The Indian insurance market

Country profile

- Area: 3 287 590 Km2

- Population (2006): 1 095 351 995 inhabitants

- GDP (2006): 796.1 billion USD

- GDP per capita (2006): 762 USD

- GDP growth rate (2006): 8.5 %

- Inflation rate (2006): 5.3%

Main cities

(per number of inhabitants)

- New Delhi (capital): 13.8 millions

- Mumbai: 18 millions

- Kolkota: 14.6 millions

Insurance market features

- Regulatory authority: Insurance Regulatory and Development Authority

- Premiums (2006-2007): 43 billion USD

- Insurance density (2006-2007): 39 USD

- Penetration rate (2006-2007): 5.4 %

The first life insurance company established in the country, Oriental Life Insurance Company, started operating in 1818. As to property insurance, it dates back to 1850 with the opening of the first agency called Triton Insurance Company.

The Indian market is governed by the principal law: the 1938 Insurance Act.

The contemporary history of the insurance business has been through successive stages: pre-nationalisation, nationalisation and liberalisation.

The pre-nationalisation stage

Until its nationalisation, the market had been characterized by the presence of a host of operators and subsidiaries of foreign companies.

The nationalisation stage

New India Assurance headquarters, Mumbai © Colin Rose, CC BY-SA 2.0 New India Assurance headquarters, Mumbai © Colin Rose, CC BY-SA 2.0 |

The promulgation of the 1956 Life Insurance Corporation Act gave birth to the company life Insurance Corporation of India (LIC), made up of the merger of several companies.

The adoption of the 1972 General Insurance Business Nationalisation Act led one year later to the creation of General Insurance Corporation (GIC), a holding which gathers 4 entities running about 107 property insurance companies, including subsidiaries of foreign companies. The headquarter of each of these GIC subsidiaries is located in one of the Indian megalopolis:

- National Insurance Company Ltd. in Kolkota

- New India Assurance Company Ltd. in Mumbai

- Oriental Insurance Company Ltd. in New Delhi

- United India Insurance Company Ltd. in Chennai

Liberalisation

© Nichalp, CC BY-SA 3.0 © Nichalp, CC BY-SA 3.0 |

Putting the final touches to the economic restructuring started as of 1991, the government promulgated a law specific to the insurance sector called the 1999 Insurance Regulatory and Development Authority Act which stands as a remarkable revolution with the end of the state monopoly and the opening of the sector to private investments.

The master piece of the provision is the Insurance Regulatory and Development Authority (IRDA). Established in 1999 and operational as of 2000, the sector's supervisory and regulatory authority is entrusted with the following tasks:

- Starting out the process of liberalisation

- Promoting the sector

- Developing insurance cover

- Guaranteeing its financial security

- Protecting the interests of the insured

Within the framework of the sector's reorganisation, IRDA set up a host of annexed institutions:

- The Tariff Advisory Committee (TAC)

- The Loss Prevention Association of India (LPA)

- The Institute of Insurance Ombudsman which has 12 ombudsmen throughout the country

- The Insurance Association of India

- The General Insurance Public Sector Association (GIPSA)

The public sector's restructuring has ushered in two key decisions:

The public sector's restructuring has ushered in two key decisions:

- The four subsidiaries companies of General Insurance Corporation (GIC) become autonomous entities and General Insurance Corporation (GIC) becomes a national reinsurer

- All state owned and private companies operating on the market are required to yield 20% of each written policy to the benefit of GIC.

The key provisions in the law

- The insurance sector is split into 4 classes of business: life, fire, marine and property

- The minimum capital required for the establishment of a company is set at:

- 1 000 million INR (25 000 USD) for a property or life insurance company

- 2 000 million INR (50 000 USD) for a reinsurance company

- The level of foreign shareholding is limited to 26% with the prospect of raising it to 49% at a later stage.

- The establishment of foreign companies must be carried out by the exclusive means of joint ventures with local operators.

- The obligation that a minimum percentage of the premiums written (15% in life insurance and 5% in non-life insurance) emanate from rural areas (Rural Sector Obligation), and from the social sector (Social Sector Obligations).

The different segments of the non-life insurance sector (fire, CAR, marine and motor) are submitted to a tariff regulation. The rates, terms and conditions are governed by a legal institution called Tariff Advisory Committee. Royal Insurance buildings, © Biswarup Ganguly, CC BY 3.0

Royal Insurance buildings, © Biswarup Ganguly, CC BY 3.0- As of 2003, brokers have been authorized to operate on the market according to the following terms setting the minimum capital required:

- 5 million INR (127 000 USD) for property insurance brokerage

- 20 million INR (508 000 USD) for reinsurance brokerage

- 25 million INR (635 000) for insurance and reinsurance brokerage

An ongoing process : the deregulation

In January 2007, IRDA has sped up the move by proceeding to a tariff dismantlement. To avoid the risk of destabilizing the market, the deregulation process shall be carried out in two stages:

- As of January 2007 : insurers are authorized to proceed to a 20% tariff increase for the new policies pertaining to the fire, CAR and marine classes of business.

- The second step is expected in April 2008 with the lifting of all restrictions.

Main features of the Indian market

|

Traditionally, Indians are rather keen on real-estate business, gold and bank savings. But the social mutations triggered by the country's high economic growth are shaping new behaviours among which the more frequent recourse to insurance.

The country remains poorly insured with 80% of the population deprived of life insurance, health or property covers.

The Indian insurance market accounts for 0.6% of the world market whereas the country's population stands for 17% of the entire world population.

