Insurance-Linked Securities: ILS

The only securities selected are the ones covering damage pertaining to specific category of event.

Insurance-Linked Securities: Types of events covered

ILS cover a number of events including:

- Earthquakes

- Hurricanes

- Storms

- Typhoons

- Floods

- Air crashes

- Marine accidents

- Accidents occurring in oil platforms

- Satellite-related accidents

- Crop losses

- High mortality rate

- Longevity

- Fire and explosion insurance

- Energy insurance

Source: Crédit Suisse, Fondation de placement

How do Insurance-Linked Securities work? Evolution and growth of ILS market

Insurance-Linked Securities include a number of by-products, the most important of which are:

Catastrophe bonds

Catastrophe bonds or index-linked bonds are securities issued by a Special Purpose Vehicle with a term of three to four years. The investor is paid by means of a quarterly coupon in exchange for the risk of occurrence of a natural catastrophe. At the occurrence of the event covered, the investor’s initial capital is reduced.

Although risks made up of natural catastrophes are not the sole risks subject to securitization, they are the ones that best fit in with the financial constructions of this type. Catastrophe bonds cover predefined events via an ad hoc entity (special purpose vehicle) which signs a reinsurance agreement with the reinsured. In return, the SPV issues bonds that investors underwrite. Realized gains and losses are defined exactly in the same way as those previously described.

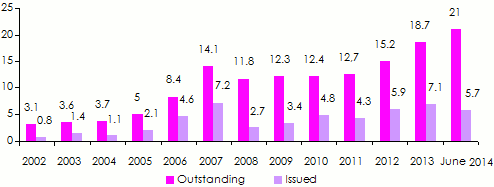

Catastrophe bonds market is witnessing a great success. The amount of the catastrophe bonds in use soared from 3.1 billion USD in 2002 to 18.7 billion USD in 2013 and to 21 billion USD at June 2014. The report outlining the issuance of catastrophe bonds during the first six months of 2014 shows that their favorite area remains the United States which accounts for 86.2% of the 5.7 billion USD in issued catastrophe bonds.

Securities issuance mainly covers hurricanes and storms. Initially used to cover non-life risks, the first Catastrophe Bonds appeared in life and health insurance in 2003.

Evolution of Cat Bonds market: 2002 - June 2014

in billion USD Sources: Willis Capital Markets & Advisory, Fitch Ratings

Sources: Willis Capital Markets & Advisory, Fitch RatingsIndustry Loss Warranties (ILWs)

The ILWs are contracts of financial flow exchange between two parties (swaps) usually involving banks or financial institutions. These swaps are collateralized with a maturity period of one year.

The guarantees provided by hedge funds in the form of derivative contracts allow reinsurers to cover any potential losses caused by a specific risk. ILWs compensation is paid only according to a certain loss threshold sustained by the entire industry in a predefined region and for a type of predefined event.

Consequently, after the passage of Hurricane Sandy in 2012, reinsurers could not benefit from ILWs contracts concluded back then with an activation threshold set for this type of event at 20 billion USD. The final costs of the damage reported in March 2013 amount to only 18.75 billion USD.

By the end of 2013, ILWs market accounted for a total of 3.5 billion USD that is 7.7% of overall alternative capital.

Sidecars

The 9/11 attacks © Michael Foran, CC BY 2.0 The 9/11 attacks © Michael Foran, CC BY 2.0 |

Sidecars are companies incorporated by a limited number of shareholders similar to hedge funds, linked to a reinsurer by a quota share treaty covering a portion of its portfolio for a fixed term.

Having a similar operational nature to that of traditional reinsurance, sidecars, like catastrophe bonds, are investment tools available to insurance or reinsurance companies. They help to provide additional capacity to reinsurers to cover natural catastrophe risks upon the withdrawal of traditional players. Sidecars, therefore, give access to business that is supported by new capital invested off-balance sheet in the special purpose entity (SPV). Their mechanism includes cash pre-financing for the settlement of claims in the event of a catastrophe.

Sidecars can increase the return on capital by creating a leverage effect. The capital injected into the sidecar often comes from third party companies wishing to join in the activity of the insurer or reinsurer. All stakeholders, therefore, benefit from the funds injected into the sidecars by third parties.

The benefits reaped from this kind of instrument are inversely proportional to the level of reported losses. The less important the losses related to the policies underwritten are, the higher return on investment is.

Sidecars have a life span of several years and the end of their activity is scheduled after a divestment process. The first sidecars were introduced in the United States after the events of September 11, 2001.

In 2013, the sidecars totaled 4 billion USD that is 8.9% of the capital invested in alternative solutions.

Catastrophe swaps

Catastrophe swaps are products that are traded over the counter. They are primarily designed to hedge against weather conditions and they have the advantage of being free of charge.

They are instruments much easier to set up than those of Catastrophe bonds. Their market is smaller, thus restricting the liquidity of these products. They have the advantage of triggering lower costs but they still generate a credit risk because they are not guaranteed.

Conditional capital

Conditional capital is associated with sales of option contracts. The holder of these options becomes entitled to issue securities at a price fixed in advance for a predetermined period if a predefined event occurs. The securities issued can be of different types: stocks, bonds, and debt or hybrid securities.

Read also: