Reinsurers’ expectations from the January 2023 renewal

Even if certain avenues of recovery have been clearly identified, many uncertainties are still straining the market, namely:

Even if certain avenues of recovery have been clearly identified, many uncertainties are still straining the market, namely:

- inflation, which poses a risk of claim underpricing,

- the level of financial investments, the amounts of which are becoming uncertain and are falling with the deterioration of the financial markets since September 2021, a decline compounded by the war in Ukraine,

- the decline in the capacities offered by the reinsurance market,

- the losses or strong reductions in profits,

- the low return on capital,

- geopolitical uncertainties,

- the maintenance of internal costs.

All these unfavorable factors to insurers will weigh heavily on the conditions offered by reinsurers. The former will find capacity but at significantly higher terms and prices. This increase is posed to reach 10% or even 20%, particularly in the fire and natural catastrophe classes of business.

At the beginning of November, by strategy or lack of responsiveness, many reinsurers had not yet replied to their clients' offers. The German-speaking markets, usually quicker to renew treaties, are particularly affected by this delay.

After the first two weeks of November, insurers will have a hard time obtaining acceptable terms. From a position of strength, reinsurers will try to impose other changes, including:

- minimum reinsurance premiums and deposited at 90%,

- paid coverage reinstatements where in the past free reinstatements were gradually imposed, especially on programs covering natural catastrophes,

- stricter time clauses to define the scope of natural catastrophes and even socio-political events,

- the limitation of the coverage of natural events to risks specifically mentioned in the contract,

- lower commissions for proportional treaties.

Read also | Traditional and alternative reinsurance capacity

Redeployment of reinsurance capacity in the third-party liability and specialty risks

The uncertainties surrounding property risks, in particular, have pushed reinsurers towards coverage that is less exposed to the hazards of nature. They are turning more readily to third party liability and specialty classes of business.

This trend is all the more interesting since rates in these segments have increased significantly as of 2022 renewal. These risks also have more predictable and stable profiles than natural disaster risks. Inflation nevertheless remains a concern, even if several factors are working in reinsurance companies' favor such as:

- the rates which seem to be consistent enough in these lines to mitigate risks,

- the very nature of liability insurance (long-term liquidation classes of business) which offers an increased possibility of return on investments made in parallel with insurance commitments. As a result, liquidity risk is reduced.

Reinsurance market concentration

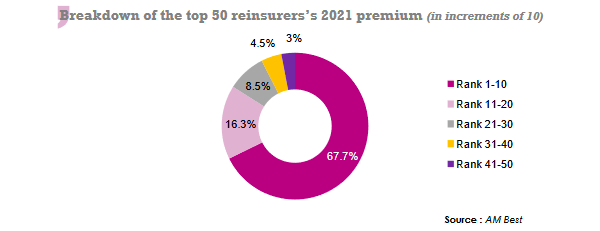

The weight of the two leading reinsurers is declining in 2021. While their combined turnover accounted for 25.6% of total global premiums in 2020, this rate went down to 24.3% in 2021.

As a result, the top ten companies in the rankings will also see their market share decline from 68.5% in 2020 to 67.7% in 2021.

China Re has reported the biggest drop, losing two places in 2021.

Despite the numerous natural catastrophe claims, a significant part of which comes from secondary perils, the top ten achieve an average combined ratio of 99.2%, whereas the top 50 will end the year 2021 with an average ratio well below the 100% mark.