Insurance and supply chain

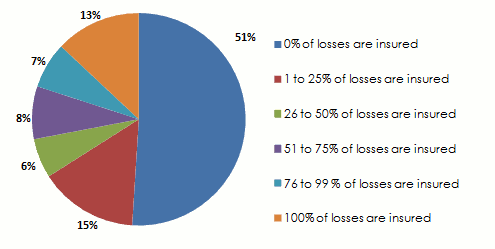

The number of companies having underwritten an insurance policy has risen from 4% in 2016 to 13% one year later. Despite this coverage rate, in clear improvement, the risk of supply chain disruption remains largely under insured.

Corporate high exposure and the substantial losses incurred are likely to trigger a gradual regain of awareness that will allow the emergence of more resilient supply chains.

Insured losses

Supply chain and risk management

Companies cannot avoid all the risks inherent to their “business model”. They may nonetheless make recourse to the mapping of their supply chain in order to identify the threats they are under and reduce their exposure accordingly.

Risk assessment is carried out at different levels of the supply chain:

- Within the company itself,

- Upstream: service or raw material suppliers,

- Downstream: distributers,transporters,…

- At the level of corporate environment: economic, geopolitical and climate risks,…

The diversification of key suppliers, the latter’s auditing, training, awareness-raising and the design of crisis and recovery plans stand among prevention solutions.

While such measures seem to be effective, they remain, nonetheless, restrictive and contrary to the objective of reducing costs and maximizing the logistic chain.

The adoption of various prevention measures does not exonerate companies from seeking solutions with their insurers. The latter relentlessly continue to develop a range of covers against the interruption of supply chain. There are currently several kinds of policies covering this risk: business interruption (BI), continuity business insurance (CBI), trade disruption insurance (TDI)(1),…

The classical business interruption insurance plans do not meet the new needs of globalized corporate business. They are too restrictive as oftentimes they are confined to the coverage of losses after the occurrence of fire or machinery breakdown.

The new schemes proposed by insurers are much broader, covering a wider range of risks: delivery delay, bankruptcy of a subcontractor,…

(1) www.supplychaindive.com/news/natural-disaster-risk-management-hurricane-earthquake-catastrophe/448581/