Turkey 2008

Breakdown of the 2006-2008 premiums per class of business

in USD| 2006 | 2007 | 2008 | |||||

|---|---|---|---|---|---|---|---|

| Written premiums | Shares in % | Written premiums | Shares in % | Written premiums | Shares in % | 2007-2008 evolution | |

| Non life | |||||||

Fire1 | 1 117 926 734 | 16.41 | 1 466 513 388 | 15.6 | 1 228 647 317 | 15.89 | -16.21% |

Marine | 244 210 733 | 3.58 | 311 613 717 | 3.31 | 271 561 415 | 3.51 | -12.85% |

Accident | 2 159 831 199 | 31.7 | 3 052 625 422 | 32.47 | 2 186 350 184 | 28.28 | -28.37% |

Motor | 1 043 597 980 | 15.31 | 1 409 542 296 | 14.99 | 1 352 924 052 | 17.5 | -4.01% |

Engineering | 303 685 441 | 4.46 | 446 946 436 | 4.75 | 352 035 481 | 4.55 | -21.23% |

Agricultural risks | 38 347 554 | 0.56 | 81 413 081 | 0.87 | 81 823 991 | 1.06 | -0.50% |

Health | 693 588 232 | 10.18 | 1 040 151 985 | 11.06 | 871 201 144 | 11.27 | -16.24% |

Other risks | 235 489 499 | 3.46 | 387 431 931 | 4.12 | 352 344 813 | 4.56 | -9.06% |

Non life total | 5 836 677 372 | 85.65 | 8 196 238 255 | 87.17 | 6 696 888 397 | 86.62 | -18.29% |

| Life | |||||||

Life | 977 632 302 | 14.35 | 1 206 017 646 | 12.83 | 1 034 064 332 | 13.38 | -14% |

Grand total | 6 814 309 674 | 100 | 9 402 255 902 | 100 | 7 730 952 729 | 100 | -17.77% |

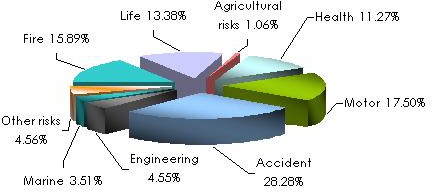

Breakdown of 2008's premiums per class of business

Breakdown of non life premiums' 2006-2008 per company

in USD| 2006 written premiums | Shares | 2007 written premiums | Shares | 2008 written premiums | Shares | 2007/08 growth | |

|---|---|---|---|---|---|---|---|

Axa | 666 433 344 | 11.41% | 964 802 024 | 11.77% | 810 260 742 | 12.10% | -16.02% |

Anadolu | 747 836 573 | 12.81% | 1 018 469 381 | 12.43% | 762 566 173 | 11.39% | -25.13% |

Allianz | 549 634 079 | 9.42% | 735 128 818 | 8.97% | 594 369 941 | 8.88% | -19.15% |

Ak Sigorta | 470 622 678 | 8.06% | 676 974 891 | 8.26% | 544 042 516 | 8.12% | -19.64% |

Gunes | 371 308 520 | 6.36% | 544 445 332 | 6.64% | 465 720 717 | 6.95% | -14.46% |

Ergo Isvicre | 361 460 418 | 6.19% | 543 696 301 | 6.63% | 458 505 558 | 6.85% | -15.67% |

Yapi Kredi | 412 982 616 | 7.08% | 536 433 815 | 6.54% | 414 666 417 | 6.19% | -22.70% |

Basak Groupama | 319 648 891 | 5.48% | 399 660 805 | 4.88% | 344 359 526 | 5.14% | -13.84% |

Eureko | 256 468 473 | 4.39% | 354 807 816 | 4.33% | 314 192 982 | 4.69% | -11.45% |

T.Genel | 188 637 404 | 3.23% | 274 784 029 | 3.35% | 226 976 180 | 3.39% | -17.40% |

Total of top 10 companies | 4 345 032 995 | 74.43% | 6 049 203 213 | 73.80% | 4 935 660 752 | 73.70% | -18.41% |

Fiba | 150 267 376 | 2.57% | 247 088 727 | 3.01% | 205 979 101 | 3.08% | -16.64% |

Ray | 185 348 152 | 3.18% | 231 232 519 | 2.82% | 180 037 574 | 2.69% | -22.14% |

Aviva | 129 789 906 | 2.22% | 190 625 839 | 2.33% | 165 216 664 | 2.47% | -13.33% |

Guven | 136 606 476 | 2.34% | 190 350 725 | 2.32% | 145 156 415 | 2.17% | -23.74% |

Aig | 86 196 616 | 1.48% | 131 855 582 | 1.61% | 122 369 399 | 1.83% | -7.19% |

Zurich1 | 81 625 196 | 1.40% | 132 229 614 | 1.61% | 122 074 693 | 1.82% | -7.68% |

Ankara | 130 631 834 | 2.24% | 163 686 842 | 2% | 120 646 639 | 1.80% | -26.29% |

