Tunis Re

It is thanks to the results achieved in the local market, traditionally less affected by losses, that Tunis Re has consolidated its financial soundness. The extraordinary events of 2011 will not have a long-term impact on the reinsurer who is poised to retrocede part of its underwritings.

It is thanks to the results achieved in the local market, traditionally less affected by losses, that Tunis Re has consolidated its financial soundness. The extraordinary events of 2011 will not have a long-term impact on the reinsurer who is poised to retrocede part of its underwritings.

|

| Lamia Ben Mahmoud |

| Chairman |

Being listed since March 2010, the company is targeting the international market to boost its sales. Three targets have been clearly identified: the Maghreb, which stands as a local market, Africa where a representation office is scheduled to open and the Middle East which accounts for 13% of underwritings in 2010.

The Tunisian reinsurer is after new clients. And to better penetrate the Arab and Asian markets, Tunis Re has established a retakaful unit, a class of business dotted with a strong growth potential.

Tunis Re in 2010

| Paid up capital | 31 540 500 USD |

| Turnover | 51 670 348 USD |

| Shareholder’s equity | 48 875 860 USD |

| Total assets | 231 983 181 USD |

| Net result after tax | 3 334 882 USD |

| ROE | 6.8% |

| Net loss ratio | 58% |

| Net combined ratio | 95% |

| Number of employees | 80 |

Management

| Corporate executive manager | Mounir Hachicha |

| Retrocession and technical executive manager | Samia Ben Youssef |

| Treaties acceptances manager | Musthapha Kotrane |

| Facultative acceptances manager | Mourad El Aroui |

| Takaful manager | Nadhim Cherif |

| Retrocession manager | Ridha Hertelli |

| Collection funds manager | Samir Ben Abid |

| Finance and accounting manager | Hela Nouira Youssef |

| Management control manager | Mounir El Behi |

| Marketing and statistics manager | Leila Baccouche |

Main shareholders

| The Tunisian government | 5.21% |

| Tunisian insurance companies | 32.68% |

| Tunisian banks | 30.04% |

| Others | 32.07% |

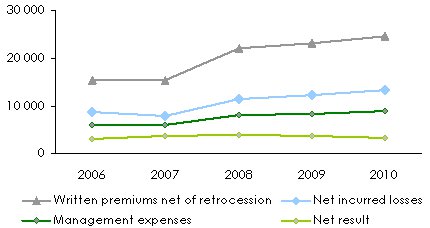

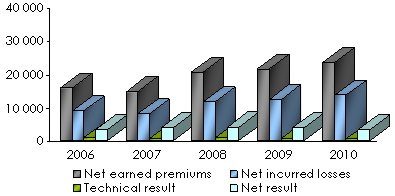

Main technical highlights: 2006-2010

in thousands USD| 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|

Gross written premiums | 41 028 | 43 294 | 46 822 | 46 378 | 51 671 |

Written premiums net of retrocession | 15 418 | 15 465 | 22 166 | 23 062 | 25 108 |

Net earned premiums | 15 738 | 14 661 | 20 472 | 21 256 | 23 442 |

Gross earned premiums | 42 006 | 41 538 | 42 865 | 42 298 | 44 376 |

Gross incurred losses | 17 098 | 15 075 | 16 985 | 21 705 | 64 973 |

Net incurred losses | 8 851 | 7 942 | 11 432 | 12 265 | 13 637 |

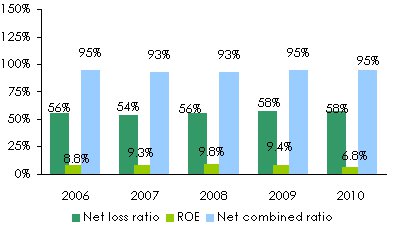

Net loss ratio | 56% | 54% | 56% | 58% | 58% |

Expenses ratio | 39% | 39% | 37% | 37% | 37% |

Management expenses* | 6 067 | 6 074 | 8 105 | 8 426 | 9 234 |

Technical result | 819 | 644 | 935 | 565 | 571 |

Financial income | 3 974 | 4 416 | 4 797 | 3 989 | 4 044 |

Net result | 3 205 | 3 773 | 3 963 | 3 847 | 3 335 |

Evolution of premiums, losses, management expenses and results: 2006-2010

in thousands USD

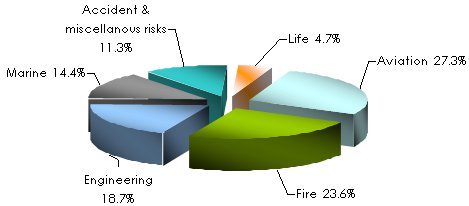

Turnover’s evolution per class of business: 2006-2010

in thousands USD| 2006 | 2007 | 2008 | 2009 | 2010 | 2010 shares | 2009/10 growth | |

|---|---|---|---|---|---|---|---|

| Non life | |||||||

Fire | 11 057 | 11 166 | 11 309 | 11 023 | 12 176 | 23.6% | 10% |

Accident and misc. risks | 6 668 | 5 820 | 5 911 | 6 148 | 5 846 | 11.3% | -5% |

Engineering | 4 973 | 7 450 | 9 652 | 9 352 | 9 682 | 18.7% | 4% |

Marine | 6 715 | 8 630 | 8 781 | 7 515 | 7 448 | 14.4% | -1% |

Aviation | 11 103 | 9 391 | 10 287 | 11 257 | 14 086 | 27.3% | 25% |

Total non life | 40 516 | 42 456 | 45 940 | 45 295 | 49 237 | 95.3% | 9% |

| Life | |||||||

Life | 511 | 838 | 882 | 1 083 | 2 434 | 4.7% | 125% |

Total | 41 027 | 43 294 | 46 822 | 46 378 | 51 671 | 100% | 11% |

Breakdown per class of business in 2010

Ratios’ evolution: 2006-2010

Exchange rate TND/USD as at 31/12 | 2006 | 2007 | 2008 | 2009 | 2010 |

0.77989 | 0.82781 | 0.78412 | 0.76309 | 0.7009 |

Contact

| Head office | Rue Borjine (ex 8006) n°7 Montplaisir (1) BP 29-1073, Tunis |

| Phone | (+216) 71 90 49 11 |

| Fax | (+216) 71 90 49 30 / 71 90 61 73 |

tunisre [at] tunisre [dot] com [dot] tn | |

| Website |