Compagnie Algérienne d’Assurance et de Réassurance (CAAR)

Endowed with an initial capital of 600 000 New Francs(1) , CAAR is today employing 1891 staff members and has a network of five branches and more than 138 agencies scattered nationwide.

Endowed with an initial capital of 600 000 New Francs(1) , CAAR is today employing 1891 staff members and has a network of five branches and more than 138 agencies scattered nationwide.

The establishment of CAAR

Before Algeria’s independence in July 1962, the insurance market was composed of foreign insurance companies, overwhelmingly French ones.

|

Once independence has been acquired, the Algerian State started a vast reorganisation of the insurance sector with the promulgation of new laws aimed at promoting national market. It is within this framework that the first insurance company saw the light of day. CAAR’s mission was to manage legal cession and control insurance operations throughout the country.

Compelled to cede 10% of their portfolio to the new state-owned insurer, foreign companies decided to suspend their activities in the country. Faced with this situation, the Algerian State had no other option but to transfer to the two Algerian companies, operating back then, CAAR and SAA, the portfolios left vacant.

The Société Algérienne d’Assurance (SAA), set up in 1964 by an order dated 12 December 1963, with the status of a mixed Algerian-Egyptian company, had been entirely nationalized in 1966, with the 39% Egyptian stake being acquired by the Algerian State.

CAAR, up against specialization

Durant la période 1973 à 1989, le marché algérien a connu d’importants bouleversements structurels.

During the 1973-1989 period, the Algerian market had been through important structural upheavals. The Compagnie Centrale de Réassurance (CCR), set up in 1973, and whose capital was initially shared between CAAR and SAA on equal basis, benefited a few years later from the monopoly of reinsurance. CAAR has, therefore, entrusted CCR with all of its reinsurance placements.

As of 1973, the Algerian State has imposed specialization of the market. CAAR, consequently, inherits the monopoly of industrial and marine risks. SAA, on its turn, was entrusted with personal lines insurance, mainly the motor class of business.

In 1985(1) , the Compagnie Algérienne des Assurances Marine (CAT), specialised in marine insurance, was set up. CAAR was once again compelled to cede part of its portfolio, that is, the entirety of its marine business.

At the end of that period that came to a close in 1989 with the discontinuation of specialization, CAAR’s operations came to be limited only to property industrial risks.

Opening the sector to private players

In 1995, the Algerian government decided to go for market economy, putting an end to the State monopoly over insurance operations. The sector then opened to private investments. Deregulation results in the arrival of numerous companies whose portfolio is mainly made up of personal lines risks.

With competition in this recent sector getting exacerbated, CAAR was pushed to seek new markets and distribution networks. In this regard, it concluded in 2009 partnership agreements with the three main Algerian banks (CPA, BEA and BNA) that market through their agencies bancassurance products designed by CAAR.

Separating out life and non life activities

The 06-04 law of 2011 has required the separation of life and non life activities. This new provision has pushed CAAR to set up a subsidiary specialized in life insurance.

Named CAARAMA Assurances, the new company is endowed with an initial share capital of 1 billion DZD (13.95 million USD). It started its activities on March 9th, 2011. By the end of 2015, its turnover amounted to 1.78 billion DZD (16.7 million USD).

CAAR’s privatization

The State, owner of the company at 100%, is now focused on the partial privatization of the company. The consultancy firm EY (Ernst & Young) has been tasked with the coaching of the Algerian insurer as regards this file. The opening of the capital is set at 25%.

This move comes within the framework of a privatization process of state-owned companies initiated as of 2008 by the authorities.

After having been the first insurance company set up by the State as a symbol of reconquered independence, CAAR would be the first company to be privatized.

(1) http://babksantina.com/caat-compagnie-algerienne-des-assurances.html#(2) Exchange rate as at 9/03/2011 : 1 DZD = 0.01395 USD

CAAR, the training school of the Algerian insurance market

he renowned Algerian insurance leaders have all been through CAAR. The most senior insurance company has indeed played the role of a trainer and supplier of executive staff for the entire market.

Upon its inception, the company has crafted different training programs for all various levels: beginners and medium professional insurance degrees, long-term training programs for actuaries and top executive staff in Europe, ongoing training for the benefit of staff members operating via the in-house television network, partaking in the establishment of training institutes, advanced training programs in Algeria and abroad, etc.

CAAR today

A historic company, a training school for the market, CAAR stands as a reference in Algeria. In spite of the end of specialization, it has remained the insurer of major industrial risks.

With a consolidated turnover (CAAR and CAARAMA) of 18.4 billion DZD (172.8 million USD), that is 14.1% of the total Algerian premiums collected in 2015, the group is ranking third on the market after SAA and CAAT.

