Reinsurance in the MENA zone: 2024's renewal

Reinsurers domiciled in the MENA region have enjoyed favorable renewal conditions in recent years due to:

Reinsurers domiciled in the MENA region have enjoyed favorable renewal conditions in recent years due to:

- global upward pricing trends,

- high inflation after the Covid years,

- new business opportunities,

- coverage restrictions imposed on insurers.

Despite competition and abundant capacity, reinsurance costs are poised to maintain their upward trend in 2024. The increase in retrocession rates imposed by the London market and the industry giants is pushing local reinsurers to respect a minimum rate discipline.

According to the rating agency AM Best, reinsurers in the MENA zone will be able to cope with economic change, develop the necessary capacities and adjust their products to direct market demand, particularly in cyber and liability lines.

Reinsurance capacity in the MENA region

Reinsurance capacity in the MENA region remains substantial despite the increase in the number of claims and climatic events. This capacity is mainly provided by the industry leaders along with local and Asian reinsurers.

Competition between the various players is fierce, particularly in the Middle East, a region with few regulatory restrictions.

Moreover, since the withdrawal of many reinsurers from the local market (Arig, Best Re, etc.), a large number of direct insurers, looking for opportunities to grow and diversify their portfolios, are developing reinsurance capacity, compounding the already strong competition.

Rising natural disaster claims

In 2023, the MENA region has been facing a significant increase in the number of natural catastrophes. Indeed, the whole region has been hit hard by climate change: devastating floods in the Gulf Cooperation Council (GCC) countries while North Africa had to come to grips with recurrent drought and heat waves leading to forest fires and water shortages, in addition to the two major earthquakes sustained:

- Turkey and Syria, 6 February 2023, economic and insured losses of 91 billion USD (1) and 6 billion USD respectively.

- Morocco, 8 September 2023, economic losses estimated at 10 billion USD (2).

Following in the footsteps of Turkey, Algeria and Morocco, which have, in the past, set up compulsory insurance schemes for natural catastrophe risks, Egypt is in turn studying a pooling system for this risk.

(1) According to AON's Global Catastrophe Recap

(2) According to the United States Geological Survey (USGS).

Performance of the MENA reinsurance market

Despite the challenges facing the region's reinsurers, the MENA zone offers solid long-term growth potential.

Main indicators for all MENA reinsurers (1): 2018-2022

Figures in millions USD

| Indicator | 2018 | 2019 | 2020 | 2021 | 2022 | 5-year average |

|---|---|---|---|---|---|---|

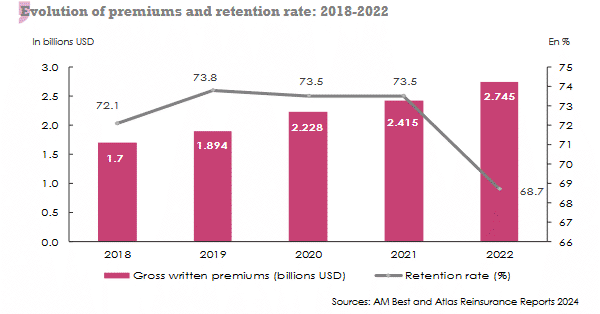

| Gross written premiums | 1 700 | 1 894 | 2 228 | 2 415 | 2 745 | 2 196 |

| Gross non-life written premiums | 1 566 | 1 736 | 2 042 | 2 242 | 2 559 | 2 029 |

