Global reinsurance market status on the eve of 2020

Standard & Poor’s has, therefore, managed to maintain their stable outlook for the next year while AM Best revised these outlooks upwards from negative to stable.

Rating agencies’ upbeat is accounted for by a series of elements that we summed up as follows:

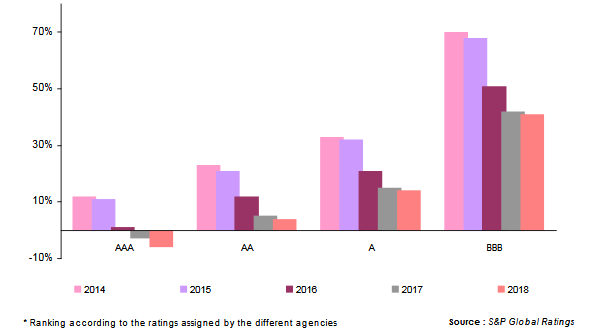

1 - The good adequacy of capital with the risks underwritten by reinsurers. Although this capacity supplied by reinsurers had been declining between 2014 and 2018, it remains, nonetheless, good enough to cover risks. In other words, capacity surplus which used to hinder market is now resorbing, hence the first slowdown of rate decreases.

Capital adequacy of the top 20 global reinsurers * (2014-2018 period)

2 - Capital consumption and distribution between conventional and alternative reinsurance. According to the figures provided by AM Best, the capacity supplied by reinsurers had hardly evolved between 2017 and 2019. The second finding pertains to alternative reinsurance which stabilized around 20 to 21% of the overall capacity.

3- Pricing terms in better adequacy with the loss experience: Reinsurers have gradually managed to improve the pricing of loss-making contract. Adjustments pertained in priority to loss-making businesses and classes, sparing profitable segments.

4 - Progress reported in risk management: The standards spelled out by Solvency II are better applied by the market.

5 - Growing reinsurance demand expressed by ceding companies: These ceding companies are in search for innovative solutions as regards coverage of new risks (weather and cyber-crime risks…). Market consolidation with potential merger/acquisition agreements has paved the way for further opportunities.

6 - Lingering low interest rates and poor investment profitability compelled reinsurers to maintain strict underwriting disciplines. Operational results are supposed to offset financial products in notable decline.

The rating agencies are expecting an improvement of return capital. Such optimism is comforted by adequate pricing perspective in the segments and classes of business subjected to tariff decrease and by the shrinking interest rates during the first half of ongoing year.

The survey conducted by S&P for 2019 and 2020 is hence targeting better combined ratio and return on equity (ROE) after 2018.

Global reinsurance market: Combined ratio and ROE of the top 20 reinsurers

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 (1) | 2020 (1) | |

|---|---|---|---|---|---|---|---|

Combined ratio in % | 89.9 | 90.7 | 95 | 109 | 101 | 95-98 | 95-98 |

Combined ratio excluding natural catastrophe losses in % | 92.2 | 94.5 | 95.4 | 96.5 | 96.3 | 91-93 | 91-93 |

ROE in % | 12.5 | 10.4 | 8.4 | 1.6 | 2.9 | 7-9% | 7-9% |

ROE : Return on equity

(1) estimation

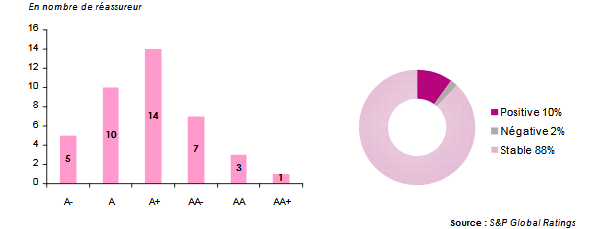

Rating agencies have by and large maintained reinsurers ratings. The diagrams below show rating distribution carried out by S&P along with their evolution during ongoing year:

S&P rating and outlook of the top 40 reinsurers

Threats to the global reinsurance market

Despite the optimism displayed by the rating agencies, structural as well as cyclic threats still linger on as reinsurance market remains at the mercy of:

- Economic conditions and geopolitical risks,

- Low interest rates over a long period of time,

- Natural disaster risks, especially those due to climate change,

- Regulatory evolutions,

- The inability to cope with rising pressures on capital cost,

- Powerful upsurge of alternative capital patterns,

- Downward alignment of tariffs among stakeholders.