CAAR group in comparison with the Algerian insurance market (2015 figures)

in thousands USD| Non life | ||||

|---|---|---|---|---|

| CAAR | Non life market turnover | CAAR turnover | % in non life market business | % in the Group’s consolidated turnover |

| 1 128 000 | 156 092 | 13.8 % | 90.32 % | |

| Life | ||||

|---|---|---|---|---|

| CAARAMA | Life market turnover | CAARAMA turnover | % in life market business | % in the Group’s consolidated turnover |

| 99 449 | 16 736 | 16.8 % | 9.68 % | |

| 2015 | |

|---|---|

| Group’s consolidated turnover | 172 828 |

| Life & non life market turnover | 1 227 449 |

| CAAR’s market share | 14.1 % |

- 1963On 8 June 1963, the insurance & reinsurance Algerian company was created in Algiers

- 1966Nationalisation of the market

- 1978

- The Algerian State imposed the specialisation of the insurance market

- CAAR became the insurer of industrial and marine risks

- 1985CAAR ceded its marine business to CAAT

- 1989End of the specialisation of the insurance market

- 1995Opening the insurance market to private investments

- 2009CAAR embarked on bancassurance

- 2011

- Mandatory separation of life and non life activities of insurance companies

- March 2011: Establishment of CAARAMA Assurances, a subsidiary specialized in life insurance

CAAR in 2015

| Paid-up capital | 159 494 000 USD |

| Turnover | 156 092 000 USD |

| Assets | 499 380 700 USD |

| Shareholder’s equity | 182 259 592 USD |

| Technical result | 4 509 000 USD |

| Net result | 10 328 000 |

| Non life gross loss ratio | 70.7% |

| Expenses ratio | 24.6% |

| Gross combined ratio | 95.3% |

CAAR network

| Number of branches | 5 (Chéraga, Annaba, Oran, Constantine, Bouzaréah) |

| Number of agencies | 138 |

| 1 life insurance subsidiary | CAARAMA |

CAAR’s staff members

| CAAR employees | 1891

|

| CAARAMA employees | 193 |

Management

| Chairman | Brahim Djamel Kassali | |

| Technical and commercial deputy general manager | Zohir Laiche | |

| Deputy general manager finance and support to activities | Hacène Ouberrane | |

| Manager of large ongoing risks | Naziha Laiche | |

| Manager of large operating risks | Ammar Meslouh | |

| Marine insurance manager | Ahmed Isikioune | |

| Reinsurance manager | Rahim Meziani | |

| Motor insurance manager | Nour el Fidah Mehiaoui | |

| Manager of networks and commercial activity | Amel Bakir | |

| Personal lines manager | Djamila Bouaza |

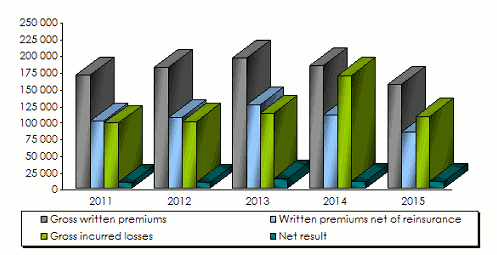

CAAR's main technical highlights: 2011-2015

in thousands USD| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

Gross written premiums | 170 121 | 181 144 | 195 601 | 184 052 | 156 092 |

Written premiums net of reinsurance | 101 628 | 106 362 | 125 842 | 110 882 | 84 475 |

Gross earned premiums | 177 756 | 171 209 | 190 004 | 177 068 | 153 515 |

-Non life gross earned premiums | 168 033 | 169 663 | 190 047 | 174 838 | 153 478 |

-Life gross earned premiums | 9 723 | 1 546 | -43 | 2 230 | 37 |

Gross incurred losses | 97 949 | 100 990 | 113 022 | 169 413 | 108 644 |

-Non life gross incurred losses | 86 466 | 98 670 | 112 656 | 169 273 | 108 529 |

-Life gross incurred losses | 11 483 | 2 320 | 366 | 140 | 115 |

Life and non life management expenses | 44 580 | 47 621 | 49 651 | 45 125 | 38 410 |

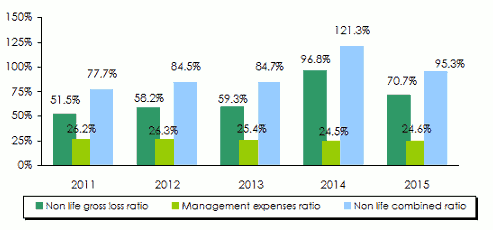

Non life gross loss ratio | 51.5% | 58.2% | 59.3% | 96.8% | 70.7% |

Management expenses ratio (1) | 26.2% | 26.3% | 25.4% | 24.5% | 24.6% |

Non life combined ratio | 77.7% | 84.5% | 84.7% | 121.3% | 95.3% |

Technical result | 3 200 | 4 657 | 15 720 | 7 208 | 4 509 |

Financial income | 9 205 | 7 973 | 6 070 | 7 426 | 9 832 |

Net result | 8 780 | 9 159 | 14 846 | 10 603 | 10 328 |

CAAR: evolution of premiums, losses and results: 2011-2015

in thousands USD

CAAR: evolution of technical ratios: 2011-2015

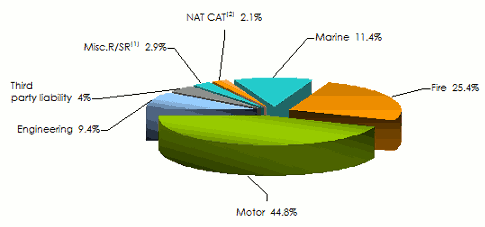

CAAR: breakdown of turnover per class of business: 2011-2015

in thousands USD| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 shares | |

