Insurance in the era of Big Data

Fotolia’s standard license Fotolia’s standard license |

According to the World Insurance Report, edited by Capgemini and Efma, nearly 80% of insurance companies' executives point to big data as their primary concern. It is obvious that this technological breakthrough pushes insurers to get further involved in this direction. While digital evolution showcases numerous upsides for the insurance business, it nonetheless raises concerns that this article will try to tackle.

Insurance & big data, the development of information volume

With the development of IT, the amount of data usable by insurance companies has grown exponentially. This situation results from the various technological breakthroughs such as miniaturization, increasing storage capacity, growing reliability of data, the marketing of better performing computers, etc.

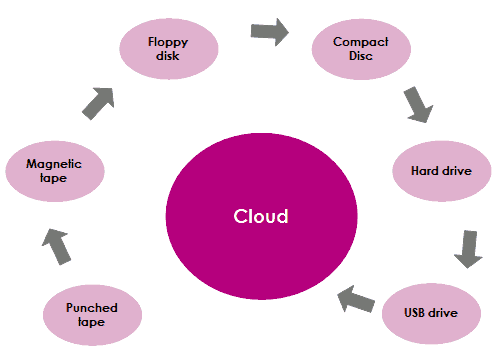

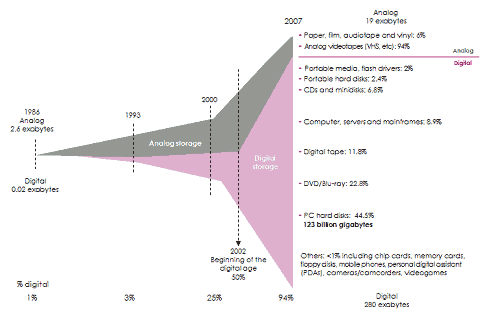

In fact, the digital era commenced in 2002, and storage solutions have continued to diversify ever since.

The evolution of storage modes and capacities has paved the way for the emergence of new IT services such as internet, social networks, cloud, connected objects.

Read also | Big data and insurance product development

Evolution of digital storage modes

Evolution of storage capacity (in optimally compressed bytes)

Source: Hilbert, M.,& Lopez, P.(2011). The World’s Technological Capacity to store, communicate and compute information. Science, 332 (6025), 60-65. www.martinhilbert.net/worldinfoCapacity.html

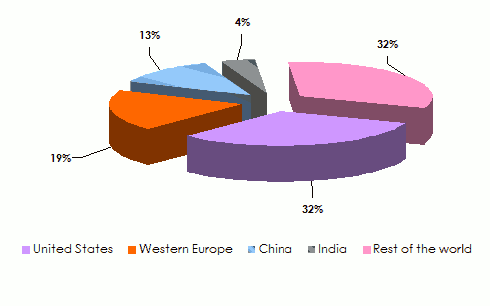

Source: Hilbert, M.,& Lopez, P.(2011). The World’s Technological Capacity to store, communicate and compute information. Science, 332 (6025), 60-65. www.martinhilbert.net/worldinfoCapacity.html Geographic breakdown of the digital universe in 2012 and estimates for 2020

As shown in the graph below, 51% of the digital universe in 2012 was in the hands of the United States and West Europe, while China’s share amounted to 13% and India 4%. The 2020 estimates are pointing to a strong surge of emerging countries with China alone accounting for 21% of the flow at this date.

Source: IDC’s Digital Universe Study, sponsored by EMC, December 2012

Source: IDC’s Digital Universe Study, sponsored by EMC, December 2012 The mass of information

The big data highlights two kinds of data:

Structured data: information that companies regularly use because they can be easily used after their collection and classification. These include demographic, economic data.

Unstructured data: they include resources that are not organized in a predefined way, such as videos, speeches, social media content, e-mails, etc. These data are growing rapidly.

Until recently, the decisions made by insurance companies have relied on a certain amount of structured data. With the booming social media, there emerged a colossal amount of unstructured or “unlabelled” data.

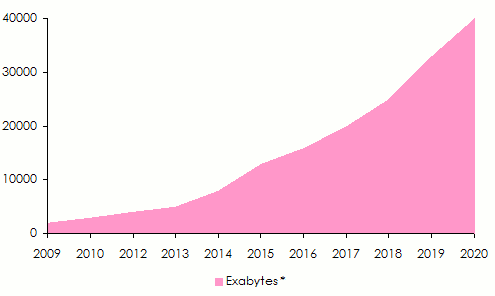

Rapid growth development of the digital universe

The mass of data collected will be multiplied by 50 during the period 2010 to the end of 2020.

Source: Source: IDC’s Digital Universe Study, sponsored by EMC, December 2012 * Exabyte : a unit of measurement of data, used in computer science to quantify the size of the computer memory, the space usable on a hard disk, the size of a file, a directory or other items.

