Insurance companies’ specific risks

The role of the manager consists in allocating the assets in optimal fashion based on the company’s engagements and return objectives.

The role of the manager consists in allocating the assets in optimal fashion based on the company’s engagements and return objectives.

However, and contrarily to classical companies that disburse sums for the acquisition of raw material prior to being paid by the customer, insurance companies are subjected to a reversal of theproduction cycle that renders activity uncertain and that multiplies risks.

Within this scheme,policyholders are required to pay before benefiting later from possible service and whose amount may vary. In view of the number of engagements, their volume and the variability for each contract, the financial management of an insurance company required adapted financial tools and models.

Moreover, due to this reversed cycle of production, the benefits are provided more or less a long time after settlement of the premium. Insurers end up with a substantial amount of funds that they have to manage before providing their benefits..

In order to make sure that insurers can honor their engagements towards policyholders and contribute to corporate solvency, regulators have imposed strict rules on asset managers. Thesemeasures pertain to the evaluation ofengagements and to their coverage by means of secure assets.

Risks sustained by insurance companies

It is up to the appointed managers or actuaries to assess the financial situation of the company and the types of risks having the biggest impact on its operation.

Two major categories of risks are particularlyprejudicial to the solvency and the performance of insurance companies:

- Technical risks affect the liability of the balance sheet. They emanate from the very activity of the company and relate in particular to the frequency and severity of claims.

- Investment risks are the set of risks related to the insurer’s asset management.

While the basic approach designed to control the risk consists in, first, identifying the periodic flowsgenerated by the liabilities and second, finding most adapted investments to cover, amount by amount and date by date, management tools have gradually developed in order to take intoaccount the greatest number of factors.

To immunize against risks, insurers are today required to reduce the duration gap between balance sheet elements by selecting asset classes that are best adapted to market context and to interest rates in particular.

Read also | Risk appetite in the insurance industry

Insurance companies and technical risks

Technical risks relate in essence to the activity of the insurer. Premium and claims provisions areattributed to the balance sheet liability. Any insufficiency in these reserves due to premium calculation error or to misevaluation of outstanding claims may strain the company.

In this situation, insurers willstruggle to face their technical engagements. Main technical risks pertain to:

- Underpricing:, inherent to insurance operation, it is accounted for by the fact that rates are set before knowing the actual cost price of benefits. Underpricing may derive from a choice undertaken by the company in order to conquer or maintain market shares. It may also derive from involuntary methodological errors,

- Risk modification: Legal, economic and regulatoryevolutions, not anticipated the day of underwriting may modify the risk. This may be, for instance, the case of a new law for the amendment of the rules designed to compensate bodily prejudice in personal accident or motor insurance,

- Other risks inherent to insurance: Insurers may also be faced with an exceptional claim: badlyassessing risks awaiting payment or sustaining growth of general costs exceeding that of loadings.

Insurance companies and investment risks

They are about the set of risks related to the insurer’s asset management. They relate to:

- Credit risk: The credit risk or counterpart risk is when the debtor is unable to honor his initialobligation to refund the credit.

There are two kinds of counterparts depending on the quality of the defaulting party:

- Counterparty risk related to a defaultingeconomic operator, also called credit risk. It depends on the quality of the debts standing in the balance sheet assets of the insurer. The debts may, for instance, arise on the occasion of a pool in which a leading member may centralize payment from direct operations or from reinsurance contracts.

- Counterparty risk related to State defaulting or to that of its banking system. This risk is part of what is called systemic risk.

- Inflation risk: It is the risk sustained by the insurers when their inflation risk erodes performance rate of financial services or the revaluation rate of their savings contracts.

- Rate risks: it is a risk related to the variations ofinterest rates on bond markets that play out in two forms:

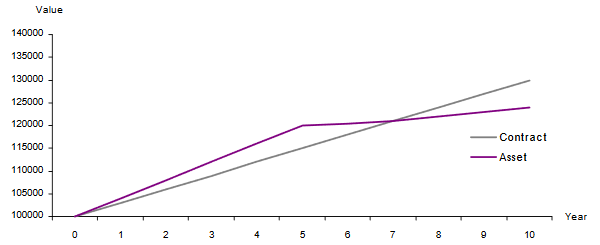

- Reinvestment risk (or declining rates) is the risk that performance rate assigned to future investments are below guaranteed rate related to insurance contracts. Reinvestment risk emerges when the life of assets (bonds) is below that of commitments. In case insurers are holding bonds having attained maturity, they are compelled to reinvest at unfavorable rate conditions.

Example of unfavourable investment in year 5. The asset value is lower than the value of the contract expiring in year 10.

- Liquidation risk results from a long asset inrelation to liability. An increase in interest rate, within this context, is likely to promptpolicyholders to buy out their contracts when they realize that the rate served by insurers is below that of the market. The liquidation risk is the risk endured by insurers when they arecompelled to cede bonds before theirreimbursement while the latter are lower in value than their initial purchase price.

- Liquidity risk: the insurer must always be able to meet its commitments. A portion of the assets must be sufficiently liquid to pay at any time the benefits owed to policyholders and beneficiaries of contracts. Liquidity risk is the risk of not being able to sell a financial security or sell it at very unfavourable price terms.

- Specific risks: They mainly refer to life contracts assigned in unit of account,…