Sanlam: clusters businesses

Sanlam Life and Savings (SLS)

In South Africa, Sanlam Life and Savings (SLS) has pooled up the life and investment activities designed for individuals and companies.

In South Africa, Sanlam Life and Savings (SLS) has pooled up the life and investment activities designed for individuals and companies.

SLS is standing strongly in the South African market where the group offers a diverse range of financial solutions aimed at facilitating the creation and protection of long-term wealth. To meet the needs of its customers, SLS is committed to strategic partnerships and to technological innovation.

Read also | Sanlam Life and Savings: main indicators

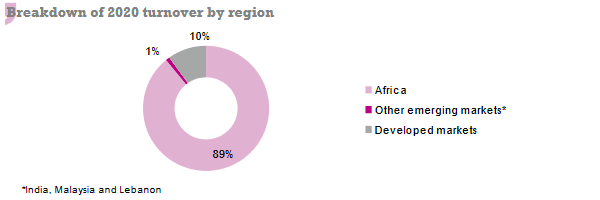

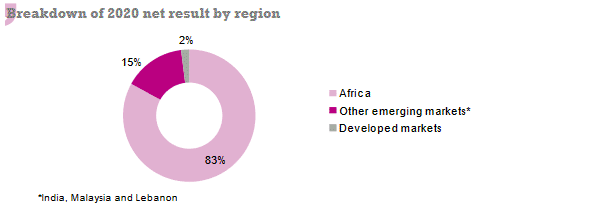

Sanlam Emerging Markets (SEM)

Sanlam Emerging Markets (SEM) has become a reference player in Africa (excluding South Africa) and Asia. This division, entirely dedicated to emerging countries, offers a wide range of life, non-life, health, credit, bancassurance, assistance, third-party payment services (TPA), asset management solutions, etc.

SEM is operating through two divisions: Sanlam Pan-Africa (SPA) and other international activities.

Sanlam Pan-Africa (SPA) has been tasked with consolidating and developing Sanlam's pan-African activities (outside South Africa) while the Other International division takes care of the emerging markets of India, Malaysia and Lebanon.

SEM is Sanlam's entry point into emerging markets. Its approach is based on local or regional partnerships. The company uses local expertise to support clients and build sustainability.

SEM can make recourse to the technical expertise of the group's other clusters if necessary.

Lire aussi | Sanlam Emerging Market: main indicators

Sanlam Investment Group (SIG)

Sanlam Investment Group (SIG) is the largest business in the group in terms of performance. It had more than 900 billion ZAR (61.4 billion USD) in assets under management in 2020, providing significant investment capacity.

SIG offers retail and institutional customers in South Africa and the UK access to investment management, wealth management, international investments, credit, restructuring, risk management, and other solutions.

Sanlam Investment Group is Sanlam's primary source of revenue. In 2020, it accounted for almost 52% of the turnover of the entire group. In the past year, SIG reported a 42% growth in revenues in original currency, from 113.236 billion ZAR (8.053 billion USD) in 2019 to 161.470 billion ZAR (11.017 billion USD) a year later. Achieved under challenging market conditions, this growth rate is more than remarkable.

Lire aussi | Sanlam Investment Group: main technical indicators

Santam (SNT)

Set up 103 years ago, Santam is the first non-life insurance company in South Africa. It covers property and casualty risks for individuals and companies through an extensive network of intermediaries and direct channels.

The company is 61.9% (1) owned by the Sanlam Group and has been listed on the Johannesburg Stock Exchange since 1964. It offers various insurance solutions through:

- traditional companies: Santam Commercial and Personal, Santam Specialist, Santam Re and MiWay (Conventional insurance),

- entities guided towards alternative solutions: Centriq and Santam Structured Insurance.

Santam is also a strategic partner of Sanlam Emerging markets (SEM).

With 38 billion ZAR (2.6 billion USD) in gross premiums in 2020, Santam controls nearly 24% of the country's non-life insurance market. The company also manages 56.180 billion ZAR (3.833 billion USD) of assets.

Outside South Africa, Santam is very present internationally, especially in Southern Africa where it has interests in Malawi, Zimbabwe, Uganda, Zambia and Tanzania. It also holds strategic investments in its Namibian subsidiary Santam Namibia Ltd.

