Doha Insurance Group

- Date of creation: 2 octobre 1999, Doha, Qatar

- Classes of business: Life and non-life

- Rating: Standard & Poor’s : A- / Stable

- Regional structures: 6 branches and 8 subsidiaries

Doha Insurance Group in 2022

|

| Share capital | 136 270 000 USD |

| Turnover | 405 004 000 USD |

| Assets | 903 090 000 USD |

| Shareholder’s equity | 315 280 000 USD |

| Net result | 27 828 000 USD |

| Net non-life loss ratio | 35.93% |

| Net non-life management expenses ratio | 23.09% |

| Net non-life combined ratio | 59.02% |

Management

| Nawaf Nasser Bin Khaled Al-Thani | Chairman of the Board of Directors |

| Bassam Hussein | Group President |

| Jassim Al Moftah | Group CEO |

Shareholding

| Shareholders | Shares |

| Mohamed Khalid Hamad Abdullah Al-Thani | 5.31% |

| Dimensional Fund Advisors LP | 0.26% |

| Dimensional Fund Advisors Ltd. | 0.038% |

| Russell Investments Ltd. | 0.0067% |

| Acadian Asset Management LLC | 0.0052% |

| McKinley Capital Management LLC | 0.0038% |

| FIL Investments International | 0.0029% |

| DFA Australia Ltd. | 0.0009% |

| Others | 94.3725% |

Doha Insurance Group: main technical highlights

Figures in thousands USD

| Highlights | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Gross written premiums (1) | 171 299 | 179 805 | 245 979 | 306 200 | 405 004 |

| Net written premiums | 70 369 | 69 173 | 100 328 | 128 297 | 131 022 |

| Gross non-life written premiums | 171 299 | 179 805 | 245 979 | 255 301 | 347 612 |

| Net non-life written premiums | 70 369 | 69 173 | 100 328 | 90 808 | 97 216 |

| Net earned premiums | 67 080 | 65 788 | 91 884 | 116 489 | 124 930 |

| Net non-life earned premiums | 67 080 | 65 788 | 91 884 | 81 188 | 94 633 |

| Net non-life incurred losses | 42 591 | 37 306 | 51 149 | 28 607 | 34 006 |

| Non-life management expenses | 12 104 | 9 985 | 14 593 | 19 505 | 22 449 |

| Net non-life loss ratio (2) | 63.49% | 56.71% | 55.67% | 35.24% | 35.93% |

| Non-life management expenses ratio (3) | 17.20% | 14.43% | 14.55% | 21.48% | 23.09% |

| Net non-life combined ratio (4) | 80.69% | 71.14% | 70.22% | 56.72% | 59.02% |

| Net result | 16 544 | 13 416 | 16 362 | 20 014 | 27 828 |

(1) Life insurance is marketed since 2021.

(2) Net non-life loss ratio = Non-life incurred losses / Net non-life earned premiums.

(3) Net non-life management expenses ratio = Non-life management expenses / Net non-life written premiums.

(4) Net non-life combined ratio = Net non-life loss ratio + Net non-life management expenses ratio.

Exchange rate as at 31/12/2022: 1 QAR = 0.27254 USD; 31/12/2021: 1 QAR = 0.27315 USD; 31/12/2020: 1 QAR = 0.27248 USD; 31/12/2019: 1 QAR = 0.27413 USD; at 31/12/2018: 1 QAR = 0.27455 USD

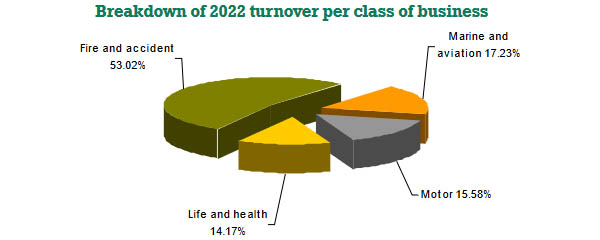

Doha Insurance Group: turnover breakdown per class of business

Figures in thousands USD

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 | Shares 2022 |

|---|---|---|---|---|---|---|

| Fire and accident | 94 132 | 91 866 | 141 200 | 141 090 | 214 713 | 53.02% |

| Marine and aviation | 40 013 | 45 288 | 48 723 | 55 425 | 69 785 | 17.23% |

| Motor | 37 154 | 42 651 | 56 056 | 58 786 | 63 114 | 15.58% |

| Non-life total | 171 299 | 179 805 | 245 979 | 255 301 | 347 612 | 85.83% |

| Life and health (1) | - | - | - | 50 899 | 57 392 | 14.17% |

| Grand total | 171 299 | 179 805 | 245 979 | 306 200 | 405 004 | 100% |

(1) The health class of business has been part of life insurance since 2021. It was previously part of the fire and accident activity.

