Concentration in reinsurance

|

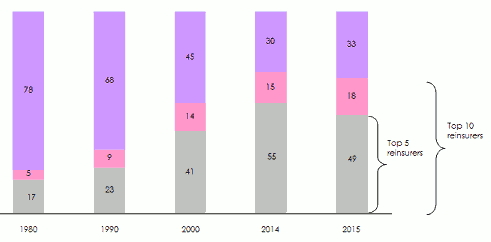

The firm grip of the major actors on the reinsurance market is getting confirmed year after year. By the end of 2015, 49% of global market is controlled by five reinsurers, a rate that was confined to 17% in 1980.

Still in 2015, the top ten global reinsurers account for 67% of the market whereas in 1980 this percentage was limited to just 22%, a 300% increase in a little more than 30 years.

Source: SCOR

Source: SCOR

Concentration in reinsurance: Major acquisitions achieved from Januaury 2015 to June 2016

| Date | Purchaser | Country | Target company | Country | Transaction amount |

|---|---|---|---|---|---|

January 2015 | Catlin | Bermuda | XL | Ireland | 4.1 billion USD |

May 2015 | Arch | Bermuda | Gulf Re | United Arab Emirates | 1.83 billion USD acquisition of 50% |

June 2015 | Tokio Marine | Japan | HCC Insurance | United States | 7.5 billion USD |

July 2015 | China Minsheng Investment | China | Sirius International | Bermuda | 2.2 billion USD |

July 2015 | Meiji Yasuda Life | Japan | StanCorp Financial | United States | 5 billion USD |

August 2015 | Exor | Italy | Partner Re | Bermuda | 6.9 billion USD |

August 2015 | Sumitomo Life | Japan | Symetra Financial Corporation | United States | 3.8 billion USD |

September 2015 | Mitsui Sumitomo | Japan | Amlin | United Kingdom | 5.3 billion USD |

August 2016 | Arch Capital | Bermuda | United Guaranty | United States | 3.4 billion USD |

October 2016 | Sompo Japan | Japon | Endurance Speciality | United States | 6.3 billion USD |

Concentration in reinsurance: Major acquisitions achieved in Africa from Januaury 2015 to June 2016

| Date | Puchaser | Country | Target company | Country | Transaction amount |

|---|---|---|---|---|---|

02/ 2015 | Old Mutual | South Africa | UAP | Kenya | 256 million USD Acquisition of 60,7% |

03/2015 | Fairfax Financial Holdings | Canada | Africa Re | Nigéria | 61 million USD Acquisition of 7.15% |

03/2015 | Axa Group | France | Africa Re | Nigeria | 61 million USD Acquisition of 7.15% |

05/2015 | International Finance Corporation | United States | PTA Reinsurance (Zep-Re) | Kenya | 20 million USD |

09/2015 | Saham Finances | Morocco | Continental Re | Nigeria | Acquisition of 53.6% |

02/2016 | Capital Alliance Private Equity | Morocco | Continental Re | Nigeria | Saham Finances reduces its participation in C-Re, the main shareholder of Continental Re |

June 2016 | Kenya Re | Kenya | PTA Reinsurance (Zep-Re) | Kenya | 20 millions USD |

07/2016 | Deutsche Investitions und Entwicklungsgesellschaft | Germany | PTA Reinsurance (Zep-Re) | Kenya | 14 million USD Increase of shareholding in Zep Re to 14.93% |

Concentration in Reinsurance brokerage market

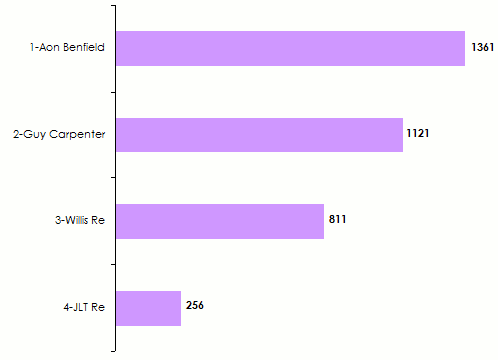

Concentration does not target only companies, but also reinsurance brokerage where a trend of a bigger scale is now playing out.

The first three brokers alone account for 80% of the market. Competition, among brokers is relentlessly fierce. It is so strong that turnover is declining. Mergers and acquisitions among brokerage companies make it possible, hence, to obtain market share gains hardly achievable otherwise.

Gross revenues of reinsurance brokerage

in millions USD Source: www.statista.com

Source: www.statista.com