Gulf Insurance Group (GIG)

The arrival of Bahrain Kuwait Insurance (BKIC) in 1975 and of Warba Insurance in 1976 did not considerably upset the insurance landscape in the Emirate.

The arrival of Bahrain Kuwait Insurance (BKIC) in 1975 and of Warba Insurance in 1976 did not considerably upset the insurance landscape in the Emirate.

The local market boomed during the 2000s, with the entry of thirty new companies on stage. Confronted with fierce competition in a market that became sluggish, some traditional insurers, including Gulf Insurance embarked on external growth.

Already operational in the Middle East through seven insurance and reinsurance subsidiaries, the company acquired a 49% stake of the non life insurance company, the Algérienne des Assurances (2A). Thanks to this acquisition, GIC has turned to Africa which provided it with new growth perspectives.

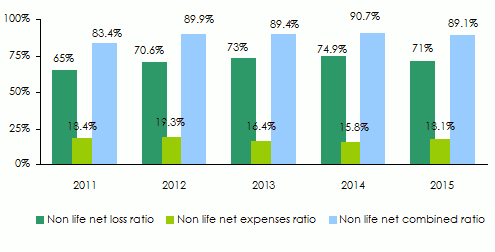

At the end of 2015, the company which was renamed in 2012 to become Gulf Insurance Group (GIG), posted a turnover worth 613 million USD. Shareholders’ equities amounted to 366 million USD. Net profits grew by 12% to be set at 53 million USD. The non life loss ratio has been stable since 2011, improving by 3.9 points, shifting from 74.9% in 2014 to 71% in 2015. The same finding applies for the combined ratio which rose by 1.6 point at 89.1%.

Thanks to these excellent technical indicators, GIG was granted in 2015 an A- rating with positive outlook by AM Best and an A- with stable outlook by S&P.

|  |

| Farqad Abdullah Al-Sane | Khaled Saoud Al Hassan |

| Group chairman | Board member and Group CEO |

GIG in 2015

| Share capital | 61 718 985 USD |

| Turnover | 613 484 790 USD |

| Total assets | 1 215 723 339 USD |

| Shareholder’s equity | 366 309 431 USD |

| Net result | 53 006 655 USD |

| Non life net loss ratio(1) | 71% |

| Non life net expenses ratio(1) | 18.1% |

| Non life net combined ratio(1) | 89.1% |

| Number of branches in Kuwait | 1 13 |

| Number of subsidiaries in the MENA region | 8 |

Management

| Group chairman | Farqad Abdullah Al-Sane |

| Board member and Group CEO | Khaled Saoud Al Hassan |

| General manager | Tareq Abdulwahab Al Sahhaf |

| Deputy general manager, Property & Casualty | Anwar Salim Al Rafidi |

| Senior deputy general manager, finance | Raafat Attia Al Salamony |

| Assistant general manager, Information Technology | Thamer Ibrahim Arab |

| Executive manager, Reinsurance | Sridharan Sundaresan |

| Assistant general manager - Internal Branches, Production, and Takaful Unit | Ibrahim Zeinhom Mohammed Shaarawi |

Main shareholders

| Kuwait Projects Company (KIPCO) | 44.04% |

| Fairfax Financial Holding Limited | 41.42% |

| Treasury shares | 4.25% |

| Autres | 10.29% |

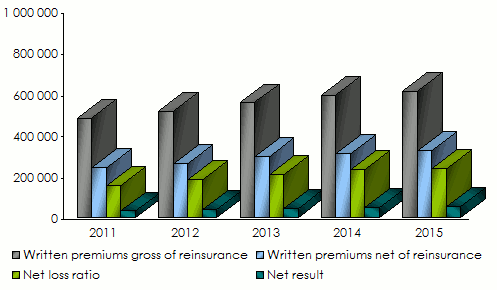

GIG: Main technical highlights (2011-2015)

in USD| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

Gross written premiums (1) | 481 451 733 | 516 428 197 | 557 433 126 | 593 775 606 | 613 484 790 |

Net written premiums(1) | 241 714 719 | 261 815 951 | 295 744 953 | 311 032 101 | 324 264 823 |

Net earned premiums(1) | 230 250 932 | 244 952 310 | 273 913 644 | 307 379 455 | 328 475 764 |

Non life net earned premiums (1) | 195 645 054 | 202 717 894 | 228 739 638 | 252 760 718 | 274 209 625 |

