The African insurance

According to the 2007 statistics, the sector is witnessing a slight slowdown, mainly due to the poor results posted by its key player, South Africa. Unfortunately this changing Africa may be affected by the current international crisis. Nonetheless, and despite the turmoil ahead, African insurance offers considerable development prospects up for grabs.

State of things

The African insurance penetration in 2007

| While the continent harbours 14% of the world's population, the African insurance market accounts for just 1.31% of the overall premiums underwritten worldwide in 2007. During the same year, the penetration rate of the African insurance did not exceed 4.31% whereas the worldwide average is of 7.5%. The 4.31% rate is boosted by South Africa which displays one of the highest penetration rates in the world, that is, 15.3%. The gap between South Africa and the other African countries remains important. Source : Sigma |

|

2007's insurance density

The density of insurance in Africa in 2007, namely the average premium per capita is very low.

in USD| Zone/Country | Life premiums | Non life premiums | Total premiums |

|---|---|---|---|

World | 358.1 | 249.6 | 607.7 |

North America | 1 869.3 | 2 115.5 | 3 984.8 |

Europe | 1 222.6 | 739.8 | 1 962.4 |

Asia | 156.7 | 54.1 | 210.7 |

Africa | 39.6 | 15.8 | 55.3 |

South Africa | 719 | 159.5 | 878.5 |

Namibia | 203.5 | 86 | 289.6 |

Botswana | 162.0 | 60.1 | 222.1 |

Morocco | 22.9 | 46 | 68.9 |

Tunisia | 7 | 60.1 | 67.2 |

Angola | 0.7 | 55 | 55.7 |

Algeria | 1.3 | 19.7 | 21 |

Kenya | 6.1 | 13.1 | 19.2 |

Egypt | 6.8 | 7.6 | 14.4 |

Nigeria | 0.9 | 4.6 | 5.5 |

Premium volume in 2007

in millions USD

|

In non life insurance, the inflation adjusted rate represents 0.6% for the overall continent and 0.7% for the rest of the world. In Africa, the non life highest evolution is of 8.8% (Morocco).

Heterogeneous markets

In the fashion of the economic and social situation of the continent's different countries, the level of development and the sector's performance are very dissimilar according to each country. To provide a relevant view, the African market may be analyzed in relation to three main areas corresponding to as many cases with relatively similar features:

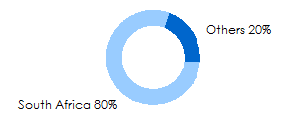

- The southern part of the continent where South Africa stands as the undisputed leader with more than 80% of the overall premiums volume.

- The central part of the continent with all the countries comprised between the Sahara and the southern cone of the continent.

- The northern part of Africa with the countries neighbouring the Mediterranean Sea.

South Africa, a special market

In view of its scale and its performance, the South African insurance sector showcases the features of a developed, liberalised and innovative market. This status is partly accounted for by the country's history. The constraints resulting from the international boycott imposed on the apartheid regime enabled national insurers to get hold of the entire market free from the foreign competition and develop the country's enormous potentialities.

In view of its scale and its performance, the South African insurance sector showcases the features of a developed, liberalised and innovative market. This status is partly accounted for by the country's history. The constraints resulting from the international boycott imposed on the apartheid regime enabled national insurers to get hold of the entire market free from the foreign competition and develop the country's enormous potentialities.

The market is largely dominated by some conglomerates, the most important of whom stand among the world's biggest groups. They are growing international, not only in Africa but also in the United States, Europe, Australia, India and China.

The overall premiums volume reached 42 676 million USD in 2007 among which 34 927 million USD in life insurance, that is, 92% of the continent's premiums and 7 749 million USD in non life insurance, that is 50% of the continent's premiums.

The amount of the contributions in percentage of the gross domestic product is one of the highest in the world.

The world's biggest insurers, reinsurers and brokers are present in the country.

Stimulated by the emergence of middle class, the increase of household real income and that of social transfer, the country's economic boom and its Anglo-Saxon influence are behind the brilliant success of life insurance which is ranking thirteenth worldwide. With an expansion already in full swing, the insurance market is relying much on the economic fallout of the upcoming football world cup due to be hosted in South Africa in 2010.

