The international financial crisis

The role of banks

Banks have three sources to finance the loans they supply to individuals, companies and even states:

- The different patterns of client deposits : current accounts, saving accounts, life insurance, ...

- Sums generated by the banks' activities: loan repayment, interest on loans, investment profits,

- Loans contracted from local banks or ultimately from the country's central bank.

Northern Rock bank run, Sept. 2007 © Lee Jordan (modified picture), CC BY-SA 2.0 Northern Rock bank run, Sept. 2007 © Lee Jordan (modified picture), CC BY-SA 2.0 |

Banks, massively invest their funds on the financial markets. Their pole of liquidity, entrusted with the management of the money immediately available, can only keep the minimum of liquid cash or semi-liquid for the sake of the day-to-day operations (withdrawals, …). This system operates as long as each player strictly fulfils his commitments.

The crisis mechanisms

Act 1: The subprime crisis

A “subprime” is a risky credit. It is a type of a mortgage credit that first appeared in the United States. This property credit is pawned on the borrower's estate.

As far as creditors are concerned, subprime credits are deemed to be individually risky, but by and large safe and profitable. This perception rested on the presumption of a rapid rise of estate values. If a borrower fails to honour repayment, the creditor recovers the property and sells it out.

When estate started collapsing, borrowers could no longer manage to refund their debts to their banks. Property credits granted to low-income households, therefore, proved to be disastrous for mortgage-funding bodies. Indeed, these households acquired their houses at high price and find themselves unable to repay. Creditors, therefore, proceed to the liquidation of the mortgaged houses at lower prices, recovering only part of their funds which implies losses and reduction of their liquidities.

In 2007, approximately three million American households were in default of payment.

Act 2: Securitization disseminates the crisis

The financial institutions which granted loans to low-income households have minimized their exposure to this kind of risks by transferring their exposure to other financial institutions through the creation of financial products (collaterized debt obligation, CDO) that are more or less risky and complex. This securitization allows them also to recover part of the loans before their maturity. Mortgage-funding bodies disengage, therefore, from loan repayment risks by disseminating CDOs throughout the system.

The financial institutions which granted loans to low-income households have minimized their exposure to this kind of risks by transferring their exposure to other financial institutions through the creation of financial products (collaterized debt obligation, CDO) that are more or less risky and complex. This securitization allows them also to recover part of the loans before their maturity. Mortgage-funding bodies disengage, therefore, from loan repayment risks by disseminating CDOs throughout the system.

All finance stakeholders exchange CDOs losing visibility at the rhythm of financial set-ups, with investors who do not always know what the drift is all about. Yet these CDOs continue to be exchanged like mere shares on the markets.

As long as stakeholders honor their commitments, the system shall continue to operate; CDOs (often with a strong leverage effect) are lucrative. To further benefit from the by-products, some bodies have set up SIV (Structured Investment Vehicle, see Atlas Magazine, June 2008) in order to avoid the financial market's prudential rules and be able to invest there massively.

Act 3: Securitization, the system's gangrene

The defaulting mortgage loan refunds are multiplying dramatically and the financial products that are endorsed to them are abruptly losing value. These assets become undesirable and their circulation comes to a halt. Banks find themselves devoid of the funds required for their current operations. For some of them, the liquidity crisis turns into bankruptcy.

The ultimate act : From the liquidity crisis to the collapse

Bearn Steams, which has been running 200 billion USD, collapses when its financial losses reached 20 billion USD in only four days. The company could not manage to find the necessary liquidity for its operations.

Bearn Steams, which has been running 200 billion USD, collapses when its financial losses reached 20 billion USD in only four days. The company could not manage to find the necessary liquidity for its operations.

This lack of liquidity has also caused the fall of most largest banking groups and AIG, one of the main insurers. The latter has been the victim of its own investment pole, just like banks, and not to its activities as insurer, which remain profitable.

Trust vanished and the pen ultimate rampart ensuring due process of the financial system collapses. Banks ceased to lend for fear they could no longer recover their funds, which further amplified the liquidity crisis. It is the breakdown of the inter-bank system.

