Impact of Covid-19 on the aviation sector

Unprecedented crisis, in a few days, almost all flights were cancelled, airports closed, the world fleet grounded, thousands of employees made redundant.

Unprecedented crisis, in a few days, almost all flights were cancelled, airports closed, the world fleet grounded, thousands of employees made redundant.

Meanwhile, some airlines went bankrupt while others are resorting to the State for a possible bailout.

Return to normal is not on the agenda for the foreseeable future.

Read also | Impact of the Coronavirus on aviation insurance

Aviation: impact of covid-19 on the airline sector

Airlines, some of which already in dire straits prior to the outbreak of Covid-19, were severely struck by the health crisis. Movement restrictions imposed on the population and the closure of borders have disrupted the usual flow of travelers. With the exception of a few repatriation flights and a low level of air cargo activity, airliners were forced to reduce their capacity by up to 90%, ground aircrafts and put in place plans for emergency including cost reduction and job shedding.

As a result, many carriers find themselves unable to honor their financial deadlines, thus declaring themselves bankrupt. This is the case of:

- Virgin Australia which, at the end of April, announced that it would voluntarily discontinue payment.

- Latam, the largest airline in Latin America with 41 000 employees, declared bankruptcy on May 26, 2020.

- Aeromexico, another major carrier in Latin America, filed for bankruptcy in late June.

In the United States, one of the four main airlines could soon disappear.

Other carriers, and not the least renowned, owe their survival only to the intervention of their respective regulatory authority:

- Alitalia will be nationalized for 3.3 billion USD,

- Air France is poised to obtain 7.7 billion USD in loans, including 3 billion USD from the French government,

- Dutch KLM will receive governmental bailout worth 4.4 billion USD,

- Lufthansa is in talks with the German state over a bailout plan amounting to 10 billion USD, subject to the granting of a stake to the public authorities in the company’s capital,

- Across the Atlantic, a package worth 50 billion USD is allocated to struggling airliners.

Read also | Air traffic: Covid-19 impact

Canceled flights

The International Air Transport Association (IATA) has reported 4.5 million flights canceled during the containment period. The list of hardest hit airlines includes Air France, Lufthansa, Ryanair, British Airways Emirates, Qatar Airways, American Airlines, Singapore Airlines. Chinese companies having suspended their flights at the start of the crisis.

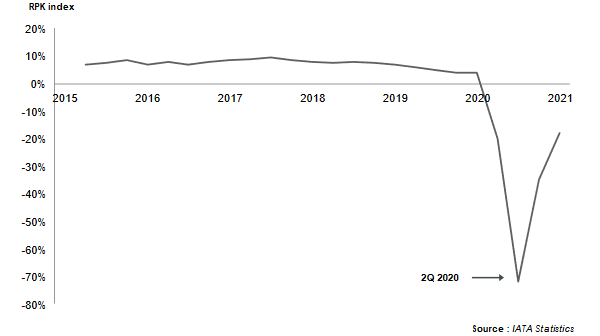

Transport volume in free fall

Transport growth rate as measured by the RPK index, or paying passenger-kilometer index, plummeted by more than 70% in the second quarter of 2020.

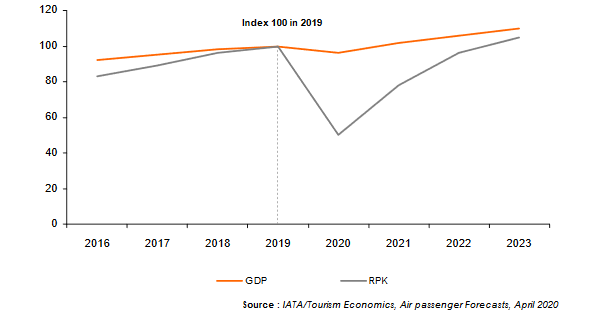

GDP and RPK evolution: 2016-2023

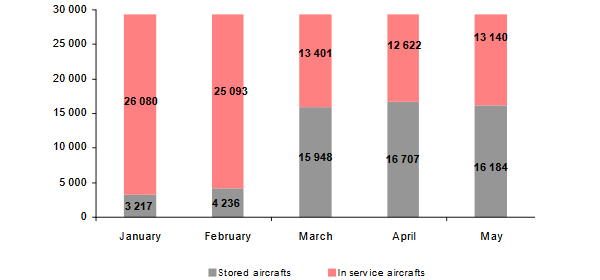

Aircraft storage

During the month of April 2020, the number of planes grounded rose to 16 707. At the very beginning of the crisis, that is to say at the end of January, this figure had already reached 3 217.

Number of stored and in service aircrafts: January-May 2020

Job cuts

To keep costs as low as possible in the face of the Covid-19 crisis, airlines are forced to drastically reduce their workforce. According to IATA estimates, 25 million jobs in the aviation sector (airlines, airports, manufacturers, subcontractors, service, etc.) are threatened worldwide, including 11.2 million jobs in the Asia-Pacific region.

Covid-19: Estimate of job cuts by airline (1)

| Airline | Country | Number of jobs at risk |

|---|---|---|

Air Canada | Canada | 20 000 |

British Airways | United Kingdom | 12 000 |

Scandinavian Airlines System (SAS) | Sweden | 5 000 |

Easyjet | United Kingdom | 4 000 |

Icelandair | Iceland | 2 000 |

Ryanair | Ireland | 3 000 |

United Airlines | United States | 3 450 |

Air France | France | 8 000 to 10 000 |

(1) Situation by the end of May mai

British Airways plans to cut 12 000 jobs, or a third of its total workforce. For Air Canada, redundancy is likely to affect 50 to 60% of the workforce. The layoffs will reach 20 000 jobs out of a total of 38 000. Air France, on its part, is intent on laying off 15 to 20% of its employees.

Aviation: impact of Covid-19 on aircraft manufacturers

Boeing and Airbus, the two main aircraft manufacturers, are also in shambles, with their production rate being lowered and purchases brought to a standstill. Even older orders are under the threat of cancellation.

According to a study, the drop in orders would be between 40 and 60% over the next five years and would affect long-haul aircraft mainly.

For Airbus, the month of May 2020 ended with zero orders and 24 deliveries of aircraft against 81 in May 2019. The European aircraft manufacturer, therefore, plans to cut 10 000 jobs.

Boeing, already strained by the 737 MAX crisis, reported 209 cancellations in April alone. Nearly 16 000 livelihoods are under threat for the American manufacturer.

Collateral victim of the crisis, the British manufacturer of aircraft engines Rolls-Royce is also struggling. The engine manufacturer plans to cut 9 000 jobs, or 17% of its workforce.