The insurance penetration rate is of 5.4%, it remains poor in comparison with that of the USA 8.5%.

The per capita premium amounted to 39 USD in 2004 while the world average is of 224 USD.

The market in figures

The market has showed a strong dynamics with an annual growth rate of 15 to 20%, which provides it with a great potential.

The 2006-2007 premium volume amounts to 43 billion USD. The most important classes of business are life, motor, marine, fire and health.

Life insurance

Life insurance has made a 64% rise in 2006-2007 with a turnover of 37.22 billion USD against 22.58 billion USD in 2005-2006.

Property insurance

The property insurance has reported a 20.5% growth rate in 2006-2007 with an overall premium volume of 5.81 billion USD against 4.82 billion USD in 2005-2006.

A market with a high-potential growth

The Indian market's main assets are:

- The country's demographic weight

- Growth acceleration

- The ever-growing demand in insurance

- The emergence of a market in semi-urban and rural areas with large population concentrations

The insurance share in GDP has gone up from 3.14% in 2005-2006 to 5.4% in 2006-2007.

The insurance business has reported a premium growth rate of 57% in 2006-2007 while the world rate is set at 8.06%.

India has jumped four places in world ranking from 19th position in 2005 to 15th position in 2006.

The rural sector

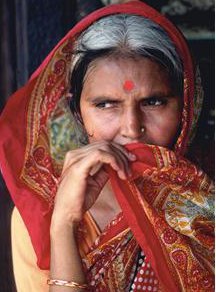

© Annadatha, CC BY 2.0 © Annadatha, CC BY 2.0 |

The rural sector stands as an enormous reserve with a high concentration of labour. Agriculture remains a vital sector of the national economy and absorbs 2/3 of the country's population. It accounts for 30% of GDP.

That is why, out of the 14 non life insurance companies, two are specialized in the agricultural insurance. Foreign companies are visibly present on this segment of activities in India.

Partnership

With the exception of the company Reliance, all private companies have a foreign partner:

- AIG (United States)/Tata

- Chubb (United States)/HDFC

- Allianz (Germany)/Bajaj

- Royal & Sun Alliance (United Kingdom)/Sundaram

- Lombard (Canada)/ICICI Bank

- Tokio Marine (Japan)/IFFCO

- Mitsui Sumitomo(Japan)/Murugappa group

A market still under the grip of the public sector

State owned companies still hold 70% of the non life market shares. In addition to the 5 companies of the public sector, National Insurance Co Ltd., New India Assurance Co Ltd., Oriental Insurance Co Ltd., United India Insurance Co Ltd. and Export Credit Guarantee Corporation (ECGC), it is important to add Agriculture Insurance Company Ltd, a company which is exclusively dedicated to farmers' needs.

Until 2000, the market had been dominated by two giants, the non-life holding General Insurance Company (GIC) whose subsidiaries have become autonomous and the company Life Insurance Corporation (LIC) which holds 80% of the market shares thanks to its well-established brand image and to its large distribution network (2000 branches, 1 million insurance salesmen). LIC is, therefore, poised to remain the country's first insurance company for the 10 to 15 years to come.

LIC is equally present on the foreign market through joint ventures in several countries : Kenya, Malaysia, Bahrain, and Nepal.

Impact of the liberalisation process

Bandra-Worli bridge, Mumbai, India © Ankitbhatt, CC BY-SA 3.0 Bandra-Worli bridge, Mumbai, India © Ankitbhatt, CC BY-SA 3.0 |

The process of liberalisation has pushed up the business in terms of volume and service quality.

The arrival of private companies, starting from 2000, has triggered a beneficial competition which compelled state owned companies to upgrade and invest in innovating products, the development and the diversification of their distribution networks and to adopt more aggressive marketing policies.

The private sector has achieved an impressive performance by consolidating its position on the market. Since its establishment in 1999, its share has increased from 9.33% in 2004-2005 to 30% in 2006-2007.

- In non-life insurance, the private sector's progression is on a steady rise, going up from 5.7% in 2003 to 12.9 in 2004 and to 21.9% in 2005.

- The private companies (including foreign ones) have allowed a notable improvement of the quality and choice of services. Most non-life insurance companies are adopting “multi-channel” strategies allying with companies or bankers. The bancassurance network ensures 20% of the non-life market, and the sale of non-life insurance products via the Internet account for 10% of the non life sector's sales in 2005.

- Reinsurance: As regards reinsurance, the objective of the Indian authorities is to maximize premiums' retention rates in India. For the non-life insurance companies, a compulsory 20% minimum of insured risks must be placed with the national reinsurer, General Insurance Corporation (GIC). Beyond those 20%, a non-life insurance company may reinsure its risks at other reinsurance or insurance companies, including those of the private sector.

Chronology

- 1818:The first life insurance company

- 1850:The first non-life insurance company

- 1938:The major law, the Insurance Act

- 1956:The nationalisation of life insurance, the creation of Life Insurance Corporation of India (LIC)

- 1973:The nationalisation of the non-life insurance, the creation of General Insurance Corporation (GIC)

- 1999:The liberalisation of the sector, Insurance Regulatory and Development Authority Act

- 2000:The start of operation for the Insurance Regulatory and Development Authority (IRDA)

- 2000:The dismantling of the holding General Insurance Corporation (GIC) which becomes a national reinsurer

- 2003:Authorizing brokerage activities

- 2007:Partial liberalisation of tariffs

- 2008:Full liberalisation of tariffs

Currently, the private market has 16 life insurance companies and 12 non-life insurance companies.

| Life insurance | Non life insurance |

|---|---|

|

|