Dhofar Insurance

The company has developed a particular know-how in the motor class of business where is quite active both as an insurer and as a key player in the prevention policy.

Being so close to local customers served by a network of about 29 agencies and considering the quality of its services, the company has been boosted to the rank of a market leader with a 25% share. The country's economic success, especially in the construction sector, has paved the way for the company to expand in a region that is regarded as of high insurance potential.

Dhofar Insurance Company in 2007

| Capital | 52 million USD |

| Turnover | 129.5 million USD |

| Net result | 18.9 million USD |

| Shareholder's equity | 77.5 million USD |

| Investment income | 27.6 million USD |

| ROE | 29.9% |

| Share in the market | 25% |

| Market's underwritten policies | 48% |

| Number of agencies | 29 |

Management

| Board chairman | Shaikh Salim Bin Mubark Al Shanfari |

| Board member vice chairman | Shaikh Salim Bin Abdulla Bin Saeed Al Rawas |

| Board member | Shaikh Hamad Bin Hamood Al Ghafri |

| Board member | Shaikh Said Bin Ahmed Mohammed Bin Al Rawas |

| Board member | Shaikh Qais Bin Mustahil Al-Mashani |

| Board member | H.E Shaikh Salim Bin Abdulla Barham Ba'Omar |

| Board member | Mustafa Bin Abdul Qadir Al-Ghassani |

| Board member | H.E Abdul Alim Bin Mustahil Rakhyoot |

| Board member | Salim Bin Tamman Al-Mashani |

| Board member | Hani Bin Jumaan Ashoor |

| Board member | Taher Bin Taleb Kamal Al Heraki |

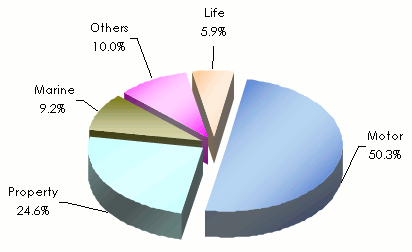

Direct premiums split by class of business1: 2003-2006

in USD

| Premiums | 2003 | % | 2004 | % | 2005 | % | 2006 | % |

|---|---|---|---|---|---|---|---|---|

| Non life | ||||||||

Motor | 39 535 835 | 56.9 | 41 635 455 | 57.6 | 42 661 559 | 57.1 | 47 007 492 | 50.3 |

Property | 15 193 070 | 21.9 | 12 852 232 | 17.8 | 15 812 432 | 21.2 | 23 017 628 | 24.6 |

Marine | 3 326 226 | 4.8 | 6 075 580 | 8.4 | 5 004 803 | 6.7 | 8 622 157 | 9.2 |

Others | 8 195 525 | 11.7 | 7 812 221 | 10.8 | 7 884 494 | 10.5 | 9 388 271 | 10.0 |

| Life | ||||||||

Total life | 3 275 766 | 4.7 | 3 879 944 | 5.4 | 3 347 054 | 4.5 | 5 479 033 | 5.9 |

Total | 61 330 897 | 100% | 72 255 432 | 100% | 74 710 342 | 100% | 93 514 581 | 100% |

1 The 2007's turnover breakdown is not available

Direct premiums split by class of business in 2006

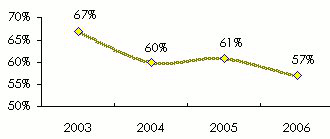

Loss ratio: 2003-2006

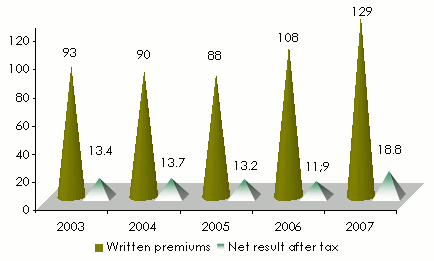

Main financial highlights: 2003-2007

in USD

| 2003 | 2004 | 2005 | 2006 | 2007 | |

|---|---|---|---|---|---|

Net written premiums | 93 231 954 | 90 861 640 | 88 136 692 | 108 134 306 | 129 515 161 |

Gross earned premiums | 65 196 422 | 67 987 403 | 70 022 190 | 80 601 703 | NA |

Loss ratio | 67% | 60% | 61% | 57% | NA |

Investment income | 5 756 909 | 6 216 128 | 6 834 759 | 2 783 773 | 27 572 608 |

Management expenses | 5 656 562 | 6 085 170 | 7 448 779 | 7 646 597 | 9 544 315 |

Net result (before tax) | 14 150 817 | 14 977 856 | 14 521 814 | 13 836 981 | 19 363 652 |

Net result (after tax) | 13 449 570 | 13 709 292 | 13 210 406 | 11 932 682 | 18 872 051 |

NA: Non available

Evolution 2003-2007

in millions USD

Exchange rate OMR/USD as at 31/12 | 2003 | 2004 | 2005 | 2006 | 2007 |

2.599 | 2.604 | 2.602 | 2.607 | 2.597 |

Contact

| Head office | Ruwi - CBDA P.O Box: 1002, P.C: 112, Sultanate of Oman |

| Phone | (+968) 24705305 |

| Fax | (+968) 24793641 |

| Website | dhofar [at] dhofarinsurance [dot] com |

0

Your rating: None

Thu, 16/05/2013 - 16:17

The online magazine

Live coverage

11:51

04/24

04/24

04/24

04/24

Latest news