HDI | 81 604 067 | 1.40% | 134 722 428 | 1.64% | 99 319 752 | 1.48% | -26.28% |

Genel Yasam | 41 208 761 | 0.71% | 84 895 751 | 1.04% | 72 186 061 | 1.08% | -14.97% |

Isik | 60 232 395 | 1.03% | 90 090 771 | 1.10% | 71 806 079 | 1.07% | -20.29% |

Total of top 20 companies | 5 428 543 774 | 93% | 7 645 982 012 | 93.28% | 6 240 453 129 | 93.19% | -18.38% |

Rest of the market2 | 408 133 598 | 7% | 550 256 243 | 6.72% | 456 435 268 | 6.81% | -17.05% |

Grand total | 5 836 677 372 | 100% | 8 196 238 255 | 100% | 6 696 888 397 | 100% | -18.29% |

Life premiums' breakdown 2006-2008 per company

in USD| 2006 written premiums | Shares | 2007 written premiums | Shares | 2008 written premiums | Shares | 2007/08 growth | |

|---|---|---|---|---|---|---|---|

Anadolu Hayat Emeklilik | 240 214 433 | 24.57% | 289 414 167 | 24% | 226 470 714 | 21.90% | -22.75% |

Basak Groupama Emeklilik | 129 492 390 | 13.25% | 183 614 589 | 15.23% | 193 956 099 | 18.77% | 5.63% |

Aviva SA | 92 739 543 | 9.49% | 131 876 127 | 10.93% | 89 940 202 | 8.70% | -31.80% |

Garanti Emeklilik | 69 552 315 | 7.11% | 92 252 052 | 7.65% | 81 113 386 | 7.84% | -12.07% |

Yapi Kredi Emeklilik | 78 895 371 | 8.07% | 84 210 150 | 6.98% | 72 316 533 | 6.99% | -14.12% |

Allianz Hayat ve Emeklilik | 61 625 247 | 6.30% | 69 946 663 | 5.80% | 51 248 057 | 4.96% | -26.73% |

Aig Hayat1 | 41 465 761 | 4.24% | 70 087 337 | 5.81% | 48 650 615 | 4.70% | -30.59% |

Birlik Hayat | 23 623 836 | 2.42% | 39 847 021 | 3.30% | 48 480 450 | 4.69% | 21.67% |

Axa Hayat | 49 781 334 | 5.09% | 68 108 348 | 5.65% | 47 509 630 | 4.59% | -30.24% |

Vakif Emeklilik | 60 316 176 | 6.17% | 68 183 833 | 5.65% | 38 294 302 | 3.70% | -43.84% |

Total of the top 10 companies | 847 706 405 | 86.71% | 1 097 540 287 | 91% | 897 979 988 | 86.84% | -18.18% |

Finans Emeklilik ve Hayat | - | - | 829 730 | 0.07% | 31 341 773 | 3.03% | 3677% |

Deniz Emeklilik ve Hayat | 1 689 816 | 0.17% | 17 784 225 | 1.48% | 22 319 384 | 2.16% | 25.50% |

Fortis Emeklilik ve Hayat | 17 966 821 | 1.84% | 16 319 582 | 1.35% | 14 839 175 | 1.44% | -9.07% |

Guven Hayat | 11 518 501 | 1.18% | 15 131 608 | 1.26% | 14 747 134 | 1.43% | -2.54% |

Ergo Isviçre Emeklilik ve Hayat | 17 171 017 | 1.76% | 22 202 430 | 1.84% | 14 178 687 | 1.37% | 36.14% |

Genel Yasam | 16 799 835 | 1.72% | 9 964 082 | 0.83% | 10 340 388 | 1% | 3.78% |

Cardif Hayat | - | - | - | - | 7 266 460 | 0.70% | - |

Acibadem Saglik ve Hayat | 6 595 539 | 0.67% | 7 717 569 | 0.64% | 5 008 943 | 0.49% | -35.10% |

Aegon Emeklilik ve Hayat | 7 260 079 | 0.74% | 7 879 778 | 0.65% | 4 886 354 | 0.47% | -37.99% |

Civ Hayat | - | - | - | - | 3 666 456 | 0.35% | - |

Total of the top 20 companies | 926 708 014 | 94.79% | 1 195 369 291 | 99.12% | 1 026 574 741 | 99.28% | -14.12% |

Restof the market2 | 50 924 288 | 5.21% | 10 648 355 | 0.88% | 7 489 591 | 0.72% | -29.66% |

Grand total | 977 632 302 | 100% | 1 206 017 646 | 100% | 1 034 064 332 | 100% | -14.25% |

Exchange rate TRY/USD as at 31/12 | 2006 | 2007 | 2008 |

0.7054 | 0.854 | 0.6566 |

Source: Association of the Insurance and Reinsurance Companies of Turkey (TSRSB)

0

Your rating: None

Fri, 17/05/2013 - 16:07

The online magazine

Live coverage

11:51

04/24

04/24

04/24

04/24

Latest news