South Africa's shares in the Africain market from 2000 to 2007

in millions USD| South Africa | Other Africain countries | Total | |

|---|---|---|---|

| Life premiums | |||

| 2000 | 19 410 | 1 072 | 20 482 |

| 2001 | 17 371 | 1 067 | 18 438 |

| 2002 | 16 592 | 1 495 | 18 087 |

| 2003 | 21 550 | 1 719 | 23 269 |

| 2004 | 23 497 | 1 734 | 25 231 |

| 2005 | 27 596 | 2 080 | 29 676 |

| 2006 | 33 106 | 2 582 | 35 688 |

| 2007 | 34 927 | 3 184 | 38 111 |

| Non Life premiums | |||

| 2000 | 3 551 | 3 112 | 6 663 |

| 2001 | 3 073 | 3 129 | 6 202 |

| 2002 | 2 983 | 3 735 | 6 718 |

| 2003 | 4 718 | 4 474 | 9 192 |

| 2004 | 6 203 | 4 989 | 11 192 |

| 2005 | 7 177 | 5 865 | 13 042 |

| 2006 | 7 637 | 6 549 | 14 186 |

| 2007 | 7 749 | 7 434 | 15 183 |

| Total Life and non Life | |||

| 2000 | 22 961 | 4 184 | 27 145 |

| 2001 | 20 444 | 4 195 | 24 639 |

| 2002 | 19 576 | 5 229 | 24 805 |

| 2003 | 26 268 | 6 193 | 32 461 |

| 2004 | 29 700 | 6 722 | 36 422 |

| 2005 | 34 773 | 7 945 | 42 718 |

| 2006 | 40 743 | 9 131 | 49 874 |

| 2007 | 42 676 | 10 618 | 53 294 |

South Africa's share in the Africain market in 2007

Central Africa

In Central Africa, the situation presents itself as a patchwork of emerging markets with unequal sizes, some of which are organised in regional groups such as CIMA. Shining in the pack are Nigeria, Angola, Kenya (leader of East Africa) and Côte d'Ivoire, leader of the CIMA zone.The structural reforms introduced in Nigeria and the restart of the Angolan economy have provided interesting development perspectives.

Northern Africa

In northern Africa, in the countries neighbouring the Mediterranean sea, the sector is undergoing a restructuring process. It is endowed with a strong growth potential thanks to high demography (75 million inhabitants in Egypt, 34 million in Algeria and 31 million in Morocco), 2007 high GDPs (Algeria 4.8%, Tunisia 6%, Egypt 10.9%) and the presence of foreign stakeholders who are investing in local infrastructure and in the field of energy.However, these markets remain small-scaled with still poor per-capita contributions. In this group, the Moroccan insurance market, ranking second on the continent, generated a turnover of 2 153 million USD in 2007, among which 716 million USD in life insurance and 1 437 million USD in non life insurance. Egypt comes third in the continental standing with an overall premiums volume of 1 090 million USD, 516 million USD in life insurance and 574 million USD in non life insurance.

Market constraints and specificities

While the insurance sector operates according to universal standards and makes use of the same techniques, the African market has specificities of its own.

While the insurance sector operates according to universal standards and makes use of the same techniques, the African market has specificities of its own.

Socio-cultural factors such as conventional solidarity and the principle of proximity are indeed at the core of the social structures that define economic exchanges.

Different prevention and risk management community strategies like tontines or reciprocal donations have been established by part of the populations, especially those with low incomes. These traditional systems of mutual help that allow to face daily contingencies are objective impediments against recourse to modern insurance.

Other factors including the lack of insurance culture and the negative image associated with insurers regarded to be slow at settling claims make up the bulk of public opinion, triggering a lack of trust and a real apathy.

The offer of insurance products seems to be often inappropriate with the reality of the local populations while risk assessment remains hardly accurate.

Likewise, the systems are failing due to the inadequacy of the regulations, the distribution networks, the products and procedures pertaining to claim settlement.

