The Turkish insurance market

Insurance market features

- Regulatory authority: General Directorate of Insurance -

Under-secretariat of Treasury - Premiums (2003): 3 544 millions USD

- Insurance density (2003): 50.13 USD

- Penetration rate (2003): 0.77%

2003 market structure

Actors | Number |

|---|---|

Non life companies | 35 |

Life companies | 24 |

Reinsurance companies | 3 |

Private pension funds | 11 |

Number of insurance agencies | 17 576 |

Number of bank guichets* | 13 271 |

Identity

- Area: 780 580 Km2

- Population (2004):

70 700 000 inhabitants - GDP (2003) :

458.5 billion USD - GDP per capita (2003):

6 500 USD - GDP growth rate (2003): 5.8%

- Inflation rate (2003): 25.3%

- Main economic sectors: textile industry, household appliances, motor industry, agriculture (tobacco, cotton, sugar, cattle), food industry, tourism

Major cities

(in number of inhabitants)

- Istambul: 10 500 000

- Ankara (capital): 3 700 000

- Izmir: 3 200 000

- Bursa: 2 000 000

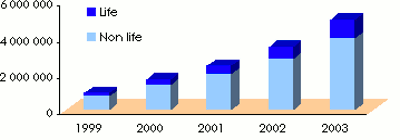

Life and non life premiums' evolution: 1999-2003

in billion TRL| Premiums | 1999 | 2000 | 2001 | 2002 | 2003 |

|---|---|---|---|---|---|

Non life | 174 869 | 326 197 | 461 349 | 671 440 | 1 029 920 |

Life | 743 783 | 1 367 415 | 1 961 609 | 2 825 944 | 3 944 278 |

Total | 918 652 | 1 693 612 | 2 422 958 | 3 497 384 | 4 974 198 |

Non life premiums split by class of business and by company in 2003

in millions USD| Fire | Marine | Casualty | Engg. | Agric. risks | Health | Non life total | Life | Grand total | |