Net loss ratio | 155 283 143 | 182 989 787 | 208 608 033 | 234 217 962 | 238 478 668 |

Non life net loss ratio (1) | 127 122 599 | 143 049 808 | 166 891 578 | 189 279 716 | 194 860 946 |

Management expenses | 48 112 107 | 54 663 802 | 52 584 798 | 53 243 516 | 61 982 381 |

Non life management expenses (1) | 44 599 286 | 50 560 542 | 48 587 213 | 49 205 647 | 58 632 325 |

Non life net loss ratio (1) | 65% | 70.6% | 73% | 74.9% | 71% |

Non life expenses ratio (1)(3) | 18.4% | 19.3% | 16.4% | 15.8% | 18.1% |

Non life net combined ratio(1) | 83.4% | 89.9% | 89.4% | 90.7% | 89.1% |

Net underwriting result | 35 414 834 | 30 965 474 | 30 139 736 | 29 226 716 | 40 628 898 |

Net result after tax | 32 545 569 | 39 524 269 | 42 748 443 | 47 396 510 | 53 006 655 |

(1) net of reinsurance

(2) including health (3) Expenses ratio = management expenses /written premiums net of reinsurance

GIG: evolution of premiums, losses and results (2011-2015)

in thousands USD

GIG: evolution of non life net ratios (1) (2011-2015)

(1)Including health

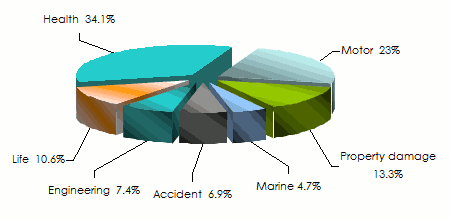

(1)Including healthGIG: Breakdown of turnover per class of business (2011 - 2015)

in USD| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 shares | |

|---|---|---|---|---|---|---|

Motor | 102 795 788 | 113 549 990 | 122 490 521 | 129 534 171 | 140 652 790 | 23% |

Property damage | 72 650 517 | 78 367 820 | 80 936 763 | 82 809 282 | 81 765 582 | 13.3% |

Marine | 34 322 788 | 30 724 470 | 27 554 387 | 29 042 135 | 28 997 456 | 4.7% |

Engineering | 40 958 841 | 30 306 693 | 35 143 669 | 40 550 175 | 45 597 716 | 7.4% |

Accident | 32 360 846 | 35 663 329 | 37 524 666 | 41 166 195 | 42 270 049 | 6.9% |

Health | 152 472 218 | 170 806 927 | 191 158 442 | 205 969 707 | 208 909 500 | 34.1% |

Total non life | 435 560 998 | 459 419 229 | 494 808 448 | 529 071 665 | 548 193 093 | 89.4% |

Life | 45 890 735 | 57 008 968 | 62 624 678 | 64 703 941 | 65 291 697 | 10.6% |

Grand total | 481 451 733 | 516 428 197 | 557 433 126 | 593 775 606 | 613 484 790 | 100% |

Gulf Insurance Company: breakdown of 2015 turnover per class of business

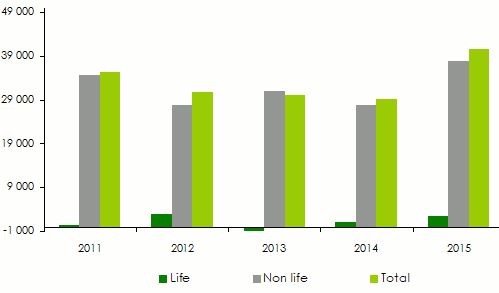

GIG: net underwriting result per class of business (2011-2015)

in USD| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

Motor | 4 439 877 | 6 753 716 | 3 967 091 | 583 869 | 6 285 447 |

Property damage | 2 983 338 | 1 698 797 | 1 613 916 | 1 677 493 | 3 023 254 |

Marine | 4 868 336 | 5 455 605 | 7 034 300 | 6 895 741 | 6 009 323 |

Engineering | 2 563 917 | 2 356 669 | 1 667 374 | 2 101 636 | 2 442 580 |

Accident | 7 090 859 | 7 515 788 | 8 349 530 | 8 581 747 | 9 700 003 |

Health | 12 884 535 | 4 059 192 | 8 371 126 | 8 179 897 | 10 433 745 |

Total non life | 34 830 862 | 27 839 767 | 31 003 337 | 28 020 383 | 37 894 352 |