A hardly favorable framework

The main reasons behind the low insurance penetration rates on the continent are related to economic factors.

The poor gross domestic product and income per household and per capita, the failing infrastructures, backward education and health have triggered a growing pauperisation of rural and urban populations. Deprived of adequate resources for living, the population is unable to save for the future. Being elite-based, insurance remains confined to industrial risks.

In addition to this finding, we note the scarcity of controls carried out by the State in a sector that needs to be strictly regulated in view of the heavy financial and economic implications at stake.

Finally, problems of governance, common practice of fraud and inadequate professional training, namely in small companies are contributing factors which hinder the development of insurance.

Main obstacles

Apart from the inadequate purchasing power of the local populations and their lack of knowledge about insurance, the main factors hampering the development of insurance are as follows:

- The deficiency of the regulations and of state control

- The stiff policies for the granting of licences to companies

- The non-compliance with insurance obligation

- The insurance relocation of large risks

- The heavy taxation of insurance contracts

- The importance of premiums arrears

- The insufficiency of training structures

- The weakness of bancassurance

- The inadequacy of products with the local contexts

The market structure

The poor representativeness of the African insurance companies is accounted for by the structural deficiencies of a sector that is too dissimilar.

Numerous companies with limited capital, holding tight shares of the market, are cohabitating with the subsidiaries of international and Pan-African groups. As a result, a number of companies have found themselves squeezed by a plethora of small insurers devoid of financial resources.

Regarding the structure of risks, motor risk and marine insurance is pervasive unlike life insurance which is undergoing a slow growth. The last remark does not apply to South Africa which has a very powerful life market.

Except South Africa (12.5%) and Namibia (5.7%), the African continent has a very low life penetration rate. These life penetration rates are only 0.65% in Côte d'Ivoire, 0.23% in Cameroon, 0.8% in Kenya and 0.4% in Egypt.

For the African populations, insurance tariffs remain very high despite the establishment of a competitive market. Another African feature consists in the difficulties encountered by the insurers in recovering premiums from already-indebted states.

A rationale of change

Most of the countries have undertaken reforms of their legislation to put an end to the state monopoly, opening the sector to foreign investments, making sure their financial institutions are in compliance with international standards and enrolling insurance structures in international competition.

Most of the countries have undertaken reforms of their legislation to put an end to the state monopoly, opening the sector to foreign investments, making sure their financial institutions are in compliance with international standards and enrolling insurance structures in international competition.

In Central Africa, insurers are working hard for decades now to boost their sector by proceeding first to its regulation. An insurance market has gradually come round and become organized. The Conference Internationale des Contrôles d'Assurances (CICA), organised as of 1960 by French-speaking states addressed the issue of reinsurance, then dealt with insurance promotion with the establishment of a training institute: Yaoundé's International Insurance Institute (Cameroon).

The CICA pushed for the creation of national insurance companies. Inter-state institutions have been set up. The Conférence Interafricaine des Marchés d'Assurance (CIMA), set up in 1992 within the franc area triggered the CIMA code which allowed the establishment of a harmonised space of insurance adapted to its economic environment, even prior to the European Economic Community. The same consolidation attempts have been made in eastern Africa and in the Indian Ocean.

Periodic inter-African meetings make it possible to exchange opinions and outline major orientations of the business. The Africain Insurance Organization (AIO), based in Douala (Cameroon), set up in 1972 to coach the development of the insurance markets in the continent, has pursued the plan backed up by UNCTAD and the World Bank. These plans are designed specifically to foster computer tools, consolidate training centres for insurance business and develop non-compulsory products (life insurance, supplementary pension, credit insurance and bancassurance.

The establishment in 1976 in Yamoussoukro (Côte d'Ivoire) of the Fédération des Sociétés d'Assurances de Droit National Africaines (FANAF), which currently counts approximately 140 members, is worthnoting.

Equal interest has been shown to the prevention against natural catastrophes and environmental risks with the creation of an African prevention centre in Casablanca (Morocco).

Insurance, a driver of development

Within an environment characterized by the presence of sound facilities, insurance may be an efficient catalyst for development. The mutualisation of risks triggers annihilation of uncertainties, which allows, thus, economic players to take full advantage of the opportunities and prompt job-generating growth.

