Reinsurance market in Sub-Saharan Africa

The African sub-continent is scrambling around in an unstable economic and political environment. Monetary depreciations, inflationary pressure, unemployment and electoral periods have triggered too much turbulence of which insurance has suffered. Nevertheless, some African economies remain sufficiently dynamic to generate growth. That is in particular the case of the Eastern part of the continent where we note that GDP growth rate is set around 6% in 2018 while growth in the overall Sub-Saharan African zone would to be set around 2.4% in 2019 and 2.5% in 2020.

The African sub-continent is scrambling around in an unstable economic and political environment. Monetary depreciations, inflationary pressure, unemployment and electoral periods have triggered too much turbulence of which insurance has suffered. Nevertheless, some African economies remain sufficiently dynamic to generate growth. That is in particular the case of the Eastern part of the continent where we note that GDP growth rate is set around 6% in 2018 while growth in the overall Sub-Saharan African zone would to be set around 2.4% in 2019 and 2.5% in 2020.

Despite these constraints, the insurance and reinsurance market continues to progress. In 2018, non-life insurance premiums in Sub-Saharan Africa amounted to 16.9 billion USD where as life premiums attained 43.2 billion USD. Little more than 80% of these premiums being underwritten in South Africa.

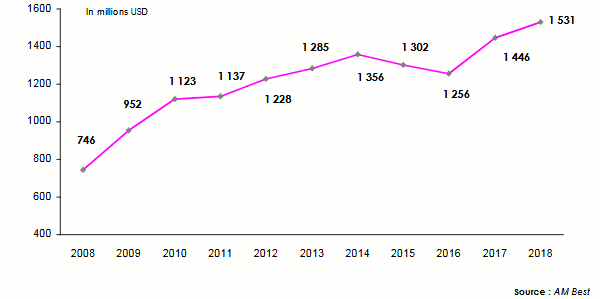

Reinsurance premiums of this zone are steadily rising, going twofold between 2008 and 2018. Non-life reinsurance is growing more rapidly than non-life insurance in most markets.

Reinsurance premiums in Sub-Saharan Africa: 2008-2018

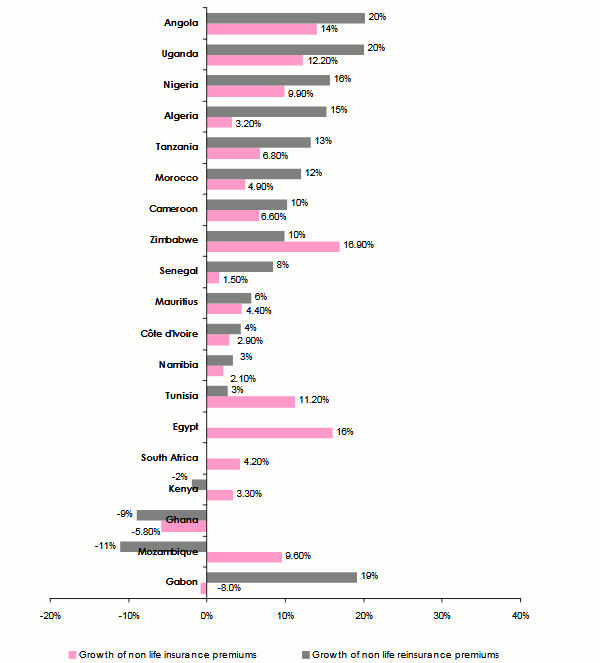

Growth rate of non-life insurance and reinsurance premiums in major African countries

With the exception of Gabon which has been sustaining a serious economic crisis since 2017, it is in Africa’s oil countries and those average-sized ones (Uganda, Senegal…) that reinsurance cession rates increase more rapidly than direct insurance premiums.

* Growth rate of non-life reinsurance is unavailable for Egypt and South Africa

Sources : AM Best

In Sub-Saharan Africa, the poor volume of premiums generated by direct insurance companies and the creation of new reinsurance capacity are not helping the market. With reinsurance supply being superior to demand, ceding companies will continue to tap into favorable renewal terms for all the classes of business with the exception of energy and transport risks that are rated on the international markets.

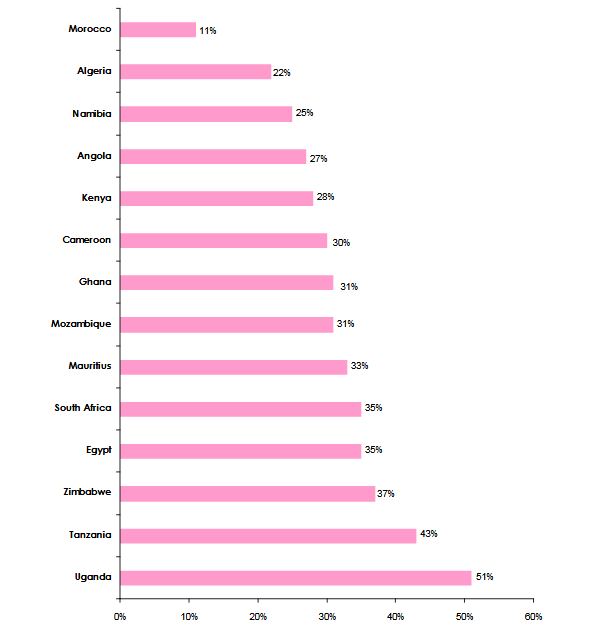

Reinsurance cession rates in Africa

Morocco and Algeria reported the lowest reinsurance cession rates, with 11% for the former and 22% for the latter. In East and West Africa, cession rates are the highest with Uganda 51% and Tanzania 43%.

Sources : AM Best

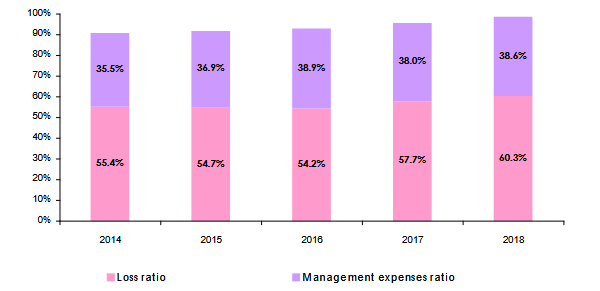

Technical ratios of Sub-Saharan African reinsurance companies: 2014-2018

Reinsurance companies technical results in West and Central Africa are generally positive with, however, a degradation of the loss ratio during the three recent years: 55.4% in 2014 against 60.3% in 2018. In this zone, corporate costs are relatively high whereas the combined ratio remains below 100%, 90.9% in 2014 and 98.9% in 2018.

It is noteworthy that claim costs have increased in recent years with a higher frequency, affecting operational margin.

The second remark pertains to the depreciation of local currencies which has tremendously impacted the cost of the claim.

Source: AM Best

Protection of Sub-Saharan reinsurance markets

This protection comes in the form of legal cession and establishment of local reinsurance companies.

Legal cession

In an effort to face international reinsurers, numerous Sub-Saharan countries have resorted to legal cession. This recourse plays out in two levels:

- Direct insurance, for instance, with CICA Re benefiting as of January 1, 2020 from a 5% legal cession on all the premiums written in the CIMA space.

- Legal cession may also be carried out at the level of reinsurance. In this case, national reinsurers or their likes shall benefit from a legal cession on all reinsurance treaties written in the region.

Establishment of national reinsurance companies

In order to retain the largest portion of premiums on the local market, Sub-Saharan States are promoting the establishment of local insurance companies that benefit from legal cessions. African reinsurers have retained a sizable portion of the premiums.

In the end, African reinsurers are underwriting 91% of their premiums in a single zone. This excessive concentration may, in the long run, strain reinsurers who are solely focused on Africa or a given African country.