Insurance companies up against systemic risk

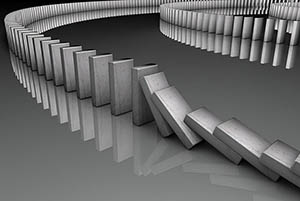

There is no common definition of a systemic risk (1). "However, we can consider as systemic, the risk that a particular event leads, by chain reactions, to a major dysfunction of the financial system and a collapse of the entire global economic activity...".

There is no common definition of a systemic risk (1). "However, we can consider as systemic, the risk that a particular event leads, by chain reactions, to a major dysfunction of the financial system and a collapse of the entire global economic activity...".

This definition is notably that of the Financial Stability Board (FSB), an international economic pool set up at the G20 meeting in London in April 2009. The role of the FSB is to preserve the stability of the financial sector.

Systemic risk emerged in the United States with the financial crisis of 2008 and the failure of several financial institutions such as Lehman Brothers, Merrill Lynch, Washington Mutual, Wachovia, Citigroup and AIG.

This crisis not only decimated the banking sector but also affected a large number of insurers, including the American giant American International Group (AIG), which totally collapsed in September 2008.

Systemic risk: examples of failing insurance companies

The case of AIG, USA (2008)

The financial situation of AIG, ranked 29th in the "Forbes Global 2000" list of the world's largest companies at the time of the events, can be summarized as follows a few months prior its collapse in September 2008:

- Market capitalization: 7.23 billion USD, as of 18 September 2008,

- Turnover: 110.06 billion USD, for the whole of 2007,

- Operating revenues: 8.94 billion USD, for the whole of 2007,

- Net revenues: 5.36 billion USD, in the second quarter of 2008,

- Total assets: 758.2 billion USD, as of the second quarter 2008,

- Shareholders' equity: 78.09 billion USD, as of Q2 2008,

- Number of employees: 116 000 in 130 countries.

The near bankruptcy of the American insurer AIG is the most famous systemic event on a global scale. Backed by the real estate market through toxic derivatives, the group faced a liquidity problem from the beginning of 2008 and accumulated losses. The group's share price reached an all-time low with the threat of imminent bankruptcy. To save the insurer, the American Federal Reserve (FED) had to bail out the company by injecting 205 billion USD in the form of loans in AIG's accounts.

The size of the company, the interdependence of its divisions, its financial indebtedness, the high concentration of asset classes and the lack of transparency of its balance sheet are at the origin of the brutal fall of the former world’s number one insurance company.

Faced with this crisis and the near bankruptcy of AIG, the U.S. Congress adopted regulatory reforms in 2010 that included measures to protect the financial market and, among other things, to reduce the size of large insurance companies.

Three insurers were particularly targeted by these reforms:

- Prudential, which was subjected to supervision and capital requirements,

- AIG, which had to sell all non-strategic assets, including the Alico subsidiaries in the United States and AIA in Asia, and divest non-core businesses,

- MetLife which was split into two companies.

(1) Atlas Magazine, No. 116, December 2014.

The case of Yamoto Life Insurance, Japan (2008)

Following a sharp drop in the value of its shares on the stock market, Yamato Life Insurance found itself bankrupt on 9 October 2008. The Japanese life insurer has suffered significant losses due to the subprime crisis, with its debt having reached 2.6 billion USD, thus exceeding its assets.

Founded in 1911, Yamato Life was managing a portfolio of 180 000 life insurance contracts with a total value of 10 billion USD by the end of March 2008.

Read also | Bankrupt insurance companies