Brexit: Consequences of the withdrawal of the European passport

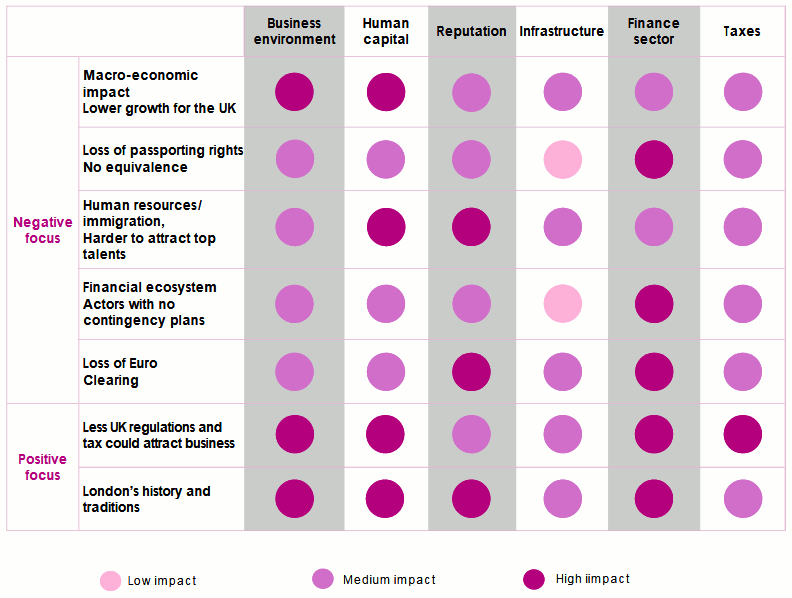

Among the negative sides is the loss of the European passport, which will have a significant impact on the financial sector. However, this same risk will have a reduced impact on economic and social organization.

Read also | Brexit upsets European insurance landscape

Banking and insurance: Withdrawal of the financial passport

London City banks and insurers have already anticipated the withdrawal of the financial passport. They have already prepared for the loss of the unique passport by considering relocation of jobs in Ireland and on the continent. Paris, Frankfurt, Brussels, Dublin and Luxemburg stand as the main drop points. The establishment of new European entities will enable these relocated institutions to redeploy their underwriting operations on the continent.

Insurers are endowed with two distinct legal devices to integrate a State of the European Union:

- The establishment of a branch in one of the member States of the EU

- The establishment of a European company

Both options yield equal results: providing companies with the possibility of pursuing operation within the European economic space after United Kingdom’s exit from the European Community. However, the rules applying to a branch or a European Company (EC) differ: A branch set up in a State of the European Union shall be subject to the rules and regulations of that State, which may turn out to be constraining.

Adversely, a European Company may also be subject to laws of a different State other than the one in which it is set up. This may result in the risk of regulatory dumping among European Union States.

Several dozens of banks and insurers have already taken the initiative of relocating their jobs:

- Lloyd’s, whose headquarters are located at the heart of the City, chose Brussels to set up its new subsidiary company, endowed with up to 201.4 million EUR in capital(230 million USD), an entity that oversees 19 European branches,

- QBE chose Brussels for the establishment of a subsidiary company,

- AIG chose to move its head office to Luxemburg,

- Liberty Specialty Markets domiciled its British company in Luxemburg by turning it into a European Company (EC). The insurer has, nevertheless, maintained a branch in London,

- HSBC consolidated its presence in Paris,

- Barclays and Bank of America have consolidated their headquarters in Dublin, Amsterdam and in Luxemburg.

To discover | Brexit, consequences for the insurance industry

Brexit and Job transfers from London to Continental Europe

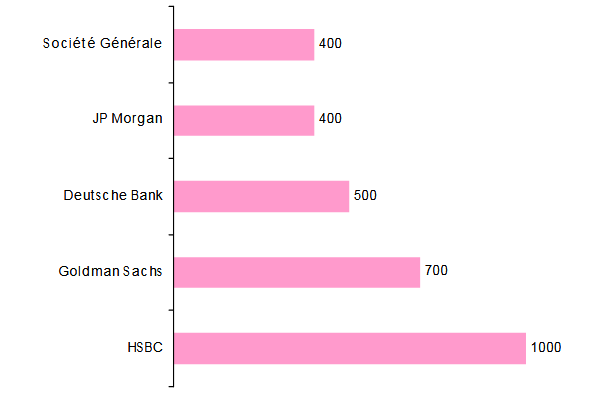

According to Bloomberg, thousands of jobs have been shifted from London to continental Europe. Here are some of the job transfers in figures for recent months:

Source: Bloomberg

Source: BloombergAccording to a survey conducted by the New Financial Institute, Dublin will remain the most attractive capital in terms of post-Brexit European hubs. The establishment of a primary or secondary hub in the Irish capital has already attracted 14 insurers who had already settled in London before.

Another 12 preferred Luxemburg while Paris and Brussels attracted each four insurers whereas Madrid appealed to just one insurer.

Portfolio transfers of residual operation in the United Kingdom towards a subsidiary bases in continental Europe are also underway. These lengthy and onerous paths have already been undertaken by most insurers.

Brexit: Various scenarios

For the time being, two Brexit scenarios remain on the table: The soft Brexit and the hard Brexit. The resignation of Theresa May from her position as Prime Minister has, however, largely paved the way for hard Brexit advocates.

- Soft Brexit

According to this unlikely scenario, financial services will not be truly harmed and the London business center will maintain its primacy in Europe. As for financial activities, just 0.75 billion GBP (0.95 billion USD) of turnover will be lost to other European places. Impact on the other activities will be slightly negative with an income loss of 2.25 billion GBP (2.8 billion USD.)

- Hard Brexit

In case of “no deal”, no agreement shall be signed between the parties. A hard Brexit will have serious consequences on the London place which will see a substantial part of its financial operations shift towards the continent. Paris, Brussels, Frankfurt, Dublin and Luxemburg will come out particularly stronger.

Loss of revenues for the United Kingdom resulting from vanishing activities is estimated at 29 billion GBP (36.8 billion USD). Moreover, a substantial portion of insurance-related financial activities such as accounting, back-up operations,…would quit London taking away in the process 10 billion GBP (12.7 billion USD) of revenues, in particular due to the loss of the financial passport. London will, nonetheless, remain a competitive financial center.