Provided that risks are managed more efficiently and household saving is mobilised, life and non-life insurance may have a positive effect on economic growth. Nonetheless, insurance alone cannot offset legal uncertainty and political instability to attract investments. Insurance is just the reflection of a socio-economic picture.

As such, insurance undoubtedly stands as a medium of support and back up for the development of all economic sectors. The overall volume of insurance contributions in each of the regional market is closely linked to the economic activity of the country concerned.

Development requirements

The insurance sector, as a whole, is required to contribute to the emergence of a national financial market. Insurers are called upon to assume their role of motivators of long-term saving. To lure saving, they will have to come up with attractive products. The State, on its part, is able to facilitate the development of saving products by means of an appropriate taxation and an efficient control.

Regional integration is likely to allow intervention on a bigger market by improving insurers' competitiveness. As a matter of fact, the CIMA zone market stands as a good example of economic integration.

Insurance companies, unable to operate fully on such tight markets, have to deploy more and more sophisticated technical tools. A successful regional integration would allow having a more structured insurance market perfectly fit to meet the needs of customers, individuals, firms or civil services.

The role that may be played by insurance to advance economic development also depends on the actions undertaken by the supervisory authority to upgrade, strengthen and boost the sector.

Priority measures pertain to the consolidation of insurance companies by namely:

- Raising their capital

- Updating and upgrading the regulatory corpus in conformity with international standards

- Improving the quality and the reliability of services

- Having recourse to technology in order to improve and extend the distribution networks

- Implementing strategies of communication and awareness raising targeting population

- Intensifying training of the entire insurance sector

- Fostering the internal mobility

Development perspectives

As far as household risks are concerned, insurance demands may not only stem from “compulsory” insurance such as motor but also from life: health, retirement, life and capitalisation.

Bancassurance has to be fostered as it allows the swift development of household risks. The recent development reported on the Moroccan market is partly accounted for by bancassurance which managed to generate new premiums.

Insurance designed for farmers, households and for the generalisation of health insurance are regarded as potential markets.

Meeting the needs of national and foreign customers, firms and individuals requires the availability of classical products as well as innovating ones. It is up to insurers to come up with products that are both affordable and geographically and culturally able to promptly resolve typically African problems.

In full swing, the micro-insurance sector is, within this context, both competitive and complementary to classical insurance.

While in general, Africa seems to be an under-developed market, it is endowed with an unquestionable potential thanks to its natural wealth. It is a future pool which will be a source of development, thus, a creator of wealth. Finally, Africa's sizable asset is its human resources since more than 50% of its inhabitants are below the age of 25.

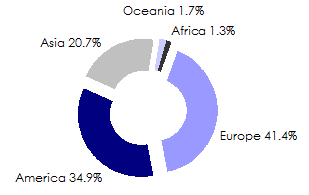

African insurance in the world 2000-2007

in millions USD| America | Europe | Asia | Oceania | Africa | World | |

|---|---|---|---|---|---|---|

2000 | 945 605 | 786 089 | 647 119 | 38 946 | 27 145 | 2 444 904 |

2001 | 943 528 | 767 432 | 595 412 | 34 707 | 24 551 | 2 415 720 |

2002 | 1 094 583 | 846 697 | 628 918 | 37 469 | 24 805 | 2 632 473 |

2003 | 1 158 987 | 1 035 838 | 684 970 | 46 103 | 32 461 | 2 958 359 |

2004 | 1 228 539 | 1 206 191 | 7398 918 | 54 088 | 36 422 | 3 264 158 |

2005 | 1 259 280 | 1 335 057 | 765 211 | 56 190 | 42 718 | 3 445 816 |

2006 | 1 333 591 | 1 455 509 | 777 680 | 58 238 | 49 874 | 3 674 892 |

2007 | 1 417 464 | 1 680 693 | 840 601 | 68 818 | 53 294 | 4 060 870 |

Market shares 2007 | 34.9% | 41.4% | 20.7% | 1.7% | 1.3% | 100% |