Source: Source: IDC’s Digital Universe Study, sponsored by EMC, December 2012 * Exabyte : a unit of measurement of data, used in computer science to quantify the size of the computer memory, the space usable on a hard disk, the size of a file, a directory or other items. An Exabyte is equal to 1000 petabytes or 10 power 18 bytes. The symbol for the Exabyte unit is EB.

Read also | Big data in risk and claims management

The new data

|

Technological breakthroughs have enabled the emergence of new data. Based on the use designed to them, these data will have a direct impact on the products, brand, customer perception of insurers and much more.

Gathering information is, however, not enough; it is especially essential to know and be able to use it. It is worth noting that the authorities are entitled to restrict the use of part of the data available.

According to International Data Corporation "IDC", 33% of the digital universe will soon contain information that is likely to be used after analysis compared to 25% today. IDC has estimated at 3% the amount of “labelled” information on the overall digital data. These figures exhibit the huge potential for the exploitation of the data currently stored.

Breakthroughs towards an “all-digital” system means that data may be collected by anyone at any time, a finding that puts additional pressure on insurers who can no longer rely solely on their own in-house data. Indeed, they will be bound to use all sources of information to better understand the risks surrounding them, attract customers and retain them.

This approach compels insurers to be proactive; they are required to forecast rather than react. Such a strategy is only possible when they have sufficient data that enable them to understand and constantly monitor the needs of their customers to whom they are committed to providing tailor-made products.

Insurance & big data, speedy collection and use of data

Traditionally, the insurer is supposed to collect data by means of discontinuous processes prior to processing them in order to make them usable by the different departments. Information processing methods have been scheduled to be carried out at specific times and frequencies: once a week, a month, etc.

Today, the use of new technologies, some of which free of rights like those developed by the foundation Apache, paves the way for acquisition, selection and use of structured as well as unstructured information in a few seconds.

To gain time, insurers are required to set the priorities towards which they will dispatch their resources made up of sensors, connected objects, fraud detectors, mathematical patterns, simulation software.

How do insurers use big data?

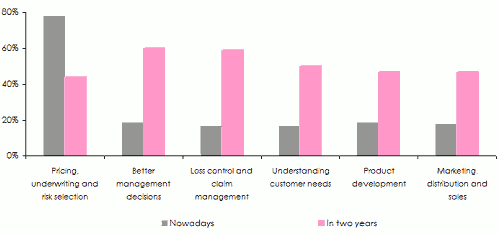

Based on a poll conducted with managers of non life insurance companies, the first use of big data today focuses on risk pricing, underwriting and selection. Activities pertaining to marketing, distribution and sale of products come well behind as they do not stand as the priority of the moment.

This hierarchy in the use of big data, that is, regarding priorities, will be reversed in the next couple of years. The activities related to the management and control of both underwriting and claims will then overshadow all other needs.

Source: Willis Towers Watson

Source: Willis Towers Watson The use of sensors and connected objects

It is precisely in the area of motor and health insurance that sensors and connected objects are most developed.

In the automotive industry, the introduction of sensors in the vehicles enables the insured to obtain customized rates. Speed, the place of passage, the time brackets and timings during which the car has been used are processed, resulting in a rate that is adapted to the driving mode. This technology enables the insurer to be posted in real time. The processing of the data collected by such means allows good drivers to benefit from tariff discounts.

Driverless cars operated by means of sensors are about to revolutionize the insurance business by transferring driver third party liability towards that of car makers and other software suppliers such as Google, Uber.

|

In health insurance, numerous insurers are taking advantage of technological breakthroughs to come up with customized covers that are adapted to their customers and their risk profile. The information used as a basis for pricing is supplied by detectors placed around the body of the policyholders (watches, bracelets). These sensors make it possible to monitor remote patients and to guide them, if need be, toward the closest and most convenient medical centers. Moreover, the information gathered make it possible to make remote diagnosis, prescribe targeted therapies and detect diseases based on predispositions, set up preventive medicine, reduce risks and decrease mortality rate.

Homeowner's insurance is set to follow on the footsteps of motor and health insurance. Domotic boxes(1) provide insurers with information on the lifestyle of their customers. They may, for instance, detect fires and stop them from spreading. Furthermore, they may be proactive in the area of tele-monitoring, manage the use of lighting, energy. Not only do these new technologies provide a standard of comfort but they also reduce loss experience.