|---|---|---|---|---|---|---|---|---|---|

AXA OYAK | 55.13 | 13.26 | 226.83 | 11.04 | 0.05 | 0.00 | 306.31 | 0.00 | 306.31 |

ANADOLU ANONIM TÜRK | 89.16 | 23.15 | 176.25 | 15.52 | 0.03 | 0.00 | 304.11 | 0.00 | 304.11 |

AKSIGORTA | 69.12 | 13.47 | 150.50 | 10.30 | 0.35 | 8.41 | 252.15 | 3.40 | 255.55 |

YAPI KREDI | 33.74 | 5.57 | 85.69 | 12.28 | 0.00 | 80.40 | 217.68 | 0.00 | 217.68 |

KOC ALLIANZ | 69.56 | 15.16 | 112.83 | 16.46 | 1.17 | 0.12 | 215.30 | 0.00 | 215.30 |

GÜNES | 54.19 | 10.53 | 105.60 | 25.41 | 0.88 | 3.68 | 200.29 | 1.32 | 201.61 |

ISVICRE | 27.09 | 10.97 | 124.03 | 3.83 | 1.36 | 0.00 | 167.28 | 0.00 | 167.28 |

BASAK | 35.76 | 9.52 | 90.02 | 10.53 | 6.90 | 7.88 | 160.61 | 3.34 | 163.95 |

RAY | 15.96 | 4.27 | 77.60 | 5.92 | 0.00 | 0.00 | 103.75 | 0.00 | 103.75 |

GARANTI | 26.76 | 8.29 | 35.22 | 7.79 | 0.00 | 6.50 | 84.56 | 0.00 | 84.56 |

T. GENEL | 18.01 | 4.26 | 48.01 | 6.31 | 0.00 | 3.17 | 79.76 | 0.00 | 79.76 |

COMMERCIAL UNION | 17.85 | 3.54 | 35.80 | 3.60 | 0.00 | 0.00 | 60.79 | 0.00 | 60.79 |

FINANS | 8.81 | 1.64 | 40.62 | 2.05 | 0.00 | 0.00 | 53.12 | 0.00 | 53.12 |

GÜVEN | 7.02 | 1.58 | 34.32 | 1.24 | 3.43 | 1.04 | 48.63 | 0.00 | 48.63 |

SEKER | 7.01 | 1.01 | 28.95 | 2.57 | 0.29 | 0.06 | 39.89 | 0.48 | 40.37 |

ANKARA ANONIM TÜRK | 4.19 | 0.78 | 33.01 | 0.91 | 0.00 | 0.00 | 38.89 | 0.00 | 38.89 |

GENERALI | 10.59 | 1.42 | 16.81 | 3.47 | 0.00 | 0.06 | 32.35 | 0.01 | 32.36 |

ISIK | 7.81 | 1.56 | 18.15 | 1.15 | 0.00 | 0.35 | 29.02 | 0.00 | 29.02 |

BATI | 5.09 | 0.83 | 19.01 | 0.76 | 0.00 | 1.48 | 27.17 | 0.06 | 27.23 |

TEB | 8.26 | 3.06 | 12.62 | 2.12 | 0.00 | 0.00 | 26.06 | 0.00 | 26.06 |

AIG | 3.59 | 2.60 | 16.92 | 2.72 | 0.00 | 0.00 | 25.83 | 0.00 | 25.83 |

IHLAS | 1.98 | 0.30 | 18.48 | 0.28 | 0.00 | 0.38 | 21.42 | 0.00 | 21.42 |

BIRLIK | 5.10 | 0.26 | 14.59 | 0.70 | 0.00 | 0.25 | 20.90 | 0.00 | 20.90 |

HÜR | 0.67 | 0.12 | 10.94 | 0.03 | 0.00 | 0.00 | 11.76 | 0.00 | 11.76 |

T. NIPPON | 0.67 | 0.13 | 7.57 | 0.19 | 0.00 | 0.20 | 8.76 | 0.00 | 8.76 |

KAPITAL | -0.20 | 0.02 | 5.91 | -0.15 | 0.00 | 0.00 | 5.58 | 0.00 | 5.58 |

TICARET | 1.11 | 0.07 | 1.85 | 0.05 | 0.00 | 0.00 | 3.08 | 0.00 | 3.08 |

TOPRAK | 0.12 | 0.03 | 1.23 | 0.17 | 0.00 | 0.00 | 1.55 | 0.00 | 1.55 |

SANKO | 0.53 | 0.64 | 0.19 | -0.08 | 0.00 | 0.00 | 1.28 | 0.00 | 1.28 |

RUMELI | 0.40 | 0.05 | 0.32 | 0.09 | 0.00 | 0.00 | 0.86 | 0.00 | 0.86 |

DEMIR | -0.07 | 0.12 | 0.79 | -0.05 | 0.00 | 0.00 | 0.79 | 0.00 | 0.79 |

EGS | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

MAGDEBURGER | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

G.I.C. DÜNYA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

MERKEZ | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -0.16 | -0.16 |

Total | 585.01 | 138.21 | 1 550.66 | 147.21 | 14.46 | 113.98 | 2 549.53 | 8.45 | 2 557.98 |

Evolution of the loss ratio split by class of business

| 2000 | 2001 | 2002 | 2003 | |

|---|---|---|---|---|

Fire | 39.60% | 65.97% | 42.16% | 38.30% |

Marine | 56.62% | 66.81% | 51.93% | 47.46% |

Casualty | 66.95% | 71.13% | 68.14% | 77.92% |

Engineering | 69.05% | 206.60% | 66.32% | 60.38% |

Agricultural risks | 36.00% | 50.03% | 60.09% | 113.10% |

Health | 76.04% | 76.66% | 74.75% | 80.98% |

Life premiums split by class of business and by company in 2003

in millions USD| Casualty | Health | Non life total | Life | Grand total | |

|---|---|---|---|---|---|

ANADOLU H. EMEKLILIK | 0.00 | 57.98 | 57.98 | 241.19 | 299.17 |

KOC ALLIANZ H. EMEKLILIK | 2.08 | 93.15 | 95.23 | 53.20 | 148.43 |

COMMERCIAL UNION H.E. | 0.00 | 1.70 | 1.70 | 103.54 | 105.24 |

YAPI KREDI EMEKLILIK | 0.02 | 0.00 | 0.02 | 85.42 | 85.44 |

AXA OYAK HAYAT | 4.36 | 31.52 | 35.88 | 35.84 | 71.72 |

BASAK EMEKLILIK | 0.29 | 19.65 | 19.94 | 27.86 | 47.80 |

VAKIF EMEKLILIK | 0.18 | 0.73 | 0.91 | 40.53 | 41.44 |

AMERICAN LIFE HAYAT | 2.83 | 3.88 | 6.71 | 24.85 | 31.56 |

ISVICRE HAYAT | 0.23 | 15.39 | 15.62 | 10.86 | 26.48 |

AK EMEKLILIK | 0.55 | -0.01 | 0.54 | 22.35 | 22.89 |

BAYINDIR HAYAT | 0.43 | 14.53 | 14.96 | 7.12 | 22.08 |

GARANTI EMEKLILIK | 0.00 | 0.00 | 0.00 | 19.90 | 19.90 |

DEMIR HAYAT | 0.12 | 12.42 | 12.54 | 5.19 | 17.73 |

GENEL YASAM | 0.00 | 0.04 | 0.04 | 17.05 | 17.09 |

ANKARA EMEKLILIK | 0.00 | 0.00 | 0.00 | 10.27 | 10.27 |

DOGAN EMEKLILIK | 0.02 | 0.02 | 0.04 | 9.70 | 9.74 |

BIRLIK HAYAT | 0.00 | 0.00 | 0.00 | 3.80 | 3.80 |

GÜVEN HAYAT | 0.00 | 0.00 | 0.06 | 2.27 | 2.33 |

RUMELI HAYAT | 0.01 | 0.05 | 0.06 | 1.14 | 1.20 |

EMEK HAYAT | 0.00 | 0.00 | 0.00 | 0.95 | 0.95 |

TOPRAK (GLOBAL) HAYAT | 0.00 | 0.00 | 0.00 | 0.58 | 0.58 |

SEKER HAYAT | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

IHLAS HAYAT | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

OYAK EMEKLILIK | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Total | 11.12 | 251.05 | 262.23 | 723.61 | 985.84 |

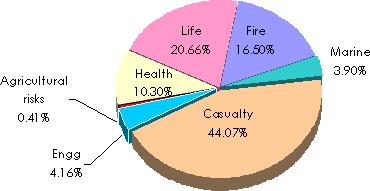

Premiums split by class of business

Exchange rate USD/TRL as at 31/12 | 1999 | 2000 | 2001 | 2002 | 2003 |

542 147.82 | 670 894.14 | 1 440 458.48 | 1 657 289.97 | 1 402 722.09 |

Survey prepared with the kind assistance of Best Re's Istanbul Regional Office with special thanks to Mr. Hafidh Hachani.

0

Your rating: None

Tue, 14/05/2013 - 11:02

The online magazine

Live coverage

16:28

16:04

11:51

04/24

04/24

Latest news