Reinsurance in Sub-Saharan Africa

In 2023, all Sub-Saharan reinsurers have been working in a difficult operating environment marked by volatile oil prices, double-digit inflation, supply chain tensions and the depreciation of many local currencies.

Characteristics of the reinsurance market in sub-Saharan Africa

Despite environmental difficulties, reinsurers in Sub-Saharan Africa continue to exhibit stable underwriting results.

Despite environmental difficulties, reinsurers in Sub-Saharan Africa continue to exhibit stable underwriting results.

With a few exceptions, companies in the region tend to focus on local and regional markets, thereby avoiding the high earnings volatility caused by the occurrence of natural catastrophe risks in Asia, Europe and America.

The Sub-Saharan reinsurance market is characterized by:

- a general deterioration in macroeconomic conditions,

- a growth in share capital in recent years,

- a dependence of local players on global reinsurance leaders,

- an upward trend in large-scale weather events, particularly flood and drought risks,

- an increase in regulatory constraints.

Reinsurance market in sub-Saharan Africa: main indicators (2018-2022)

Figures in millions USD

| Indicator | 2018 | 2019 | 2020 | 2021 | 2022 | 5-year average |

|---|---|---|---|---|---|---|

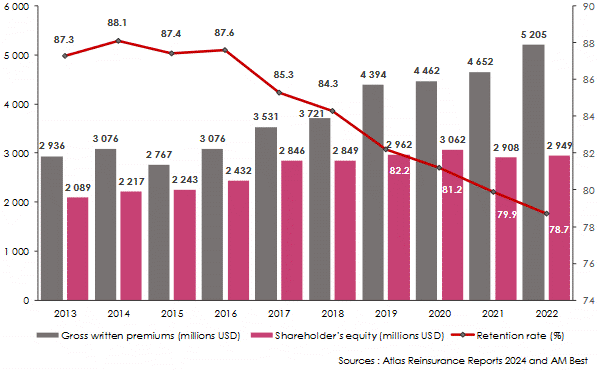

| Gross written premiums | 3 721 | 4 394 | 4 462 | 4 652 | 5 205 | 4 487 |

| Gross non-life written premiums | 3 394 | 3 764 | 4 088 | 4 176 | 4 603 | 4 005 |

| Gross life written premiums | 327 | 630 | 374 | 476 | 602 | 482 |

| Share capital | 808 | 824 | 927 | 1 091 | 1 074 | 945 |

| Net result | 197 | 330 | 210 | -55 | 227 | 182 |

| Shareholder’s equity | 2 849 | 2 962 | 3 062 | 2 908 | 2 949 | 2 946 |

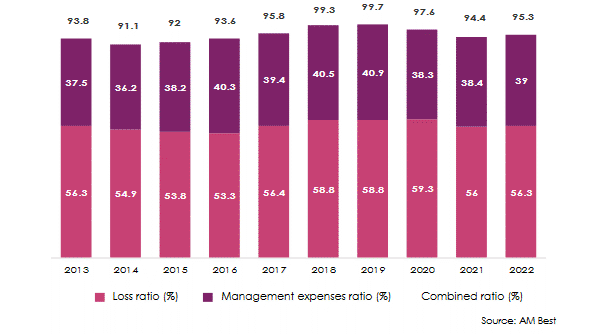

| Loss ratio (in %) | 58.8 | 58.8 | 59.3 | 56 | 56.3 | 57.8 |

| Management expenses ratio (in %) | 40.5 | 40.9 | 38.3 | 38.4 | 39 | 39.4 |

| Combined ratio (in %) | 99.3 | 99.7 | 97.6 | 94.4 | 95.3 | 97.3 |

| Retention rate (in %) | 84.3 | 82.2 | 81.2 | 79.9 | 78.7 | 81.3 |

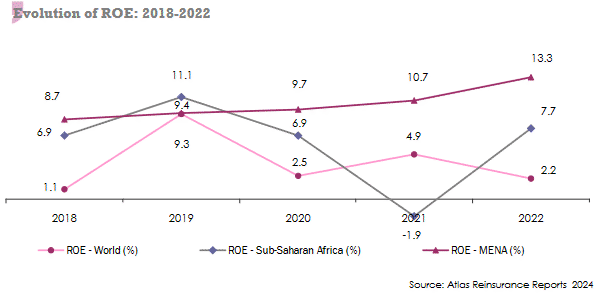

| ROE (in %) | 6.9 | 11.1 | 6.9 | -1.9 | 7.7 | 6.1 |

Sources: Atlas Reinsurance Reports 2024 and AM Best

Reinsurance market in sub-Saharan Africa: premium trends

In 2022, gross written premiums increased by 12% at 5.205 billion USD. This growth was driven by life insurance, up 26%, compared with 10% for non-life.

The region's five leading players, Munich Reinsurance Co. of Africa, Africa Re, Swiss Re South Africa, Hannover Re and General Re Africa, have underwritten nearly 60% of the market by 2022. Four of the five leaders in Sub-Saharan reinsurance are subsidiaries of major international groups.

Reinsurance market in sub-Saharan Africa: technical ratios

Remarkably, in the last 10 years, neither the combined ratio nor the loss ratio has exceeded 100% for the former, or 60% for the latter. Another typically African feature is the very high level of overheads compared to other markets. Over the past ten years, this rate has fluctuated between 36.2% and 40.9%.

The overhead rate of Sub-Saharan reinsurers is 11 points higher than that reported worldwide (28%).

Reinsurance market in sub-Saharan Africa: ROE

After 2021, a post-Covid loss-making year (-1.89%), return on equity (ROE) has recovered in 2022 to reach 7.7%. Over the past five years, ROE has averaged 6.1%, compared with 4% worldwide, a high rate accounted for by the adequate level of risk-adjusted capitalization.

Reinsurance market in sub-Saharan Africa: Limited regional capacity

With the exception of South African reinsurers and large regional groups, many Sub-Saharan professionals have benefited from legal cessions. The capacity offered by these reinsurers remains too low and not enough to meet the growing needs of the market.

With industrialization and increased investment, particularly in infrastructure, insurance and reinsurance needs have grown faster than local market capacity.

As a result, all ceding companies, often small ones, turn to the international market to secure their investments. Only large reinsurers have the expertise to underwrite large and complex risks. This results in higher written premiums and lower retention rates in the local market.

Rating of the main reinsurers in sub-Saharan Africa

The deteriorating political, economic and financial context in Sub-Saharan countries is affecting the ratings of local reinsurers.

AM Best has renewed the same ratings for 2023 as those awarded to its clients in 2022. As the 2024 renewals approach, only five reinsurers hold a rating of at least B+. Africa Re and Gen Re Africa benefit from AM Best's highest ratings, namely A for the former and A++ for the latter (rating assigned to parent company Berkshire Hathaway).

Standard & Poor's ratings have remained stable overall in 2023 for all Sub-Saharan reinsurers, except for SCOR SE-Africa Branch whose AA- rating became A+.

All the African subsidiaries of major international groups have benefited from the financial strength ratings assigned by the agencies to their parent companies.