Continental Reinsurance (Continental Re)

Ever since, the company has been providing services in facultative and conventional reinsurance for all classes of business.

It is from its base in Lagos that Continental Re started its long march toward Africa. Endowed with an authorized capital of 10 million NGN upon its establishment in 1985, the shareholders had to regularly inject funds at times of degraded economic environment in an effort to offset the permanent erosion of the Nigerian currency. Growth financing has required numerous increases of authorized capital. The latter rose to 100 million in 1992, then to 200 million in 1997, to 1 billion in 2003, to 2 billion in 2005, to 7.5 billion in 2006 and to 12.5 billion in 2013, an amount still in force by the end of 2015.

Endowed with the required capital, Continental Re has embarked on a networking endeavour of the African continent. The first regional office was set up in Douala in 2004, followed by another one in Nairobi in 2008 (regional office that was later turned into a subsidiary in 2012), Abidjan in 2008 (regional office), Tunis in April 2014 (regional office), Gaborone in 2014 (reinsurance subsidiary) and Johannesburg (specialized reinsurance subsidiary).

The strategy developed has paid off, with the turnover taking an upward trend. Indeed, from 14.9 million USD in 2005, premiums attained 100 million USD ten years later. These statistics made of Continental Re a major West African reinsurer with a local Nigerian market poised to become a pillar of African insurance.

|  |

| Nadia Alaoui Fettah | Olufemi Oyetunji |

| Chairman of the board of directors | CEO |

Continetal Re in 2015

| An authorized share capital | 63 362 000 USD |

| A paid up share capital | 26 290 000 USD |

| Turnover | 100 052 000 USD |

| Assets | 150 391 000 USD |

| Shareholder’s equity | 78 758 000 USD |

| Net result | 10 862 000 USD |

| Non life gross loss ratio | 41.6% |

| Non life expenses ratio | 46.5% |

| Non life combined ratio | 88.1% |

| Regional offices | 3 (Cameroon, Côte d’Ivoire, Tunisia) |

| subsidiaries | 3 (South Africa, Botswana, Kenya) |

| Number of employees | 74 |

Main shareholders as at 31.12.2015

| C-Re Holding Ltd | 56.57% |

| Others | 44.43% |

Board of directors and management

| Chairman of the board of directors | Nadia Alaoui Fettah |

| CEO | Olufemi Oyetunji |

| General manager, finance | Musa Kolo |

| Deputy general manager, administration and human resources | Olusegun Ajibewa |

| Group executive director, operations | Lawrence Nazare |

| Chief risk officer | Abayomi Oluremi-Judah |

| Deputy general manager, IT | Kanma Okafor |

| General manager for Anglophone West Africa | Shola Ajibade |

| Deputy general manager, technical training & quality assurance | Steve Odjugo |

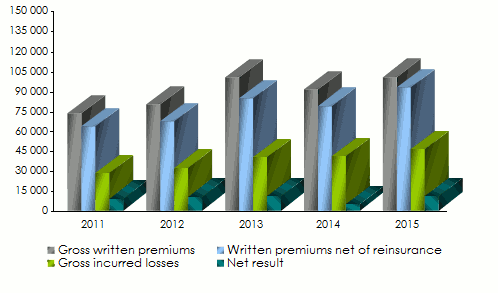

Main technical highlights of Continental Re: 2011-2015

in thousands USD

| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

Gross written premiums | 73 039 | 79 419 | 99 403 | 90 813 | 100 052 |

Non life gross written premiums | 59 478 | 63 365 | 81 911 | 79 355 | 85 594 |

Written premiums net of reinsurance | 63 034 | 66 571 | 83 683 | 78 425 | 92 232 |

Gross earned premiums | 71 156 | 76 527 | 94 249 | 89 249 | 104 826 |

-Non life gross earned premiums | 58 855 | 60 533 | 76 722 | 78 184 | 91 404 |

-Life gross earned premiums | 12 301 | 15 994 | 17 527 | 11 065 | 13 422 |

Gross incurred losses | 27 995 | 32 051 | 39 967 | 40 717 | 45 724 |

-Non life gross incurred losses | 22 849 | 25 202 | 32 185 | 32 639 | 38 010 |

- Life benefits | 5 146 | 6 849 | 7 782 | 8 078 | 7 714 |

Management expenses | 29 109 | 32 378 | 40 496 | 37 353 | 44 198 |

-Non life management expenses | 24 068 | 26 514 | 33 433 | 33 271 | 39 797 |

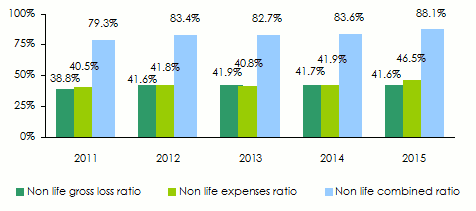

Non life gross loss ratio | 38.8% | 41.6% | 41.9% | 41.7% | 41.6% |

Non life expenses ratio(1) | 40.5% | 41.8% | 40.8% | 41.9% | 46.5% |

Non life combined ratio | 79.3% | 83.4% | 82.7% | 83.6% | 88.1% |

Net result | 9 046 | 10 420 | 10 990 | 4 727 | 10 862 |

Continental Re: evolution of premiums, losses and results (2011-2015)

In thousands USD

Continental Re: evolution of non life ratios (2011-2015)