States, the system's ultimate rampart intervene: On September 7, Fannie Mae and Freddie Mac are bailed out by the US Treasury Department. September 15, Lehman Brothers goes bankrupt and Merryl Lynch is taken over by Bank of America. Two days later, AIG is partially nationalized. Nationalization moves are also seen in France, Belgium, Luxemburg and England where the country's main banks are rescued courtesy of the bail-out plan.

Within this mood, the stock market shares crash beginning with banks' and insurers'. Banks stop lending to companies. It is the entire economy which is on the line.

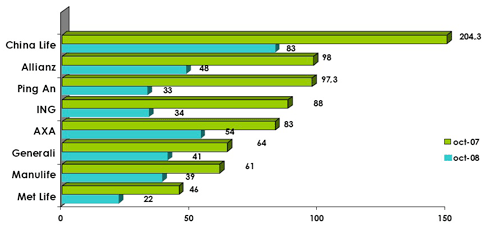

Insurers' stock market capitalization

in billion USD Source: Le Monde

Source: Le MondeInsurers' and reinsurers' stock market variation*

Companies | Countries | Variation |

|---|---|---|

AIG | United States | -97.08% |

ALLIANZ | Germany | -59.08% |

AVIVA | United Kingdom | -63.26% |

AXA | France | -48.32% |

GENERALI | Italy | -36.55% |

MAPFRE | Spain | -24.92% |

OLD MUTUAL | United Kingdom | -74.11% |

SWISS LIFE HOLDINGS | Switzerland | -59.86% |

MUNICH RE | Germany | -32.10% |

SWISS RE | Switzerland | -46.55% |

The crisis impact on the insurance sector

Even if we consider that the risk of a spin-off effect of the crisis on the insurance sector has not yet occurred, some companies' exposure to “toxic products” and the stock markets' nosedive have already caused considerable damages which are likely to affect adversely the 2008 results.

- In the United States: Following the losses triggered by the bankruptcy of Lehman and Brothers and the state's takeover of AIG, Hartford Financial is undergoing difficulties as its rating has been lowered by the agency Fitch Rating. The trend continues dragging in the process both Metropolitan Life and Genworth Financial.

- In Japan: Following the abrupt crash of its shares value, the company Yamato Life Insurance sank into bankruptcy on October 9, 2008.

- In Europe: Most big companies have sustained substantial depreciation of their portfolios as a result of their financial investments. While reiterating their solvency and their ability to withstand trouble, Generali, AXA, Aviva, Allianz, ING and Aegon have announced big losses.

The bank insurer Fortis is regarded as the first casualty of the financial Tsunami come from the United States. Following the intervention of the three Benelux countries which injected 14.56 billion USD to bail out its capital, the group has been nationalized and dismantled. For the sums of 18.85 billion USD, the French bank Paribas has taken control of Fortis by acquiring 75% of its banking activities and 100% of its insurance transactions in Belgium.

Following the strong devaluation of its stakes in the bank Dexia's capital, nationalized in emergency by the Belgian, French and Luxemburgian governments, the Belgian insurer Ethias announced its obligation to recourse to foreign capitals to restore its solvency margin, seriously strained by plummeting stock markets.

- In the Middle East: Because of their inter-connection with world markets, Gulf countries expect their economies to be adversely impacted by the event. The Saudi stock market (the most important in the Arab world), as well as those of Dubai, Kuwait and Qatar have declined. By October 8, the seven markets of the Gulf had lost more than 800 million USD of their capitalization.

- In Africa: Only South Africa may be hard hit. As the other countries' financial systems are hardly integrated in international finance, they will sustain minor damages. Nevertheless, the African countries may witness an economic slowdown due to the cancellation or postponement of various foreign projects.

Crisis outline

- October 2, 2008:Adoption, by the American government, of a rescue plan worth 700 billion USD to address bad assets

- September 25, 2008:Bankruptcy of Washington Mutual, the first saving fund bought out by JP Morgan bank

- September 16, 2008:Takeover of AIG for the sum of 85 billion USD

- September 15, 2008:Bankruptcy of the bank Lehman & Brothers

- September 7, 2008:Nationalization of Fannie Mae and Freddie Mac for the sum of 200 billion USD

- July 28, 2008:The American Congress votes a rescue plan of the estate sector designed for the 400 000 property owners threatened by seizure

- August 2007:Collapse of the subprime market