---|---|---|

Non life | 47 988 319 | 62 569 590 | 52 895 221 | 47 810 352 | 44 213 470 | 76.29% | -7.52% |

Life and health | 23 924 884 | 11 157 266 | 12 503 949 | 13 169 572 | 13 741 024 | 23.71% | 4.34% |

Total | 71 913 203 | 73 726 856 | 65 399 170 | 60 979 924 | 57 954 494 | 100% | -4.96% |

Split of gross written premiums per class of business in 2011

Net incurred losses: 2007-2011

in USD| 2007 | 2008 | 2009 | 2010 | 2011 | 2010/11 evolution | |

|---|---|---|---|---|---|---|

Non life | 17 739 758 | 14 739 585 | 15 507 647 | 14 532 488 | 13 801 837 | -5.02% |

Life and health | 3 330 453 | 3 719 089 | 5 214 165 | 6 141 046 | 6 472 585 | 5.39% |

Total | 21 070 211 | 18 458 674 | 20 721 812 | 20 673 534 | 20 274 422 | -1.93% |

Technical results: 2007-2011

in USD| 2007 | 2008 | 2009 | 2010 | 2011 | 2010/11 evolution | |

|---|---|---|---|---|---|---|

Non life | 556 818 | 7 453959 | 7 059 747 | 5 124 141 | 4 769 830 | -6.91% |

Life and health | 4 687207 | 570 751 | 801 162 | 179 609 | 1 131 645 | 530.06% |

Total | 5 244 025 | 8 024 710 | 7 860 909 | 5 303 750 | 5 901 475 | 11.26% |

Exchange rate BHD/USD as at 31/12 | 2007 | 2008 | 2009 | 2010 | 2011 |

2.61417 | 2.63019 | 2.64410 | 2.64131 | 2.64403 |

Contact

| Head office | BNH Tower, Seef Business District, P.O. Box 843, Kingdom of Bahrain |

| Phone | (+973) 17 587 300 |

| Fax | (+973) 17 583 099 |

bnh [at] bnhgroup [dot] com | |

| Website |

0

Your rating: None

Tue, 21/05/2013 - 12:57

The online magazine

Live coverage

16:56

16:21

16:03

11:45

04/16

Latest news