| Gross life written premiums | 134 | 159 | 186 | 173 | 186 | 168 |

| Share capital | 1 125 | 1 116 | 1 211 | 1 237 | 1 228 | 1 183 |

| Net result | 166 | 187 | 218 | 240 | 306 | 223 |

| Shareholder's equity | 1 920 | 1 994 | 2 239 | 2 246 | 2 307 | 2 141 |

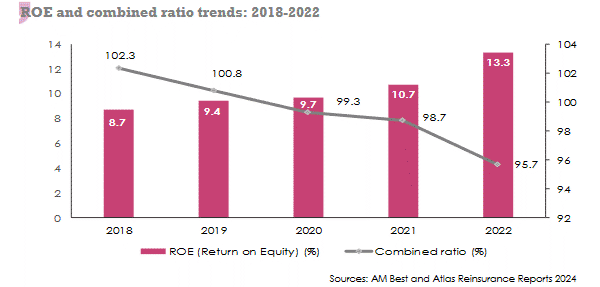

| Combined ratio (in %) | 102.3 | 100.8 | 99.3 | 98.7 | 95.7 | 99.4 |

| Retention (in %) | 72.1 | 73.8 | 73.5 | 73.5 | 68.7 | 72.3 |

| ROE (in %) | 8.7 | 9.4 | 9.7 | 10.68 | 13.26 | 10.4 |

Sources : Atlas Reinsurance Reports 2024 and AM Best

(1) 11 reinsurers: International General Ins. (IGI), Saudi Re, Société Centrale de réassurance (SCR), Compagnie Centrale de Réassurance (CCR), Milli Re, Kuwait Re, Türk Reasürans, Hannover ReTakaful, Oman Re, Tunis Re and Arab Re.

MENA reinsurance market: evolution of premiums

By 2022, all reinsurers domiciled in the MENA zone have reported a 13.6% growth in premium income, at 2.745 billion USD, an increase that can be attributed to the non-life class of business. The latter accounted for 93.2% of premium income, as the life business is not very developed in this region.

Since the transfer of Qatar Re's headquarters to Bermuda and the reduction in Milli Re's premium income, the leading reinsurer in the MENA zone is IGI, with 582 million USD in premiums. The Jordanian reinsurer is followed by Saudi Re, which has enormous growth potential, and SCR, with 374 million USD and 330 million USD of written premiums respectively.

Read also | MENA zone reinsurers: ranking per turnover

Reinsurers in the MENA region: shareholders’ equity, net result and ROE

With 306 million USD in 2022, the net income for all reinsurers in the region is up 27.5% over one year.

Reinsurers' equity in the MENA zone is up 2.7%, while equity in the Europe, Bermuda and Asia zones is down 37.61% for the four leading European reinsurers, 12.65% for Bermudan and American reinsurers, and 6.85% for Asian reinsurers.

Return on equity (ROE) for the MENA zone rose by an average of 24.15%, from 10.68% at the end of 2021 to 13.26% twelve months later, the highest ROE of all the regions studied, (Africa, Europe, Lloyd's, America, Asia). The highest 2022 ROEs for MENA companies are Türk Reasürans 43.02%, IGI 19.77% and Milli Re 17.67%. Conversely, the lowest ROEs are achieved by Saudi Re at 4.14% and Arab Re at 4.59%.

Reinsurers in the MENA region: technical ratios

According to AM Best, the average combined ratio for the region is 95.7% in 2022. This ratio has been improving steadily since 2018, when it peaked at 102.3%.

In 2022, three reinsurers reported combined ratios above 100%: Milli Re (160%), Hannover ReTakaful (101.6%) and SCR (101.2%). The best combined ratios were achieved by IGI (76.7%), CCR (77.3%) and Türk Reasürans (85.1%).

Read also | Réassureurs de la zone MENA : ratios techniques

Reinsurers’ rating in the MENA zone

Non-oil exporting countries in the MENA zone are facing increasing economic, fiscal and political risks. With the devaluation of local currencies against the US dollar, many countries are bound to endure increasing pressure from mounting public debt and persistently high commodity prices.

Against this backdrop, AM Best has already downgraded the long-term credit ratings of two reinsurers (Milli Re and Tunis Re). The agency has also downgraded the outlook on three ratings from stable to negative (Milli Re, Tunis Re and Arab Re).

Two reinsurers domiciled in the region retain strong ratings: IGI "A" and Kuwait Re "A-".

Standard and Poor's (S&P), on their part, confirmed on 16 September 2023 the "A-" long-term financial strength and credit rating assigned to Saudi Re in December 2022. The agency also confirms Kuwait Re's "A-" rating with a stable outlook. The ratings of the other reinsurers have not changed since the last renewal.

Read also | MENA reinsurance companies rating