Wafa

In the context of the 1970s when the market was hardly structured, SNA strived for the consolidation of its foundation and for the development of its portfolio, especially in the fire and marine cargo classes of business.

In the context of the 1970s when the market was hardly structured, SNA strived for the consolidation of its foundation and for the development of its portfolio, especially in the fire and marine cargo classes of business.

The year 1989 marked a major turning point in the history of the company with its integration within the group WAFABANK and the adoption of a new identity WAFA assurance.

Ever since, and without any external acquisition, WAFA has kept reporting a two-digit annual turnover, an achievement no other company in the area managed to rise to.

Champion of communication and pioneer of bancassurance, WAFA is endowed with the key assets to become the market's leader, an objective so realistic that the recent restructuring has opened the company's capital to the most powerful financial and industrial holding of Morocco.

Nationally, the momentum is in full swing. The process is most likely to extend to the regional and international levels: Isn't its major shareholder, Wafatijari bank, present in the Maghreb and in Africa?

Wafa in 2006

| Rank | 3rd national insurer leader in life insurance and bancassurance |

| Capital | 350 million MAD (41.6 million USD) |

| Turnover | 2.39 billion MAD (284 million USD) |

| Net result | 314 million MAD (37.3 million USD) |

| Shareholders'equity | 1.09 billion MAD (130 million USD) |

| Solvency margin | 492 % |

| ROE | 40,3 % |

| Number of employees | 315 |

Management

Chairman | M. R. Arroub |

Deputy General Manager: Technical | M.Belbaraka |

Deputy General Manager: Network | Y. Bencheqroun |

Deputy General Manager: Industrial risks | A. Tamim |

Finance Manager | M. H Jai |

Logistics and support Manager | S. El Gharbi |

Bancassurance Manager | S. Echchihab |

General Secretary: Strategy & developement | N. Adel |

Main shareholders

| O.G.M | 79.22% |

| Various shareholders | 12.65% |

| Wafa gestion | 8.13% |

Turnover by class of business: 2001-2006

in thousands USD| Written premiums | 2001 | % | 2002 | % | 2003 | % | 2004 | % | 2005 | % | 2006 | % |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Non life | ||||||||||||

Motor | 45 411 | 32 | 58 429 | 31 | 64 125 | 32 | 73 932 | 40 | 72 039 | 40 | 84 783 | 30 |

W.C 1 | 9 641 | 7 | 12 069 | 6 | 17 614 | 9 | 16 450 | 9 | 10 806 | 6 | 14 982 | 5 |

Personal Accident | 10 899 | 8 | 15 325 | 8 | 15 833 | 8 | 15 895 | 8 | 19 811 | 11 | 17 004 | 6 |

Property | 13 554 | 10 | 17 816 | 9 | 21 177 | 11 | 23 474 | 13 | 21 612 | 12 | 28 182 | 10 |

Total non life | 79 505 | 57 | 103 639 | 54 | 118 749 | 60 | 129 751 | 70 | 124 268 | 69 | 144 951 | 51 |

| Life | ||||||||||||

Total life | 60 222 | 43 | 87 931 | 46 | 79 166 | 40 | 55 079 | 30 | 55 830 | 31 | 139 244 | 49 |

Grand total | 139 727 | 100 | 191 570 | 100 | 197 915 | 100 | 184 830 | 100 | 180 098 | 100 | 284 195 | 100 |

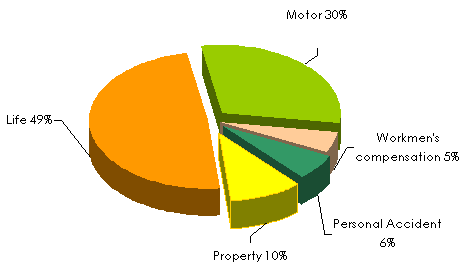

Premiums' split by class of business in 2006

Main financial highlights: 2001-2006

in thousands USD| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |

|---|---|---|---|---|---|---|

Written premiums | 140 003 | 192 719 | 199 110 | 185 447 | 180 127 | 284 190 |

Unearned premiums | 2 492 | 1 945 | -80 | 3 204 | 146 | 5 173 |

Earned premiums | 137 511 | 190 775 | 199 191 | 182 243 | 179 981 | 279 017 |

Operating products | 446 | 405 | 819 | 1 979 | 2 809 | 5 386 |

Operating revenues | 137 957 | 191 180 | 200 009 | 184 222 | 182 791 | 284 404 |

Services and fees | 134 159 | 201 609 | 217 393 | 201 239 | 159 476 | 294 871 |

Acquisition fees | 11 688 | 15 429 | 17 324 | 18 509 | 18 619 | 22 785 |

Management fees | 11 784 | 18 792 | 21 399 | 27 457 | 20 377 | 28 732 |

Services and operating costs | 157 631 | 235 830 | 256 116 | 247 205 | 198 473 | 346 388 |

Gross technical margin | -19 673 | -44 650 | -56 107 | -62 983 | -15 682 | -61 984 |

Reinsurance Balance | 2 475 | 11 214 | 15 436 | 6 511 | -5 246 | -6 809 |

Underwriting result | -17 198 | -33 436 | -40 671 | -56 472 | -20 927 | -68 793 |

Investments, net of charges | 27 343 | 45 936 | 43 711 | 102 186 | 50 771 | 115 528 |

Technical result | 7 037 | -3 290 | -7 644 | 35 242 | 23 883 | 41 283 |

Result net of tax | 6 064 | -4 571 | -10 278 | 34 478 | 20 322 | 37 286 |

Exchange rate MAD/USD as at 31/12 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 |

0.08617 | 0.1006 | 0.1157 | 0.12233 | 0.11103 | 0.11891 |

Contact

| Head office | 1, boulevard Abdelmoumen Casablanca - Morocco |

| Phone | (+212) 5 22 54 55 55 |

| Fax | (+212) 5 22 20 91 03 |

Thanks: We thank WAFA for their kind assistance in the conception of this survey.