Middle East, a reinsurance market under pressure

|

The notable event in the recent 10 years consists in the double digital average annual growth of the Emirati and Saudi markets.

The reinsurance market of these four countries is estimated at 3.5 billion USD.

Major Middle Eastern reinsurers ranked according to 2015 turnover

in millions USD| Country | Gross premiums | |

|---|---|---|

Qatar Re (2) | Qatar | 1156.2 |

Trust Re | Bahrain | 475.9 |

Milli Re | Turkey | 342.3 |

Arig | Bahrain | 220.4 |

Saudi Re | Saudi Arabia | 214.6 |

Hannover ReTakaful | Bahrain | 184.8 |

Kuwait Re | Kuwait | 130.8 |

Arab Re | Lebanon | 79.3 |

Emirates Re | United Arab Emirates | 62.7 |

Gulf Re | United Arab Emirates | 42,3 |

ACR ReTakaful | Bahrain | 37,8 |

Oman Re | Oman | 19,8 |

(2) Qatar Re has been domiciled in Bermuda since december 2015 Source: AM Best

The market growth of the Middle East markets is driven by:

- the high oil prices before their drop in 2015,

- the substantial progression margin provided thanks to a low insurance penetration rate,

- the introduction of compulsory covers, especially in Saudi Arabia and in United Arab Emirates,

- the initiatives taken by supervisory authorities for the establishment of a legal framework, especially favorable to Takaful insurance.

Local reinsurance size remains relatively modest in comparison with that of their international competitors. The majority of risks remain, thus, covered by international reinsurers.

Moreover, regional reinsurers have rather poor retentions, which triggers substantial cessions in reinsurance.

The attractiveness of Middle Eastern countries has nonetheless faded away. The capacity inflow in recent years has prompted fierce competition among the different players. Loss experience has witnessed an increase in terms of frequency, especially with regard to fire, engineering and energy risks. The fall of oil prices and their steady low levels for long periods have strained demand, compromising investment projects. Eventually, the poor premium average rates and the lack of monitoring in risk management have been prejudicial to the quality of insurance and reinsurance portfolios.

Evolution of loss and combined ratios of non life reinsurance

in %| Loss ratio | Combined ratio | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Company | Country | 2013 | 2014 | 2015 | Average of the last 5 years | 2013 | 2014 | 2015 | Average of the last 5 years |

Qatar Re (1) | Qatar | 82 | 84 | 68 | 86 | 111 | 103 | 87 | 108 |

Trust Re | Bahrain | 63 | 66 | 63 | 65 | 96 | 98 | 96 | 96 |

Milli Re | Turkey | 79 | 83 | 88 | 86 | 113 | 116 | 120 | 117 |

ARIG | Bahrain | 63 | 67 | 66 | 65 | 99 | 104 | 109 | 103 |

Saudi Re | Saudi Arabia | 119 | 75 | 58 | 77 | 154 | 109 | 80 | 107 |

Kuwait Re | Kuwait | 70 | 68 | 60 | 67 | 97 | 106 | 95 | 98 |

Arab Re | Lebanon | 72 | 78 | 69 | 71 | 105 | 113 | 99 | 103 |

Emirates Re | U.A.E | 62 | 67 | 64 | - | 98 | 96 | 97 | - |

ACR ReTakaful | Bahrain | 28 | 21 | 74 | 100 | 189 | 45 | 121 | 150 |

The poor technical results have directly impacted the return on equity of the reinsurers concerned. With high combined ratios, the profits reaped from technical operations are poor and even nil. It is the financial products that account for results. In an economic environment where poor interest rates and return on investment prevail, reinsurers can only report inadequate return on equity (ROE) in comparison with those of international players whose ROE are at least twice as high.

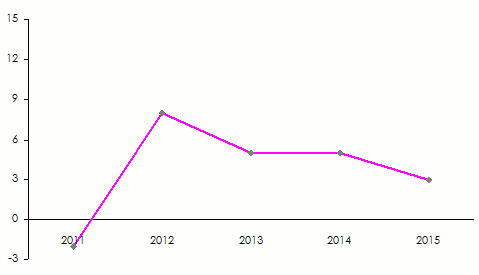

Return on shareholder’s equity of the Middle Eastern reinsurers

Source: Best’s Special Report, AM Best

Source: Best’s Special Report, AM Best Related article: