The 2019 Reinsurance treaties' renewal

|

All regions were affected, with North America being the hardest-hit with more than 23% of the number of events occurring, 83% of the economic damage incurred and 93% of the insured losses sustained. Eventually, North America accounted for more than 125 billion USD in insured losses for a total amount of 135 billion USD worldwide.

At the Monte Carlo 2017 meeting, reinsurers, in upbeat but naïve mood, promised a substantial revision of reinsurance conditions and rates. This readjustment was expected to target not only affected programs but more generally all treaties in all zones. Unfortunately, these upward forecasts have not been realized. The very few localized adjustments that were made in January 2018 and in the months that followed did not meet the expectations of the reinsurers.

So what should be expected from the 2019 reinsurance treaties' renewal when the year 2018 could end, for some market players, with combined ratios 10 points lower than those of the past year? Is the offer of alternative capacity at its height? Will the fierce competition among reinsurance companies continue to weigh on mergers and acquisitions? What can we expect from the next 2019 renewal?

These are the questions we will try to answer in next part of this report.

Combined ratios of major reinsurers by June 30th, 2018

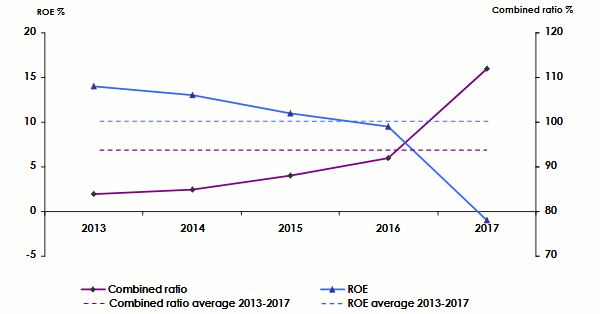

All twenty largest reinsurers had posted a combined ratio of 92.3% by the end of June 2018, compared to 94.7% reported a year earlier. Last year, this ratio deteriorated sharply in the second half of 2017 for the whole market, rising above 100% for many of them.

Combined ratio and ROE of twenty major reinsurers

* As a reminder, the very high loss experience occurred during the third quarter of 2017

The 2019 alternative reinsurance treaties' renewal

Although alternative reinsurance matters only to the most important markets, it nevertheless has an indirect impact on the entire profession. By capturing part of the reinsurance demand (mainly natural disasters), it puts pressure on the markets. In an effort to offset their premium deficit, traditional reinsurers are trying to gain market shares in other segments or industries, thus exacerbating competition.

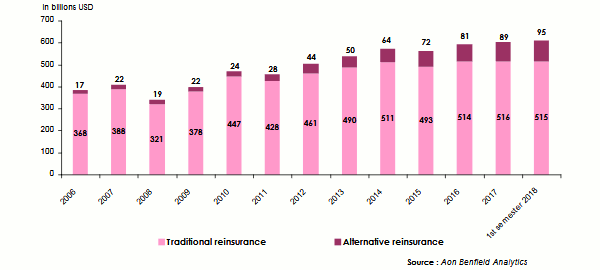

Analysts are forecasting an increase of alternative reinsurance offer in 2019. On the Insurance Linked Securities (ILS) (1) front, the funds managing the risk-backed investments held 100 billion USD in assets under management by the end of June 2017. By December 31st of the same year, the 10 largest Insurance-Linked Securities (ILS) funds managed 56.5 billion USD in hurricane assets. As a result, these ILS management funds sustained losses in 2017, with hurricanes Irma, Harvey and Maria alone absorbing between 15% and 20% of insured losses, or 14 billion to 18 billion USD.

Most likely, the assets affected by the 2017 claims have been bailed out in January 2018. In general, the 2019 alternative reinsurance offer is poised to undergo new growth.

Evolution of the total reinsurance capacity 2006 - 2018

Insurance-linked securities (ILS) dominate the alternative reinsurance market with 60% of market shares. This form of reinsurance does not show signs of slowing down, proving very successful with insurers because it’s operating principle is close to that of traditional reinsurance. It is poised to keep pressure on traditional reinsurance, particularly in highly modeled markets where this technique is very present.

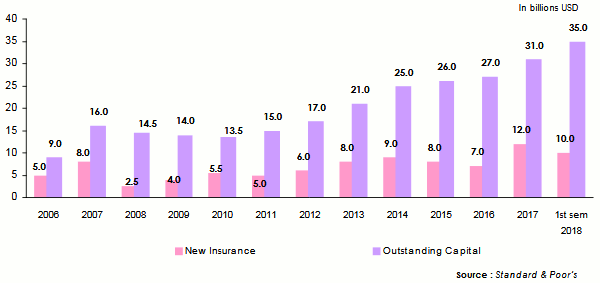

Alternative reinsurance is tackling new areas of reinsurance such as third party liability and life, while cat bonds will set new records. Outstanding capital will amount to 35 billion USD even if the latter showed a slight slowdown.

Growth of cat bonds market

According to AON, traditional reinsurers are sufficiently competitive in the Eastern European and MENA regions, a strong positioning that has slowed the penetration of alternative reinsurance in these markets.

Traditional players perceive these parts of the world as a good way of diversifying their portfolios, hence striving to stay competitive.

The 2019 treaties' renewal: less and less visible reinsurance cycles

In 2019, reinsurers will reap modest but sufficient margins, with the greater portion going to the most diversified reinsurers. This finding was confirmed in 2017, when the players endowed with a significant life reinsurance portfolio were able to balance the poor results reported in non-life reinsurance.

Rates for natural disaster coverages rose modestly in 2018, with only a few regions and classes of business reporting higher price increases. It is unlikely, however, that these increases will continue in 2019. The excess capacity available in all business classes, the current low level of tariffs and a persistent low interest rate environment account for the main causes behind market stagnation. Rating agencies are therefore downbeat about any upward trend in the terms and conditions of the January 2019 renewal while their outlook on reinsurance remains stable for the year ahead.

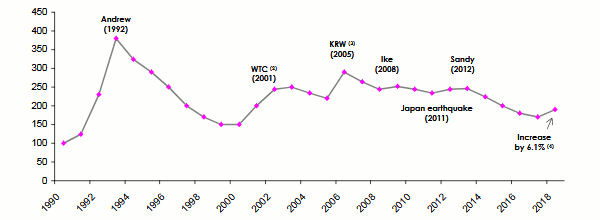

Catastrophe ROL index from 1990 to 2018

* ROL= Rate On Line= Premium/capacity

(2) World Trade Center

(3) Ouragans Katrina, Rita, Wilma

(4) Increase by 6.1% at the global level of the price of catastrophe covers

In the past, major catastrophic losses had a considerable incidence on the tightening of tariff conditions, a finding that was particularly true for property damage reinsurance treaties. This relation between loss experience and premium failed to work out neither during the 2018 renewal nor in previous years marked by major events (2011 and 2017). This dysfunction has been accounted for by excess of capital which led to a very small variation of the ROL.

It is noteworthy that the release of reserves has been steadily decreasing since 2000, a situation that compels reinsurers to focus on their operating margins. So we are probably close to the bottom of the cycle as sluggish as it is.

Read also:2018 reinsurance treaties' renewal