(1) Domotic box is the word used to define an electronic device that makes it possible to manage different aids of security, comfort, automation and multimedia. Domotic boxes are connected directly to ADSL Box because they are monitored via internet. (1) Box domotique est le terme générique utilisé pour définir un appareil électronique qui permet de gérer différents accessoires de sécurité, de confort, d’automatisation et de multimédia. Les box domotiques se connectent directement au Box ADSL car elles sont pilotées par Internet.The role of data in insurance fraud detection

The insurance industry is particularly exposed to fraud which may take place during the underwriting of the contract when policyholders withhold information that is likely to increase the rate of risk premium. Fraud may also happen upon the occurrence of an event with policyholders drafting a misrepresentation in order to obtain compensation that they are not entitled to.

|

With the advent of new technologies, insurers are now endowed with different means and tools that enable them to check the truthfulness of the notifications made by policyholders. Upon the occurrence of an event, insurers may verify the presence or not of the policyholder on the spot of the event thanks to the social networks from which they may consult cell phone data and emails. Insurers also get to know whether the policyholder has had any contact with a third party involved in the claim.

Eventually, some insurers are using the statistical prediction model in order to spot scammers. These processes are based on the conducts of both fraudulent and non-fraudulent customers. Based on the findings of this analysis, it is possible to model future behaviors in order to measure the likelihood of fraud among customers.

Other methods make use of big data to process the information collected on every customer. Thanks to the data available to insurers, the latter may use text mining (1). This process rests on the analysis of the words used in the claim notification. Because some words are more frequently used by scammers, they may be indicative of a potential fraud.

Finally the abundance of information collected by means of big data makes it possible to improve the scoring(2) techniques set up by insurance companies.

(1) Text mining is a set of methods, techniques and tools designed to process unstructured documents(2) Scoring is a technique that makes it possible to give a score to a customer or to a prospect

The role of big data in the adjustment strategies of insurers

The collection of substantial amount of quantitative as well as qualitative data and the evolution of the systems of information technologies make it possible to:

- provide customers with better adapted guarantees. It is now possible for insurers to set up automated analyses in order to adjust covers according to the needs detected and to respond accurately to the different demands of the insured.

- improve risk analysis and maximize profitability. The bigger quantitative samples are the more faithfully drafted risk behavior we obtain. Tariffs are therefore set in a more accurate way.

- obtain better consistency of the risks accepted by the insurer by minimizing random fluctuations thanks to a sophisticated portfolio analysis on the policy-per-policy basis.

- draft contracts anywhere by means of mobile applications made available to underwriters. This means yields important gains in terms of productivity and also consolidates proximity with customers.

Insurance companies depend largely on their distribution networks whose management is of paramount importance. By monitoring in detail the performance of agents and brokers, by processing some key information such as the rate of loss of customers and the average size of risks, calculation of the commission given to each intermediary becomes better adapted to the productive effort of the latter.

Big data and customer loyalty of insurers

Which customers to keep and which ones need no longer be included in the portfolio? The answer to this question may be resolved through the extraction and analysis of the information available thanks to big data.

|

The IT systems in the hands of insurance companies may detect the quotes issued by their rivals for the customers in portfolio. They may also spot the customers in search of more competitive tariffs. Likewise, when the situation of a policyholder changes, insurers fail to react soon enough to grasp whether the insured is in need of a different coverage. That happens, for instance, during a change in the purchasing power of a customer: when a student enters the labor market, when an employee gets promoted or leaves on retirement.

Nowadays, the tools designed to analyze sales are witnessing huge development. They provide customers with optimal covers in keeping with their profile, and make it possible to retain policyholders who are likely to shift toward competition.

Some insurers have also developed platforms designed to interact with their customers. That is the case, for instance, of the American insurer MetLife which centralizes in a single platform information that used to be available on 70 different systems. This has enabled the company to interact more efficiently with the insured and better address their problems and needs.

Big data facing Solvency 2 requirements

Solvency 2 compels insurance companies to constantly ensure the quality and accuracy of data. In this regard, insurers are required to submit to the regulators reports containing key information. Big data makes it possible to verify these data by means of consistency check in order to confirm their veracity and exhaustiveness.

Questions raised by big data

While big data fills insurers with hope, it, nonetheless, remains a source of concern. Resulting upheavals may have numerous negative effects:

|

- Policyholders’ confidential data and information are held by private companies and public departments. Some of these data may be of personal nature in connection with the health, banking and financial situation of the insured. These data may come to the possession of malicious persons or computer hackers. The issue is to find out the extent to which laws are capable of protecting the insured. This situation now constitutes an impediment to the use of data.

- The provision of covers at customized tariffs is likely to be prejudicial to the sector as it goes against the principle of risk mutualization that is at the core of the insurance industry.

- The specific knowledge of risks and their constant monitoring would remove a large part of the hazard, another basic principle of insurance

- Human as well as material investments designed to collect and process information are important. Return on investments is not guaranteed so far.

- As big data turned out to be necessary, the insurers who fail to get adapted to it are doomed to extinction. Moreover, this new technology has prompted the arrival of new competitors, such as Google, who have, by nature, access to the users' data and are endowed with the financial and technical resources that enable them to make the difference and prevail.