Doha Insurance Group: net written premiums by class of business

Figures in thousands USD| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 | Evolution 2020-2021 (1) |

|---|---|---|---|---|---|---|

| Fire and accident | 31 453 | 25 364 | 43 205 | 30 421 | 35 101 | 15.64% |

| Marine and aviation | 3 942 | 4 518 | 4 101 | 7 089 | 2 964 | -58.09% |

| Motor | 34 974 | 39 291 | 53 022 | 53 298 | 59 151 | 11.23% |

| Non-life total | 70 369 | 69 173 | 100 328 | 90 808 | 97 216 | 7.30% |

| Life and health (2) | - | - | - | 37 489 | 33 806 | -9.62% |

| Grand total | 70 369 | 69 173 | 100 328 | 128 297 | 131 022 | 2.35% |

(1) Evolution in local currency.

(2) The health class of business has been part of life insurance since 2021. It was previously part of the fire and accident activity.

Doha Insurance Group: net earned premiums by class of business

Figures in thousands USD

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 | 2021-2022 evolution (1) |

|---|---|---|---|---|---|---|

| Fire and accident | 28 707 | 25 491 | 38 771 | 25 287 | 32 709 | 29.64% |

| Marine and aviation | 3 738 | 4 318 | 4 432 | 4 860 | 4 438 | -8.49% |

| Motor | 34 635 | 35 989 | 48 681 | 51 041 | 57 486 | 12.88% |

| Non-life total | 67 080 | 65 788 | 91 884 | 81 188 | 94 633 | 16.82% |

| Life and health (2) | - | - | - | 35 301 | 30 297 | -13.98% |

| Grand total | 67 080 | 65 788 | 91 884 | 116 489 | 124 930 | 7.49% |

(1) Evolution in local currency.

(2) The health class of business has been part of life insurance since 2021. It was previously part of the fire and accident activity.

Doha Insurance Group: net incurred losses by non-life insurance

Figures in thousands USD

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 | 2021-2022 evolution (1) |

|---|---|---|---|---|---|---|

| Fire and accident (2) | 21 765 | 14 749 | 25 229 | 3 571 | -1 502 | -142.14% |

| Marine and aviation | 87 | 1 480 | -536 | 268 | 1 740 | 551.53% |

| Motor | 20 739 | 21 077 | 26 456 | 24 768 | 33 768 | 36.64% |

| Non-life total | 42 591 | 37 306 | 51 149 | 28 607 | 34 006 | 19.14% |

(1) Evolution in local currency.

(2) Includes the life and health class of business for fiscal years 2018. 2019 and 2020.

Doha Insurance Group: management expenses by non-life insurance

Figures in thousands USD

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 | 2021-2022 evolution (1) |

|---|---|---|---|---|---|---|

| Fire and accident (2) | 8 179 | 5 022 | 7 355 | 10 535 | 10 512 | 0.00% |

| Marine and aviation | 534 | 1 221 | 1 508 | 1 244 | -1 953 | -257.43% |

| Motor | 3 391 | 3 742 | 5 730 | 7 726 | 13 890 | 80.19% |

| Non-life total | 12 104 | 9 985 | 14 593 | 19 505 | 22 449 | 15.35% |

(1) Evolution in local currency.

(2) Includes the life and health class of business for fiscal years 2018. 2019 and 2020.

Doha Insurance Group: net loss ratio by non-life insurance

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Fire and accident (1) | 75.82% | 57.86% | 65.07% | 14.12% | 4.59% |

| Marine and aviation | 2.33% | 34.26% | -12.09% | 5.51% | 39.21% |

| Motor | 59.88% | 58.58% | 54.34% | 48.53% | 58.74% |

| Non-life total | 63.49% | 56.71% | 55.67% | 35.24% | 35.93% |

(1) Includes the life and health class of business for fiscal years 2018. 2019 and 2020.

Doha Insurance Group: net management expenses ratio by non-life insurance

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Fire and accident (1) | 26.00% | 19.80% | 17.02% | 34.63% | 29.95% |

| Marine and aviation | 13.56% | 27.03% | 36.77% | 17.54% | -65.91% |

| Motor | 9.70% | 9.52% | 10.81% | 14.50% | 23.48% |

| Non-life total | 17.20% | 14.43% | 14.55% | 21.48% | 23.09% |

(1) Includes the life and health class of business for fiscal years 2018. 2019 and 2020.

Doha Insurance Group: net combined ratio by non-life insurance

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Fire and accident (1) | 101.82% | 77.66% | 82.09% | 48.75% | 25.36% |

| Marine and aviation | 15.89% | 61.29% | 24.68% | 23.05% | -26.70% |

| Motor | 69.58% | 68.10% | 65.15% | 63.03% | 82.22% |

| Non-life total | 80.69% | 71.14% | 70.22% | 56.72% | 59.02% |

(1) Includes the life and health class of business for fiscal years 2018. 2019 and 2020

Doha Insurance Group: Contact

| Head office | 213. C-Ring Road. Doha Qatar |

| Phone | +97444292777 |

| Fax | +97444657777 |

support [at] dig [dot] qa | |

| Website |