Reinsurance market in Sub-Saharan Africa: 2018 renewals

Nairobi, Kenya © Waceke kamau, CC BY-SA 4.0 Nairobi, Kenya © Waceke kamau, CC BY-SA 4.0 |

While the economic outlook remains good, the occurrence of several events has put pressure on the State budget, thus limiting investment policies.

This slowdown has resulted in:

- an increase in import costs

- the decline in commodity prices

- the decline in investment capacity of foreign partners, particularly from China

- the depreciation of local currencies

Reinsurance market in Sub-Saharan Africa: African reinsurers’ profitability

The African reinsurance market has been growing steadily for almost a decade. Its turnover now amounts to approximately 8.3 billion USD.

However, reinsurers are faced with a number of challenges:

- inflation leads to an unfavorable change in exchange rates

- competition among insurers leads to a decline in the volume of premiums

- claims frequency and management costs are on the rise

- due to restrictions on financial flows headed abroad, investment opportunities remain low

- return on investment remains low

Despite these constraints, the African reinsurance market remains attractive. International reinsurers are competing over premiums with local players whose numbers have increased substantially.

This attraction for the African continent is supported by the relative absence of natural catastrophes. Africa remains hardly exposed to this type of claims, which provides international reinsurers with diversification of their portfolio without increasing their exposure to these risks.

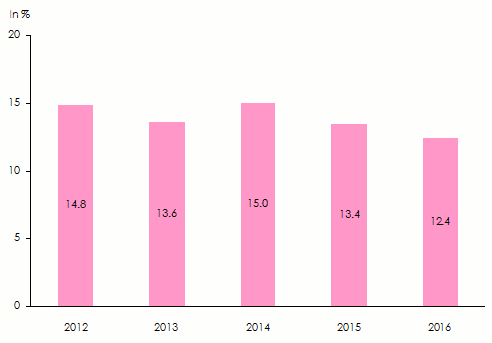

Capitalization of local and regional reinsurance companies ranges from weak to strong. Return on equity remains stable at over 12%.

Return on equity of Sub-Saharan reinsurers

Source : Best’s Special Report, A.M. Best

Source : Best’s Special Report, A.M. Best

Rating of the Main African reinsurers (excluding the Maghreb)

| AM Best | Standard & Poor’s | ||||

|---|---|---|---|---|---|

Compagnie | Country | Rating | Outlook | Rating | Outlook |

Africa Re | Nigeria | A | Stable | A- | Stable |

Munich Re of Africa | South Africa | - | - | AA- | Stable |

Hannover Life Reassurance Africa | South Africa | - | - | AA- | Negative |

Hannover Re Africa | South Africa | - | - | AA- | Negative |

General Reinsurance Africa | South Africa | - | - | AA- | - |

African Reinsurance Corporation | South Africa | - | - | A- | Stable |

Kenya Re | Kenya | B+ | Negative | - | - |

Zep Re (PTA Reinsurance Co) | Kenya | B++ | Stable | - | - |

Scor Africa | South Africa | AA- | Stable | - | - |

Continental Re | Nigeria | B+ | Stable | - | - |

CICA RE | Togo | B | Stable | - | - |

GIC Re South Africa | South Africa | - | - | BB+ | Stable |

Ghana Re | Ghana | B | Stable | - | - |

East Africa Re | Kenya | B | Stable | - | - |

Source: Reinsurance Directory, Renewal 2018– Atlas Magazine

Direct insurance market in Sub-Saharan Africa

Due to the large number of players, direct insurance markets remain tight and fragmented. However, the presence of large African and foreign groups of insurers is spreading with the start of concentration initiated by the participation of South African giants in local companies.

The 2016 economic slowdown led to a decline in premium volumes of 15.3% at 61 billion USD. The threshold of 64 billion USD in premiums should be reached in the next five years.

Just like in the MENA zone, international reinsurers play a crucial role in the placement of major commercial and industrial risks. Their know-how and the vast capacities they have are essential for the underwriting of high-profile risks.

Reinsurance market in Sub-Saharan Africa: the upsurge of protectionism

On the defensive, several states no longer hesitate to impose legal assignment for the benefit of their national reinsurers. These measures have been designed to maximize premium retention on the local market, an undertaking that is done both nationally and regionally.

National reinsurance company projects are currently under study in Ethiopia and Cameroon.

Many regional reinsurers like Africa Re, Cica Re and Zep Re are partly owned by a group of African States. From their home market, these entities are gradually developing an underwriting policy that covers the whole of Africa, sometimes extending to Asian countries.

Reinsurance markets in Sub-Saharan Africa: 2018 renewal trends

The fragmentation of the market and the competitive environment are good news for sub-Saharan ceding companies. Apart from South Africa, which remains exposed to natural catastrophes and where loss ratio is particularly high, the rest of the continent is well-positioned for the next renewal. There is no reason for an increase in reinsurance rates in 2018.