|---|---|---|---|---|---|---|

Fire | 35 559 | 37 442 | 40 947 | 43 318 | 39 529 | 25.4% |

Engineering | 15 048 | 19 588 | 21 868 | 16 814 | 14 660 | 9.4% |

Third party liability | 5 974 | 6 527 | 6 674 | 7 132 | 6 256 | 4% |

Miscellaneous risks/special risks | 6 669 | 6 439 | 5 787 | 5 651 | 4 567 | 2.9% |

Natural catastrophes | 3 694 | 3 794 | 3 777 | 3 796 | 3 300 | 2.1% |

Total P&C (1) | 66 944 | 73 790 | 79 053 | 76 711 | 68 312 | 43.8% |

Marine | 25 107 | 24 763 | 22 109 | 23 464 | 17 792 | 11.4% |

Motor | 71 208 | 81 840 | 93 916 | 81 717 | 69 996 | 44.8% |

Life insurance | 6 862 | 751 | 523 | 2 160(2) | -8(3) | - |

Grand total | 170 121 | 181 144 | 195 601 | 184 052 | 156 092 | 100% |

(2) Settlement of the group insurance premium "death and disability "

(3)Returns (reimbursements)

CAAR: breakdown of 2015 turnover per class of business

(1)Miscellaneous risks/special risks

(1)Miscellaneous risks/special risks (2) Natural catastrophes

CAAR: non life gross earned premiums2011-2015

in thousands USD| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

Fire | 32 626 | 36 194 | 41 116 | 36 672 | 41 063 |

Engineering | 19 169 | 17 675 | 19 320 | 16 570 | 14 102 |

Third party liability | 6 266 | 6 446 | 7 580 | 6 875 | 6 332 |

Miscellaneous risks/special risks | 6 415 | 6 347 | 6 021 | 5 588 | 4 642 |

Natural catastrophes | 3 650 | 3 653 | 3 718 | 3 805 | 3 177 |

Total P&C (1) | 68 126 | 70 315 | 77 755 | 69 510 | 69 316 |

Marine | 27 819 | 25 880 | 24 526 | 21 520 | 17 110 |

Motor | 72 088 | 73 452 | 87 766 | 83 808 | 67 052 |

Credit | - | 16 | - | - | - |

Grand total | 168 033 | 169 663 | 190 047 | 174 838 | 153 478 |

CAAR: non life gross incurred losses 2011-2015

in thousands USD| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

Fire | 23 604 | 16 006 | 18 118 | 25 755 | 41 968 |

Engineering | -243 | 2 283 | 4 687 | 6 524 | 6 103 |

Third party liability | -421 | -81 | 849 | 119 | 2 296 |

Miscellaneous risks/special risks | 652 | -2 545 | 401 | 2 444 | -285 |

Natural catastrophes | 62 | 10 | -10 | -28 | - |

Total P&C (1) | 23 654 | 15 673 | 24 045 | 34 814 | 50 082 |

Marine | 1 921 | 7 370 | 7 018 | 70 657 | 3 835 |

Motor | 59 203 | 75 259 | 81 468 | 63 813 | 54 614 |

Credit | 1 688 | 368 | 125 | -11 | -2 |

Grand total | 86 466 | 98 670 | 112 656 | 169 273 | 108 529 |

CAAR: non life gross loss ratio 2011-2015

| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

Fire | 72.3% | 44.2% | 44.1% | 70.2% | 102.2% |

Engineering | -1.3% | 12.9% | 24.3% | 39.4% | 43.3% |

Third party liability | -6.7% | -1.3% | 11.2% | 1.7% | 36.3% |

Miscellaneous risks/special risks | 10.2% | -40.1% | 6.7% | 43.7% | -6.1% |

Natural catastrophes | 1.7% | 0.3% | -0.3% | -0.7% | - |

Total P&C (1) | 34.7% | 22.3% | 30.9% | 50.1% | 72.3% |

Marine | 6.9% | 28.5% | 28.6% | 328.3% | 22.4% |

Motor | 82.1% | 102.5% | 92.8% | 76.1% | 81.4% |

Total | 51.5% | 58.2% | 59.3% | 96.8% | 70.7% |

Exchange rate DZD/USD as at 31/12 | 2011 | 2012 | 2013 | 2014 | 2015 |

0.01325 | 0.01285 | 0.01287 | 0.01144 | 0.009382 |

CAAR

| Head office | 448, Didouche Mourad Algiers, 16000 Algeria |

| Tel | 213 2163 20 72/73 |

| Fax | 213 21 63 13 77 |

| Website |