BH Assurance: technical indicators (2014-2018)

In June 1997, the company began underwriting all business lines and was renamed "Assurances Salim". Its capital was increased successively to 4 000 000 TND (2 915 000 USD) and then to 10 000 000 TND (7 286 000 USD) in 2003.

In June 1997, the company began underwriting all business lines and was renamed "Assurances Salim". Its capital was increased successively to 4 000 000 TND (2 915 000 USD) and then to 10 000 000 TND (7 286 000 USD) in 2003.

2010: Public listing of "Assurances SALIM": On the occasion of its public listing in 2010, Assurances SALIM further increased its capital from 10 000 000 to 13 300 000 TND (9 131 000 USD).

2019: New era, new identity, new logo, new brand: Assurances SALIM becomes BH Assurance: After 25 years of existence, the company dares to change and embarks on a rebranding action. An operation that has the double benefit of highlighting the label of the group as well as its dynamism. BH Assurance is henceforth establishing itself as a brand of the powerful financial group BH Group. This belonging allows it to improve its notoriety on the local and international markets.

The new identity is inspired by the values of BH BANK. It displays a mix of colors combining a dynamic, passionate red and a reassuring indigo blue, inspiring confidence and peaceful strength. The choice of colours echoes BH Assurance's opening up to new horizons.

BH Assurance in 2018

Employees | 83 |

Share capital | 4 652 139 USD |

Turnover | 35 708 379 USD |

Assets | 98 860 962 USD |

Shareholder's equity | 18 791 310 USD |

Net result | 2 672 669 USD |

Management

| Ahmed Trabelsi | Chairman of the board |

| Dalila Bader | Chief Executive Officer (CEO) |

| Sami Banaoues | Technical manager |

| Abderraouf Amiri | Support manager |

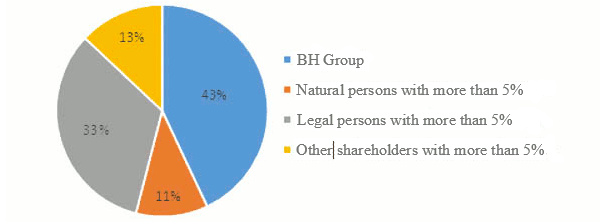

Shareholding

BH Assurance, a listed company since 2010, is 43% owned by BH GROUP. The remaining 57% of the capital isdivided between legal and natural persons, the majority of whom are shareholders of BH BANK.

Shareholding at 31/12/2018 |

|

Development and operating evolution

The company's turnover growth has gone through two major periods:

- 1998-2013: underwritings grew at a relatively rapid pace, from 8 100000 TND (7 350 000 USD) in 1998 to 15 600 000 TND (11 360 000 USD) in 2003, then to 27 600 000 TND (20 740 000 USD) in 2008 to reach 43 100 000 TND (26 140 000 USD) in 2013. However, this growth does not reflect the capabilities of the company which is backed by one of the largest banks of the market.

- 2014-2019: The company sets more ambitious targets, in line with its potential. Hence, from 2014 to 2018, BH Assurance recorded a strong growth of its turnover. The latter increased from 49 100 000 TND (26 280 000 USD) in 2014 to 73 200 000 TND (31 360 000 USD) in 2016, then to 90 200 000 TND (36 370 000 USD) in 2017 and peaked at 102 000 000 TND (33 880 000) in 2018. This development is reflective of a dynamism the company has to maintain to ensure its sustainability.

BH Assurance: technical indicators (2014-2018)

Figures in USD| 2018 | 2017 | 2016 | 2015 | 2014 | |

|---|---|---|---|---|---|

Written premiums | 35 708 379 | 31 551 396 | 25 631 168 | 21 514 556 | 17 533 272 |

Premiums net of reinsurance | 25 197 856 | 21 682 564 | 17 166 767 | 13 470 757 | 10 154 409 |

Earned premiums | 35 091 653 | 31 166 892 | 24 828 717 | 20 583 095 | 16 793 828 |

Incurred losses | 19 046 516 | 18 095 517 | 13 390 007 | 10 639 608 | 7 266 477 |

Loss ratio | 54% | 58% | 54% | 52% | 43% |

Management expenses | 10680 099 | 8854 000 | 7446 713 | 6 629 063 | 5 879 148 |

Management expenses ratio | 30% | 28% | 29% | 31% | 34% |

Combined ratio | 84% | 86% | 83% | 83% | 77% |

Net result | 2 672 669 | 2 150 001 | 1 791 901 | 2 118 808 | 1 894 927 |

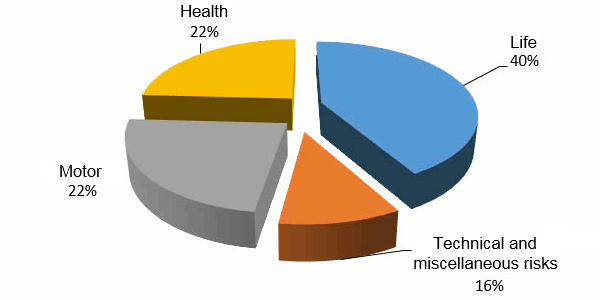

BH Assurance: breakdown of turnover per class of business (2014-2018)

Figures in USD| Class of business | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|

Technical and miscellaneous risks | 5 528 902 | 4 718 057 | 3940 075 | 4124 116 | 3 471 936 |

Motor | 8 000 692 | 7 289 693 | 6 121 682 | 5 309 843 | 3 987 919 |

Health | 7 973 454 | 5731 240 | 5 608 577 | 4 520 683 | 2957 367 |

Total non life | 21 503 048 | 17 738 990 | 15 670 334 | 13954 642 | 10 417 222 |

Life | 14205 331 | 13812 406 | 9960 834 | 7559 914 | 7116 050 |

Grand total | 35708 379 | 31 551 396 | 25 631 168 | 21 514 556 | 17 533 272 |

Breakdown of 2018 turnover per class of business

BH Assurance: forecasts 2019

Figures in USD| Exercices | 2018 | 2019 | Variation in % |

|---|---|---|---|

Turnover | 35 708 379 | 40 085 651 | 12% |

Incurred losses | 19 046516 | 55 071 022 | 1% |

Acquisition costs | 5325 005 | 16 567 449 | 9% |

Administration fees | 5355 094 | 17 407 270 | 14% |

Provisions for unearned premiums | 616 727 | 423 685 | -31% |

Combined ratio | 84% | 79% | -6% |

Total investments | 56665 777 | 66226 302 | 17% |

Financial income | 4571 557 | 4844 870 | 6% |

BH Assurance : Contact

| Head officel | Lotissement AFH BC5 Centre Urbain Nord- 1003-Tunis- Tunisia |

| Phone | 00 216 71 184 200 |

| Fax | 00 216 71 184 284 |

| Website |