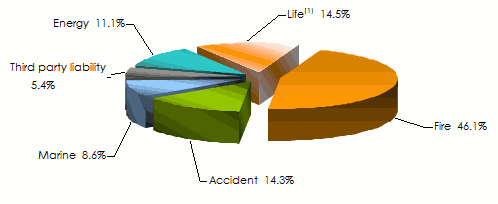

Breakdown of turnover per class of business of Continental Re (2011-2015)

in thousands USD

| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 shares | |

|---|---|---|---|---|---|---|

Fire | 28 287 | 25 480 | 35 030 | 33 102 | 46 116 | 46.1% |

Accident | 10 133 | 14 747 | 18 061 | 17 582 | 14 338 | 14.3% |

Marine | 7 475 | 5 618 | 7 992 | 8 854 | 8 578 | 8.6% |

Third party liability | 4 998 | 5 272 | 6 825 | 7 734 | 5 414 | 5.4% |

Energy | 8 585 | 12 247 | 14 427 | 11 685 | 11 148 | 11.1% |

Total non life | 59 478 | 63 364 | 82 335 | 78 957 | 85 594 | 85.5% |

Ordinary life insurance | 530 | 1 549 | 410 | 1 572 | 1 100 | 1.1% |

Group life insurance | 13 031 | 14 506 | 16 658 | 10 284 | 13 358 | 13.4% |

Total life | 13 561 | 16 055 | 17 068 | 11 856 | 14 458 | 14.5% |

Grand total | 73 039 | 79 419 | 99 403 | 90 813 | 100 052 | 100% |

Continental Re: breakdown of turnover per class of business in 2015

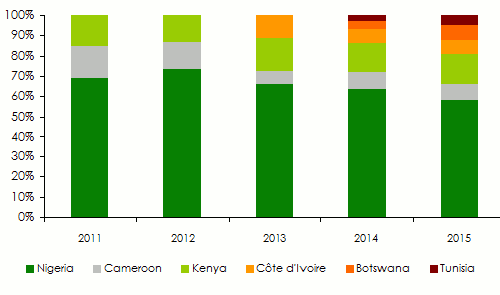

Continental Re: breakdown of turnover per underwriting unit (2011-2015)

in thousands USD

| 2011 | % | 2012 | % | 2013 | % | 2014 | % | 2015 | % | |

|---|---|---|---|---|---|---|---|---|---|---|

Nigeria | 50 377 | 69% | 58 362 | 73.5% | 65 824 | 66.2% | 57 646 | 63.5% | 58 131 | 58.1% |

Cameroon (1) | 11 504 | 15.7% | 10 528 | 13.2% | 6 102 | 6.2% | 7 515 | 8.3% | 7 744 | 7.7% |

Kenya (2) | 11 158 | 15.3% | 10 529 | 13,3% | 16 129 | 16.2% | 13 192 | 14,5% | 14 784 | 14.8% |

Côte d’Ivoire (1) | - | - | - | - | 11 348 | 11.4% | 6 072 | 6.7% | 7 293 | 7.3% |

Botswana (2) | - | - | - | - | - | - | 3 595 | 3.9% | 7 377 | 7.4% |

Tunisia (1) | - | - | - | - | - | - | 2 793 | 3.1% | 4 723 | 4.7% |

Grand total | 73 039 | 100% | 79 419 | 100% | 99 403 | 100% | 90 813 | 100% | 100 052 | 100% |

(2) reinsurance subsidiary

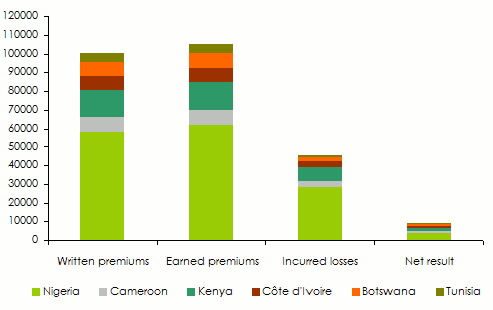

Continental Re: main indicators per underwriting unit in 2015

in thousands USD

| Nigeria | Cameroon (1) | Kenya (2) | Côte d’Ivoire(1) | Botswana (2) | Tunisia (1) | Total | |

|---|---|---|---|---|---|---|---|

Gross written premiums | 58 131 | 7 744 | 14 784 | 7 293 | 7 377 | 4 723 | 100 052 |

Gross earned premiums | 61 668 | 8 080 | 15 262 | 7 231 | 7 988 | 4 597 | 104 826 |

Gross incurred losses | 28 981 | 2 892 | 7 832 | 2 868 | 2 170 | 981 | 45 724 |

Management expenses | 26 974 | 3 835 | 5 752 | 3 353 | 2 989 | 2 427 | 44 198 (3) |

Loss ratio(4) | 47% | 35.8% | 51.3% | 39.7% | 27.2% | 21.3% | 43.6% |

Expenses ratio(4) | 46.4% | 49.5% | 38.9% | 46% | 40.5% | 51.4% | 44.2% |

Combined ratio(4) | 93.4% | 85.3% | 90.2% | 85.7% | 67.7% | 72.7% | 87.8% |

Net result | 4 486 | 1 084 | 1 279 | 943 | 1 061 | 877 | 10 862 (3) |

(2) reinsurance subsidiary

(3) including elimination of 1 132 thousand USD

(4) including life and non life premiums

Continental Re: premiums, losses and results per underwriting zone in 2015

Source: The different balance sheets of «Continental Re»

Exchange NGN/USD as at 31/12 | 2011 | 2012 | 2013 | 2014 | 2015 |

0.006271 | 0.006406 | 0.006268 | 0.005525 | 0.005069 |

Continental Re

| Head office | St. Nicholas House, 8th Floor, 6 Catholic Mission Street, P.O. Box 2401, Lagos, Nigeria |

| Tel | +234 1 4622779 / 8732624 |

| Website |