Reinsurance cycle and tariff globalization

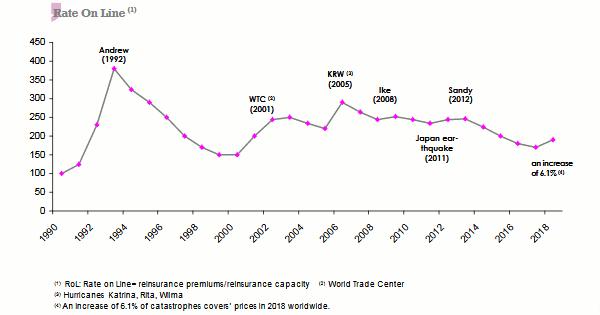

Due to the abundant availability of capital, a major natural disaster in the United States has no longer any impact on other regions in the world. The Rate On Line confirms in the following diagram the previous remark. Hence, since 2005, the increasing natural disasters have not any influence on the average global Rate on Line.

In best case scenarios, tariff increases following a disaster now focus on the sole treaties impacted. In 2019, a slight increase of reinsurance prices has been observed in areas affected by a high loss experience such as Australia, United States and Japan.

By January 1, 2020, the market is poised to undergo an upward adjustment of reinsurance rates for the affected areas and the loss-making classes of business. This is namely the case of marine, aviation and engineering, heavily affected in 2019.

In the other classes of business, capital abundance is likely to trigger a stabilization or even a moderate decrease of rates. According to Hannover Re, the absence of a major loss experience will not trigger tariff increase for European treaties protecting natural catastrophes. Reinsurers know it and those having adopted a stringent position in 2019 and who, in doing so, lost market shares, will probably change their minds. Consequently, natural disaster rates will be at best renewed all the same or with a slight decrease. This analysis of the non-life insurance market seems to be shared by Swiss Re.

A survey conducted by Moody’s following the Monte Carlo meeting in September 2019 revealed that ceding companies are no longer expecting tariff decrease in third party liability. An increase up to 5% is anticipated in the United States and for the affected businesses in Europe, MENA and Sub-Saharan Africa. This increase is motivated by an inflation of claims in some segments belonging to the third party liability insurance.

On the retrocession market, buyers will be more cautious than they used to be in the past. In this area, the observed inflation of demand and the dependence of some players on retrocession have triggered some nervousness. The call for alternative reinsurance is, therefore, poised to grow in this class of business.