(1) Participations as at 31/12/2020

Sanlam : turnover per division

Figures in billions| 2016 | 2017 | 2018 | 2019 | 2020 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| ZAR | USD | ZAR | USD | ZAR | USD | ZAR | USD | ZAR | USD | |

| Sanlam Life and Savings | 66.777 | 4.883 | 63.443 | 5.124 | 74.297 | 5.144 | 77.051 | 5.48 | 77.847 | 5.312 |

| Sanlam Emerging Markets | 23.696 | 1.733 | 21.903 | 1.769 | 26.224 | 1.815 | 34.809 | 2.476 | 46.898 | 3.2 |

| Santam Investment Group | 122.879 | 8.986 | 114.391 | 9.238 | 99.696 | 6.902 | 113.236 | 8.053 | 161.47 | 11.017 |

| Santam (1) | 19.826 | 1.45 | 21.435 | 1.731 | 22.812 | 1 579 | 24.227 | 1.723 | 24.66 | 1.683 |

| Total Sanlam Group | 233.178 | 17.052 | 221.172 | 17.862 | 223.029 | 15 440 | 249.323 | 17.732 | 310.875 | 21.212 |

(1) 233.178

Sanlam: breakdown of 2020 turnover per division and type of activity

Figures in billions

| Divisions | Life insurance activity | Non-life insurance activity | Investment activity | Total | ||||

|---|---|---|---|---|---|---|---|---|

| ZAR | USD | ZAR | USD | ZAR | USD | ZAR | USD | |

| Sanlam Life and Savings (SLS) | 43.517 | 2.969 | - | - | 34.33 | 2.342 | 77.847 | 5.311 |

| - SA Retail Affluent (1) | 34.459 | 2 351 | - | - | 30.982 | 2.114 | 65.441 | 4.465 |

| - SA Retail Mass (2) | 2.558 | 0.175 | - | - | - | - | 2.558 | 0.175 |

| - Sanlam Corporate | 6.5 | 0.443 | - | - | 3.348 | 0.228 | 9.848 | 0.671 |

| Sanlam Emerging Markets (SEM) | 9.241 | 0.631 | 16.479 | 1.124 | 21.178 | 1.445 | 46.898 | 3.2 |

| - Southern Africa | 4.268 | 0.292 | 1.091 | 0.074 | 15.481 | 1.056 | 20.84 | 1.422 |

| - Sanlam Pan-Africa | 3.65 | 0.249 | 12.601 | 0.86 | 5.697 | 0.389 | 21.948 | 1.498 |

| - Other countries | 1.323 | 0.09 | 2.787 | 0.19 | - | - | 4.11 | 0.28 |

| Sanlam Investement Group (SIG) | 3.353 | 0.229 | - | - | 158.117 | 10.788 | 161.47 | 11.017 |

| - Investment management | - | - | - | - | 120.006 | 8.188 | 120.006 | 8.188 |

| - Asset management | - | - | - | - | 10.403 | 0.71 | 10.403 | 0.71 |

| - International | 3.353 | 0.229 | - | - | 27.708 | 1.89 | 31.061 | 2.119 |

| Santam (SNT) | - | - | 24.66 | 1.683 | - | - | 24.66 | 1.683 |

| Total | 56.111 | 3.828 | 41.139 | 2.807 | 213.625 | 14.576 | 310.875 | 21.211 |

(1) Sanlam Retail Affluent (SRA) provides middle to high-income South Africans with financial solutions through several platforms

(2) SA Retail Mass includes Sanlam Sky, Safrican and African Rainbow Life

Exchange rate as at 31/12/2020 : 1 ZAR = 0.06823 USD

Sanlam : net result per division

Figures in billions

| 2016 | 2017 | 2018 | 2019 | 2020 | 2020 shares | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZAR | USD | ZAR | USD | ZAR | USD | ZAR | USD | ZAR | USD | ||

| Sanlam Life and Savings | 4.609 | 0.337 | 4.793 | 0.387 | 4.613 | 0.319 | 4.855 | 0.345 | 4.6 | 0.314 | 54.88% |

| Sanlam Emerging Markets | 1.557 | 0.114 | 1.793 | 0.145 | 2.038 | 0.141 | 2.632 | 0.187 | 2.377 | 0.162 | 28.36% |

| Santam Investment Group | 1.096 | 0.08 | 1.227 | 0.099 | 1.152 | 0.08 | 1.07 | 0.076 | 0.805 | 0.055 | 9.60% |

| Santam | 0.814 | 0.06 | 0.851 | 0.069 | 1.196 | 0.083 | 1.217 | 0.087 | 0.686 | 0.047 | 8.18% |

| Other | -0.107 | -0.008 | -0.115 | -0.01 | -0.109 | -0.008 | -0.1 | -0.007 | -0.086 | -0.006 | -1.03% |

| Total Sanlam Group | 7.969 | 0.583 | 8.549 | 0.69 | 8.89 | 0.615 | 9.674 | 0.688 | 8.382 | 0.572 | 100% |

Exchange rate as at 31/12/2020 : 1 ZAR = 0.06823 USD ; 31/12/2019 : 1 ZAR = 0.07112 USD ; at 31/12/2018 : 1 ZAR = 0.06923 USD ; at 31/12/2017 : 1 ZAR = 0.08076 USD ; at 31/12/2016 : 1 ZAR = 0.07313 USD