SONAM

Upon its creation in 1972, SONAM is the only Senegalese insurance company having no foreign shareholding in its capital as provided for in its statutes.

Upon its creation in 1972, SONAM is the only Senegalese insurance company having no foreign shareholding in its capital as provided for in its statutes.

Within the difficult context of the 1980s and 1990s, Diouldé Niane managed in a short lapse of time to boost the company to the first rank of the market ahead of UAP, AGF and Préservatrice Foncière.

SONAM owes this success to the quality of its leaders as well as to the mutualistic spirit which goes well with the African values of solidarity and mutual help.

Since any success rests on human resources, SONAM has managed to lure a great number of young executives who found in it favourable grounds to prosper and blossom.

In today's globalized world, SONAM is in search for a second wind. It remains, nonetheless, the market's Reference.

SONAM in 2005

| Capital | 2 billion CFA (3.611 million USD)1 |

| Turnover | 5 750 millions CFA (10.380 millions USD)2 |

| Net result | 498 million CFA (899 230 USD)2 |

| Shareholder's equity | 7 839 million CFA (14 million USD)2 |

| Number of employees | 662 |

Management

Chairman | Mr Diouldé Niane |

General Manager | Mr Mamadou Diop |

Sales & Marine Departments Manager | Mrs Marthe Ba |

Technical & Marketing Manager | Mr Abdoul Aziz Ndaw |

Accounts Manager | Mr Ibrahima Georges |

Head of Accident Department | Mr El Caba Toure |

Head of Motor & GTPL Departments | Mr Mor Ngom |

Main shareholders

| Sonam Mutuelle |

| Sonamvie |

| MAAS |

Turnover by class of business: 2001-2005

in USD| Written premiums | 2001 | % | 2002 | % | 2003 | % | 2004 | % | 2005 | % |

|---|---|---|---|---|---|---|---|---|---|---|

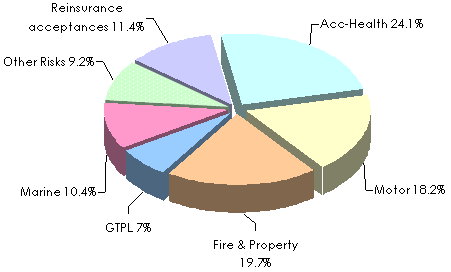

Accident & Health | 2 988 743 | 38 | 4 029 435 | 40.2 | 3 087 950 | 29.6 | 3 168 620 | 24.5 | 2 505 375 | 24.1 |

Motor | 1 295 230 | 16.5 | 1 404 597 | 13.9 | 1 799 747 | 17.3 | 2 204 746 | 17 | 1 883 675 | 18.2 |

Fire & Property | 1 074 000 | 13.7 | 1 492 651 | 14.8 | 1 926 400 | 18.5 | 2 368 713 | 18.3 | 2 044 993 | 19.7 |

General TPL | 333 486 | 4.3 | 665 222 | 6.7 | 575 507 | 5.5 | 782 008 | 6 | 729 783 | 7 |

Marine | 1 333 081 | 16.9 | 1 394 782 | 13.8 | 1 725 251 | 16.5 | 1 499 482 | 11.6 | 1 080 635 | 10.4 |

Other Risks | 622 067 | 7.9 | 794 587 | 7.9 | 811 895 | 7.8 | 998 885 | 7.8 | 950 365 | 9.2 |

Acceptances | 207 675 | 2.7 | 263 861 | 2.7 | 472 423 | 4.5 | 1 924 674 | 14.8 | 1 185 476 | 11.4 |

Total | 7 854 282 | 100 | 10 045 135 | 100 | 10 399 173 | 100 | 12 947 128 | 100 | 10 380 302 | 100 |

Premiums' split by class of business in 2005

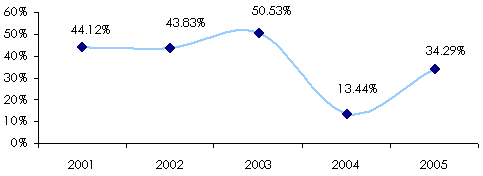

Loss ratio: 2001-2005

Main financial highlights: 2001-2005

in USD| 2001 | 2002 | 2003 | 2004 | 2005 | |

|---|---|---|---|---|---|

Gross written premiums | 7 854 274 | 10 045 133 | 10 399 174 | 12 947 125 | 10 380 303 |

Net written premiums | 5 104 284 | 6 534 458 | 6 288 878 | 7 225 004 | 5 132 830 |

Gross earned premiums | 7 950 612 | 10 116 941 | 10 523 063 | 12 403 542 | 10 084 340 |

Incurred losses | 3 507 570 | 4 434 185 | 5 316 975 | 1 666 876 | 3 458 220 |

Loss ratio | 44.12% | 43.83% | 50.53% | 13.44% | 34.29% |

Overhead expenses | 2 656 685 | 3 052 676 | 3 810 954 | 4 624 116 | 4 223 181 |

Investment income | 706 699 | 886 617 | 1 073 705 | 1 148 748 | 973 006 |

Technical result | 4 346 703 | 5 610 949 | 5 082 199 | 11 280 249 | 6 922 082 |

Net result after tax | 256 971 | 1 221 213 | 782 965 | 1 768 779 | 900 332 |

Exchange rate XOF/USD as at 31/12 | 2001 | 2002 | 2003 | 2004 | 2005 |

0.001351 | 0.0016 | 0.001916 | 0.002079 | 0.001805 |

Contact

| Head office | 6, avenue Léopold Sédar Senghor, BP 210 Dakar |

| Phone | (+221) 823 10 03 |

| Fax | (+221) 821 70 25 |

sonam [at] sentoo [dot] sn |

Thanks: We thank SONAM for their kind assistance in the conception of this survey.