Life | 583 972 | 3 125 707 | - 863 601 | 1 206 333 | 2 734 546 |

Grand total | 35 414 834 | 30 965 474 | 30 139 736 | 29 226 716 | 40 628 898 |

GIG: evolution of net underwriting result per class of business

GIG: net incurred losses per non life class of business (2011-2015)

in USD| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 shares | |

|---|---|---|---|---|---|---|

Motor | 66 848 616 | 65 738 437 | 73 178 742 | 87 931 957 | 97 333 318 | 50% |

Property damage | 3 925 768 | 4 817 566 | 6 110 820 | 5 904 235 | 4 585 184 | 2.3% |

Marine | 1 813 988 | 512 071 | 745 594 | 1 106 306 | 1 433 891 | 0.7% |

Engineering | 1 501 271 | 1 693 774 | 3 752 942 | 2 763 407 | 3 537 306 | 1.8% |

Accident | 4 595 556 | 4 028 407 | 4 428 190 | 5 653 556 | 3 629 908 | 1.9% |

Health | 48 437 400 | 66 259 553 | 78 675 290 | 85 920 255 | 84 341 339 | 43.3% |

Total non life | 127 122 599 | 143 049 808 | 166 891 578 | 189 279 716 | 194 860 946 | 100% |

GIG: net earned premiums per non life class of business (2011-2015)

in USD| 2011 | 2012 | 2013 | 2014 | 2015 | 2015 shares | |

|---|---|---|---|---|---|---|

Motor | 93 656 808 | 98 863 303 | 104 568 983 | 115 755 986 | 133 909 478 | 48.8% |

Property damage | 7 922 827 | 8 122 349 | 7 556 640 | 8 513 696 | 9 499 138 | 3.5% |

Marine | 6 122 926 | 6 033 030 | 6 234 538 | 6 117 342 | 6 430 096 | 2.3% |

Engineering | 4 566 293 | 3 901 811 | 4 587 561 | 4 731 770 | 6 465 173 | 2.4% |

Accident | 15 064 977 | 15 642 279 | 16 461 842 | 17 282 159 | 15 035 120 | 5.5% |

Health | 68 311 223 | 70 155 122 | 89 330 074 | 100 359 765 | 102 870 620 | 37.5% |

Total non life | 195 645 054 | 202 717 894 | 228 739 638 | 252 760 718 | 274 209 625 | 100% |

GIG: net loss ratios per non life class of business (2011-2015)

| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

Motor | 71.4% | 66.5% | 70% | 76% | 72.7% |

Property damage | 49.6% | 59.3% | 80.9% | 69.3% | 48.3% |

Marine | 29.6% | 8.5% | 12% | 18.1% | 22.3% |

Engineering | 32.9% | 43.4% | 81.8% | 58.4% | 54.7% |

Accident | 30.5% | 25.8% | 26.9% | 32.7% | 24.1% |

Health | 70.9% | 94.4% | 88.1% | 85.6% | 82% |

Total non life | 65% | 70.6% | 73% | 74.9% | 71.1% |

GIG participation rate in its subsidiaires as at 31/12/2015

| Countries | Class of business | GIG share in the capital | |

|---|---|---|---|

Fajr Al Gulf Insurance & Reinsurance | Lebanon | Life and non life | 92.69% |

Arab Misr Insurance | Egypt | Non life | 94.85% |

Syrian Kuwait Insurance | Syria | Life and non life | 54.35% |

Bahrain Kuwaiti Insurance | Bahrain | Non life | 56.12% |

Arab Orient Insurance | Jordan | Non life | 90.37% |

Egypt Life Takaful Ins | Egypt | Life | 59.5% |

Dar Al-Salam Insurance | Iraq | Life and non life | 51% |

L’Algérienne des Assurances (2A) | Algeria | Non life | 49% |

Gulf Insurance & Reinsurance (1) | Kuwait | Life and non life | 99.8% |

Exchange rate KWD/USD as at 31/12 | 2011 | 2012 | 2013 | 2014 | 2015 |

3.59635 | 3.5524 | 3.54962 | 3.42032 | 3.29979 |

Gulf Insurance Group (GIG)

| Head office | Ahmed Al-Jaber Street, Al-Sharq, P.O.Box 1040, Safat 13011, Kuwait |

| Tel | +965 1802 080 ; 22 961 999 |

| Fax | +965 22 961 998 |

| Website |